Week 2 - University of Massachusetts Amherst

... – In the last decade, many major countries like Thailand, Indonesia, S. Korea, Brazil, and Argentina have changed their system from fixed to floating. – Amongst the major nations, exceptions are Malaysia and China. ...

... – In the last decade, many major countries like Thailand, Indonesia, S. Korea, Brazil, and Argentina have changed their system from fixed to floating. – Amongst the major nations, exceptions are Malaysia and China. ...

Solutions to BA 178 Midterm Exam B Summer 2007

... future international earning power is affected by changes in exchange rates (economic exposure is concerned with the long-run effect of changes in exchange rates on future prices, sales, and costs. This is distinct from transaction exposure, which is concerned ...

... future international earning power is affected by changes in exchange rates (economic exposure is concerned with the long-run effect of changes in exchange rates on future prices, sales, and costs. This is distinct from transaction exposure, which is concerned ...

1005Edwards_Euro

... Government finance: • Annual government deficit: Ratio of the annual government deficit to GDP must not exceed 3% at the end of the preceding fiscal year. • Government debt: Ratio of gross government debt to GDP must not exceed 60% at the end of the preceding fiscal year. Exchange rate: Applicant co ...

... Government finance: • Annual government deficit: Ratio of the annual government deficit to GDP must not exceed 3% at the end of the preceding fiscal year. • Government debt: Ratio of gross government debt to GDP must not exceed 60% at the end of the preceding fiscal year. Exchange rate: Applicant co ...

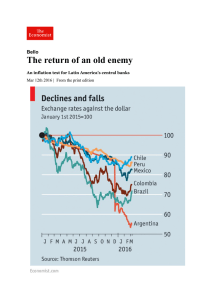

The return of an old enemy | The Economist

... targeting in Latin America. One can argue whether individual central banks should have tightened monetary policy earlier or later. The big picture is that those countries that have been serious about inflation targeting are adapting to a tougher external ...

... targeting in Latin America. One can argue whether individual central banks should have tightened monetary policy earlier or later. The big picture is that those countries that have been serious about inflation targeting are adapting to a tougher external ...

A Macroeconomic Theory of the Open Economy

... Real Exchange Rate (RER) adjusts to balance the demand and supply of domestic currency (Can$). At the equilibrium RER, the demand for $ to buy net exports exactly balances the supply of $ to be exchanged into foreign currency to buy assets abroad. What if the NFI is negative? ...

... Real Exchange Rate (RER) adjusts to balance the demand and supply of domestic currency (Can$). At the equilibrium RER, the demand for $ to buy net exports exactly balances the supply of $ to be exchanged into foreign currency to buy assets abroad. What if the NFI is negative? ...

Document

... become relatively more expensive for Canadians and Canadian goods will not become relatively less ...

... become relatively more expensive for Canadians and Canadian goods will not become relatively less ...

Balance of Payments

... 1. U.S. income increase relative to other countries. Does the balance of trade move toward a deficit or a surplus? - U.S. citizens have more disposable income - Americans import more - Net exports (Xn) decrease - The current account balance decreases and moves toward a deficit. 2. If the U.S. dollar ...

... 1. U.S. income increase relative to other countries. Does the balance of trade move toward a deficit or a surplus? - U.S. citizens have more disposable income - Americans import more - Net exports (Xn) decrease - The current account balance decreases and moves toward a deficit. 2. If the U.S. dollar ...

By: Sebastian Spio

... its 23/24 May meetings and agree to a massive inflationary program of quantitative easing and monetization of public (and some corporate) debts, several major local conglomerates and their banks may skid into defaults. More than 70% of the multibillion dollar local corporate debt portfolio is held b ...

... its 23/24 May meetings and agree to a massive inflationary program of quantitative easing and monetization of public (and some corporate) debts, several major local conglomerates and their banks may skid into defaults. More than 70% of the multibillion dollar local corporate debt portfolio is held b ...

63529 Webster Econ Review

... I spent a wonderful month in Italy during the summer of 2001, when the newly emerging euro only cost about 85 cents! My morning cappuccino was then priced at about two euros, which amounted to only $1.70 at those cheap exchange ...

... I spent a wonderful month in Italy during the summer of 2001, when the newly emerging euro only cost about 85 cents! My morning cappuccino was then priced at about two euros, which amounted to only $1.70 at those cheap exchange ...

1 CHAPTER 10 INTERNATIONAL MONETARY SYSTEM 1. Explain

... Britain returned to the gold standard in the early 1930’s at the same par value that existed before the war. The United States returned to the gold standard at a new, lower par value that reflected the inflation of previous years. c. The U.S. decision in 1934 to devalue its currency and Britain's de ...

... Britain returned to the gold standard in the early 1930’s at the same par value that existed before the war. The United States returned to the gold standard at a new, lower par value that reflected the inflation of previous years. c. The U.S. decision in 1934 to devalue its currency and Britain's de ...

Study Guide for Final: Material studied BEFORE the Second Midterm

... Understand both the advantages and the difficulties of fixed rates Definition of foreign direct investment Why some firms do FDI instead of exporting or licensing; costs of FDI Arguments for and against acquiring an existing foreign firm as opposed to building a foreign business from scratch (“green ...

... Understand both the advantages and the difficulties of fixed rates Definition of foreign direct investment Why some firms do FDI instead of exporting or licensing; costs of FDI Arguments for and against acquiring an existing foreign firm as opposed to building a foreign business from scratch (“green ...

Dollarization In El Salvador

... El Salvador is the third largest economy in that region, behind Costa Rica and Panama GDP per capita is $5,800 Still considered a developing country ...

... El Salvador is the third largest economy in that region, behind Costa Rica and Panama GDP per capita is $5,800 Still considered a developing country ...

Open-Economy Macroeconomics

... person can trade the currency of one country for the currency of another Appreciation: An increase in the value of a currency as measured by the amount of foreign currency it can buy Depreciation: A decrease in the value of a currency as measured by the amount of foreign currency it can buy ...

... person can trade the currency of one country for the currency of another Appreciation: An increase in the value of a currency as measured by the amount of foreign currency it can buy Depreciation: A decrease in the value of a currency as measured by the amount of foreign currency it can buy ...

Foreign Exchange

... • Ex. a preference for Japanese goods creates an increase in the supply of dollars in the currency exchange market which leads to depreciation of the Dollar and an appreciation of Yen ...

... • Ex. a preference for Japanese goods creates an increase in the supply of dollars in the currency exchange market which leads to depreciation of the Dollar and an appreciation of Yen ...

Amy Chapman, Gordonstoun School

... investors believed the crisis would have a more negative effect on cyclical growth in the UK than in other countries. • C One of the reasons for this was that it was thought that the UK would fair worse because of the high levels of household debt in the UK compared to other countries. • C In additi ...

... investors believed the crisis would have a more negative effect on cyclical growth in the UK than in other countries. • C One of the reasons for this was that it was thought that the UK would fair worse because of the high levels of household debt in the UK compared to other countries. • C In additi ...

FIN MRKTS 1 NO VEMBER 2012 SOL UTIONS FINAL CO PY

... 1. Equity market is the market for equity shares. A share represents ownership in a company. Anyone who holds/buys shares of a company he/she is called a shareholder. A shareholder owns a percentage interest in a firm, consistent with the percentage of outstanding stock held. There two types of comp ...

... 1. Equity market is the market for equity shares. A share represents ownership in a company. Anyone who holds/buys shares of a company he/she is called a shareholder. A shareholder owns a percentage interest in a firm, consistent with the percentage of outstanding stock held. There two types of comp ...

Interest Group Influence on Exchange Rate Policy during

... Discussion • On the aggregate, effects may cancel out • Data on foreign debt is readily available, data on foreign-currency-denominated debt is not. • Variable so far does not consider net domestic liabilities and assets • Measurement of the joint effects ...

... Discussion • On the aggregate, effects may cancel out • Data on foreign debt is readily available, data on foreign-currency-denominated debt is not. • Variable so far does not consider net domestic liabilities and assets • Measurement of the joint effects ...

International Political Economy

... from the Second World War as the strongest economy in the world, experiencing rapid industrial growth and capital accumulation. The U.S. had remained untouched by the ravages of World War II and had built a thriving manufacturing industry and grown wealthy selling weapons and lending money to the ot ...

... from the Second World War as the strongest economy in the world, experiencing rapid industrial growth and capital accumulation. The U.S. had remained untouched by the ravages of World War II and had built a thriving manufacturing industry and grown wealthy selling weapons and lending money to the ot ...

Sabse Bada Rupaiya

... level of business activity, gross domestic product (GDP), and employment levels. The more people there are out of work, the less the public as a whole will spend on goods and services. Central banks typically have little difficulty adjusting the available money supply to accommodate changes in the d ...

... level of business activity, gross domestic product (GDP), and employment levels. The more people there are out of work, the less the public as a whole will spend on goods and services. Central banks typically have little difficulty adjusting the available money supply to accommodate changes in the d ...

Lecture - Module 2

... gifts, and public aid between countries • trade deficit • trade surplus – Capital account – record of all long-term direct investment, portfolio investment, and capital flows ...

... gifts, and public aid between countries • trade deficit • trade surplus – Capital account – record of all long-term direct investment, portfolio investment, and capital flows ...

The Spectre of the Thirties* Prabhat Patnaik

... (because less of their goods are now demanded). Such an attempt, however, which amounts to becoming better off at the expense of one’s neighbor (whence the term “beggar-myneighbour” policy) does not work, if other countries too take protective action, by also devaluing their currencies. In such a ca ...

... (because less of their goods are now demanded). Such an attempt, however, which amounts to becoming better off at the expense of one’s neighbor (whence the term “beggar-myneighbour” policy) does not work, if other countries too take protective action, by also devaluing their currencies. In such a ca ...

GDP and Economic Policy

... These transactions, i.e. trade in goods and services, financial transactions including foreign investment and remittances, are captured in the balance of payments. ...

... These transactions, i.e. trade in goods and services, financial transactions including foreign investment and remittances, are captured in the balance of payments. ...

Currency war

Currency war, also known as competitive devaluation, is a condition in international affairs where countries compete against each other to achieve a relatively low exchange rate for their own currency. As the price to buy a country's currency falls so too does the price of exports. Imports to the country become more expensive. So domestic industry, and thus employment, receives a boost in demand from both domestic and foreign markets. However, the price increase for imports can harm citizens' purchasing power. The policy can also trigger retaliatory action by other countries which in turn can lead to a general decline in international trade, harming all countries.Competitive devaluation has been rare through most of history as countries have generally preferred to maintain a high value for their currency. Countries have generally allowed market forces to work, or have participated in systems of managed exchanges rates. An exception occurred when currency war broke out in the 1930s. As countries abandoned the Gold Standard during the Great Depression, they used currency devaluations to stimulate their economies. Since this effectively pushes unemployment overseas, trading partners quickly retaliated with their own devaluations. The period is considered to have been an adverse situation for all concerned, as unpredictable changes in exchange rates reduced overall international trade.According to Guido Mantega, the Brazilian Minister for Finance, a global currency war broke out in 2010. This view was echoed by numerous other government officials and financial journalists from around the world. Other senior policy makers and journalists suggested the phrase ""currency war"" overstated the extent of hostility. With a few exceptions, such as Mantega, even commentators who agreed there had been a currency war in 2010 generally concluded that it had fizzled out by mid-2011.States engaging in possible competitive devaluation since 2010 have used a mix of policy tools, including direct government intervention, the imposition of capital controls, and, indirectly, quantitative easing. While many countries experienced undesirable upward pressure on their exchange rates and took part in the ongoing arguments, the most notable dimension of the 2010–11 episode was the rhetorical conflict between the United States and China over the valuation of the yuan. In January 2013, measures announced by Japan which were expected to devalue its currency sparked concern of a possible second 21st century currency war breaking out, this time with the principal source of tension being not China versus the US, but Japan versus the Eurozone. By late February, concerns of a new outbreak of currency war had been mostly allayed, after the G7 and G20 issued statements committing to avoid competitive devaluation. After the European Central Bank launched a fresh programme of quantitative easing in January 2015, there was once again an intensification of discussion about currency war.