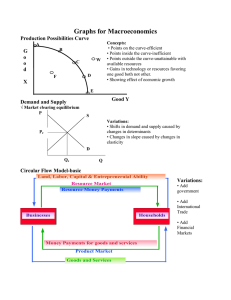

Graphs for Macroeconomics Production Possibilities Curve G o

... Applications: • As new demand and supply factors impact this market, changes in interest rate causes changes in investment and interest rate-driven consumption, which affects AD, ASsr, ASlr PL and Real GDP. • When government financing deficit spending, the impact of borrowing increases the demand cu ...

... Applications: • As new demand and supply factors impact this market, changes in interest rate causes changes in investment and interest rate-driven consumption, which affects AD, ASsr, ASlr PL and Real GDP. • When government financing deficit spending, the impact of borrowing increases the demand cu ...

New logo in yellow - Queen`s Economics Department

... ameliorate any problems associated with spreading dollarization in the Americas. This can be addressed via informal meetings. These will then begin to evolve toward more formal contacts and this could trigger the beginnings of what could eventually become the Federal Reserve Bank of the Americas. [T ...

... ameliorate any problems associated with spreading dollarization in the Americas. This can be addressed via informal meetings. These will then begin to evolve toward more formal contacts and this could trigger the beginnings of what could eventually become the Federal Reserve Bank of the Americas. [T ...

sdr.rev2_ - Harvard University

... The market is better developed in the United Kingdom, but the amount of pounddenominated government debt at $1.1 trillion was significantly smaller than that of the larger continental countries, and only ten percent was short-term. Canada’s public debt was $0.9 trillion, and Australia’s a mere $0.2 ...

... The market is better developed in the United Kingdom, but the amount of pounddenominated government debt at $1.1 trillion was significantly smaller than that of the larger continental countries, and only ten percent was short-term. Canada’s public debt was $0.9 trillion, and Australia’s a mere $0.2 ...

Chapter 11

... international role if there exists monetary and financial stability at home • The foremost indicator of monetary stability is the rate of inflation (which measures the stability of the purchasing power of money) • In both Europe and the USA, price stability has become the major objective of policyma ...

... international role if there exists monetary and financial stability at home • The foremost indicator of monetary stability is the rate of inflation (which measures the stability of the purchasing power of money) • In both Europe and the USA, price stability has become the major objective of policyma ...

Introduction to International Finance

... International macroeconomics (or international finance) as a subject covers many topical issues. What has happened (what will happen) to the dollar? Is the current account deficit too large? Should China devalue its yuan? 1 Should it first liberalize financial flows? Should Sweden give up its curren ...

... International macroeconomics (or international finance) as a subject covers many topical issues. What has happened (what will happen) to the dollar? Is the current account deficit too large? Should China devalue its yuan? 1 Should it first liberalize financial flows? Should Sweden give up its curren ...

Yes “It” Did Happen Again—A Minsky Crisis Happened in Asia

... balance sheets of firms and banks Banks and firms then sought to limit damage from rising $ rising interest rates by repaying foreign currency loans as fast as possible The result was a free fall in the ER and asset prices in many countries as financing units tried to sell anything possible to raise ...

... balance sheets of firms and banks Banks and firms then sought to limit damage from rising $ rising interest rates by repaying foreign currency loans as fast as possible The result was a free fall in the ER and asset prices in many countries as financing units tried to sell anything possible to raise ...

Article - Mirae Asset Global Investments (USA)

... But no country was spared the currency wreck, and those bets are off. Van Der Walt and other say there’s different criteria as well: The countries he likes are the ones that will adapt fastest and unleash their currencies to do what they are supposed to in a noncommodity-warped world and offer true ...

... But no country was spared the currency wreck, and those bets are off. Van Der Walt and other say there’s different criteria as well: The countries he likes are the ones that will adapt fastest and unleash their currencies to do what they are supposed to in a noncommodity-warped world and offer true ...

Industrial countries other than the United States

... exchange rate within ±1% of the adopted par value by buying or selling foreign reserves as necessary. • The U.S. was only responsible for maintaining the gold parity. • Under Bretton Woods, the IMF was created. • The Bretton Woods is also known as an adjustable peg system. When facing serious balanc ...

... exchange rate within ±1% of the adopted par value by buying or selling foreign reserves as necessary. • The U.S. was only responsible for maintaining the gold parity. • Under Bretton Woods, the IMF was created. • The Bretton Woods is also known as an adjustable peg system. When facing serious balanc ...

East Asian Financial Crisis

... falls more than 30% in two months, despite interventions by the country's central bank to prop up the currency Hong Kong's stock index falls 10.4% after it raises bank lending rates to 300% to fend off speculative attacks on the Hong Kong dollar. The plunge on the Hong Kong Stock Exchange wipes $2 ...

... falls more than 30% in two months, despite interventions by the country's central bank to prop up the currency Hong Kong's stock index falls 10.4% after it raises bank lending rates to 300% to fend off speculative attacks on the Hong Kong dollar. The plunge on the Hong Kong Stock Exchange wipes $2 ...

Unit 2

... Appreciation is the increase in the value of a currency Depreciation is the decrease in the value of a currency The real exchange rate is the rate at which a person can trade the goods and services of one country in terms of another country ...

... Appreciation is the increase in the value of a currency Depreciation is the decrease in the value of a currency The real exchange rate is the rate at which a person can trade the goods and services of one country in terms of another country ...

Stocktaking of International Financial Architecture Conference Remarks Turalay KENÇ

... markets face the challenges of the unconventional and unusual monetary policies in the advanced economies as well as diverging monetary policies of these countries, uncertainty in commodity prices, the risk of China’s economic hard-landing and the unintended market liquidity consequences of the rece ...

... markets face the challenges of the unconventional and unusual monetary policies in the advanced economies as well as diverging monetary policies of these countries, uncertainty in commodity prices, the risk of China’s economic hard-landing and the unintended market liquidity consequences of the rece ...

Carbaugh, International Economics 9e, Chapter 15

... foreign vs. domestic currency As foreign-currency denominated costs rise as a proportion of total costs, exchange rate changes have less effect on the foreign currency price and more effect on the domestic price If foreign-currency costs are a small part of total costs, exchange rate changes hav ...

... foreign vs. domestic currency As foreign-currency denominated costs rise as a proportion of total costs, exchange rate changes have less effect on the foreign currency price and more effect on the domestic price If foreign-currency costs are a small part of total costs, exchange rate changes hav ...

Document

... foreign vs. domestic currency As foreign-currency denominated costs rise as a proportion of total costs, exchange rate changes have less effect on the foreign currency price and more effect on the domestic price If foreign-currency costs are a small part of total costs, exchange rate changes hav ...

... foreign vs. domestic currency As foreign-currency denominated costs rise as a proportion of total costs, exchange rate changes have less effect on the foreign currency price and more effect on the domestic price If foreign-currency costs are a small part of total costs, exchange rate changes hav ...

chapter14 - University of San Diego Home Pages

... foreign vs. domestic currency As foreign-currency denominated costs rise as a proportion of total costs, exchange rate changes have less effect on the foreign currency price and more effect on the domestic price If foreign-currency costs are a small part of total costs, exchange rate changes hav ...

... foreign vs. domestic currency As foreign-currency denominated costs rise as a proportion of total costs, exchange rate changes have less effect on the foreign currency price and more effect on the domestic price If foreign-currency costs are a small part of total costs, exchange rate changes hav ...

Carbaugh Intl Econ 8e Chapter 15

... foreign vs. domestic currency As foreign-currency denominated costs rise as a proportion of total costs, exchange rate changes have less effect on the foreign currency price and more effect on the domestic price If foreign-currency costs are a small part of total costs, exchange rate changes hav ...

... foreign vs. domestic currency As foreign-currency denominated costs rise as a proportion of total costs, exchange rate changes have less effect on the foreign currency price and more effect on the domestic price If foreign-currency costs are a small part of total costs, exchange rate changes hav ...

On Global Currencies Jeffrey Frankel, Harpel Professor, Harvard

... Economic historians have decided competitive devaluation under 1930s conditions was not a problem after all. True, countries couldn’t all devalue against each other, But they could and did all devalue against gold • which worked to ease global monetary policy, ...

... Economic historians have decided competitive devaluation under 1930s conditions was not a problem after all. True, countries couldn’t all devalue against each other, But they could and did all devalue against gold • which worked to ease global monetary policy, ...

The Exchange Rate Mechanism and the Ruble Devaluation of 1998

... country's merchandise trade equilibrium. From this perspective, capital inflows in excess of capital outflows, overvalue a country's currency. It will make imports relatively cheaper than domestically produced equivalent goods. And, it will have the opposite effect on the county's exports. A further ...

... country's merchandise trade equilibrium. From this perspective, capital inflows in excess of capital outflows, overvalue a country's currency. It will make imports relatively cheaper than domestically produced equivalent goods. And, it will have the opposite effect on the county's exports. A further ...

1. Efficiency of the international monetary system means that the

... increase in national debt in the three major continental economies, Italy, France and Germany. These countries have a large implicit debt, Germany for instance 240 per cent of GDP. This implicit debt will become explicit, unless major institutional changes are made, especially in the level of social ...

... increase in national debt in the three major continental economies, Italy, France and Germany. These countries have a large implicit debt, Germany for instance 240 per cent of GDP. This implicit debt will become explicit, unless major institutional changes are made, especially in the level of social ...

Currency Wars - Harvard University

... September 27 warning from Brazil’s Finance Minister Guido Mantega: “We’re in the midst of an international currency war, a general weakening of currency. This threatens us because it takes away our competitiveness.” I.e., countries everywhere are trying to push down the value of their currencies, ...

... September 27 warning from Brazil’s Finance Minister Guido Mantega: “We’re in the midst of an international currency war, a general weakening of currency. This threatens us because it takes away our competitiveness.” I.e., countries everywhere are trying to push down the value of their currencies, ...

Peter Nicholl: Perspectives on monetary policy in Bosnia and

... chooses or the economy needs. The amount that can be issued is tied to the net position of Bosnia and Herzegovina’s external accounts. This is the Currency Board arithmetic. What does this Currency Board arithmetic mean for a central bank and a country? If the net position on a country’s external ac ...

... chooses or the economy needs. The amount that can be issued is tied to the net position of Bosnia and Herzegovina’s external accounts. This is the Currency Board arithmetic. What does this Currency Board arithmetic mean for a central bank and a country? If the net position on a country’s external ac ...

operating_exposure

... The less price elastic the demand for the company’s products, the more price flexibility the company has. Price elasticity depends on the degree of competition and the location of key competitors. The more differentiated a company’s products are, the less competition it will face. (e.g. Merced ...

... The less price elastic the demand for the company’s products, the more price flexibility the company has. Price elasticity depends on the degree of competition and the location of key competitors. The more differentiated a company’s products are, the less competition it will face. (e.g. Merced ...

Edward Lazear: Chinese `Currency Manipulation`

... growth in Chinese exports to Europe averaged 35% per year and 32% per year for exports from China to the U.S. during this period. But the more important message here is that the growth of Chinese exports to the two regions was almost the same—even though the euro bought 44% more yuan at the end of t ...

... growth in Chinese exports to Europe averaged 35% per year and 32% per year for exports from China to the U.S. during this period. But the more important message here is that the growth of Chinese exports to the two regions was almost the same—even though the euro bought 44% more yuan at the end of t ...

Appendix: Description of Methodology Data Used in the Principal

... that the information about the key economic factors can be inferred from a large number of economic time series. Specifically, we can think of the key factors in terms of concepts such as “economic activity” or “investment climate”. They cannot be represented by a single economic variable but rather ...

... that the information about the key economic factors can be inferred from a large number of economic time series. Specifically, we can think of the key factors in terms of concepts such as “economic activity” or “investment climate”. They cannot be represented by a single economic variable but rather ...

Problem 12

... Problem 18.3 In spite of the flaws of the pre-1914 gold standard, exchange rate changes were rare. In contrast, such changes became quite frequent in the interwar period (1919 – 1939). Contrast the pre – World War I and interwar periods. Explain the difference is exchange rate behavior in the two p ...

... Problem 18.3 In spite of the flaws of the pre-1914 gold standard, exchange rate changes were rare. In contrast, such changes became quite frequent in the interwar period (1919 – 1939). Contrast the pre – World War I and interwar periods. Explain the difference is exchange rate behavior in the two p ...

Currency war

Currency war, also known as competitive devaluation, is a condition in international affairs where countries compete against each other to achieve a relatively low exchange rate for their own currency. As the price to buy a country's currency falls so too does the price of exports. Imports to the country become more expensive. So domestic industry, and thus employment, receives a boost in demand from both domestic and foreign markets. However, the price increase for imports can harm citizens' purchasing power. The policy can also trigger retaliatory action by other countries which in turn can lead to a general decline in international trade, harming all countries.Competitive devaluation has been rare through most of history as countries have generally preferred to maintain a high value for their currency. Countries have generally allowed market forces to work, or have participated in systems of managed exchanges rates. An exception occurred when currency war broke out in the 1930s. As countries abandoned the Gold Standard during the Great Depression, they used currency devaluations to stimulate their economies. Since this effectively pushes unemployment overseas, trading partners quickly retaliated with their own devaluations. The period is considered to have been an adverse situation for all concerned, as unpredictable changes in exchange rates reduced overall international trade.According to Guido Mantega, the Brazilian Minister for Finance, a global currency war broke out in 2010. This view was echoed by numerous other government officials and financial journalists from around the world. Other senior policy makers and journalists suggested the phrase ""currency war"" overstated the extent of hostility. With a few exceptions, such as Mantega, even commentators who agreed there had been a currency war in 2010 generally concluded that it had fizzled out by mid-2011.States engaging in possible competitive devaluation since 2010 have used a mix of policy tools, including direct government intervention, the imposition of capital controls, and, indirectly, quantitative easing. While many countries experienced undesirable upward pressure on their exchange rates and took part in the ongoing arguments, the most notable dimension of the 2010–11 episode was the rhetorical conflict between the United States and China over the valuation of the yuan. In January 2013, measures announced by Japan which were expected to devalue its currency sparked concern of a possible second 21st century currency war breaking out, this time with the principal source of tension being not China versus the US, but Japan versus the Eurozone. By late February, concerns of a new outbreak of currency war had been mostly allayed, after the G7 and G20 issued statements committing to avoid competitive devaluation. After the European Central Bank launched a fresh programme of quantitative easing in January 2015, there was once again an intensification of discussion about currency war.