Information Disclosure and Market Quality

... SEC Rule 605 and 606 Increase the visibility of execution quality of the U.S. securities markets for public ...

... SEC Rule 605 and 606 Increase the visibility of execution quality of the U.S. securities markets for public ...

short selling regulations

... Designated Securities provided he has first obtained the approval of the Chairman of the Board, which may be given either orally or in writing. Notice of such restriction or prohibition to the Exchange Participant, whether oral or written, shall take effect immediately upon communication to or servi ...

... Designated Securities provided he has first obtained the approval of the Chairman of the Board, which may be given either orally or in writing. Notice of such restriction or prohibition to the Exchange Participant, whether oral or written, shall take effect immediately upon communication to or servi ...

USE Insider Trading Rules-2009

... An insider shall not trade in securities during the closed periods which shall be periods 8 weeks to the publication of financial information. However, the prohibition on purchases, sales, pledges and gifts of listed securities during closed periods does not apply to: a) Purchases made under an empl ...

... An insider shall not trade in securities during the closed periods which shall be periods 8 weeks to the publication of financial information. However, the prohibition on purchases, sales, pledges and gifts of listed securities during closed periods does not apply to: a) Purchases made under an empl ...

O novo mercado ea regulamentação

... Issue of voting shares only Board of Directors: unified one year terms for all members General Meetings: minimum 15 days notice Tag Along: tender offer should be extended to all shareholders within the conditions obtained by the controlling shareholders De-listing: mandatory tender offer at the econ ...

... Issue of voting shares only Board of Directors: unified one year terms for all members General Meetings: minimum 15 days notice Tag Along: tender offer should be extended to all shareholders within the conditions obtained by the controlling shareholders De-listing: mandatory tender offer at the econ ...

Performance Measurement

... Growing regulatory obligations to demonstrate • best execution practices • soft and bundled commissions paid by money manager are in investors interests ...

... Growing regulatory obligations to demonstrate • best execution practices • soft and bundled commissions paid by money manager are in investors interests ...

Australian ambassador praises KRCS charities

... Exchange throughout the week exhibited a tangible robustness as a cascade of firms started pouring out their midyear financial statements, said two stock market watchers yesterday, the last day of trading for this week. What really dominated the market momentum this week was speculative trading and ...

... Exchange throughout the week exhibited a tangible robustness as a cascade of firms started pouring out their midyear financial statements, said two stock market watchers yesterday, the last day of trading for this week. What really dominated the market momentum this week was speculative trading and ...

,-

... In this way "to arrive" contracts were created as the first form of futures, assuring farmers of the future purchase or delivery of their crops.4 ...

... In this way "to arrive" contracts were created as the first form of futures, assuring farmers of the future purchase or delivery of their crops.4 ...

IRRI-6 Weekly

... woven sacs. The bags should not be torn from any side and should be machine stitched. No tare allowance will be applicable. Karachi or Port Qasim at Exchange approved and designated warehouses. The Exchange will notify in advance the contract weeks available for IRRI-6 Rice futures. Trading in any c ...

... woven sacs. The bags should not be torn from any side and should be machine stitched. No tare allowance will be applicable. Karachi or Port Qasim at Exchange approved and designated warehouses. The Exchange will notify in advance the contract weeks available for IRRI-6 Rice futures. Trading in any c ...

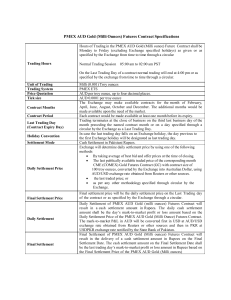

PMEX AUD Gold Futures Contract

... Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will result in a cash settlement amount in Rupees. The daily cash settlement amount ...

... Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will result in a cash settlement amount in Rupees. The daily cash settlement amount ...

Can Asia`s financial markets continue to grow without AEV`s

... Some exchanges are spending huge amounts to try to compete on technology rather than price ...

... Some exchanges are spending huge amounts to try to compete on technology rather than price ...

Trading and Electronic Markets

... they obtain some benefit besides profits when trading. Investors and borrowers move money forward or backward in time, risk managers transfer risk to others, and gamblers obtain excitement and stories to tell from their trading activities. In contrast, profit-motivated traders trade only because the ...

... they obtain some benefit besides profits when trading. Investors and borrowers move money forward or backward in time, risk managers transfer risk to others, and gamblers obtain excitement and stories to tell from their trading activities. In contrast, profit-motivated traders trade only because the ...

FREE Sample Here

... Which of the following statements is not true about the law of one price a. investors prefer more wealth to less b. investments that offer the same return in all states must pay the risk-free rate c. if two investment opportunities offer equivalent outcomes, they must have the same price d. investor ...

... Which of the following statements is not true about the law of one price a. investors prefer more wealth to less b. investments that offer the same return in all states must pay the risk-free rate c. if two investment opportunities offer equivalent outcomes, they must have the same price d. investor ...

Ch 14 Problems - U of L Class Index

... 1- Suppose today is January 1, 2007; MAM Industries issued a 20-year bond with a 9% coupon and a $1,000 face value, payable on January 1, 2027. The bond now sells for $915. Use this bond to determine the firm’s after-tax cost of debt. Assume a 34% tax rate. (6.6%) 2- MAM Industries just declared a d ...

... 1- Suppose today is January 1, 2007; MAM Industries issued a 20-year bond with a 9% coupon and a $1,000 face value, payable on January 1, 2027. The bond now sells for $915. Use this bond to determine the firm’s after-tax cost of debt. Assume a 34% tax rate. (6.6%) 2- MAM Industries just declared a d ...

CHAPTER 32. INTERNATIONAL CORPORATE FINANCE. I. The

... n The spot market and the forward market Size of FX market n Daily volume approximately $1 Trillion or $250 Trillion per year. n Daily trading volume on the NYSE is about $7 Billion [0.7%] Participants of FX markets n Typically larger commercial banks. n Stand ready to buy or sell currencies on a co ...

... n The spot market and the forward market Size of FX market n Daily volume approximately $1 Trillion or $250 Trillion per year. n Daily trading volume on the NYSE is about $7 Billion [0.7%] Participants of FX markets n Typically larger commercial banks. n Stand ready to buy or sell currencies on a co ...

What Types of Financial Market Structures Exist

... the market is a public market consisting of a number of dealers spread across a region, a country, or indeed the world, who make the market in some type of asset. That is, the dealers themselves post bid and asked prices for this asset and then stand ready to buy or sell units of this asset with any ...

... the market is a public market consisting of a number of dealers spread across a region, a country, or indeed the world, who make the market in some type of asset. That is, the dealers themselves post bid and asked prices for this asset and then stand ready to buy or sell units of this asset with any ...

FREE Sample Here

... 92. A difference between the primary market and the secondary market is a. Liquidity b. That primary markets allow corporations, government units, and others to raise needed funds for the expansion of their capital base C. Price competition in the secondary markets between different risk-return clas ...

... 92. A difference between the primary market and the secondary market is a. Liquidity b. That primary markets allow corporations, government units, and others to raise needed funds for the expansion of their capital base C. Price competition in the secondary markets between different risk-return clas ...

Secondary Market Regulations of Government Bonds

... Trading per se is neutral to total returns, and never pays for trading costs without additional risk taking. Even a capital gain brings you nothing. Trading always eats up some yield. Nonetheless, people trade for: ...

... Trading per se is neutral to total returns, and never pays for trading costs without additional risk taking. Even a capital gain brings you nothing. Trading always eats up some yield. Nonetheless, people trade for: ...

Competition and Regulation in Trading Arenas

... traders. In order to cover these losses and remain in business, dealers must recoup these losses from trades with uninformed traders to their detriment. Glosten and Milgrom (1985) formalized this insight. They postulate an anonymous market in which a market maker posts a bid for one share, a price ...

... traders. In order to cover these losses and remain in business, dealers must recoup these losses from trades with uninformed traders to their detriment. Glosten and Milgrom (1985) formalized this insight. They postulate an anonymous market in which a market maker posts a bid for one share, a price ...

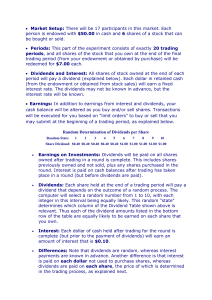

Experimental Instructions

... desired and the maximum or "limit" price that they are willing to pay. Similarly, those who wish to sell shares will indicate the number of shares offered and the minimum "limit" price that they are willing to accept. Buy and Sell Orders: The same person may offer to buy and sell shares, but the b ...

... desired and the maximum or "limit" price that they are willing to pay. Similarly, those who wish to sell shares will indicate the number of shares offered and the minimum "limit" price that they are willing to accept. Buy and Sell Orders: The same person may offer to buy and sell shares, but the b ...

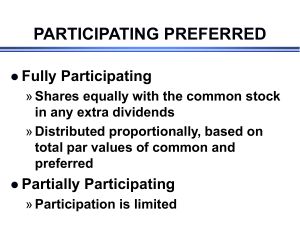

Chapter 15 - Salem State University

... A nonreciprocal transfer of nonmonetary assets between a corporation and its owners. Assets other than cash Usually securities of other companies Record at fair value of the asset transferred Gain or loss is recognized ...

... A nonreciprocal transfer of nonmonetary assets between a corporation and its owners. Assets other than cash Usually securities of other companies Record at fair value of the asset transferred Gain or loss is recognized ...

Algorithms for VWAP and Limit Order Trading

... – exchanges – technical analysis/indicators – algorithmic trading ...

... – exchanges – technical analysis/indicators – algorithmic trading ...