Networks in Finance and Economics

... For every guy j you compute this quantity. The sum at the denominator runs over the different holders of i Then you sum on the different stocks in the portfolio This gives a measure of the number of stocks controlled ...

... For every guy j you compute this quantity. The sum at the denominator runs over the different holders of i Then you sum on the different stocks in the portfolio This gives a measure of the number of stocks controlled ...

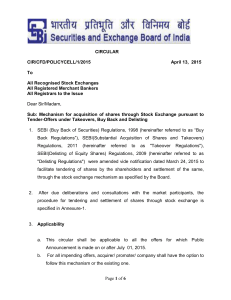

Regulation 10(5)

... f. Rationale, if any, for the proposed transfer Relevant sub-clause of regulation 10(1)(a) under which the acquirer is exempted from making open offer ...

... f. Rationale, if any, for the proposed transfer Relevant sub-clause of regulation 10(1)(a) under which the acquirer is exempted from making open offer ...

bovespa index methodology

... 4. In the course of the portfolio cycle, it is designated to be under ‘exceptional trading status’ (see the Concepts and Practices Manual for BM&FBOVESPA Indices). In this event, the removal will be implemented from the close as of the first trading day following recognition of such status. WEIGHTI ...

... 4. In the course of the portfolio cycle, it is designated to be under ‘exceptional trading status’ (see the Concepts and Practices Manual for BM&FBOVESPA Indices). In this event, the removal will be implemented from the close as of the first trading day following recognition of such status. WEIGHTI ...

IB Group Comment Letter to SEC Urging Market Data Distribution

... market data is essential in order for retail customers to compete on a level playing field with market makers and other professional traders, we feel strongly that self-regulatory organizations (“SROs”) and the Information Processors that are responsible for disseminating market data should do so c ...

... market data is essential in order for retail customers to compete on a level playing field with market makers and other professional traders, we feel strongly that self-regulatory organizations (“SROs”) and the Information Processors that are responsible for disseminating market data should do so c ...

Financial Markets

... A market for short-term instruments such as T-bills, commercial paper, banker’s acceptance, etc A subsector of fixed-income securities Money market instruments are highly marketable, offer low-return, posses low-risk Trade in large denominations, so are out of the reach of small investors ...

... A market for short-term instruments such as T-bills, commercial paper, banker’s acceptance, etc A subsector of fixed-income securities Money market instruments are highly marketable, offer low-return, posses low-risk Trade in large denominations, so are out of the reach of small investors ...

Rational Expectations Lecture

... As the number of firms in a constant cost industry increases, there is convergence to the competitive limit regardless of whether firms compete on price or quantity. When there are declining unit costs or scope economies, competitive behavior is not sustainable, and price is not equated with margina ...

... As the number of firms in a constant cost industry increases, there is convergence to the competitive limit regardless of whether firms compete on price or quantity. When there are declining unit costs or scope economies, competitive behavior is not sustainable, and price is not equated with margina ...

Presentation - NCDEX Institute of Commodity Markets and Research

... Variability in world prices had been transmitted to LDCs in export unit values ($), but not in average producer prices Trade restrictions, exchange rate or domestic distortions responsible for discrepancy between domestic and world prices ...

... Variability in world prices had been transmitted to LDCs in export unit values ($), but not in average producer prices Trade restrictions, exchange rate or domestic distortions responsible for discrepancy between domestic and world prices ...

Conventional Wisdom and the Impact of Market Volatility

... are new “demand” then the short positions for the same contracts are new “supply”? • In theory, no limit to the number of futures contracts that can be created at a given price level • Price changes as information changes not necessarily as trader positions change ...

... are new “demand” then the short positions for the same contracts are new “supply”? • In theory, no limit to the number of futures contracts that can be created at a given price level • Price changes as information changes not necessarily as trader positions change ...

The incumbent presentation shall attempt to delineate

... Incumbent herding literature confirms the co-existence of the two, especially with respect to situations entailing uncertainty. As we mentioned before in our review findings, such cases may involve small-cap stocks, overseas markets and performance evaluation vis-à-vis peers. However, given the flaw ...

... Incumbent herding literature confirms the co-existence of the two, especially with respect to situations entailing uncertainty. As we mentioned before in our review findings, such cases may involve small-cap stocks, overseas markets and performance evaluation vis-à-vis peers. However, given the flaw ...

Chapter 10

... “fairly” priced • If this is true, then you should not be able to earn “abnormal” or “excess” returns • Efficient markets DO NOT imply that investors cannot earn a positive return in the stock market ...

... “fairly” priced • If this is true, then you should not be able to earn “abnormal” or “excess” returns • Efficient markets DO NOT imply that investors cannot earn a positive return in the stock market ...

multi-market trading and market liquidity: the post-mifid picture

... No evidence that order flow fragmentation between trading platforms harms liquidity ● Spreads have decreased between Oct. 2007 and Sep. 2009 in proportion with the level of market competition o More significant after June 2009 o More significant for FTSE 100 stocks/ Less or no significant for SBF ...

... No evidence that order flow fragmentation between trading platforms harms liquidity ● Spreads have decreased between Oct. 2007 and Sep. 2009 in proportion with the level of market competition o More significant after June 2009 o More significant for FTSE 100 stocks/ Less or no significant for SBF ...

Trading Policy of Securities Issued by CPFL Energia S.A.

... Communication of a Material Event: all communication of a material event carried out by the Company in accordance with the Disclosure Policy on Material Events. Board of Directors: signifies the Company Board of Directors. Statutory Audit Committee: signifies the Company Statutory Audit Committee. E ...

... Communication of a Material Event: all communication of a material event carried out by the Company in accordance with the Disclosure Policy on Material Events. Board of Directors: signifies the Company Board of Directors. Statutory Audit Committee: signifies the Company Statutory Audit Committee. E ...

First North Price List

... by multiplying the number of shares by the closing prices for all trading days of the previous calendar year. Upon admission for trade, the market value of shares is calculated as the product of the number of shares and the weighted average price of transactions recorded with the Estonian CSD during ...

... by multiplying the number of shares by the closing prices for all trading days of the previous calendar year. Upon admission for trade, the market value of shares is calculated as the product of the number of shares and the weighted average price of transactions recorded with the Estonian CSD during ...

of 6 CIRCULAR CIR/CFD/POLICYCELL/1/2015 April 13, 2015

... Acquisition Window of the Stock Exchanges through selling brokers. However, reconciliation for acceptances shall be conducted by the Merchant banker and the Registrar to the offer after closing of the Offer and the final list shall be provided to the Stock Exchanges to facilitate settlement. Page 4 ...

... Acquisition Window of the Stock Exchanges through selling brokers. However, reconciliation for acceptances shall be conducted by the Merchant banker and the Registrar to the offer after closing of the Offer and the final list shall be provided to the Stock Exchanges to facilitate settlement. Page 4 ...

Efficient Markets Today - The University of Chicago Booth School of

... “Wait a minute,” the hedge fund manager responds. “None of my investors has ever thought through how much put option or carry-trade risk-exposure they want. They’re sitting on the market index. These premia are alpha to my investors. Knowing which factors work, how to run these regressions, and how ...

... “Wait a minute,” the hedge fund manager responds. “None of my investors has ever thought through how much put option or carry-trade risk-exposure they want. They’re sitting on the market index. These premia are alpha to my investors. Knowing which factors work, how to run these regressions, and how ...

Document

... •1 Adjusted for local and cross-border inter-dealer double-counting (ie “net-net” basis). 2 Previously classified as part of the so-called "Traditional FX market". 3 The category "other FX products" covers highly leveraged transactions and/or trades whose notional amount is variable and where a deco ...

... •1 Adjusted for local and cross-border inter-dealer double-counting (ie “net-net” basis). 2 Previously classified as part of the so-called "Traditional FX market". 3 The category "other FX products" covers highly leveraged transactions and/or trades whose notional amount is variable and where a deco ...

Regulatory and accounting issues: a focus on energy commodity

... way. these changes might mean for global gas trading strategy, players are reassessing their accounting Accounting for LNG contracts: their organisations approach. With the increased fair value or accrual account? liquidity in the market and The Liquefied Natural Gas (LNG) market was previously char ...

... way. these changes might mean for global gas trading strategy, players are reassessing their accounting Accounting for LNG contracts: their organisations approach. With the increased fair value or accrual account? liquidity in the market and The Liquefied Natural Gas (LNG) market was previously char ...

newsletter

... cyclical businesses going through incredibly tough times, which will not last forever, but which are trading at very low prices as a result. It is in these market environments that a value investor’s temperament and mettle are tested – particularly when cheap stocks get even cheaper, and overpriced ...

... cyclical businesses going through incredibly tough times, which will not last forever, but which are trading at very low prices as a result. It is in these market environments that a value investor’s temperament and mettle are tested – particularly when cheap stocks get even cheaper, and overpriced ...

addressing emerging risks in the nigerian

... our regulations to allow product innovation for new products like: ...

... our regulations to allow product innovation for new products like: ...

Demutualizing African Stock Exchanges

... Markets are still not sufficiently liberalized, e.g. Ghana Of 20 exchanges, only about 7 are likely to be financially viable as demutualized exchanges Governments who support exchanges financially are not in a hurry to demutualize if policy objectives are being met in mutual form ...

... Markets are still not sufficiently liberalized, e.g. Ghana Of 20 exchanges, only about 7 are likely to be financially viable as demutualized exchanges Governments who support exchanges financially are not in a hurry to demutualize if policy objectives are being met in mutual form ...

記錄 編號 6812 狀態 NC094FJU00457001 助教 查核 索書 號 學校

... Through a certain domestic reputed securities company, 53680 individual investors account transaction details were supplied for this research. Based on the research model of Barber and Odean (2001) as the basis, the behavioral framework of procurement decision by dispersed investors is established. ...

... Through a certain domestic reputed securities company, 53680 individual investors account transaction details were supplied for this research. Based on the research model of Barber and Odean (2001) as the basis, the behavioral framework of procurement decision by dispersed investors is established. ...

Regional Equity Market Integration in South America

... and sellers interact with one another in a diverse market. Nonetheless, there are challenges to the integration process. These include: a lack of free flow of capital among the three countries, jurisdiction-related differences among the domestic markets, technical issues in the sophistication level ...

... and sellers interact with one another in a diverse market. Nonetheless, there are challenges to the integration process. These include: a lack of free flow of capital among the three countries, jurisdiction-related differences among the domestic markets, technical issues in the sophistication level ...

A Collaborative Kalman Filter for Time

... 2. We can introduce other machine learning algorithm to the latent variable space, in order to dig up the law of the motion in the latent variable space. ps. this is no longer a high dimensional problem, but it contains much information about all stocks and the marketing environment. ...

... 2. We can introduce other machine learning algorithm to the latent variable space, in order to dig up the law of the motion in the latent variable space. ps. this is no longer a high dimensional problem, but it contains much information about all stocks and the marketing environment. ...

Trade Scheduling in Equity Markets: Theory and Practice

... our trades which lead to temporary price movement from equilibrium. Transient impact induced price will reverse after our trade and decay to 0 at the end. Permanent impact: Impact due to changes in the equilibrium price caused by our trading, which accumulates and remains for the life of the trade ...

... our trades which lead to temporary price movement from equilibrium. Transient impact induced price will reverse after our trade and decay to 0 at the end. Permanent impact: Impact due to changes in the equilibrium price caused by our trading, which accumulates and remains for the life of the trade ...

The Stock Market Crash of 1929

... 1923 and 1929, banks closed at the rate of two a day. Until the stock market crash in 1929, prosperity covered up the flaws in the banking system. 4. Foreign Balance of Payments World War I had turned the U.S. from a debtor nation into a creditor nation. In the aftermath of the war, the U.S. was owe ...

... 1923 and 1929, banks closed at the rate of two a day. Until the stock market crash in 1929, prosperity covered up the flaws in the banking system. 4. Foreign Balance of Payments World War I had turned the U.S. from a debtor nation into a creditor nation. In the aftermath of the war, the U.S. was owe ...