Marcus Corporation has a capital budget of $5 million and wants to

... A company’s dividend policy decision should not be influenced by which of the following? Constraints imposed by the firm's bond indenture. The fact that much of the firm's equipment has been leased rather than purchased The firm's ability to accelerate investment projects. The firm's ability to dela ...

... A company’s dividend policy decision should not be influenced by which of the following? Constraints imposed by the firm's bond indenture. The fact that much of the firm's equipment has been leased rather than purchased The firm's ability to accelerate investment projects. The firm's ability to dela ...

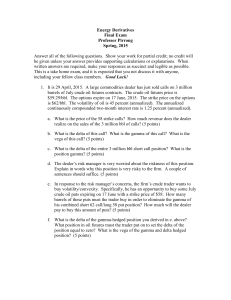

Risk Management

... barrels of July crude oil futures contracts. The crude oil futures price is $59.29/bbl. The options expire on 17 June, 2015. The strike price on the options is $62/bbl. The volatility of oil is 45 percent (annualized). The annualized continuously compounded two-month interest rate is 1.25 percent (a ...

... barrels of July crude oil futures contracts. The crude oil futures price is $59.29/bbl. The options expire on 17 June, 2015. The strike price on the options is $62/bbl. The volatility of oil is 45 percent (annualized). The annualized continuously compounded two-month interest rate is 1.25 percent (a ...

The floating Greeks

... mid- to late 1990s (except for some MIF holdovers) and 10 newbuildings on order. A handful of the vessels are traded spot, with the balance on short time charters or longer contracts that renew at rates tied to spot indices. Affiliated Tsakos companies provide the technical management, mirroring arr ...

... mid- to late 1990s (except for some MIF holdovers) and 10 newbuildings on order. A handful of the vessels are traded spot, with the balance on short time charters or longer contracts that renew at rates tied to spot indices. Affiliated Tsakos companies provide the technical management, mirroring arr ...

IIAC Comments to CSA re the Application of the Order Protection

... (d) complexities and changes you anticipate from participating in both protected and unprotected visible marketplaces, including costs and effort; and (e) the provision and use of consolidated data. The flexibility and potential cost savings to members as a result of designating certain markets as u ...

... (d) complexities and changes you anticipate from participating in both protected and unprotected visible marketplaces, including costs and effort; and (e) the provision and use of consolidated data. The flexibility and potential cost savings to members as a result of designating certain markets as u ...

Technical Analysis on Selected Stocks of Energy Sector

... Technical Analysis is a study of the stock market considering factors related to the supply and demand of stocks. Technical analysis is a method of evaluating securities by analyzing the statistics generated by market activity, such as past prices and volume. Technical analysts do not attempt to mea ...

... Technical Analysis is a study of the stock market considering factors related to the supply and demand of stocks. Technical analysis is a method of evaluating securities by analyzing the statistics generated by market activity, such as past prices and volume. Technical analysts do not attempt to mea ...

offensive selling – selling into strength

... - Ideally, the relative strength line will lead a stock to new highs, or at least over coincident with the stock - When new price highs are not confirmed by the relative strength line, it indicates that the stock is not as strong as the broader market, suggesting that the stock is a laggard - If a s ...

... - Ideally, the relative strength line will lead a stock to new highs, or at least over coincident with the stock - When new price highs are not confirmed by the relative strength line, it indicates that the stock is not as strong as the broader market, suggesting that the stock is a laggard - If a s ...

“MORE IS DIFFERENT” transition in Finance

... Example of “MORE IS DIFFERENT” transition in Finance: ...

... Example of “MORE IS DIFFERENT” transition in Finance: ...

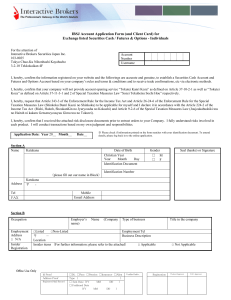

IBSJ Account Application Form (and Client Card) for Exchange listed

... by reason of forces beyond human control. IB is not liable for system or network failures, and customers who require the highest level of reliability, agree to maintain secondary trading facilities. Customers are responsible for protecting the secrecy of their usernames and passwords, and they will ...

... by reason of forces beyond human control. IB is not liable for system or network failures, and customers who require the highest level of reliability, agree to maintain secondary trading facilities. Customers are responsible for protecting the secrecy of their usernames and passwords, and they will ...

International Portfolio Investment

... potentially benefit a great deal from international diversification. The actual portfolios that investors hold, however, are quite different from those predicted by the ...

... potentially benefit a great deal from international diversification. The actual portfolios that investors hold, however, are quite different from those predicted by the ...

ANSWER - We can offer most test bank and solution manual you need.

... Full file at http://testbankonline.eu/Test-bank-for-Fundamentals-of-Financial-Management,-ConciseEdition,-8th-Edition-by-Eugene-F.-Brigham 13. In a “Dutch auction” for new stock, individual investors place bids for shares directly. Each potential bidder indicates the price he or she is willing to p ...

... Full file at http://testbankonline.eu/Test-bank-for-Fundamentals-of-Financial-Management,-ConciseEdition,-8th-Edition-by-Eugene-F.-Brigham 13. In a “Dutch auction” for new stock, individual investors place bids for shares directly. Each potential bidder indicates the price he or she is willing to p ...

ANSWER: True - We can offer most test bank and solution manual

... Full file at http://textbooktestbank.eu/Fundamentals-of-Financial-Management-Concise-8th-Edition-TestBank-Brigham 13. In a “Dutch auction” for new stock, individual investors place bids for shares directly. Each potential bidder indicates the price he or she is willing to pay and how many shares he ...

... Full file at http://textbooktestbank.eu/Fundamentals-of-Financial-Management-Concise-8th-Edition-TestBank-Brigham 13. In a “Dutch auction” for new stock, individual investors place bids for shares directly. Each potential bidder indicates the price he or she is willing to pay and how many shares he ...

OCA - Federation of European Securities Exchanges

... What should be the regulatory response to globalisation? Do we need a “world regulator”? The case-by case-approach • Historically, derivative exchanges have benefited from the CFTC’s no-action letter regime • No retail investor protection concerns A new multilateral approach? • The SEC’s expected c ...

... What should be the regulatory response to globalisation? Do we need a “world regulator”? The case-by case-approach • Historically, derivative exchanges have benefited from the CFTC’s no-action letter regime • No retail investor protection concerns A new multilateral approach? • The SEC’s expected c ...

Summary Verbal Instructions PO tax on seller

... the number of units you have available to sell. This will be private information. • What decisions do Sellers make? You specify an Offer price, and you specify the number of units that you would like to sell at the specified Offer price. You can sell as many units as you have available. • How do Sel ...

... the number of units you have available to sell. This will be private information. • What decisions do Sellers make? You specify an Offer price, and you specify the number of units that you would like to sell at the specified Offer price. You can sell as many units as you have available. • How do Sel ...

The Dual-Listing Law:

... Dual-listing on the TASE provides many benefits for U.S/U.K.-traded Israeli companies and for investors, as well as for the Israeli securities industry as a whole. The dual-listing law enables companies to list easily and at no cost. Thirty-seven companies have dual-listed on the TASE since October ...

... Dual-listing on the TASE provides many benefits for U.S/U.K.-traded Israeli companies and for investors, as well as for the Israeli securities industry as a whole. The dual-listing law enables companies to list easily and at no cost. Thirty-seven companies have dual-listed on the TASE since October ...

Lecture 3

... disclose investment policies, makes shares redeemable at any time, limit use of leverage take no short positions. ...

... disclose investment policies, makes shares redeemable at any time, limit use of leverage take no short positions. ...

Lecture 06.2

... – Loss of efficiency can raise a potential competitor's value enough to overcome market entry barriers, or provide incentive for research and investment into new alternatives. – The theory of contestable markets argues that in some circumstances (private) monopolies are forced to behave as if there ...

... – Loss of efficiency can raise a potential competitor's value enough to overcome market entry barriers, or provide incentive for research and investment into new alternatives. – The theory of contestable markets argues that in some circumstances (private) monopolies are forced to behave as if there ...

CBOE SYSTEMS ACRONYM DICTIONARY

... maintain all types of orders from a Booth and Crowd in compliance with COATS systemization requirements. FBW also provides derived order functionality in support of order handling and trading in Hybrid classes. This system is currently provided by a vendor. FIX – Financial Information EXchange: A st ...

... maintain all types of orders from a Booth and Crowd in compliance with COATS systemization requirements. FBW also provides derived order functionality in support of order handling and trading in Hybrid classes. This system is currently provided by a vendor. FIX – Financial Information EXchange: A st ...

Emerging Derivative Markets

... OTC Gross market value 3% [1%] ; FX swaps 13% [5%] Public banks very active in D ; 85% unrelated to loans 15% institutional investors ; tax incentives for D trading Questions on legal and counterparty risk ; 14% ø netting Questions on exchange margins ; trading collars ; cushions Page 13 ...

... OTC Gross market value 3% [1%] ; FX swaps 13% [5%] Public banks very active in D ; 85% unrelated to loans 15% institutional investors ; tax incentives for D trading Questions on legal and counterparty risk ; 14% ø netting Questions on exchange margins ; trading collars ; cushions Page 13 ...

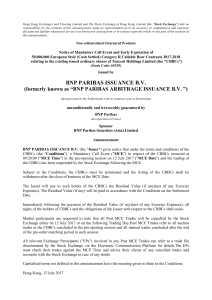

bnp paribas issuance bv

... rights of the holders of CBBCs and the obligations of the Issuer with respect to the CBBCs shall cease. Market participants are requested to note that all Post MCE Trades will be cancelled by the Stock Exchange either on 12 July 2017 or on the following Trading Day.Post MCE Trades refer to all aucti ...

... rights of the holders of CBBCs and the obligations of the Issuer with respect to the CBBCs shall cease. Market participants are requested to note that all Post MCE Trades will be cancelled by the Stock Exchange either on 12 July 2017 or on the following Trading Day.Post MCE Trades refer to all aucti ...

bnp paribas issuance bv

... rights of the holders of CBBCs and the obligations of the Issuer with respect to the CBBCs shall cease. Market participants are requested to note that all Post MCE Trades will be cancelled by the Stock Exchange either on 12 July 2017 or on the following Trading Day.Post MCE Trades refer to all aucti ...

... rights of the holders of CBBCs and the obligations of the Issuer with respect to the CBBCs shall cease. Market participants are requested to note that all Post MCE Trades will be cancelled by the Stock Exchange either on 12 July 2017 or on the following Trading Day.Post MCE Trades refer to all aucti ...

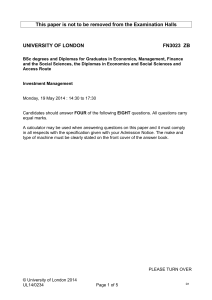

This paper is not to be removed from the Examination Halls

... when the value is high and sell if the value is low. The ratio of informed to uninformed traders is 1 to 5. The value of the stock is 110 if it is high and 90 if it is low, and both are seen as equally likely by the market maker. Work out the market maker’s bid and ask quotes in the first round of t ...

... when the value is high and sell if the value is low. The ratio of informed to uninformed traders is 1 to 5. The value of the stock is 110 if it is high and 90 if it is low, and both are seen as equally likely by the market maker. Work out the market maker’s bid and ask quotes in the first round of t ...

CME Group customer forum

... Futures and swaps trading is not suitable for all investors, and involves the risk of loss. Futures and swaps are leveraged investments, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money initially deposited for a futures an ...

... Futures and swaps trading is not suitable for all investors, and involves the risk of loss. Futures and swaps are leveraged investments, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money initially deposited for a futures an ...

NYSE National, Inc. Schedule of Fees and Rebates As Of

... The “taker” fee of $0.0003 per share for any marketable order that removes liquidity will be charged to any ETP Holder that executes at least 50,000 shares of liquidity-adding volume during a calendar month. An ETP Holder that does not execute at least 50,000 shares of liquidity-adding volume during ...

... The “taker” fee of $0.0003 per share for any marketable order that removes liquidity will be charged to any ETP Holder that executes at least 50,000 shares of liquidity-adding volume during a calendar month. An ETP Holder that does not execute at least 50,000 shares of liquidity-adding volume during ...

nymex 1090 - CME Group

... The provisions of these rules shall apply to all contracts bought or sold on the Exchange for cash settlement based on the Floating Price. ...

... The provisions of these rules shall apply to all contracts bought or sold on the Exchange for cash settlement based on the Floating Price. ...