Gleadell Market Report

... year-on-year. This pace points to an end-of-season figure of 25mln t, leaving stocks well over 20mln t. The UK market is down 75p on the week as sterling continues to soar, limiting export opportunities. Delivery premiums remain under pressure in the nearby positions. In summary, technical factors a ...

... year-on-year. This pace points to an end-of-season figure of 25mln t, leaving stocks well over 20mln t. The UK market is down 75p on the week as sterling continues to soar, limiting export opportunities. Delivery premiums remain under pressure in the nearby positions. In summary, technical factors a ...

STOCKS

... and the power grid 1929, 2 out of every 5 dollars a bank loaned were used to purchase stocks ...

... and the power grid 1929, 2 out of every 5 dollars a bank loaned were used to purchase stocks ...

TTSE Rule 405 - Price Stabilisation Amended April 19th 2010

... This proposal seeks to amend the price band for daily price movements from 10% to 15%. Increasing the price band to 15% would allow investors to place orders within a wider price band making them more attractive to the market which should result in an increase in market activity and more flexible an ...

... This proposal seeks to amend the price band for daily price movements from 10% to 15%. Increasing the price band to 15% would allow investors to place orders within a wider price band making them more attractive to the market which should result in an increase in market activity and more flexible an ...

The Great Depression - What Crashed and Why?

... products. American farmers were left with piles of surplus crops and no market. The world market left its mark on the American economy in other ways. Congress had set tariffs, or taxes on imported products. The tariffs made it very hard for other countries to sell their goods in the U.S. With the lo ...

... products. American farmers were left with piles of surplus crops and no market. The world market left its mark on the American economy in other ways. Congress had set tariffs, or taxes on imported products. The tariffs made it very hard for other countries to sell their goods in the U.S. With the lo ...

Stocks, Bonds, And Futures

... specialize in trading stocks and other securities • Profit off commission or fee ...

... specialize in trading stocks and other securities • Profit off commission or fee ...

Electrode Placement for Chest Leads, V1 to V6

... – Allowing people to deposit their money in a bank account for safekeeping – Allowing checking account holders to write checks demanding that the bank pay another party a specific amount ...

... – Allowing people to deposit their money in a bank account for safekeeping – Allowing checking account holders to write checks demanding that the bank pay another party a specific amount ...

(BN) China Cuts Transaction Fees for Share Trading to Boost Mark

... China Cuts Transaction Fees for Share Trading to Boost Market 2012-08-02 10:20:20.76 GMT ...

... China Cuts Transaction Fees for Share Trading to Boost Market 2012-08-02 10:20:20.76 GMT ...

Technical analysis

... Advantages of technical analysis Most technical analyst admit that a fundamental analyst with a good information, good analytical ability, and a keen sense of information requires qualification. According to technical analysts, it is important to recognize that the fundamental analysts can exper ...

... Advantages of technical analysis Most technical analyst admit that a fundamental analyst with a good information, good analytical ability, and a keen sense of information requires qualification. According to technical analysts, it is important to recognize that the fundamental analysts can exper ...

Referee report on Ph.D. dissertation “Essays on the Behavior of

... the need of trading activity, whereas private information is reflected in excess buying or excess selling pressure (abnormal order flow). In other words, order flow captures information that is ...

... the need of trading activity, whereas private information is reflected in excess buying or excess selling pressure (abnormal order flow). In other words, order flow captures information that is ...

Capital Markets in Egypt

... - Transition to unified flexible FX rate regime (Dec.2004) -- subsequent stabilization - strengthened external position ...

... - Transition to unified flexible FX rate regime (Dec.2004) -- subsequent stabilization - strengthened external position ...

Markets

... • Describe, briefly, the bond and derivatives markets. • Discuss the factors behind rapid change in the securities markets ...

... • Describe, briefly, the bond and derivatives markets. • Discuss the factors behind rapid change in the securities markets ...

Commodity Marketing Activity

... • 1922 Grain Futures Act - regulate trading • 1936 Commodity Exchange Act made it illegal to “fix prices” • 1974 Commodity Futures Trading Act est. the Commodity Futures Trading Commission as the independent federal body that oversees all futures trading in U.S. • Exchanges today page 5 ...

... • 1922 Grain Futures Act - regulate trading • 1936 Commodity Exchange Act made it illegal to “fix prices” • 1974 Commodity Futures Trading Act est. the Commodity Futures Trading Commission as the independent federal body that oversees all futures trading in U.S. • Exchanges today page 5 ...

Investments & the Stock Market PowerPoint

... Bonds—loans made by the investor to the issuer; the investor is repaid with interest ...

... Bonds—loans made by the investor to the issuer; the investor is repaid with interest ...

File

... Profit When you make money in business, it is called a profit. Mathematically: Profit = Revenue – Cost For example: If you buy an iPod for $250 and sell it for $300, you made a profit of … ...

... Profit When you make money in business, it is called a profit. Mathematically: Profit = Revenue – Cost For example: If you buy an iPod for $250 and sell it for $300, you made a profit of … ...

2.03-PowerPoint

... Bonds—loans made by the investor to the issuer; the investor is repaid with interest ...

... Bonds—loans made by the investor to the issuer; the investor is repaid with interest ...

Stock Market Liquidity: Behavior of Short-Term and Long-Term

... the third largest exchange worldwide in 2006 based on the number of trades, after NYSE and NASDAQ. The NSE classifies traders in terms of their legal affiliations. We find that these legal classifications of traders (such as retail, institutions, etc.) are not adequate for understanding liquidity pr ...

... the third largest exchange worldwide in 2006 based on the number of trades, after NYSE and NASDAQ. The NSE classifies traders in terms of their legal affiliations. We find that these legal classifications of traders (such as retail, institutions, etc.) are not adequate for understanding liquidity pr ...

Chapter 3: How Securities are Traded

... • Price-contingent – Investors specify prices – Stop orders ...

... • Price-contingent – Investors specify prices – Stop orders ...

Cattle marketing: understanding traders perceptions and market

... • Markets play a role in the exchange of ownership for livestock resources destined for breeding, fattening and slaughter. • Markets acts as a hub for a bigger network which can enhance disease spread to other production systems and farms. • A clear understanding on how markets operate and weaknesse ...

... • Markets play a role in the exchange of ownership for livestock resources destined for breeding, fattening and slaughter. • Markets acts as a hub for a bigger network which can enhance disease spread to other production systems and farms. • A clear understanding on how markets operate and weaknesse ...

MS DOC - University of Nairobi

... • Markets play a role in the exchange of ownership for livestock resources destined for breeding, fattening and slaughter. • Markets acts as a hub for a bigger network which can enhance disease spread to other production systems and farms. • A clear understanding on how markets operate and weaknesse ...

... • Markets play a role in the exchange of ownership for livestock resources destined for breeding, fattening and slaughter. • Markets acts as a hub for a bigger network which can enhance disease spread to other production systems and farms. • A clear understanding on how markets operate and weaknesse ...

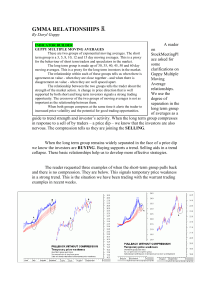

gmma relationships

... agreement on value - when they are close together - and when there is disagreement on value - when they are well spaced apart. The relationship between the two groups tells the trader about the strength of the market action. A change in price direction that is well supported by both short and long t ...

... agreement on value - when they are close together - and when there is disagreement on value - when they are well spaced apart. The relationship between the two groups tells the trader about the strength of the market action. A change in price direction that is well supported by both short and long t ...

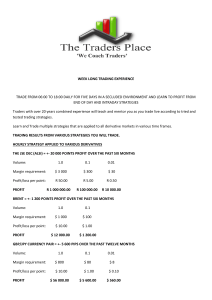

week long trading experience trade from 06:00 to 18:00 daily for five

... Warren began trading stocks in 2003 and progressed to Index and Forex trading in 2004. In 2005 he joined Share Direct, a financial market training company where he trained retail traders in Stocks, Index and Forex trading. He later joined Ideal CFD’s a CFD provider that was bought by IG Markets, he ...

... Warren began trading stocks in 2003 and progressed to Index and Forex trading in 2004. In 2005 he joined Share Direct, a financial market training company where he trained retail traders in Stocks, Index and Forex trading. He later joined Ideal CFD’s a CFD provider that was bought by IG Markets, he ...

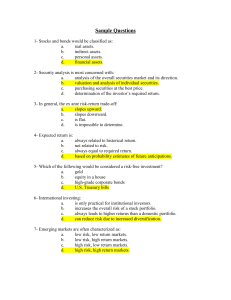

Sample Questions - U of L Class Index

... enable investors to earn money market rates on their dividend income. b. enable investors to directly purchase shares from corporations, thereby eliminating brokerage commissions. c. are provided by full-service brokerage houses only. d. are provided by corporations to their employees only. 37- Ms. ...

... enable investors to earn money market rates on their dividend income. b. enable investors to directly purchase shares from corporations, thereby eliminating brokerage commissions. c. are provided by full-service brokerage houses only. d. are provided by corporations to their employees only. 37- Ms. ...

The Stock Exchange Corner

... What does a limited service broker do? A limited service broker executes transactions on behalf of investors, but does not provide advice or other ancillary services. What does a broker/dealer do? A broker dealer carries on business both as an agent for his customers and as a principal for his own ...

... What does a limited service broker do? A limited service broker executes transactions on behalf of investors, but does not provide advice or other ancillary services. What does a broker/dealer do? A broker dealer carries on business both as an agent for his customers and as a principal for his own ...