semester v cm05bba05 – investment management

... b. Securities in a depository are fungible c. Securities in a depository are held in dematerialized form d. Dematerialized securities have distinct numbers 93. SEBI has prescribed code of conduct for the sub broker in _____________ a. Indian contract Act,1872 b. Securities Contract (Regulation) Act ...

... b. Securities in a depository are fungible c. Securities in a depository are held in dematerialized form d. Dematerialized securities have distinct numbers 93. SEBI has prescribed code of conduct for the sub broker in _____________ a. Indian contract Act,1872 b. Securities Contract (Regulation) Act ...

Lei, Noussair, and Plott: Non-Speculative Bubbles in Experimental

... The 1920s were a period of strong economic growth, spurred in part by changes in production technology. For a variety of reasons, interest in stocks grew in this period as well. In March 1928, stock prices began a sharp upwards climb. While originally based on good economic news, this rapid increase ...

... The 1920s were a period of strong economic growth, spurred in part by changes in production technology. For a variety of reasons, interest in stocks grew in this period as well. In March 1928, stock prices began a sharp upwards climb. While originally based on good economic news, this rapid increase ...

How can I sell my Share Certificates? - Trop-X

... In most cases when companies sell you their shares, they will issue you with a certificate that represents your ownership in that company. As a shareholder you can go on to sell your shares in one of two ways: Firstly you can search for someone who is willing to buy the shares from you (normally a f ...

... In most cases when companies sell you their shares, they will issue you with a certificate that represents your ownership in that company. As a shareholder you can go on to sell your shares in one of two ways: Firstly you can search for someone who is willing to buy the shares from you (normally a f ...

pdf

... 1. You suspect that Delta airlines will merge with Northwest Airlines in the coming month. Delta stock is trading at $0.85. We assume that the forward price equals the stock price. There is a 60% chance that the merger will occur, in which case the stock will be worth $1.20. There is a 40% chance th ...

... 1. You suspect that Delta airlines will merge with Northwest Airlines in the coming month. Delta stock is trading at $0.85. We assume that the forward price equals the stock price. There is a 60% chance that the merger will occur, in which case the stock will be worth $1.20. There is a 40% chance th ...

Circular 2013/8 Market conduct rules Supervisory rules on

... VI. Market abuse on the primary market, with foreign securities or on other markets For the purpose of assessing the assurance of proper business conduct on the part of the supervised institutions listed in margin nos. 4, 5 and 6 and with a view to applying measures in accordance with Articles 29-3 ...

... VI. Market abuse on the primary market, with foreign securities or on other markets For the purpose of assessing the assurance of proper business conduct on the part of the supervised institutions listed in margin nos. 4, 5 and 6 and with a view to applying measures in accordance with Articles 29-3 ...

Week 45 saw just over 38000 bales offered for sale to

... Week 45 saw just over 38,000 bales offered for sale to the trade. On the first day of selling the market opened very solidly in the Eastern States with most types and descriptions selling at levels at or above those achieved at the previous sale, buyer confidence remained high through to the final l ...

... Week 45 saw just over 38,000 bales offered for sale to the trade. On the first day of selling the market opened very solidly in the Eastern States with most types and descriptions selling at levels at or above those achieved at the previous sale, buyer confidence remained high through to the final l ...

download

... trading the mispriced security and then waiting for the market to recognize its "mistake" and reprice the security. 2. Technical analysis maintains that all information is reflected already in the stock price. Trends 'are your friend' and sentiment changes predate and predict trend changes. Investor ...

... trading the mispriced security and then waiting for the market to recognize its "mistake" and reprice the security. 2. Technical analysis maintains that all information is reflected already in the stock price. Trends 'are your friend' and sentiment changes predate and predict trend changes. Investor ...

Instructions for Setting Up and Operating Firebird

... Main trend line “Waiting for Main trend” is referring to a manual trend line that needs to be added before the EA will function. Create this line as a normal trend line. Select the line by right clicking it. Select Trendline properties…, and Common. In the Description field enter “Main_UpTrend_Alert ...

... Main trend line “Waiting for Main trend” is referring to a manual trend line that needs to be added before the EA will function. Create this line as a normal trend line. Select the line by right clicking it. Select Trendline properties…, and Common. In the Description field enter “Main_UpTrend_Alert ...

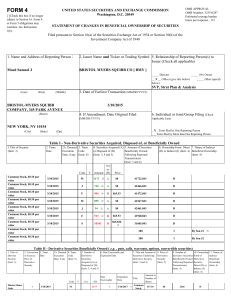

BRISTOL MYERS SQUIBB CO (Form: 4, Received

... ( 3) Shares withheld for payment of taxes upon vesting of awards. ( 4) Represents vesting of one-quarter of market share units granted on March 10, 2014. ( 5) The price reported reflects the weighted average sales price. The shares were sold in multiple transactions at prices ranging from $65.77 to ...

... ( 3) Shares withheld for payment of taxes upon vesting of awards. ( 4) Represents vesting of one-quarter of market share units granted on March 10, 2014. ( 5) The price reported reflects the weighted average sales price. The shares were sold in multiple transactions at prices ranging from $65.77 to ...

Fabozzi_CM4_Chapter13(equitymarkets)

... • over-the-counter (OTC) trading (also called multiple market maker systems), which results from geographically dispersed traders or market makers electronically linked to one another • The trading mechanism is a negotiated system whereby buyers negotiate with sellers Copyright © 2009 Pearson Educat ...

... • over-the-counter (OTC) trading (also called multiple market maker systems), which results from geographically dispersed traders or market makers electronically linked to one another • The trading mechanism is a negotiated system whereby buyers negotiate with sellers Copyright © 2009 Pearson Educat ...

DOMTrader

... Trailing stop orders adjust their trigger price in concert to the direction of the market on a tick-by-tick basis, initially trailing the market with the same distance to the market price when the order is first placed. The trigger price of a trailing sell stop order automatically steps higher with ...

... Trailing stop orders adjust their trigger price in concert to the direction of the market on a tick-by-tick basis, initially trailing the market with the same distance to the market price when the order is first placed. The trigger price of a trailing sell stop order automatically steps higher with ...

Ethan Frome - Eurex Exchange

... determining a particular opening price, additional orders and quotes may be entered until a time established by the Boards of Management of the Eurex Exchanges; a preliminary opening price will be continuously displayed during this period (the ”Pre-Opening Period”). Quotes may be individually cancel ...

... determining a particular opening price, additional orders and quotes may be entered until a time established by the Boards of Management of the Eurex Exchanges; a preliminary opening price will be continuously displayed during this period (the ”Pre-Opening Period”). Quotes may be individually cancel ...

WORD

... t. Any material change in the shareholding of the company or its controlling company. u. The company's securities traded on the centralized securities exchange market or the OTC securities market are subject to an event of bidding, auctioning, material default in settlement, change of the original ...

... t. Any material change in the shareholding of the company or its controlling company. u. The company's securities traded on the centralized securities exchange market or the OTC securities market are subject to an event of bidding, auctioning, material default in settlement, change of the original ...

stock exchange

... commodities at a particular date in the future at a specified price today. • Similarly, options are contracts that give investors the choice to buy or sell stock and other financial assets. • Most people who buy stock hold their investment for a significant period of time. – Day traders, on the othe ...

... commodities at a particular date in the future at a specified price today. • Similarly, options are contracts that give investors the choice to buy or sell stock and other financial assets. • Most people who buy stock hold their investment for a significant period of time. – Day traders, on the othe ...

TSO preferred start time of WD Trading Day

... relates to the time of the peak demand. As shown in the demand curves below, in summer the peak typically happens at lunchtime but on occasion a peak of similar or greater magnitude happens in the evening. In the late spring and early autumn, the demand is consistently high from lunchtime till the l ...

... relates to the time of the peak demand. As shown in the demand curves below, in summer the peak typically happens at lunchtime but on occasion a peak of similar or greater magnitude happens in the evening. In the late spring and early autumn, the demand is consistently high from lunchtime till the l ...

Diapositiva 1

... – article 22 (2) MiFID requires investment firms to make public limit orders concerning shares admitted to trading on a regulated market, which are not immediately executed under prevailing market conditions – article 27 MiFID requires internalisers to publish firm quotes only if a number of conditi ...

... – article 22 (2) MiFID requires investment firms to make public limit orders concerning shares admitted to trading on a regulated market, which are not immediately executed under prevailing market conditions – article 27 MiFID requires internalisers to publish firm quotes only if a number of conditi ...

50 The LC Gupta Committee Report: Some Observations

... closer look. Specifically, there are two questions that beg satisfactory responses.9 First, given that derivatives exchanges would have to work in harmony with other institutions in the financial market, will the setting up of an efficiently functioning derivatives exchange necessarily ensure the av ...

... closer look. Specifically, there are two questions that beg satisfactory responses.9 First, given that derivatives exchanges would have to work in harmony with other institutions in the financial market, will the setting up of an efficiently functioning derivatives exchange necessarily ensure the av ...

FOREX 1

... liquid market is one in which there is enough activity to satisfy both buyers and sellers. Open position: A position in a currency that has not yet been offset. For example, if you have bought 100,000 USDJPY, you have an open position in USDJPY until you offset it by selling 100,000 USDJPY, thus “ ...

... liquid market is one in which there is enough activity to satisfy both buyers and sellers. Open position: A position in a currency that has not yet been offset. For example, if you have bought 100,000 USDJPY, you have an open position in USDJPY until you offset it by selling 100,000 USDJPY, thus “ ...

Presentation - NCDEX Institute of Commodity Markets and Research

... First Difference of log form, i.e., rates of growth series of these indices are stationary. It implies that while it may not be possible to predict future values, the rate of growth of either of the two series is predictable. ...

... First Difference of log form, i.e., rates of growth series of these indices are stationary. It implies that while it may not be possible to predict future values, the rate of growth of either of the two series is predictable. ...

The Stock Market

... On the left hand side of the screen you should see a menu. Click on “INTRODUCTION,” read the information on this page and answer any questions below that pertain to this information. Continue to click next after each section. 1. How did the Colonial Government, during the American Revolution, ra ...

... On the left hand side of the screen you should see a menu. Click on “INTRODUCTION,” read the information on this page and answer any questions below that pertain to this information. Continue to click next after each section. 1. How did the Colonial Government, during the American Revolution, ra ...

Limit Orders and the Intraday Behavior of Market Liquidity

... expected gains from trading with liquidity traders exceeded the expected loss from trading with informed traders. However, his model does not endogenize the traders' choice between market and limit orders. Handa and Schwartz (1996) extend Glosten's analysis by examining the investors' rational choic ...

... expected gains from trading with liquidity traders exceeded the expected loss from trading with informed traders. However, his model does not endogenize the traders' choice between market and limit orders. Handa and Schwartz (1996) extend Glosten's analysis by examining the investors' rational choic ...

Tom Lawless

... Look around in region – can you use them? This is a volume business – harness economies of ...

... Look around in region – can you use them? This is a volume business – harness economies of ...

Why YOU Should Trade CME Currency Futures Instead

... the Euro FX made over that time frame, keep in mind the difference in spreads offered in the cash market versus the CME electronic markets. Since late 2003, in the CME Euro FX futures, in the hundreds of trade entry signals generated in my trading programs, I was not filled on my full amount [roughl ...

... the Euro FX made over that time frame, keep in mind the difference in spreads offered in the cash market versus the CME electronic markets. Since late 2003, in the CME Euro FX futures, in the hundreds of trade entry signals generated in my trading programs, I was not filled on my full amount [roughl ...

Kevin Houstoun

... “New types of circuit breakers triggered by ex ante rather than ex post trading may be effective in dealing with periodic illiquidity.” “In times of overall market stress there is a need for coordination of circuit breakers across markets, and this could be a mandate for regulatory involvement.” Nee ...

... “New types of circuit breakers triggered by ex ante rather than ex post trading may be effective in dealing with periodic illiquidity.” “In times of overall market stress there is a need for coordination of circuit breakers across markets, and this could be a mandate for regulatory involvement.” Nee ...

By Robert C Merton, John and Natty McArthur

... management and corporate financial decision-making. But surely the prime exemplifying case is the development, refinement and broad-based adoption of derivative securities such as futures, options, swaps and other contractual agreements. It is estimated that more than USD 500 trillion – half a quadr ...

... management and corporate financial decision-making. But surely the prime exemplifying case is the development, refinement and broad-based adoption of derivative securities such as futures, options, swaps and other contractual agreements. It is estimated that more than USD 500 trillion – half a quadr ...