Mechanics of Futures Markets

... CH where A agrees to buy an asset from B in one year for a certain price, the CH becomes the counterparties to both A and B and agrees to ...

... CH where A agrees to buy an asset from B in one year for a certain price, the CH becomes the counterparties to both A and B and agrees to ...

A Multiple Lender Approach to Understanding Supply and Search in

... This is a $700 million [sic] market, according to calculations by Vodia Group, a research firm, but one that is so hidden from view that this suspected fraud could go on for more than five years without being detected.…. ….Profits can be lower for market makers in transparent markets, and while inst ...

... This is a $700 million [sic] market, according to calculations by Vodia Group, a research firm, but one that is so hidden from view that this suspected fraud could go on for more than five years without being detected.…. ….Profits can be lower for market makers in transparent markets, and while inst ...

CE91 - MexDer

... There will be no maximum fluctuation in the Futures Rate during a same auction session. 2. Trading Hours Trading hours for the 91-Day Cetes Futures Contract will be Bank Business Days from 7:30 to 14:00 hours, Mexico City time. Also, trading hours will be understood to include the period for trading ...

... There will be no maximum fluctuation in the Futures Rate during a same auction session. 2. Trading Hours Trading hours for the 91-Day Cetes Futures Contract will be Bank Business Days from 7:30 to 14:00 hours, Mexico City time. Also, trading hours will be understood to include the period for trading ...

Securities Trading Policy

... Dealing with security analysts, institutional investors and journalists A person may be exposed to others outside the Group such as security analysts, institutional investors and journalists. It is important that all Restricted Persons be aware that selective disclosure of non-public information may ...

... Dealing with security analysts, institutional investors and journalists A person may be exposed to others outside the Group such as security analysts, institutional investors and journalists. It is important that all Restricted Persons be aware that selective disclosure of non-public information may ...

Securities Trading of Concepts (STOC)

... participant to maximize the value of his or her portfolio, evaluated at the last price prior to the closing of the market, and markets are typically open for 20 to 30 minutes. If participants play with real money, they will have the opportunity to profit from trading and bear the risk of losing mone ...

... participant to maximize the value of his or her portfolio, evaluated at the last price prior to the closing of the market, and markets are typically open for 20 to 30 minutes. If participants play with real money, they will have the opportunity to profit from trading and bear the risk of losing mone ...

WNE UW - Derivatives Markets

... In the last 30 years, derivatives have become increasingly important in finance. Futures and options are actively traded on many exchanges throughout the world. Many different types of forward contracts, swaps, options, and other derivatives are entered into by financial institutions, fund managers, ...

... In the last 30 years, derivatives have become increasingly important in finance. Futures and options are actively traded on many exchanges throughout the world. Many different types of forward contracts, swaps, options, and other derivatives are entered into by financial institutions, fund managers, ...

An approach on how to trade in commodities market

... the buyers and sellers do not carry a risk of not more than one day. Do I have to give delivery or settle in cash? You can do both however as per the guidelines of the exchanges. Some commodities are cash settled while rest are compulsory deliverables. The choice is yours. If you want your contract ...

... the buyers and sellers do not carry a risk of not more than one day. Do I have to give delivery or settle in cash? You can do both however as per the guidelines of the exchanges. Some commodities are cash settled while rest are compulsory deliverables. The choice is yours. If you want your contract ...

Multimarket Trading and Market Liquidity Author(s): Bhagwan

... fourth markets" in some stocks. Also, there often exist active markets in derivative securities, such as futures and options. An investor with private information about a stock could trade, for example, on one or more exchanges on which the stock is listed, while simultaneously trading in off-the-ex ...

... fourth markets" in some stocks. Also, there often exist active markets in derivative securities, such as futures and options. An investor with private information about a stock could trade, for example, on one or more exchanges on which the stock is listed, while simultaneously trading in off-the-ex ...

1 Rational Expectations Equilibrium

... All this follows from properties of the Radner equilibrium when types are θ. Substituting back in the definitions xi (θi , q (θ)) = xfi (θ) and p (q (θ)) = pf (θ) shows that the tentative Radner equilibrium relative to beliefs satisfies the optimality conditions of equilibrium. The market clearing c ...

... All this follows from properties of the Radner equilibrium when types are θ. Substituting back in the definitions xi (θi , q (θ)) = xfi (θ) and p (q (θ)) = pf (θ) shows that the tentative Radner equilibrium relative to beliefs satisfies the optimality conditions of equilibrium. The market clearing c ...

02_riskreturn_ch12

... Stock prices are in equilibrium or are “fairly” priced If this is true, then you should not be able to earn “abnormal” or “excess” returns Efficient markets do not imply that investors cannot earn a positive return in the stock market ...

... Stock prices are in equilibrium or are “fairly” priced If this is true, then you should not be able to earn “abnormal” or “excess” returns Efficient markets do not imply that investors cannot earn a positive return in the stock market ...

Monopoly - ComLabGames

... most auction and monopoly models 1. Monopolists price discriminate through market segmentation, but auction rules do not make the winner’s payment depend on his type. However holding auctions with multiple rounds (for example restricting entry to qualified bidders in certain auctions) segments the m ...

... most auction and monopoly models 1. Monopolists price discriminate through market segmentation, but auction rules do not make the winner’s payment depend on his type. However holding auctions with multiple rounds (for example restricting entry to qualified bidders in certain auctions) segments the m ...

Estimating a Structural Model of Herd Behavior in Financial Markets

... by the data, which implies both that herd behavior arises in equilibrium and that there is information content in the sequence of trades. Note that in each day of trading there is always high heterogeneity in trading decisions (i.e., even in days when the fundamental value has increased, we observe ...

... by the data, which implies both that herd behavior arises in equilibrium and that there is information content in the sequence of trades. Note that in each day of trading there is always high heterogeneity in trading decisions (i.e., even in days when the fundamental value has increased, we observe ...

12-1

... “fairly” priced • If this is true, then you should not be able to earn “abnormal” or “excess” returns • Efficient markets DO NOT imply that investors cannot earn a positive return in the stock market ...

... “fairly” priced • If this is true, then you should not be able to earn “abnormal” or “excess” returns • Efficient markets DO NOT imply that investors cannot earn a positive return in the stock market ...

Stock Underwriting

... used as a backdoor way of becoming a public company. The easiest way to become a public company is to merge into the public shell. – One big advantage is the time and money saved. The entrepreneurs pay little to “acquire” the shell. The entrepreneurs essentially purchase control of the shell by buyi ...

... used as a backdoor way of becoming a public company. The easiest way to become a public company is to merge into the public shell. – One big advantage is the time and money saved. The entrepreneurs pay little to “acquire” the shell. The entrepreneurs essentially purchase control of the shell by buyi ...

CSI Short Term Note 50 Index Methodology

... 1. Adjustment formula Divisor Adjustment Methodology. 2. Cases for Index Adjustment: Constituents adjustment Amount outstanding Adjustment— if issued amount of constituent bond changes, the index is adjusted before the change occurs. On the last trading day of the month, interest and reinvestm ...

... 1. Adjustment formula Divisor Adjustment Methodology. 2. Cases for Index Adjustment: Constituents adjustment Amount outstanding Adjustment— if issued amount of constituent bond changes, the index is adjusted before the change occurs. On the last trading day of the month, interest and reinvestm ...

The Hunger-Makers: How Deutsche Bank, Goldman

... Futures prices at the exchanges for physical trade serve as reference prices for buyers and sellers of commodities. It would make no economic sense for a grain producer to sell goods significantly cheaper than the price guaranteed by futures one or two months ahead. Similarly, it makes no sense for ...

... Futures prices at the exchanges for physical trade serve as reference prices for buyers and sellers of commodities. It would make no economic sense for a grain producer to sell goods significantly cheaper than the price guaranteed by futures one or two months ahead. Similarly, it makes no sense for ...

Derivatives and their feedback effects on the spot markets

... importance and information content, Monthly Report, ...

... importance and information content, Monthly Report, ...

Tender offer approval

... authority, Komisja Nadzoru Finansowego, approved the Tender Offer that the Company submitted on 5 January 2017 in connection with its intention to delist its shares from trading on the Warsaw Stock Exchange. The subject of the Tender Offer are 434 531 shares, i.e. 4.71% of the share capital of the C ...

... authority, Komisja Nadzoru Finansowego, approved the Tender Offer that the Company submitted on 5 January 2017 in connection with its intention to delist its shares from trading on the Warsaw Stock Exchange. The subject of the Tender Offer are 434 531 shares, i.e. 4.71% of the share capital of the C ...

Non-Display Declaration Form

... OTC Markets Non-Display Usage is broken down into three (3) categories: Category 1—Non-Display Trading Platform Usage (OTC Link Participant). Applies to Non-Display Usage by a Distributor or Recipient who is an OTC Link participant when the Distributor or Recipient uses the Information in an Electro ...

... OTC Markets Non-Display Usage is broken down into three (3) categories: Category 1—Non-Display Trading Platform Usage (OTC Link Participant). Applies to Non-Display Usage by a Distributor or Recipient who is an OTC Link participant when the Distributor or Recipient uses the Information in an Electro ...

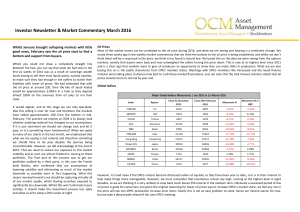

Market Commentary March 2016

... However, it is bad news if the OPEC nations become distressed sellers of equities as they have been year to date, so it is in their interest to help make things more manageable. However, we must remember that inventories remain sky high; running at the highest level in eight decades, so we are think ...

... However, it is bad news if the OPEC nations become distressed sellers of equities as they have been year to date, so it is in their interest to help make things more manageable. However, we must remember that inventories remain sky high; running at the highest level in eight decades, so we are think ...

Market Impact Studies

... the deviation between the actual number and the expected number of an upcoming economic data release, i.e., how much of a deviation we must see in a certain event to have a trading opportunity. Choosing the right deviation trigger is the key to effective news trading. It can be also atractive for bi ...

... the deviation between the actual number and the expected number of an upcoming economic data release, i.e., how much of a deviation we must see in a certain event to have a trading opportunity. Choosing the right deviation trigger is the key to effective news trading. It can be also atractive for bi ...

A Langevin approach to stock market fluctuations and crashes

... sell their stocks; it is thus tempting to think of a crash as some kind of critical point where (as in statistical physics models undergoing a phase transition) the response to a small external perturbation becomes infinite, because all the subparts of the system respond cooperatively. Corresponding ...

... sell their stocks; it is thus tempting to think of a crash as some kind of critical point where (as in statistical physics models undergoing a phase transition) the response to a small external perturbation becomes infinite, because all the subparts of the system respond cooperatively. Corresponding ...

Aramis NSC

... Our track record with Euronext, Euronext.liffe, CBOT but also Amman Stock Exchange & Muscat Stock Market demonstrates capabilities and our dedication to client service ...

... Our track record with Euronext, Euronext.liffe, CBOT but also Amman Stock Exchange & Muscat Stock Market demonstrates capabilities and our dedication to client service ...

Stock Market Prediction Using Support Vector Machine

... variables selected and included in the model generally ...

... variables selected and included in the model generally ...