• Price controls : a legal maximum on the price

... society’s resources. This allocation is altered when policymakers restrict prices. ...

... society’s resources. This allocation is altered when policymakers restrict prices. ...

E(R i ) - Cengage

... risky portfolios, one portfolio will emerge that maximizes the return investors can expect for a given standard deviation. To determine the composition of the optimal portfolio, you need to know the expected return and standard deviation for every risky asset, as well as the covariance between ever ...

... risky portfolios, one portfolio will emerge that maximizes the return investors can expect for a given standard deviation. To determine the composition of the optimal portfolio, you need to know the expected return and standard deviation for every risky asset, as well as the covariance between ever ...

Special Risks in Securities Trading

... Conversely, when you are obliged to deliver securities that you have sold, you may not simultaneously receive the purchase price from the buyer. Settlement risks mainly occur in emerging markets (see 209). – Risks associated with custody of financial instruments Financial instruments can be held eit ...

... Conversely, when you are obliged to deliver securities that you have sold, you may not simultaneously receive the purchase price from the buyer. Settlement risks mainly occur in emerging markets (see 209). – Risks associated with custody of financial instruments Financial instruments can be held eit ...

File

... • Interest payments may vary [variable rate mortgages] • Home owner may prepay • Refinance a fixed mortgage if interest rates decline ...

... • Interest payments may vary [variable rate mortgages] • Home owner may prepay • Refinance a fixed mortgage if interest rates decline ...

A Guide to Your Market Linked CD Value

... reflected in the value of your Market Linked CD. This is due to the fact that there is more uncertainty surrounding whether this underlying asset performance value will hold until maturity. Interest rate movements: As a general rule, if interest rates decrease, your Market Linked CD’s interim statem ...

... reflected in the value of your Market Linked CD. This is due to the fact that there is more uncertainty surrounding whether this underlying asset performance value will hold until maturity. Interest rate movements: As a general rule, if interest rates decrease, your Market Linked CD’s interim statem ...

Derivatives Debacles: Case Studies of Large Losses

... as part of a strategy known as a “stack-and-roll” hedge. In its simplest form, a stack-and-roll hedge involves repeatedly buying a bundle, or “stack,” of shortdated futures or forward contracts to hedge a longer-term exposure. Each stack is rolled over just before expiration by selling the existing ...

... as part of a strategy known as a “stack-and-roll” hedge. In its simplest form, a stack-and-roll hedge involves repeatedly buying a bundle, or “stack,” of shortdated futures or forward contracts to hedge a longer-term exposure. Each stack is rolled over just before expiration by selling the existing ...

Growth/Value/Momentum Returns as a Function of the Cross

... long an option. Strongin, Petsch, Segal and Sharenow (2002) find value strategies work best when confined within sector (small crosssectional dispersion), while growth strategies work best with no sector constraints (high dispersion) Solnik and Roulet (2000) examine the dispersion of country returns ...

... long an option. Strongin, Petsch, Segal and Sharenow (2002) find value strategies work best when confined within sector (small crosssectional dispersion), while growth strategies work best with no sector constraints (high dispersion) Solnik and Roulet (2000) examine the dispersion of country returns ...

LIFE OFFICE PRACTICE DEFINITIONS

... Group contract :- this is a contract that covers a group of lives, where the group is specified but not necessarily the individuals within it. Group personal pension scheme (GPP Scheme) :- an arrangement made for employees of a particular employer, or for a group of self-employed individuals, to par ...

... Group contract :- this is a contract that covers a group of lives, where the group is specified but not necessarily the individuals within it. Group personal pension scheme (GPP Scheme) :- an arrangement made for employees of a particular employer, or for a group of self-employed individuals, to par ...

Dr. Krzysztof Ostaszewski, FSA, CFA, MAAA Actuarial Program

... - Bonds (or loans): assets that specify in advance the amount of income that will be forwarded to the financial asset holder. - Stocks (or shares): assets that allow the asset holder to share in both good and bad fortunes of income producer, but do not specify in advance what the amount of income fo ...

... - Bonds (or loans): assets that specify in advance the amount of income that will be forwarded to the financial asset holder. - Stocks (or shares): assets that allow the asset holder to share in both good and bad fortunes of income producer, but do not specify in advance what the amount of income fo ...

from the full article

... the time everyone knows something, or how they should react, it is almost certainly no longer useful. ‘Buying the Dip’ is one such phrase. By the time everyone knows that the supposedly sensible thing to do is buy any weakness, or dip, then it is almost certain that the market has been rising for a ...

... the time everyone knows something, or how they should react, it is almost certainly no longer useful. ‘Buying the Dip’ is one such phrase. By the time everyone knows that the supposedly sensible thing to do is buy any weakness, or dip, then it is almost certain that the market has been rising for a ...

Document

... • We’ve reached free cash flow, but we need to figure out what the cash flows are worth today. We need to discount them back to the future. • But what discount rate do we use? How do we find an discount rate that reflects the diversity of risk within our specific company? ...

... • We’ve reached free cash flow, but we need to figure out what the cash flows are worth today. We need to discount them back to the future. • But what discount rate do we use? How do we find an discount rate that reflects the diversity of risk within our specific company? ...

Analysis of the Discount Factors in Swap Valuation

... feature removes the effects of an unusually volatile single day and ensures that the payment will more accurately represent the value of the index. Average-price payoff structures are also found in other derivatives, particularly options. (4) Equity swaps In an equity swap, one of the two parties ex ...

... feature removes the effects of an unusually volatile single day and ensures that the payment will more accurately represent the value of the index. Average-price payoff structures are also found in other derivatives, particularly options. (4) Equity swaps In an equity swap, one of the two parties ex ...

file

... Introduction to IFRS 9 Debt Instrument (continued) • Examples that satisfy this criterion: a) A variable rate loan with a stated maturity date that permits the borrower to choose to pay three months LIBOR for a three month term or one month LIBOR for a one month term b) A fixed term variable market ...

... Introduction to IFRS 9 Debt Instrument (continued) • Examples that satisfy this criterion: a) A variable rate loan with a stated maturity date that permits the borrower to choose to pay three months LIBOR for a three month term or one month LIBOR for a one month term b) A fixed term variable market ...

Securities Markets Primary Versus Secondary Markets How

... Spread: cost of trading with dealer – Bid: Bid: price dealer will buy from you – Ask: Ask: price dealer will sell to you – Spread: Spread: ask - bid ...

... Spread: cost of trading with dealer – Bid: Bid: price dealer will buy from you – Ask: Ask: price dealer will sell to you – Spread: Spread: ask - bid ...

LSEDM - Tariff Schedule - London Stock Exchange Group

... index options and futures as well as 3 single stock options & futures, it will benefit from a further 15% discount on its OBX derivatives trading, adding up to a total of 70% discount (55%+15%), plus a 60% discount of stock option fees. The same rationale applies to discounts on single stock options ...

... index options and futures as well as 3 single stock options & futures, it will benefit from a further 15% discount on its OBX derivatives trading, adding up to a total of 70% discount (55%+15%), plus a 60% discount of stock option fees. The same rationale applies to discounts on single stock options ...

Consumer and Producer Surplus

... Emphasis on the MARKET demand – of those in the market there are some who are willing to pay higher prices than the market price ...

... Emphasis on the MARKET demand – of those in the market there are some who are willing to pay higher prices than the market price ...

The Futures Market

... 2. The initial buy or the physical ownership is called a long in the futures market. If a trader buys a futures contract, he or she is often referred to as being long that particular contract. a. If someone buys or is said to be long and then later sells, he or she has offset (taken the opposite act ...

... 2. The initial buy or the physical ownership is called a long in the futures market. If a trader buys a futures contract, he or she is often referred to as being long that particular contract. a. If someone buys or is said to be long and then later sells, he or she has offset (taken the opposite act ...

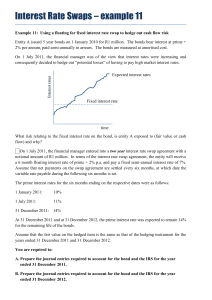

Interest Rate Swaps – example 11

... At 31 December 2011 and at 31 December 2012, the prime interest rate was expected to remain 14% for the remaining life of the bonds. Assume that the fair value on the hedged item is the same as that of the hedging instrument for the years ended 31 December 2011 and 31 December 2012. You are required ...

... At 31 December 2011 and at 31 December 2012, the prime interest rate was expected to remain 14% for the remaining life of the bonds. Assume that the fair value on the hedged item is the same as that of the hedging instrument for the years ended 31 December 2011 and 31 December 2012. You are required ...

Price Discrimination

... • Practiced by monopolists or any firm with price setting power • Does not occur in perfectly competitive markets • A firm price discriminates when it charges different prices to different consumers for reasons that do not reflect cost differences • This involves extracting consumer surplus from buy ...

... • Practiced by monopolists or any firm with price setting power • Does not occur in perfectly competitive markets • A firm price discriminates when it charges different prices to different consumers for reasons that do not reflect cost differences • This involves extracting consumer surplus from buy ...

Section 1, Mean variance analysis 1 Risk and return

... • The investor is a price taker, which means that the investor may purchase any amount of the asset, and nothing the investor does will effect the asset price. The price per share is independent of the amount purchased. • The price is the same for long and short positions. This really is a combinat ...

... • The investor is a price taker, which means that the investor may purchase any amount of the asset, and nothing the investor does will effect the asset price. The price per share is independent of the amount purchased. • The price is the same for long and short positions. This really is a combinat ...

FERC - Robert Blohm

... • It can be an economic optimization market • The real time-market is the true end-point of the forward market price path. • Real time transactions cannot be done moment-by-moment deterministically – Time is too short • Real time performance and value must be measured probabilistically – Classical p ...

... • It can be an economic optimization market • The real time-market is the true end-point of the forward market price path. • Real time transactions cannot be done moment-by-moment deterministically – Time is too short • Real time performance and value must be measured probabilistically – Classical p ...

PDF

... The theoretical and empirical evidence on hedging agricultural commodities has been discussed in numerous studies (Wisner; Leuthold, et al.; Working) which suggest that hedging using the futures market is beneficial. However, the full benefits of the hedging may not be obtained or evaluated accurate ...

... The theoretical and empirical evidence on hedging agricultural commodities has been discussed in numerous studies (Wisner; Leuthold, et al.; Working) which suggest that hedging using the futures market is beneficial. However, the full benefits of the hedging may not be obtained or evaluated accurate ...

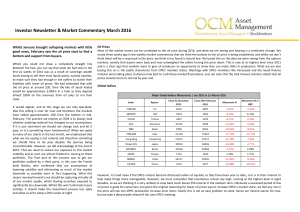

Market Commentary March 2016

... Brexit, the refugee/migration question and the breakdown of the Schengen agreement, or economic data; most news has been negative. European data out on Monday saw what we expected, namely that we are seeing deflation on the back of the lower oil prices. If we strip this out we are seeing inflation n ...

... Brexit, the refugee/migration question and the breakdown of the Schengen agreement, or economic data; most news has been negative. European data out on Monday saw what we expected, namely that we are seeing deflation on the back of the lower oil prices. If we strip this out we are seeing inflation n ...

FREE Sample Here

... 97. From 1965 to 2003 large block trades of common stock traded on the New York Stock Exchange increased from 3.1 percent to almost 50 percent. This indicates that a. Individual investors are getting out of the market entirely b. Individual investors are avoiding a long term buy-and-hold strategy in ...

... 97. From 1965 to 2003 large block trades of common stock traded on the New York Stock Exchange increased from 3.1 percent to almost 50 percent. This indicates that a. Individual investors are getting out of the market entirely b. Individual investors are avoiding a long term buy-and-hold strategy in ...

Risk Management and Financial Institutions

... distributed. They will be comfortable using the same volatility to value all options on a particular exchange rate. But you know that the lognormal assumption is not a good one for exchange rates. What should you do? – You should buy deep-out-of-the-money call and put options on a variety of differe ...

... distributed. They will be comfortable using the same volatility to value all options on a particular exchange rate. But you know that the lognormal assumption is not a good one for exchange rates. What should you do? – You should buy deep-out-of-the-money call and put options on a variety of differe ...