Block trade reporting for OTC derivatives markets, January

... of overall turnover. For example, 45% of trading turnover on the LSE is subject to a delay in trade reporting (but only 5% of the number of trades). This seems to be a ...

... of overall turnover. For example, 45% of trading turnover on the LSE is subject to a delay in trade reporting (but only 5% of the number of trades). This seems to be a ...

Volatility Strategies for 2016

... buy or sell any security or operate any specific strategy. Any securities included in this presentation are for illustrative purposes only and are not intended as recommendations. Execution fees for US options contracts with Interactive Brokers are $0.70c per contract for non-directed orders and $1. ...

... buy or sell any security or operate any specific strategy. Any securities included in this presentation are for illustrative purposes only and are not intended as recommendations. Execution fees for US options contracts with Interactive Brokers are $0.70c per contract for non-directed orders and $1. ...

Part 5 Clearing and settlement facilities

... (2) For paragraph 12BAB (18) (i) of the Act, the conduct of: (a) the Stock Exchange of Newcastle Limited, or an agent of that body; or (b) a participant of the Stock Exchange of Newcastle Limited, or an agent of the participant; or (c) Bendigo Stock Exchange Limited, or an agent of that body; or (d) ...

... (2) For paragraph 12BAB (18) (i) of the Act, the conduct of: (a) the Stock Exchange of Newcastle Limited, or an agent of that body; or (b) a participant of the Stock Exchange of Newcastle Limited, or an agent of the participant; or (c) Bendigo Stock Exchange Limited, or an agent of that body; or (d) ...

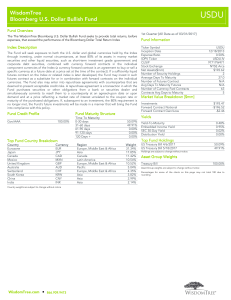

WisdomTree Bloomberg U.S. Dollar Bullish Fund

... The Fund will seek exposure to both the U.S. dollar and global currencies held by the Index through investing, under normal circumstances, at least 80% of its assets in money market securities and other liquid securities, such as short-term investment grade government and corporate debt securities, ...

... The Fund will seek exposure to both the U.S. dollar and global currencies held by the Index through investing, under normal circumstances, at least 80% of its assets in money market securities and other liquid securities, such as short-term investment grade government and corporate debt securities, ...

Haksoz Kadam-Suppy Portfolio Risk

... zinc may have liquid spot and futures markets. However, for commodities such as steel, pulp and some types of chemicals, market liquidity is a major issue. In any case, spot markets are in general becoming increasingly liquid and transparent around the world with the extensive use of converging info ...

... zinc may have liquid spot and futures markets. However, for commodities such as steel, pulp and some types of chemicals, market liquidity is a major issue. In any case, spot markets are in general becoming increasingly liquid and transparent around the world with the extensive use of converging info ...

Credit Risk

... ignores migration and market risk. For a large number of obligors, the number of defaults during a given period has a Poisson distribution. The loss distribution of a bond/loan portfolio is derived. Belongs to the class of intensity-based (or reduced-form) models. Default risk is not linked to t ...

... ignores migration and market risk. For a large number of obligors, the number of defaults during a given period has a Poisson distribution. The loss distribution of a bond/loan portfolio is derived. Belongs to the class of intensity-based (or reduced-form) models. Default risk is not linked to t ...

US subprime credit crisis and its implications from a corporate

... Impact in the CEE region and Hungary CEE banks did not have significant exposure to US subprime credit market Risk appetite of investors deteriorated: investors partially moved to safe markets from the region Asset prices came under pressure Due to weaker macro-fiscal conditions, heavier equilibriu ...

... Impact in the CEE region and Hungary CEE banks did not have significant exposure to US subprime credit market Risk appetite of investors deteriorated: investors partially moved to safe markets from the region Asset prices came under pressure Due to weaker macro-fiscal conditions, heavier equilibriu ...

4028-10-Syllabus

... – A first order Markov process is one where this probability distribution only depends on the previous value: ie p = p(x1,t1|x2,t2) – Generally just called a Markov process ...

... – A first order Markov process is one where this probability distribution only depends on the previous value: ie p = p(x1,t1|x2,t2) – Generally just called a Markov process ...

MANAGING VOLATILITY: A STRATEGIC FRAMEWORK

... Institutional investors usually have a long-term strategic asset mix policy that is formally revisited every three years or so. In the past, this seldom changed, as investment horizons for DB pension plans, for example, were very long-term-oriented and various asset and liability smoothing mechanism ...

... Institutional investors usually have a long-term strategic asset mix policy that is formally revisited every three years or so. In the past, this seldom changed, as investment horizons for DB pension plans, for example, were very long-term-oriented and various asset and liability smoothing mechanism ...

Abstracts - Society for Industrial and Applied

... Arbitrage Pricing of Credit Derivatives Credit default swap (CDS) and single-tranch credit default swap (STCDS) markets have experienced exponential growth in recent years. The market standard for CDS pricing, however, is not based on arbitrage. In this talk, I will first present an arbitrage pricing ...

... Arbitrage Pricing of Credit Derivatives Credit default swap (CDS) and single-tranch credit default swap (STCDS) markets have experienced exponential growth in recent years. The market standard for CDS pricing, however, is not based on arbitrage. In this talk, I will first present an arbitrage pricing ...

PDF

... marginal cost equating price, thus maximizing the joint consumer and producer surpluses), no ...

... marginal cost equating price, thus maximizing the joint consumer and producer surpluses), no ...

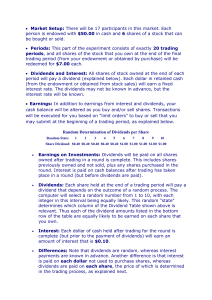

Experimental Instructions

... those who wish to purchase shares will indicate the number of shares desired and the maximum or "limit" price that they are willing to pay. Similarly, those who wish to sell shares will indicate the number of shares offered and the minimum "limit" price that they are willing to accept. Buy and Sel ...

... those who wish to purchase shares will indicate the number of shares desired and the maximum or "limit" price that they are willing to pay. Similarly, those who wish to sell shares will indicate the number of shares offered and the minimum "limit" price that they are willing to accept. Buy and Sel ...

The Challenge of Derivatives - The Fordham Law Archive of

... has asked me to review a term sheet for a derivative contract that it hopes will be viewed as an equity swap 19 rather than an option.20 Both swaps and options are classified as derivatives, though only the latter are currently regulated. 2 If the proposed individually tailored transaction between t ...

... has asked me to review a term sheet for a derivative contract that it hopes will be viewed as an equity swap 19 rather than an option.20 Both swaps and options are classified as derivatives, though only the latter are currently regulated. 2 If the proposed individually tailored transaction between t ...

PowerPoint for Chapter 5

... Setting a low initial selling price (usually below cost) to drive out the competition Then raise prices once they control the market Illegal ...

... Setting a low initial selling price (usually below cost) to drive out the competition Then raise prices once they control the market Illegal ...

Capital Requirements for Major Swap Participants and Swap Dealers

... make it an MSP, that entity should have to meet a financial eligibility requirement – a minimum net worth that is commensurate with what the Commission determines is a “substantial position” in swaps. The eligibility amount may change based on the type and number of categories of swaps to which the ...

... make it an MSP, that entity should have to meet a financial eligibility requirement – a minimum net worth that is commensurate with what the Commission determines is a “substantial position” in swaps. The eligibility amount may change based on the type and number of categories of swaps to which the ...

Gerhard Illing (2008) Money: Theory and Practise Chapter xx Liquidity

... role of banks in providing liquidity to borrowers is declining. But this would be the wrong conclusion. In fact, instead of providing liquidity directly to a large firm, a bank provides a backup line of credit that can be drawn down in case the firm’s commercial paper cannot be refinanced. It seems ...

... role of banks in providing liquidity to borrowers is declining. But this would be the wrong conclusion. In fact, instead of providing liquidity directly to a large firm, a bank provides a backup line of credit that can be drawn down in case the firm’s commercial paper cannot be refinanced. It seems ...

Comments on “Risk Allocation, Debt Fueled Expansion and Financial Crisis,” Beaudry

... In these circumstances, the market price of MBS reflect’s buyers’ belief that most securities that are offered for sale are low quality (fire-sale price). The true value of the average MBS may in fact be much higher. This is the hold-to-maturity price. The adverse selection problem then aggregates f ...

... In these circumstances, the market price of MBS reflect’s buyers’ belief that most securities that are offered for sale are low quality (fire-sale price). The true value of the average MBS may in fact be much higher. This is the hold-to-maturity price. The adverse selection problem then aggregates f ...

Chapter 3: How Securities are Traded

... • Commission: fee paid to broker for making the transaction • Spread: cost of trading with dealer – Bid: price dealer will buy from you – Ask: price dealer will sell to you – Spread: ask - bid • Combination: on some trades both are paid ...

... • Commission: fee paid to broker for making the transaction • Spread: cost of trading with dealer – Bid: price dealer will buy from you – Ask: price dealer will sell to you – Spread: ask - bid • Combination: on some trades both are paid ...

understanding stable value - Galliard Capital Management

... No. Stable value funds are not mutual funds. The investment vehicle type used for Galliard’s stable value strategies are either collective investment funds or separately managed accounts. Collective investment funds pool together multiple plans to purchase stable value investments. Separately manage ...

... No. Stable value funds are not mutual funds. The investment vehicle type used for Galliard’s stable value strategies are either collective investment funds or separately managed accounts. Collective investment funds pool together multiple plans to purchase stable value investments. Separately manage ...

Another view on the pricing of MBSs, CMOs and CDOs of ABSs

... about prepayment and now default are available and potentially allow the estimation of sophisticated duration models (but under the physical measure). Therefore, many authors have explained the duration of mortgages directly in reduced-form approaches.2 Note that standard corporate CDOs pricing mode ...

... about prepayment and now default are available and potentially allow the estimation of sophisticated duration models (but under the physical measure). Therefore, many authors have explained the duration of mortgages directly in reduced-form approaches.2 Note that standard corporate CDOs pricing mode ...

Gerhard Illing

... Developments in the market for corporate bonds are somewhat less clear cut. Since the start of the new currency, issues in Euro (as compared to its predecessor currencies) have reached long-time highs, admittedly starting from an extremely low level. As noted in this years BIS annual report (2000, ...

... Developments in the market for corporate bonds are somewhat less clear cut. Since the start of the new currency, issues in Euro (as compared to its predecessor currencies) have reached long-time highs, admittedly starting from an extremely low level. As noted in this years BIS annual report (2000, ...

I 1) Which of the following is NOT an example of a

... 1) Which of the following is NOT an example of a forward contract? a) An agreement to buy a car in the future at a specified price. b) An agreement to buy an airplane ticket at a future date for a certain price c) An agreement to buy a refrigerator today at the posted price. d) An agreement to subsc ...

... 1) Which of the following is NOT an example of a forward contract? a) An agreement to buy a car in the future at a specified price. b) An agreement to buy an airplane ticket at a future date for a certain price c) An agreement to buy a refrigerator today at the posted price. d) An agreement to subsc ...

Chapter 5

... Setting a low initial selling price (usually below cost) to drive out the competition Then raise prices once they control the market Illegal ...

... Setting a low initial selling price (usually below cost) to drive out the competition Then raise prices once they control the market Illegal ...

Fundamentals of Corporate Finance

... • Some other ways that a foreign government can affect the risk of a foreign project include: Change tax laws in a way that adversely impacts the firm. Impose laws related to labor, wages, and prices that are more restrictive than those applicable for domestic firms. Disallow any remittance of funds ...

... • Some other ways that a foreign government can affect the risk of a foreign project include: Change tax laws in a way that adversely impacts the firm. Impose laws related to labor, wages, and prices that are more restrictive than those applicable for domestic firms. Disallow any remittance of funds ...

300% q 3 MTR MQ Find the competitive equilibrium. Calculate the

... With heterogeneous consumers, the profit maximizing tariff and per unit price is found by trial and error. Starting with a $10 price per unit the maximum entry fee that can be charged while still retaining both consumers is equal to the consumer surplus of the marginal consumer, consumer two, which ...

... With heterogeneous consumers, the profit maximizing tariff and per unit price is found by trial and error. Starting with a $10 price per unit the maximum entry fee that can be charged while still retaining both consumers is equal to the consumer surplus of the marginal consumer, consumer two, which ...