Limit Orders - Fight Finance

... Exchange and OTC Trading Listed stock, futures, options and some bonds are commonly traded on securities exchanges such as the NYSE, LSE, or ASX. Foreign exchange (FX), short term debt (money market securities), bonds, forwards and swaps are commonly traded in the over-the-counter (OTC) markets. OTC ...

... Exchange and OTC Trading Listed stock, futures, options and some bonds are commonly traded on securities exchanges such as the NYSE, LSE, or ASX. Foreign exchange (FX), short term debt (money market securities), bonds, forwards and swaps are commonly traded in the over-the-counter (OTC) markets. OTC ...

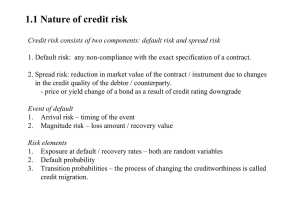

Default risk and spread risk

... (that is, low joint default frequency), though it can be significant for related companies, and smaller companies within the same domestic industry sector. ...

... (that is, low joint default frequency), though it can be significant for related companies, and smaller companies within the same domestic industry sector. ...

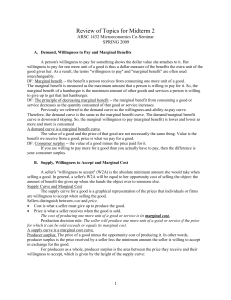

Review of Topics for Midterm 2

... Production decision rule: The seller will produce one more unit of a good or service if the price for which it can be sold exceeds or equals its marginal cost. A supply curve is a marginal cost curve. Producer surplus: The price of a good minus the opportunity cost of producing it. In other words, p ...

... Production decision rule: The seller will produce one more unit of a good or service if the price for which it can be sold exceeds or equals its marginal cost. A supply curve is a marginal cost curve. Producer surplus: The price of a good minus the opportunity cost of producing it. In other words, p ...

Financial Management

... In addition Conventional financial management tagged with Shriah rulings is termed as Islamic financial management. In this case data used whether historical or current and evaluation process for valuation of any asset remains the same, However investment strategy differs in some ways. 1. Managerial ...

... In addition Conventional financial management tagged with Shriah rulings is termed as Islamic financial management. In this case data used whether historical or current and evaluation process for valuation of any asset remains the same, However investment strategy differs in some ways. 1. Managerial ...

Algorithms for VWAP and Limit Order Trading

... • Note if all orders executed, we are within (1-ε) of overall VWAP - since each limit order is (1-ε) close to VWAP_j ...

... • Note if all orders executed, we are within (1-ε) of overall VWAP - since each limit order is (1-ε) close to VWAP_j ...

1.Explain the following key words

... The income elasticity of demand measures how much the quantity demanded responds to changes in consumers’ income. The cross-price elasticity of demand measures how much the quantity demanded of one good responds to changes in the price of another good. The price elasticity of supply measures how muc ...

... The income elasticity of demand measures how much the quantity demanded responds to changes in consumers’ income. The cross-price elasticity of demand measures how much the quantity demanded of one good responds to changes in the price of another good. The price elasticity of supply measures how muc ...

Trading Strategies Involving Options

... Fundamentals of Futures and Options Markets, 8th Ed, Ch 11, Copyright © John C. Hull 2013 ...

... Fundamentals of Futures and Options Markets, 8th Ed, Ch 11, Copyright © John C. Hull 2013 ...

Adjusted operating income excludes “Realized

... consolidated operating subsidiaries represents the portion of these earnings associated with net realized investment gains and losses. The changes in these related charges from one period to another may be disproportionate to the changes in “Realized investment gains (losses), net,” because the indi ...

... consolidated operating subsidiaries represents the portion of these earnings associated with net realized investment gains and losses. The changes in these related charges from one period to another may be disproportionate to the changes in “Realized investment gains (losses), net,” because the indi ...

list of eu regulated markets - Agencija za trg vrednostnih papirjev

... system operated and/or managed by a market operator, which brings together or facilitates the bringing together of multiple third-party buying and selling interests in financial instruments — in the system and in accordance with its non-discretionary — rules in a way that results in a contract, in r ...

... system operated and/or managed by a market operator, which brings together or facilitates the bringing together of multiple third-party buying and selling interests in financial instruments — in the system and in accordance with its non-discretionary — rules in a way that results in a contract, in r ...

Monthly Meat Lookout

... considerably in carcass size and quality and come from several thousand different sellers to packing plants. The pork and chicken sectors are highly concentrated and integrated and produce “peas in a pod” in terms of uniformity. What options are open to the beef industry? Forcing cattle feeders to s ...

... considerably in carcass size and quality and come from several thousand different sellers to packing plants. The pork and chicken sectors are highly concentrated and integrated and produce “peas in a pod” in terms of uniformity. What options are open to the beef industry? Forcing cattle feeders to s ...

Monopoly - ComLabGames

... most auction and monopoly models 1. Monopolists price discriminate through market segmentation, but auction rules do not make the winner’s payment depend on his type. However holding auctions with multiple rounds (for example restricting entry to qualified bidders in certain auctions) segments the m ...

... most auction and monopoly models 1. Monopolists price discriminate through market segmentation, but auction rules do not make the winner’s payment depend on his type. However holding auctions with multiple rounds (for example restricting entry to qualified bidders in certain auctions) segments the m ...

private placement bonds and commercial mortgage loans.

... The incurral date of the Credit Risk Event is the earliest of the date of the first missed payment, the date of modification of the principal or interest terms, date of sale or the bankruptcy filing date. The loss calculation date is the earliest of the date of the first missed payment, the date of ...

... The incurral date of the Credit Risk Event is the earliest of the date of the first missed payment, the date of modification of the principal or interest terms, date of sale or the bankruptcy filing date. The loss calculation date is the earliest of the date of the first missed payment, the date of ...

I_Ch03

... for several stocks (but for each security, it is assigned to one single specialist) Make a market (造市): be always ready, willing, and able to trade a particular security at quoted bid and asked prices The task of dealers is to make a market, but in dealer markets, there could be many dealers for one ...

... for several stocks (but for each security, it is assigned to one single specialist) Make a market (造市): be always ready, willing, and able to trade a particular security at quoted bid and asked prices The task of dealers is to make a market, but in dealer markets, there could be many dealers for one ...

Lecture 21: Risk Neutral and Martingale Measure

... • PDE solution can be found for exotic options such as a barrier call option which looks like a regular call except • there is a barrier (B) set in the contract • if S reaches B at any time before T, the option disappears • easy to set up in the PDE problem by a proper boundary condition ...

... • PDE solution can be found for exotic options such as a barrier call option which looks like a regular call except • there is a barrier (B) set in the contract • if S reaches B at any time before T, the option disappears • easy to set up in the PDE problem by a proper boundary condition ...

Hutchins Center Roundtable discussion, presentation by Richard

... be offset by scoring higher tax revenues than are actually collected. c) In 2009, OMB was required by statute to include a loss aversion penalty to TARP estimates. It could not countenance scoring outlays and deficits higher than they would be over time, and so created an artificial offset; the upwa ...

... be offset by scoring higher tax revenues than are actually collected. c) In 2009, OMB was required by statute to include a loss aversion penalty to TARP estimates. It could not countenance scoring outlays and deficits higher than they would be over time, and so created an artificial offset; the upwa ...

The Myth of Diversification: Risk Factors vs. Asset Classes

... individually or collectively, not develop over time. The analysis reflected in this information is based upon data at time of analysis. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommenda ...

... individually or collectively, not develop over time. The analysis reflected in this information is based upon data at time of analysis. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommenda ...

CME SPAN - CME Group

... and calculate the profit or loss on individual contracts given the market moves. • Exchanges may determine any number of market scenarios to be ...

... and calculate the profit or loss on individual contracts given the market moves. • Exchanges may determine any number of market scenarios to be ...

Suitability - Alastair Hudson`s

... between market participants. Therefore, the identified policy of precluding the parties from entering into further damaging transactions does not apply in the context of a provision, such as a netting clause on termination, which reduces the net amount of the parties’ exposure to one another. The va ...

... between market participants. Therefore, the identified policy of precluding the parties from entering into further damaging transactions does not apply in the context of a provision, such as a netting clause on termination, which reduces the net amount of the parties’ exposure to one another. The va ...

Stock Underwriting

... used as a backdoor way of becoming a public company. The easiest way to become a public company is to merge into the public shell. – One big advantage is the time and money saved. The entrepreneurs pay little to “acquire” the shell. The entrepreneurs essentially purchase control of the shell by buyi ...

... used as a backdoor way of becoming a public company. The easiest way to become a public company is to merge into the public shell. – One big advantage is the time and money saved. The entrepreneurs pay little to “acquire” the shell. The entrepreneurs essentially purchase control of the shell by buyi ...

derivatives - Borsa İstanbul

... 2 - Floor: A long position in put option with (X-a) exercise price, maturity at t in the underlying (Buy a Put) 3 - Ceiling: A short position in call option with (X+b) exercise price and maturity at t in the underlying currency (Sell a Call) For example, let’s consider you USD 100,000 in your portfo ...

... 2 - Floor: A long position in put option with (X-a) exercise price, maturity at t in the underlying (Buy a Put) 3 - Ceiling: A short position in call option with (X+b) exercise price and maturity at t in the underlying currency (Sell a Call) For example, let’s consider you USD 100,000 in your portfo ...

American Funds® IS US Govt/AAA

... value or underperform investments with similar objectives and strategies or the market in general. Bank Loans Investments in bank loans, also known as senior loans or floating-rate loans, are rated below-investment grade and may be subject to a greater risk of default than are investment-grade loans ...

... value or underperform investments with similar objectives and strategies or the market in general. Bank Loans Investments in bank loans, also known as senior loans or floating-rate loans, are rated below-investment grade and may be subject to a greater risk of default than are investment-grade loans ...

IB Comment Letter to SEC Opposing New Margin Requirements for

... days (less than one “day trade” per day) to pose a risk to the customer, the member or the Exchange. Even customers who are not pursuing a day trading strategy may decide to open and close out a position in the same day for a variety of reasons, for example because of a change in market conditions, ...

... days (less than one “day trade” per day) to pose a risk to the customer, the member or the Exchange. Even customers who are not pursuing a day trading strategy may decide to open and close out a position in the same day for a variety of reasons, for example because of a change in market conditions, ...

Irish Pension Schemes, new SORP (Statement of Recommended

... evaluate the nature and extent of credit risk and market risk (which includes interest rate, currency and other price risk) including objectives and policies for managing and measuring such risks. In DC schemes it is permissible to restrict this information to the default fund or the most commonly u ...

... evaluate the nature and extent of credit risk and market risk (which includes interest rate, currency and other price risk) including objectives and policies for managing and measuring such risks. In DC schemes it is permissible to restrict this information to the default fund or the most commonly u ...

SIFMA AMG Submits Comments to the Basel Committee on Banking

... Association (“SIFMA”) writes to express our concern that the Basel Leverage Ratio’s failure to take into account the exposure-reducing effect of segregated initial margin for clearing firms is impairing AMG members’ ability to hedge risk and reduce volatility through the use of cleared derivatives. ...

... Association (“SIFMA”) writes to express our concern that the Basel Leverage Ratio’s failure to take into account the exposure-reducing effect of segregated initial margin for clearing firms is impairing AMG members’ ability to hedge risk and reduce volatility through the use of cleared derivatives. ...

Regulation 2016 - Federal Register of Legislation

... company’s counterparty or other party to the transaction (like the clearing house or exchange) rather than the life company itself. Foreign laws which require a financial institution to segregate customer assets, rather than laws which require that performance of derivative obligations be secured, ...

... company’s counterparty or other party to the transaction (like the clearing house or exchange) rather than the life company itself. Foreign laws which require a financial institution to segregate customer assets, rather than laws which require that performance of derivative obligations be secured, ...