ice clear credit llc exhibit h: portfolio approach to cds margining and

... Index CDS and single-name CDS, index products are first decomposed to produce single-name index-derived positions with notional sizes corresponding to their weight in the index. These new, “synthetic,” single-name positions have a coupon which is the same one as the index from which the single-name ...

... Index CDS and single-name CDS, index products are first decomposed to produce single-name index-derived positions with notional sizes corresponding to their weight in the index. These new, “synthetic,” single-name positions have a coupon which is the same one as the index from which the single-name ...

Chapter 14 Capital requirements for settlement and counterparty risk

... percentage for the potential future credit exposure will be determined by the lowest credit quality of the underlying obligations in the basket. If there are non-qualifying items in the basket, the percentage applicable to the nonqualifying reference obligation should be used. For second and subsequ ...

... percentage for the potential future credit exposure will be determined by the lowest credit quality of the underlying obligations in the basket. If there are non-qualifying items in the basket, the percentage applicable to the nonqualifying reference obligation should be used. For second and subsequ ...

Lecture 1

... • Alternatively, you may pay on a running basis, with several payments until maturity, if you survive to maurity. • In case one dies, the payments would stop and a fraction of the amount paid is given to the heirs. ...

... • Alternatively, you may pay on a running basis, with several payments until maturity, if you survive to maurity. • In case one dies, the payments would stop and a fraction of the amount paid is given to the heirs. ...

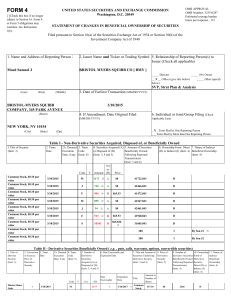

BRISTOL MYERS SQUIBB CO (Form: 4, Received

... ( 5) The price reported reflects the weighted average sales price. The shares were sold in multiple transactions at prices ranging from $65.77 to $65.86, inclusive. The reporting person undertakes to provide to the SEC staff, the issuer, or a security holder of the issuer, upon request, full informa ...

... ( 5) The price reported reflects the weighted average sales price. The shares were sold in multiple transactions at prices ranging from $65.77 to $65.86, inclusive. The reporting person undertakes to provide to the SEC staff, the issuer, or a security holder of the issuer, upon request, full informa ...

Ethan Frome - Eurex Exchange

... Options and futures trading begins with the determination of an opening price for each option series and each futures contract. The Opening Period comprises the Pre-Opening Period and the netting process. For the purpose of determining a particular opening price, additional orders and quotes may be ...

... Options and futures trading begins with the determination of an opening price for each option series and each futures contract. The Opening Period comprises the Pre-Opening Period and the netting process. For the purpose of determining a particular opening price, additional orders and quotes may be ...

Theme 3

... • purchase of one currency in one financial EM and its selling in other • the aim - reach the profit from the price difference in two or three financial exchange markets • involves: - no negative cash-flow at any probabilistic or temporal state - a positive cash-flow in at least one state Conditions ...

... • purchase of one currency in one financial EM and its selling in other • the aim - reach the profit from the price difference in two or three financial exchange markets • involves: - no negative cash-flow at any probabilistic or temporal state - a positive cash-flow in at least one state Conditions ...

Risk and Return

... stock’s returns on the Y axis and market returns on the X axis. The slope of the line of best fit as estimated through regression is the stock’s beta coefficient, or b. ...

... stock’s returns on the Y axis and market returns on the X axis. The slope of the line of best fit as estimated through regression is the stock’s beta coefficient, or b. ...

Risk, Return, and Discount Rates

... Return Related? There are two main reasons to be concerned with this question. (1) When conducting discounted cash flow analysis, how should we adjust discount rates to allow for risk in the future cash flow stream? (2) When saving/investing, what is the tradeoff between taking risks and our expecte ...

... Return Related? There are two main reasons to be concerned with this question. (1) When conducting discounted cash flow analysis, how should we adjust discount rates to allow for risk in the future cash flow stream? (2) When saving/investing, what is the tradeoff between taking risks and our expecte ...

Determination of Forward and Futures Prices

... Of the $900, $39.60 is therefore borrowed at 3% per annum for 4 months so that it can be repaid with the coupon payment. The remaining $860.40 is borrowed at 4% per annum for 9 months. The amount owing at the end of the 9-month period is 860.40e0.04x0.75 = $886.60. A sum of $910 is received for the ...

... Of the $900, $39.60 is therefore borrowed at 3% per annum for 4 months so that it can be repaid with the coupon payment. The remaining $860.40 is borrowed at 4% per annum for 9 months. The amount owing at the end of the 9-month period is 860.40e0.04x0.75 = $886.60. A sum of $910 is received for the ...

Colombia Firm Energy Auction: Descending Clock or Sealed-Bid?

... • A clock auction is slightly harder to conduct and participate in than a seal-bid auction; auctioneer introduces uncertainty to address market power • However, with proxy bidding, participation can be just as easy ...

... • A clock auction is slightly harder to conduct and participate in than a seal-bid auction; auctioneer introduces uncertainty to address market power • However, with proxy bidding, participation can be just as easy ...

Description of Investment Instruments and Warning of

... Description of investment instruments follows usual features of investment instruments. The decisive factor is the structure of a specific investment instrument. For that reason, the following description is no substitute for a thorough examination of the specific investment instrument by the invest ...

... Description of investment instruments follows usual features of investment instruments. The decisive factor is the structure of a specific investment instrument. For that reason, the following description is no substitute for a thorough examination of the specific investment instrument by the invest ...

Bitcoin Comes of Age

... Lim argues that for many BTC market participants, physical settling of derivatives is the most appealing way to hedge. Miners who produce new bitcoin and merchant processors who accumulate bitcoin and disburse dollars would prefer to actually deliver their bitcoin to settle their hedges; meanwh ...

... Lim argues that for many BTC market participants, physical settling of derivatives is the most appealing way to hedge. Miners who produce new bitcoin and merchant processors who accumulate bitcoin and disburse dollars would prefer to actually deliver their bitcoin to settle their hedges; meanwh ...

Slide 1

... We have looked at a single asset manager, now we explore the case of multiple managers trading the same asset N agents, they “share” the liquidity option, the impact on the given asset ...

... We have looked at a single asset manager, now we explore the case of multiple managers trading the same asset N agents, they “share” the liquidity option, the impact on the given asset ...

Chapter 27 Risk Management and Financial Engineering

... more efficiently and effectively than other corporations. For example, insurance companies have expertise in negotiating, settling, and providing legal representation in liability suits. Hedging marketwide sources of risk, on the other hand, does not seem to provide any real service other than reduce ...

... more efficiently and effectively than other corporations. For example, insurance companies have expertise in negotiating, settling, and providing legal representation in liability suits. Hedging marketwide sources of risk, on the other hand, does not seem to provide any real service other than reduce ...

MODULE 11 Guidance to completing the Leverage Ratio module of

... Report the bank’s Replacement Cost (“RC”) for all of its derivatives exposures (equivalent to the “Positive Mark-to-Market” element of the Credit Equivalent Amount as calculated under the Standardised Approach to Credit Risk - see section N of Module 1). This figure should be reported net of cash va ...

... Report the bank’s Replacement Cost (“RC”) for all of its derivatives exposures (equivalent to the “Positive Mark-to-Market” element of the Credit Equivalent Amount as calculated under the Standardised Approach to Credit Risk - see section N of Module 1). This figure should be reported net of cash va ...

Options Scanner Manual

... Moneyness – the amount any contract or strategy is in-, out- or at-the money Expiry – the amount of time left on the option Liquidity – how often a given option trades Risk – measured by calculations known as the “Greeks”. The Basic view measures time decay (for buyers) and a contract’s sens ...

... Moneyness – the amount any contract or strategy is in-, out- or at-the money Expiry – the amount of time left on the option Liquidity – how often a given option trades Risk – measured by calculations known as the “Greeks”. The Basic view measures time decay (for buyers) and a contract’s sens ...

Download attachment

... Risk management products allow the market participants at a micro-level to avoid undesirable risks. These products make it possible to transfer risks to other participants who would like to bear them. Risk management products or derivatives have proliferated over the last two decades in response to ...

... Risk management products allow the market participants at a micro-level to avoid undesirable risks. These products make it possible to transfer risks to other participants who would like to bear them. Risk management products or derivatives have proliferated over the last two decades in response to ...

options markets - AUEB e

... banks the make the market (market makers) big multinationals, etc. The contracts are not standardized and “tailor-made” for clients • Organized exchanges: Most organized exchanges use market makers to facilitate options trading; A market maker quotes both bid and ask prices when requested; The marke ...

... banks the make the market (market makers) big multinationals, etc. The contracts are not standardized and “tailor-made” for clients • Organized exchanges: Most organized exchanges use market makers to facilitate options trading; A market maker quotes both bid and ask prices when requested; The marke ...

Institutions for Managing Risks to Living Standards

... created, based on contracts settled in cash on regional real estate price indexes.11 For example, futures markets for both residential and commercial real estate in each major metropolitan area could be devised, allowing people in each area to take short positions in the futures market corresponding ...

... created, based on contracts settled in cash on regional real estate price indexes.11 For example, futures markets for both residential and commercial real estate in each major metropolitan area could be devised, allowing people in each area to take short positions in the futures market corresponding ...

cash settlement option symbol: qihu date

... OCC will delay settlement of the QIHU deliverable until the final net cash merger consideration is confirmed. Once the final amount is determined, settlement in QIHU options will take place through OCC’s cash settlement system. Settlement will be accomplished by payment of the difference between the ...

... OCC will delay settlement of the QIHU deliverable until the final net cash merger consideration is confirmed. Once the final amount is determined, settlement in QIHU options will take place through OCC’s cash settlement system. Settlement will be accomplished by payment of the difference between the ...

PIPEs Transaction and Regulation D

... Who issues structured products? Generally, large financial institutions that are WKSIs issue structured products, usually on an SEC-registered basis Foreign banks may issue structured products to US investors in reliance on the Section 3(a)(2) exemption or in a private placement Usually, the ...

... Who issues structured products? Generally, large financial institutions that are WKSIs issue structured products, usually on an SEC-registered basis Foreign banks may issue structured products to US investors in reliance on the Section 3(a)(2) exemption or in a private placement Usually, the ...

Luminis Credit Assessment Information

... Each prospective counterparty must provide to Luminis certain data and information as required to complete the credit assessment. Generally speaking, this includes all related legal documents, financial information, investment/portfolio details, and management/operating policies. For a complete li ...

... Each prospective counterparty must provide to Luminis certain data and information as required to complete the credit assessment. Generally speaking, this includes all related legal documents, financial information, investment/portfolio details, and management/operating policies. For a complete li ...

IKE`s Rationale for State Intervention in the Financial System

... premiums (Mehra and Prescott and many others) • Currency markets: inability to account for nominal exchange rate movements: “an embarrassment, but one shared with virtually any other field that attempts to explain asset price data.” (Obstfeld and Rogoff, 1996). ...

... premiums (Mehra and Prescott and many others) • Currency markets: inability to account for nominal exchange rate movements: “an embarrassment, but one shared with virtually any other field that attempts to explain asset price data.” (Obstfeld and Rogoff, 1996). ...

Lecture10(Ch10)

... • Definition: charging different prices for the same product to different consumers • Examples ...

... • Definition: charging different prices for the same product to different consumers • Examples ...