Learning Goals

... New issue is created and sold Key factor: issuer receives the proceeds from the sale Public offerings: registered with the SEC and sale is made to the investing public Private offerings: not registered, and sold to only a limited number of investors, with restrictions on resale ...

... New issue is created and sold Key factor: issuer receives the proceeds from the sale Public offerings: registered with the SEC and sale is made to the investing public Private offerings: not registered, and sold to only a limited number of investors, with restrictions on resale ...

Compiled by CA. Aditya Kumar Maheshwari AS – 30 :: Financial

... Permitted to be transferred from AFS to HTM or at Cost on fulfillment of three conditions: Change of intention (Say to be kept till maturity) Fair Value no longer available In preceding two years, assets from HTM have not been sold The fair value as on the date of classification becomes cost. ...

... Permitted to be transferred from AFS to HTM or at Cost on fulfillment of three conditions: Change of intention (Say to be kept till maturity) Fair Value no longer available In preceding two years, assets from HTM have not been sold The fair value as on the date of classification becomes cost. ...

CH05

... An investor purchases common shares of two companies on margin. The first share (A) has a margin requirement of 70% and is presently trading for $10, while the second share (B) has a margin of 50% and is trading at $2. a- What is the total margin requirement if the investor purchases 1,000 shares of ...

... An investor purchases common shares of two companies on margin. The first share (A) has a margin requirement of 70% and is presently trading for $10, while the second share (B) has a margin of 50% and is trading at $2. a- What is the total margin requirement if the investor purchases 1,000 shares of ...

short selling regulations

... the Exchange and an aggregate turnover of not less than HK$500 million during such period; and ...

... the Exchange and an aggregate turnover of not less than HK$500 million during such period; and ...

BAML Partners with Thesys on New High-Speed Trading

... faster than what BAML previously could provide. The SEC recently approved rules that establish new risk management obligations on brokers when providing access to U.S. securities markets. BAML officials emphasized that the new platform fully complies with those requirements while also providing clie ...

... faster than what BAML previously could provide. The SEC recently approved rules that establish new risk management obligations on brokers when providing access to U.S. securities markets. BAML officials emphasized that the new platform fully complies with those requirements while also providing clie ...

Investing Options

... Bond- money loaned to government or corporation – Corporate • Study Guide- read pages • Debenture 306-315 and • Mortgage 1.Explain the following types of bonds. • Convertible 2.Explain where and how – Government you can buy bonds. • Municipal 3.What are the three ways to • Revenue earn a return on ...

... Bond- money loaned to government or corporation – Corporate • Study Guide- read pages • Debenture 306-315 and • Mortgage 1.Explain the following types of bonds. • Convertible 2.Explain where and how – Government you can buy bonds. • Municipal 3.What are the three ways to • Revenue earn a return on ...

FUTURES PRODUCT DISCLOSURE STATEMENT INTERACTIVE

... IB does not generally permit its customers to make or take delivery of the commodity underlying the Futures contract. It is therefore not advisable to enter into deliverable contracts in the last weeks before maturity. If you intend to make or take delivery, first check with IB. See section 3.18 for ...

... IB does not generally permit its customers to make or take delivery of the commodity underlying the Futures contract. It is therefore not advisable to enter into deliverable contracts in the last weeks before maturity. If you intend to make or take delivery, first check with IB. See section 3.18 for ...

Financial instruments

... dematerialised and are issued mainly by the Belgian treasury for short, medium and long-term periods (up to 30 years). Their interest rate, term and redemption price are fixed. They are issued in stages and the issue price is fixed by auction. These instruments are mainly for professionals. Individu ...

... dematerialised and are issued mainly by the Belgian treasury for short, medium and long-term periods (up to 30 years). Their interest rate, term and redemption price are fixed. They are issued in stages and the issue price is fixed by auction. These instruments are mainly for professionals. Individu ...

finalterm examination

... Exchange-traded derivative contracts (ETD) are those derivatives instruments that are traded via specialized derivatives exchanges or other exchanges. A derivatives exchange is a market where individual’s trade standardized contracts that have been defined by the exchange. A derivatives exchange act ...

... Exchange-traded derivative contracts (ETD) are those derivatives instruments that are traded via specialized derivatives exchanges or other exchanges. A derivatives exchange is a market where individual’s trade standardized contracts that have been defined by the exchange. A derivatives exchange act ...

2010-09-10 MFR interview with Vince Reinhart_1

... You make yourself complicated for lots of reasons. The more complicated you make yourself, the harder it is to replicate the institution, the more leverage you have with regulators. I don’t think BS was betting too much on TBTF. But it gains you an advantage with regulators. Think about how the indu ...

... You make yourself complicated for lots of reasons. The more complicated you make yourself, the harder it is to replicate the institution, the more leverage you have with regulators. I don’t think BS was betting too much on TBTF. But it gains you an advantage with regulators. Think about how the indu ...

Investments: Analysis and Management, Second Canadian Edition

... • TR, RR, and CWI are useful for a given, single time period • What about summarizing returns over several time periods? – Arithmetic mean and geometric mean ...

... • TR, RR, and CWI are useful for a given, single time period • What about summarizing returns over several time periods? – Arithmetic mean and geometric mean ...

Lecture 6

... THE WEIGHTED AVERAGE OF THE REQUIRED RETURN OF EACH OF THE SECURITIES MUST BE EQUAL TO THE REQUIRED RETURN ASSOCIATED WITH THE RISK OF THE OPERATING CASH FLOWS OF THE FIRM. THE WEIGHTS ARE THE RELATIVE MARKET VALUES OF EACH OF THE SECURITIES. ...

... THE WEIGHTED AVERAGE OF THE REQUIRED RETURN OF EACH OF THE SECURITIES MUST BE EQUAL TO THE REQUIRED RETURN ASSOCIATED WITH THE RISK OF THE OPERATING CASH FLOWS OF THE FIRM. THE WEIGHTS ARE THE RELATIVE MARKET VALUES OF EACH OF THE SECURITIES. ...

Trading forex options on the JSE

... The premium is simply the price the purchaser pays in order to get the right and not the obligation. It serves as an insurance premium for the seller of the Option. Investors wishing to trade Currency Options are required to pay a premium. Please note that this premium is a wasting asset and once th ...

... The premium is simply the price the purchaser pays in order to get the right and not the obligation. It serves as an insurance premium for the seller of the Option. Investors wishing to trade Currency Options are required to pay a premium. Please note that this premium is a wasting asset and once th ...

A How To Read Performance Report Guide

... deposits) grows to equal the ending market value (minus any capital withdrawals but before any fees or expenses deducted), regardless of the length of the holding period. ...

... deposits) grows to equal the ending market value (minus any capital withdrawals but before any fees or expenses deducted), regardless of the length of the holding period. ...

This paper is not to be removed from the Examination Halls

... compounded) is 2%. The costs of a 20-day European call and put options on the portfolio with exercise price 1,000 are, respectively, 17.766 and 16.671 per 1,000 capital invested at time t (i.e. assuming Vt = 1,000). Create a put-protected portfolio which – over a 20-day period – will not end up at a ...

... compounded) is 2%. The costs of a 20-day European call and put options on the portfolio with exercise price 1,000 are, respectively, 17.766 and 16.671 per 1,000 capital invested at time t (i.e. assuming Vt = 1,000). Create a put-protected portfolio which – over a 20-day period – will not end up at a ...

Is investing in structured products a form of betting?

... risk categories, 1 and 2. These have a lower market risk than equities or most equity or property funds. Of the total k What is a bet? volume invested by retail investors, 97.9 percent flows in In common usage, a bet is an agreement between investment products with a medium to long-term holding two ...

... risk categories, 1 and 2. These have a lower market risk than equities or most equity or property funds. Of the total k What is a bet? volume invested by retail investors, 97.9 percent flows in In common usage, a bet is an agreement between investment products with a medium to long-term holding two ...

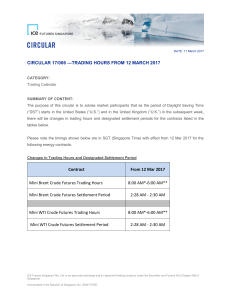

Trading hours from 12 March 2017

... CIRCULAR 17/006 —TRADING HOURS FROM 12 MARCH 2017 CATEGORY: Trading Calendar ...

... CIRCULAR 17/006 —TRADING HOURS FROM 12 MARCH 2017 CATEGORY: Trading Calendar ...

Where Does Underwriting Fit in the Acquisition Process

... An LOI is signed giving buyer exclusive right to purchase the asset for a period of time and the buyer’s puts up a deposit (typically 10% of the purchase price). Buyer & seller begin negotiating PSA ...

... An LOI is signed giving buyer exclusive right to purchase the asset for a period of time and the buyer’s puts up a deposit (typically 10% of the purchase price). Buyer & seller begin negotiating PSA ...

Slide 1

... ◦ Provide a guide to the general trend of exchange rates in particular circumstances. ◦ Serves an important reminder that exchange rate and the price level cannot be divorced from each other. ◦ Both exchange rates and prices respond to the same set of shocks and both can be influenced by same set of ...

... ◦ Provide a guide to the general trend of exchange rates in particular circumstances. ◦ Serves an important reminder that exchange rate and the price level cannot be divorced from each other. ◦ Both exchange rates and prices respond to the same set of shocks and both can be influenced by same set of ...

Chapter 3 Financial Instruments, Financial Markets, and Financial

... Financial Instruments • A financial instrument is the written legal obligation of one party to transfer something of value – usually money – to another party at some future date, under certain conditions, such as stocks, loans, or insurance. ...

... Financial Instruments • A financial instrument is the written legal obligation of one party to transfer something of value – usually money – to another party at some future date, under certain conditions, such as stocks, loans, or insurance. ...

FIN 331 Real Estate

... 3. Why are FHA/VA mortgages of interest to investors? 4. When is a home buyer most like to have to buy mortgage insurance? 5. What makes an Adjustable Rate Mortgage (ARM) risky for the borrower? Attractive to the lender? 6. What are Home Equity Loans? 7. When would it be a good idea to refinance a l ...

... 3. Why are FHA/VA mortgages of interest to investors? 4. When is a home buyer most like to have to buy mortgage insurance? 5. What makes an Adjustable Rate Mortgage (ARM) risky for the borrower? Attractive to the lender? 6. What are Home Equity Loans? 7. When would it be a good idea to refinance a l ...

INFINOX- Order Execution Policy

... and will include, but are not restricted to; Price and costs of execution: The automated system will seek out the best overall outcome for the transaction and this is likely to be the most important execution factor to our clients. Characteristics of the client: Our client base will mainly be Re ...

... and will include, but are not restricted to; Price and costs of execution: The automated system will seek out the best overall outcome for the transaction and this is likely to be the most important execution factor to our clients. Characteristics of the client: Our client base will mainly be Re ...

average daily value traded in cash equities up ten

... On the Group’s derivatives platforms, the average daily notional value traded was down 11 per cent at £2.6 billion (€3.1 billion), while the average daily number of contracts traded was down 41 per cent to 217,831 against July 2009. A large proportion of the reduction in volumes for the Group can be ...

... On the Group’s derivatives platforms, the average daily notional value traded was down 11 per cent at £2.6 billion (€3.1 billion), while the average daily number of contracts traded was down 41 per cent to 217,831 against July 2009. A large proportion of the reduction in volumes for the Group can be ...

Arbitrage. Risk neutral valuation relationship

... risk have the risk-free rate of return. Therefore zero payoffs are result of zero initial investments. This definition of arbitrage is a generalization of the law of one price (LoOP) that asserts that two assets traded in the same market under the same conditions should have the same price. Hence if ...

... risk have the risk-free rate of return. Therefore zero payoffs are result of zero initial investments. This definition of arbitrage is a generalization of the law of one price (LoOP) that asserts that two assets traded in the same market under the same conditions should have the same price. Hence if ...