The Federal Reserve System (cont`d)

... • National Credit Union Association (NCUA) – Insures the deposits of credit union members for up to $100,000 per account ...

... • National Credit Union Association (NCUA) – Insures the deposits of credit union members for up to $100,000 per account ...

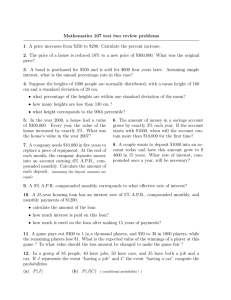

test two review problems

... 3. A bond is purchased for $500 and is sold for $600 four years later. Assuming simple interest, what is the annual percentage rate in this case? 4. Suppose the heights of 1000 people are normally distributed, with a mean height of 160 cm and a standard deviation of 20 cm. • what percentage of the h ...

... 3. A bond is purchased for $500 and is sold for $600 four years later. Assuming simple interest, what is the annual percentage rate in this case? 4. Suppose the heights of 1000 people are normally distributed, with a mean height of 160 cm and a standard deviation of 20 cm. • what percentage of the h ...

Presentation to the CFA Hawaii Seventh Annual Economic Forecast Dinner

... funds rate, the rate banks pay to borrow from each other on overnight loans, close to zero. It’s been there ever since. Given the weakness in the economy, standard monetary policy guidelines indicate that the federal funds rate should have gone deep into negative territory. But, of course, it’s not ...

... funds rate, the rate banks pay to borrow from each other on overnight loans, close to zero. It’s been there ever since. Given the weakness in the economy, standard monetary policy guidelines indicate that the federal funds rate should have gone deep into negative territory. But, of course, it’s not ...

HOMs Conference on Central Asia

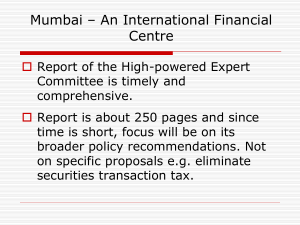

... Indian taxes are now comparable with many other jurisdictions. However, there are frequent legal challenges to existing rules/ regulations. This is likely to hamper the development of longmaturity financial contracts such as currency or interest rate SWAPS. GST stamp duties etc. Need to ...

... Indian taxes are now comparable with many other jurisdictions. However, there are frequent legal challenges to existing rules/ regulations. This is likely to hamper the development of longmaturity financial contracts such as currency or interest rate SWAPS. GST stamp duties etc. Need to ...

Global Financial Markets in an Era of Turbulence

... Iraq expenditures did not stimulate economy in the way that other expenditures might have • 2001-2003 tax cuts were not designed to stimulate the economy, and did so only to a limited extent Question: Why did the economy seem as strong as it did? • Answer: America was living on borrowed money and ...

... Iraq expenditures did not stimulate economy in the way that other expenditures might have • 2001-2003 tax cuts were not designed to stimulate the economy, and did so only to a limited extent Question: Why did the economy seem as strong as it did? • Answer: America was living on borrowed money and ...

May 10, 2007 - Lorain County

... interest rates; hence a flat yield curve. However, inflation and other factors affecting higher rates could also shift the curve higher, especially if US Government spending and borrowing increases. The US Treasury has announced there will be a suspension of the issuance of the 3-year Treasury note, ...

... interest rates; hence a flat yield curve. However, inflation and other factors affecting higher rates could also shift the curve higher, especially if US Government spending and borrowing increases. The US Treasury has announced there will be a suspension of the issuance of the 3-year Treasury note, ...

Financial Crises and Aggegate Economic Activity

... Banks will start to fail and fear can spread from one bank to another, causing even healthy banks to go under The multiple bank failures that result are known as a bank panic In a panic, depositors, fearing for the safety of their deposits and not knowing the quality of banks’ loan portfolios, wit ...

... Banks will start to fail and fear can spread from one bank to another, causing even healthy banks to go under The multiple bank failures that result are known as a bank panic In a panic, depositors, fearing for the safety of their deposits and not knowing the quality of banks’ loan portfolios, wit ...

Quarterly Review - Q1 - Boston Advisors, LLC

... Non-U.S. stock markets rallied this past quarter, continuing to show signs of reversing multi-year weak price performance. The big draw for investors? Cheap(er) companies and increasing growth prospects. Valuations of companies in International Developed markets (particularly Europe) and Emerging Ma ...

... Non-U.S. stock markets rallied this past quarter, continuing to show signs of reversing multi-year weak price performance. The big draw for investors? Cheap(er) companies and increasing growth prospects. Valuations of companies in International Developed markets (particularly Europe) and Emerging Ma ...

833-2869-1-SP

... over into real economy but with safeguards and coordination Effective for highly credible central banks to a degree when the policy rate is at the lower bound but there are risks and policy overlaps Effective for highly credible central banks in stemming appreciation in the short-run but also poses ...

... over into real economy but with safeguards and coordination Effective for highly credible central banks to a degree when the policy rate is at the lower bound but there are risks and policy overlaps Effective for highly credible central banks in stemming appreciation in the short-run but also poses ...

Georgia Credit Union Affiliates Annual Meeting May 8, 2004

... U.S. fiscal budget concerns could lower the value of the dollar and raise interest rates. The Federal Reserve will maintain its massive injection of reserves into the banking system to keep interest rates low for the next two years. Government intervention into the economy has proved to be less than ...

... U.S. fiscal budget concerns could lower the value of the dollar and raise interest rates. The Federal Reserve will maintain its massive injection of reserves into the banking system to keep interest rates low for the next two years. Government intervention into the economy has proved to be less than ...

Go Back Print this page The Minsky Moment by John Cassidy

... the Internet, or a war, or an abrupt change of economic policy. The current cycle began in 2003, with the Fed chief Alan Greenspan’s decision to reduce short-term interest rates to one per cent, and an unexpected influx of foreign money, particularly Chinese money, into U.S. Treasury bonds. With the ...

... the Internet, or a war, or an abrupt change of economic policy. The current cycle began in 2003, with the Fed chief Alan Greenspan’s decision to reduce short-term interest rates to one per cent, and an unexpected influx of foreign money, particularly Chinese money, into U.S. Treasury bonds. With the ...

Quantitative Easing New York Times blog

... the fall of 2008. In those circumstances, central banks turn to what economists call “quantitative easing’' — unorthodox methods of pumping money into an economy and working to lower the long-term interest rates that central bankers do not usually control. The most usual approach is large-scale purc ...

... the fall of 2008. In those circumstances, central banks turn to what economists call “quantitative easing’' — unorthodox methods of pumping money into an economy and working to lower the long-term interest rates that central bankers do not usually control. The most usual approach is large-scale purc ...

Last quarter, we cautioned that conditions were right for a

... ter and also in July. Longer term, we strongly believe that some of In the short run, Japanese stocks are up over 30% year-to-date in the most attractive investment opportunities for equity investors will response to an improving economic environment in Japan, combe found overseas, especially in the ...

... ter and also in July. Longer term, we strongly believe that some of In the short run, Japanese stocks are up over 30% year-to-date in the most attractive investment opportunities for equity investors will response to an improving economic environment in Japan, combe found overseas, especially in the ...

A CASE White Paper

... the credit expense that flows through a bank’s income statement, have been elevated since 2008. From 2008 through 2010 banks generally were provisioning more than they were charging off. When a bank’s provision expense exceeds its net charge offs in a given period, it signals that the bank is buildi ...

... the credit expense that flows through a bank’s income statement, have been elevated since 2008. From 2008 through 2010 banks generally were provisioning more than they were charging off. When a bank’s provision expense exceeds its net charge offs in a given period, it signals that the bank is buildi ...

Slide 1

... See Romer reading. Good example of “bad equilibrium, good equilibrium” like bank runs (here, runs on countries whose liabilities are in foreign currencies). Why is Spain in trouble but not UK? ...

... See Romer reading. Good example of “bad equilibrium, good equilibrium” like bank runs (here, runs on countries whose liabilities are in foreign currencies). Why is Spain in trouble but not UK? ...

The Oak Financial Times - Oak Financial Group, Inc.

... employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.” If one was to read through the entire transcript they would notice that The Fed removed th ...

... employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.” If one was to read through the entire transcript they would notice that The Fed removed th ...

File

... •Budgeting refers to drawing up a plan for how available funds will be spent. •A typical approach is to write down the total income that you expect to have available to spend, and then to write down how you plan to spend it. •Budgeting helps you know where your money is actually going, which in tur ...

... •Budgeting refers to drawing up a plan for how available funds will be spent. •A typical approach is to write down the total income that you expect to have available to spend, and then to write down how you plan to spend it. •Budgeting helps you know where your money is actually going, which in tur ...

PROFIT REPORTING SEASON

... Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is d ...

... Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is d ...

Natural Selection - Rain Capital Management

... The contents of this report represent the confidential work product of Rain Capital Management, LLC. Data referenced in this report are deemed to be reliable but have not been independently verified. Unauthorized distribution of this material is strictly prohibited. The conclusions presented in this ...

... The contents of this report represent the confidential work product of Rain Capital Management, LLC. Data referenced in this report are deemed to be reliable but have not been independently verified. Unauthorized distribution of this material is strictly prohibited. The conclusions presented in this ...