Speech to the Stanford Institute for Economic Policy Research Stanford, California

... subprime mortgages are delinquent or in foreclosure. Hot spots now include inland areas of California and parts of Nevada, Florida, and Ohio. In the West, the highest delinquency rates are in California’s Central Valley. Stockton, for example, jumped from about 3½ percent at the end of 2005 to over ...

... subprime mortgages are delinquent or in foreclosure. Hot spots now include inland areas of California and parts of Nevada, Florida, and Ohio. In the West, the highest delinquency rates are in California’s Central Valley. Stockton, for example, jumped from about 3½ percent at the end of 2005 to over ...

when borrowing from nonbank lenders

... By: Bertrand-Karlan-Mullainathan-Shafir-Zinman • Researchers worked with large consumer lender in South Africa to send direct mail: – To former, experienced clients – With randomized interest rates • Very expensive (200% APR), short-term (4-month) loans • Market looks like a cross between payday loa ...

... By: Bertrand-Karlan-Mullainathan-Shafir-Zinman • Researchers worked with large consumer lender in South Africa to send direct mail: – To former, experienced clients – With randomized interest rates • Very expensive (200% APR), short-term (4-month) loans • Market looks like a cross between payday loa ...

Tutorial 8 - Peter Foldvari

... It would increase the cost of new funds and would reduce the returns from the new investments. If the increase in interest rate is high enough, BP would abandon the project. Yes, since the opportunity costs of using own funds would increase. This is because the own funds could be lent at the higher ...

... It would increase the cost of new funds and would reduce the returns from the new investments. If the increase in interest rate is high enough, BP would abandon the project. Yes, since the opportunity costs of using own funds would increase. This is because the own funds could be lent at the higher ...

- Partners in Financial Planning

... This interest rate watch has created a peculiar dynamic where up is down and down is up in terms of how traders and stock market gamblers look at the future. The generally positive economic news is greeted with dismay (The Fed will notice and start raising rates sooner rather than later! Boo!) and a ...

... This interest rate watch has created a peculiar dynamic where up is down and down is up in terms of how traders and stock market gamblers look at the future. The generally positive economic news is greeted with dismay (The Fed will notice and start raising rates sooner rather than later! Boo!) and a ...

Better incentives to service debt

... Bonds and Private Placements Offshore borrowing. But • NBFCs have declined since 1997 crisis • New inflows and demand for offshore funds drying up. • India’s capital market is one of largest but it is down India is still bank dominated: Banks assets more than double market capitalization. Banks are ...

... Bonds and Private Placements Offshore borrowing. But • NBFCs have declined since 1997 crisis • New inflows and demand for offshore funds drying up. • India’s capital market is one of largest but it is down India is still bank dominated: Banks assets more than double market capitalization. Banks are ...

1) Corporate financial plans are often used as a basis

... decisions, but be rescued by good luck. In other words, it may be difficult to separate performance and ability from results. Corporations use numerous arrangements in an attempt to ensure that managers’ actions are consistent with stockholders’ objectives. Agency costs can be mitigated by ‘carrots, ...

... decisions, but be rescued by good luck. In other words, it may be difficult to separate performance and ability from results. Corporations use numerous arrangements in an attempt to ensure that managers’ actions are consistent with stockholders’ objectives. Agency costs can be mitigated by ‘carrots, ...

Martin Feldstein Housing, Housing Finance, and Monetary Policy

... markets had become less risky. Better monetary policies around the world have reduced inflation and contributed to smaller real volatility. Securitization and the use of credit derivatives were thought to disperse risk in ways that reduced overall risk levels. Most emerging market governments now av ...

... markets had become less risky. Better monetary policies around the world have reduced inflation and contributed to smaller real volatility. Securitization and the use of credit derivatives were thought to disperse risk in ways that reduced overall risk levels. Most emerging market governments now av ...

FRBSF E L CONOMIC ETTER

... house price declines on subprime delinquencies is that many of those loans were designed to be bridge loans. For example, so-called 2-28 loans were set up at fairly high initial mortgage rates for borrowers with low FICO scores. If such a borrower made the payments, and if the price of the house ros ...

... house price declines on subprime delinquencies is that many of those loans were designed to be bridge loans. For example, so-called 2-28 loans were set up at fairly high initial mortgage rates for borrowers with low FICO scores. If such a borrower made the payments, and if the price of the house ros ...

Kiútprogram – A Social Microcredit Program for the Roma in Hungary

... Main features of the Kiútprogram model Unsecured loans of relatively small amounts (max. 3500 EUR) Real interest rate around 10% (yearly), weekly repayment, 1 year loan period Encouraging saving Groups of 5 loan recipients, sequential lending (2 – 2 – 1) In the formal economy: sole propri ...

... Main features of the Kiútprogram model Unsecured loans of relatively small amounts (max. 3500 EUR) Real interest rate around 10% (yearly), weekly repayment, 1 year loan period Encouraging saving Groups of 5 loan recipients, sequential lending (2 – 2 – 1) In the formal economy: sole propri ...

the 2016 economic summit conference schedule

... Credit Unions can seize the moment, regardless of what naysayers and fintech disrupters declare. Like it our not, we live in an era of engagement banking – a time when credit unions must engage members in new ways and maintain relevant, contextual interactions. Life and money are inextricably linked ...

... Credit Unions can seize the moment, regardless of what naysayers and fintech disrupters declare. Like it our not, we live in an era of engagement banking – a time when credit unions must engage members in new ways and maintain relevant, contextual interactions. Life and money are inextricably linked ...

Personal Finance and Portfolio Management Strategies Module Exam

... seven years from now? (b) If his income is $30,000 per year for a family of three, and prices increase by four percent a year for the next three years, what amount will the family need for living expenses? ...

... seven years from now? (b) If his income is $30,000 per year for a family of three, and prices increase by four percent a year for the next three years, what amount will the family need for living expenses? ...

Personal Finance and Portfolio Management Strategies Module Exam

... seven years from now? (b) If his income is $30,000 per year for a family of three, and prices increase by four percent a year for the next three years, what amount will the family need for living expenses? ...

... seven years from now? (b) If his income is $30,000 per year for a family of three, and prices increase by four percent a year for the next three years, what amount will the family need for living expenses? ...

MARKET COMMENTARY April, 2008

... 2008 has put the worst and most disruptive phase behind us. Importantly, it was the quarter that marked the full deployment of the US Government’s significant resources into the battle. There will undoubtedly be more credit market problems from here, but the Federal Reserve by its actions has taken ...

... 2008 has put the worst and most disruptive phase behind us. Importantly, it was the quarter that marked the full deployment of the US Government’s significant resources into the battle. There will undoubtedly be more credit market problems from here, but the Federal Reserve by its actions has taken ...

Strong Demand for Muni Bonds Yields Pros, Cons

... The fixed income securities are subject to price volatility and a number of risks, including interest rate risk. Interest rates and bond prices move in opposite directions so that as interest rates rise, bond prices usually fall and vice versa. Interest rates are currently at historically low levels ...

... The fixed income securities are subject to price volatility and a number of risks, including interest rate risk. Interest rates and bond prices move in opposite directions so that as interest rates rise, bond prices usually fall and vice versa. Interest rates are currently at historically low levels ...

Understanding the Global Economic Crisis

... index traders is very large, sometimes more than ten times the size of an average long position held by either commercial or noncommercial traders ...

... index traders is very large, sometimes more than ten times the size of an average long position held by either commercial or noncommercial traders ...

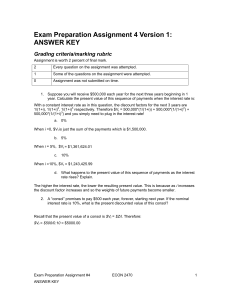

Exam Preparation Assignment 4 Version 1: ANSWER KEY

... The higher the interest rate, the lower the resulting present value. This is because as i increases the discount factor increases and so the weights of future payments become smaller. 2. A “consol” promises to pay $500 each year, forever, starting next year. If the nominal interest rate is 10%, what ...

... The higher the interest rate, the lower the resulting present value. This is because as i increases the discount factor increases and so the weights of future payments become smaller. 2. A “consol” promises to pay $500 each year, forever, starting next year. If the nominal interest rate is 10%, what ...

Global Imbalances Ford Ramsey, Claire Huang, and

... Imbalances in savings, investment, and portfolios led to a situation where real interest rates were driven down and assets increased in price. ...

... Imbalances in savings, investment, and portfolios led to a situation where real interest rates were driven down and assets increased in price. ...

FRBSF E L CONOMIC ETTER

... Federal Reserve Bank of San Francisco, to the National Association for Business Economics in San Francisco, California, on September 10, 2007.1 Good morning. It’s my pleasure to welcome you to this beautiful city. I’m delighted that NABE chose to have its national meeting here, and I’m especially pl ...

... Federal Reserve Bank of San Francisco, to the National Association for Business Economics in San Francisco, California, on September 10, 2007.1 Good morning. It’s my pleasure to welcome you to this beautiful city. I’m delighted that NABE chose to have its national meeting here, and I’m especially pl ...