Autoriti Monetari Brunei Darussalam Policy Statement - US

... increased by 0.9% year-on-year, due to higher indices of Food and NonAlcoholic Beverages; Recreation and Culture; and Transport2. The Brunei Dollar is forecasted to strengthen further in line with the appreciation of the Singapore Dollar. Global food price inflation remained moderate where the UNFAO ...

... increased by 0.9% year-on-year, due to higher indices of Food and NonAlcoholic Beverages; Recreation and Culture; and Transport2. The Brunei Dollar is forecasted to strengthen further in line with the appreciation of the Singapore Dollar. Global food price inflation remained moderate where the UNFAO ...

President’s Message

... extra liquidity created by the Fed is driving higher returns in risky investments, typically owned by highnet-worth individuals. The primary beneficiary of the Fed’s low interest rate strategy is the U.S. government, the world’s largest debtor. The federal government’s annual deficit is at least $25 ...

... extra liquidity created by the Fed is driving higher returns in risky investments, typically owned by highnet-worth individuals. The primary beneficiary of the Fed’s low interest rate strategy is the U.S. government, the world’s largest debtor. The federal government’s annual deficit is at least $25 ...

L01_IntroNIPA - Duke University`s Fuqua School of Business

... Sg=Budget surplus if positive. If negative, then a budget deficit ...

... Sg=Budget surplus if positive. If negative, then a budget deficit ...

COPY FOR “DECCAN HERALD” OF NOVEMBER 1 2008

... deficit in the balance of payments and putting pressure on the Rupee’s external value. Then the sub-prime scandal broke in the USA due to the bundling of good and bad housing and other loans, giving them high ratings and their being sold from one bank or financial institution to another. When the co ...

... deficit in the balance of payments and putting pressure on the Rupee’s external value. Then the sub-prime scandal broke in the USA due to the bundling of good and bad housing and other loans, giving them high ratings and their being sold from one bank or financial institution to another. When the co ...

current investment positioning

... As China marches towards being the largest economy in the world, it is becoming increasingly likely that they may have some type of major dislocation in this process. A large part of their economic growth over the past six years has been driven by fixed investment, which in turn has been driven by h ...

... As China marches towards being the largest economy in the world, it is becoming increasingly likely that they may have some type of major dislocation in this process. A large part of their economic growth over the past six years has been driven by fixed investment, which in turn has been driven by h ...

what would you do with a million dollars?

... 2014 lessened the sequestration cuts and policy gridlock that were a drag in 2013. UK and Eurozone pulled out of their recessions and China’s growth stabilized. Long-term unemployment and stagnant pay rates in the U.S. are cause for concern. Manufacturing, construction and home sales remain below op ...

... 2014 lessened the sequestration cuts and policy gridlock that were a drag in 2013. UK and Eurozone pulled out of their recessions and China’s growth stabilized. Long-term unemployment and stagnant pay rates in the U.S. are cause for concern. Manufacturing, construction and home sales remain below op ...

No Method in this Confusion C.P. Chandrasekhar

... rate hike as a signal of weakness in these economies, aggravating rather than stalling, capital exit. While interest rate hikes may not work to stall capital flight, they would have an adverse impact on domestic investment and growth. This could imply that the deceleration in growt ...

... rate hike as a signal of weakness in these economies, aggravating rather than stalling, capital exit. While interest rate hikes may not work to stall capital flight, they would have an adverse impact on domestic investment and growth. This could imply that the deceleration in growt ...

Deflation: Economic Significance, Current Risk, and Policy Responses

... • Banks’ lack of the needed degree of confidence. ...

... • Banks’ lack of the needed degree of confidence. ...

Ngoc Pham (Nathan) Professor Bernstein ECON 1901 November 23, 2015

... strongly believed that housing prices would continue to become higher regardless of the situation. This belief continued to push the housing prices up. Gradually, the higher mortgages rates became financial burdens for many homeowners and the possibility of the bubble burst increased. The Fed ...

... strongly believed that housing prices would continue to become higher regardless of the situation. This belief continued to push the housing prices up. Gradually, the higher mortgages rates became financial burdens for many homeowners and the possibility of the bubble burst increased. The Fed ...

Boom and Bust

... subprime mortgages – as well as the highly publicized difficulties of some financial institutions, not just in the United States but also in the United Kingdom. By the fall of 2008, a continuing litany of foreclosures and financial failures, mostly in the United States and Europe, was causing panic. ...

... subprime mortgages – as well as the highly publicized difficulties of some financial institutions, not just in the United States but also in the United Kingdom. By the fall of 2008, a continuing litany of foreclosures and financial failures, mostly in the United States and Europe, was causing panic. ...

שקופית 1

... By forcing the fourth largest investment bank, Lehman Brothers, into bankruptcy and Merrill Lynch into a distressed sale to Bank of America, they helped to facilitate a badly needed consolidation in the financial services sector. However, at this juncture, there is every possibility that the credit ...

... By forcing the fourth largest investment bank, Lehman Brothers, into bankruptcy and Merrill Lynch into a distressed sale to Bank of America, they helped to facilitate a badly needed consolidation in the financial services sector. However, at this juncture, there is every possibility that the credit ...

Speech to the Chartered Financial Analysts of Hawaii Honolulu, Hawaii

... markets, because they influence not only the economy’s most likely course but also the risks that could alter that course. In my view, these disruptions are likely to continue for some time. In other words, I think they have laid bare some fundamental issues with the structure of the financial syste ...

... markets, because they influence not only the economy’s most likely course but also the risks that could alter that course. In my view, these disruptions are likely to continue for some time. In other words, I think they have laid bare some fundamental issues with the structure of the financial syste ...

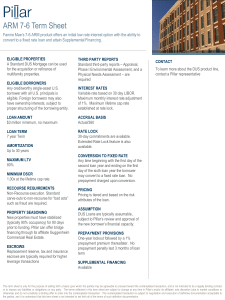

Spanish mortgage finance

... 1. Vulnerability of systems featuring high borrower leverage, mismatch, dubious valuations, small rental sector to a given liquidity shock is maximal. 2. Such risk layering increases the impact of a given liquidity shock on prices, credit growth (pass-through). 3. Liquidity shocks themselves are max ...

... 1. Vulnerability of systems featuring high borrower leverage, mismatch, dubious valuations, small rental sector to a given liquidity shock is maximal. 2. Such risk layering increases the impact of a given liquidity shock on prices, credit growth (pass-through). 3. Liquidity shocks themselves are max ...

Financialization and the crisis

... • The Fed set short-term rates at too low a level (from 2002 to 2004). • The Chinese rigged the exchange rate and flooded long-term bond markets, also leading to overly low long-term rates. • There would be no crises if government was small and interest rates were always set at their natural levels. ...

... • The Fed set short-term rates at too low a level (from 2002 to 2004). • The Chinese rigged the exchange rate and flooded long-term bond markets, also leading to overly low long-term rates. • There would be no crises if government was small and interest rates were always set at their natural levels. ...

Powerpoint Presentation

... redlining areas – they were forced to make loans to the poor. Because the poor did not have the normal 20% down payment, banks had to innovate other loan structures getting around it. ...

... redlining areas – they were forced to make loans to the poor. Because the poor did not have the normal 20% down payment, banks had to innovate other loan structures getting around it. ...

Monetary Policy

... Expansionary monetary policy typically involves the central bank buying shortterm government bonds in order to lower short-term market interest rates. However, when short-term interest rates are either at, or close to, zero, normal monetary policy can no longer lower interest rates. Quantitative eas ...

... Expansionary monetary policy typically involves the central bank buying shortterm government bonds in order to lower short-term market interest rates. However, when short-term interest rates are either at, or close to, zero, normal monetary policy can no longer lower interest rates. Quantitative eas ...

handout1

... For this activity, you will be required to do some research. Your great spinster aunt is very concerned that you will not remember her when she is gone. However, she is also very frugal. She is willing to give you some money to open a savings account. Her condition in giving you this money is that y ...

... For this activity, you will be required to do some research. Your great spinster aunt is very concerned that you will not remember her when she is gone. However, she is also very frugal. She is willing to give you some money to open a savings account. Her condition in giving you this money is that y ...

Canadian Fixed Income 2017 Outlook

... writing, the economy had not yet begun to benefit from the federal government's injection of fiscal infrastructure spending. Despite the positive equity and credit market environment in 2016, many global government bond markets established new historical low levels in terms of yield, as low or negat ...

... writing, the economy had not yet begun to benefit from the federal government's injection of fiscal infrastructure spending. Despite the positive equity and credit market environment in 2016, many global government bond markets established new historical low levels in terms of yield, as low or negat ...

Slide 1

... with respect to financial markets, true; but not with respect to the rest of the economy; Obama’s economics are centrist, not far left. ...

... with respect to financial markets, true; but not with respect to the rest of the economy; Obama’s economics are centrist, not far left. ...

Questions

... which makes them difficult to sell. There are readily available second-hand markets for cars and houses with plenty of buyers which make them easy to sell. There are likely to be few number plate buyers available at any time – the market is ‘thin’. This implies either taking some time to sell (e.g. ...

... which makes them difficult to sell. There are readily available second-hand markets for cars and houses with plenty of buyers which make them easy to sell. There are likely to be few number plate buyers available at any time – the market is ‘thin’. This implies either taking some time to sell (e.g. ...