Personal Finance

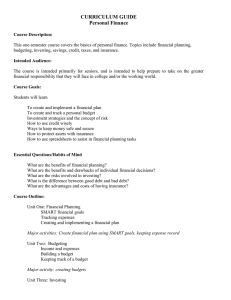

... Personal Finance Course Description: This one-semester course covers the basics of personal finance. Topics include financial planning, budgeting, investing, savings, credit, taxes, and insurance. Intended Audience: The course is intended primarily for seniors, and is intended to help prepare to tak ...

... Personal Finance Course Description: This one-semester course covers the basics of personal finance. Topics include financial planning, budgeting, investing, savings, credit, taxes, and insurance. Intended Audience: The course is intended primarily for seniors, and is intended to help prepare to tak ...

- Wasatch Advisors

... the key to money and credit expansion. But, the multiple expansion of bank reserves so diligently explained in the textbooks was written for a regulatory environment that no longer exists, which is the second different condition. Beginning in 2015, large banks as well as banks with substantial fore ...

... the key to money and credit expansion. But, the multiple expansion of bank reserves so diligently explained in the textbooks was written for a regulatory environment that no longer exists, which is the second different condition. Beginning in 2015, large banks as well as banks with substantial fore ...

Free 2009 Macro FRQs Click Here

... (a) [3 pts] Assume that Kim deposits $100 of cash from her pocket into her checking account. Calculate each of the following. (i) The maximum dollar amount the commercial bank can initially lend (ii) The maximum total change in demand deposits in the banking system (iii) The maximum change in the mo ...

... (a) [3 pts] Assume that Kim deposits $100 of cash from her pocket into her checking account. Calculate each of the following. (i) The maximum dollar amount the commercial bank can initially lend (ii) The maximum total change in demand deposits in the banking system (iii) The maximum change in the mo ...

Prosperity

... Inflation occurs when there is too much money in the economy. The government raises interest rates to take money out of the economy. Rising interest rates discourage consumers and businesses from borrowing money. Sales of durable goods fall. Consumers "make do" with current homes, cars, etc. Bus ...

... Inflation occurs when there is too much money in the economy. The government raises interest rates to take money out of the economy. Rising interest rates discourage consumers and businesses from borrowing money. Sales of durable goods fall. Consumers "make do" with current homes, cars, etc. Bus ...

JohnMuellbauer

... House Prices”, Duca, Muellbauer and Murphy • New model (consistent with hp/rent model) is based on inverted demand approach: hp driven by income relative to housing stock, user cost, and LTV for first time buyers. • Model implies over-shooting and shock amplification in booms as user cost uses last ...

... House Prices”, Duca, Muellbauer and Murphy • New model (consistent with hp/rent model) is based on inverted demand approach: hp driven by income relative to housing stock, user cost, and LTV for first time buyers. • Model implies over-shooting and shock amplification in booms as user cost uses last ...

UK property markets

... (a) Per cent of buy-to-let mortgages originated over the five quarters to 2015 Q1 for which interest payments would exceed 125% of rental income for a given rise in mortgage interest rates. (b) Per cent of owner-occupier mortgages originated over the five quarters to 2015 Q1 for which interest payme ...

... (a) Per cent of buy-to-let mortgages originated over the five quarters to 2015 Q1 for which interest payments would exceed 125% of rental income for a given rise in mortgage interest rates. (b) Per cent of owner-occupier mortgages originated over the five quarters to 2015 Q1 for which interest payme ...

Negative real yields on inflation linked bonds

... Much like a frustrated man pouring petrol on damp firewood and not seeing any flame, it seems most likely that the Fed will be increasingly aggressive with type 1 QE. The danger is that artificially low interest rates create imbalances in the form of misallocation of capital, which will lead to fres ...

... Much like a frustrated man pouring petrol on damp firewood and not seeing any flame, it seems most likely that the Fed will be increasingly aggressive with type 1 QE. The danger is that artificially low interest rates create imbalances in the form of misallocation of capital, which will lead to fres ...

This PDF is a selection from a published volume from... Bureau of Economic Research

... to Asian countries (as shown by the author, citing statistics collected by the Bank for International Settlements [BIS]). Given how important international bank lending has been in Asian economies, both positively (before the crisis) and negatively (during the crisis), a contribution on understandin ...

... to Asian countries (as shown by the author, citing statistics collected by the Bank for International Settlements [BIS]). Given how important international bank lending has been in Asian economies, both positively (before the crisis) and negatively (during the crisis), a contribution on understandin ...

GDP- (GROSS DOMESTIC PRODUCT)

... 1. Demand Pull Inflation:- This is the monetary type of inflation. Happens when people have too much money but enough goods aren’t there The reason for demand pull inflation are:a) Black money b) Benami Transactions c) Money lenders (not institutional) d) Increase in disposable income due to dearnes ...

... 1. Demand Pull Inflation:- This is the monetary type of inflation. Happens when people have too much money but enough goods aren’t there The reason for demand pull inflation are:a) Black money b) Benami Transactions c) Money lenders (not institutional) d) Increase in disposable income due to dearnes ...

Practice Powerpoint - Black Hawk College

... for loans, the Feds determine which banks will receive them. • The Federal Reserve also determines the interest rate it will charge for these loans. • That interest rate is called the discount rate. ...

... for loans, the Feds determine which banks will receive them. • The Federal Reserve also determines the interest rate it will charge for these loans. • That interest rate is called the discount rate. ...

Twenty years of inflation targeting 1 Introduction

... driven by self-fulfilling expectations. Their model shows that ...

... driven by self-fulfilling expectations. Their model shows that ...

Arresting the Adverse Feedback Loop

... The financial crisis validated the FOMC’s concern, igniting what has become the worst post-World War II economic downturn in terms of length and, by some measures, depth and breadth. Housing market troubles began in 2006 and deepened well into 2009. As the economy sank into recession, an October 20 ...

... The financial crisis validated the FOMC’s concern, igniting what has become the worst post-World War II economic downturn in terms of length and, by some measures, depth and breadth. Housing market troubles began in 2006 and deepened well into 2009. As the economy sank into recession, an October 20 ...

FINANCE 729 FINANCIAL RISK MANAGEMENT

... • Strike rate: determines cash flows (similar to exercise price) • Settlement frequency: how often the strike rate and underlying index are compared • Notional amount: principal to which the interest rate is applied • Up-front premium: paid by purchaser to seller for the option ...

... • Strike rate: determines cash flows (similar to exercise price) • Settlement frequency: how often the strike rate and underlying index are compared • Notional amount: principal to which the interest rate is applied • Up-front premium: paid by purchaser to seller for the option ...

Reducing US Stocks to Bring Balanced Portfolios Closer to Long

... environment (as we expect in 2017) is that the interest paid on bank loans is typically reset every three months at some margin above 3-month LIBOR. This means that as short-term interest rates increase, the interest paid on bank loans usually increases as well. ...

... environment (as we expect in 2017) is that the interest paid on bank loans is typically reset every three months at some margin above 3-month LIBOR. This means that as short-term interest rates increase, the interest paid on bank loans usually increases as well. ...

Commercial Mortgage Backed Securities (CMBS)

... Mortgage Association • Government National Mortgage Association • Federal Home Loan Mortgage Corporation • Federal Agricultural Mortgage Corporation ...

... Mortgage Association • Government National Mortgage Association • Federal Home Loan Mortgage Corporation • Federal Agricultural Mortgage Corporation ...

Helpful Comments: Excel Financial functions perform common

... Problem #3: Luis purchased a condominium five years ago. At that time he took a 15year $100,000 home mortgage at 10% per year, compounded monthly. Payments on the loan are made at the end of each month. a) What is Luis monthly payment? b) What is the remaining principal on Luis' mortgage after makin ...

... Problem #3: Luis purchased a condominium five years ago. At that time he took a 15year $100,000 home mortgage at 10% per year, compounded monthly. Payments on the loan are made at the end of each month. a) What is Luis monthly payment? b) What is the remaining principal on Luis' mortgage after makin ...

SU12_Econ 2630_Study..

... 23. Suppose inflation is 1% and there is a recessionary gap of 4%. According to the Taylor rule, the Federal Funds rate should equal ____. ...

... 23. Suppose inflation is 1% and there is a recessionary gap of 4%. According to the Taylor rule, the Federal Funds rate should equal ____. ...

Company: Arab Bank Group Date: Oct 12, 2011 Stock Code on: ASE

... 2011 is expected to be another difficult year for ARBK. The unrest in several regional countries were ARBK operates, is expected to result in lower business activities and a hike in non-performing loans (NPL). Although as of mid-2011 no such impact was reflected on the Group’s profitability or asset ...

... 2011 is expected to be another difficult year for ARBK. The unrest in several regional countries were ARBK operates, is expected to result in lower business activities and a hike in non-performing loans (NPL). Although as of mid-2011 no such impact was reflected on the Group’s profitability or asset ...

Menu - Housing Finance Network

... customers mortgages with a higher loan-to-value ratio (LTV) of more than 60 per cent only to the price of a considerable interest increase. This is due to the fact that mortgages with a LTV not over 60 per cent can be refinanced to better conditions by the bank. Bausparkassen hypothecate up to a LTV ...

... customers mortgages with a higher loan-to-value ratio (LTV) of more than 60 per cent only to the price of a considerable interest increase. This is due to the fact that mortgages with a LTV not over 60 per cent can be refinanced to better conditions by the bank. Bausparkassen hypothecate up to a LTV ...

FRBSF E

... might have led to the turmoil. One major problem was that underwriting standards deteriorated substantially.This development is most evident in the mortgage market where subprime mortgages were created with high loan-to-value ratios, high debt-to-income ratios, or little or no documentation. However ...

... might have led to the turmoil. One major problem was that underwriting standards deteriorated substantially.This development is most evident in the mortgage market where subprime mortgages were created with high loan-to-value ratios, high debt-to-income ratios, or little or no documentation. However ...