Reserve Bank softens its views on the economy

... The Reserve Bank had previously lifted rates seven times from October 2009 to November 2010 – a total of 1.75 percentage points, from 3.00 per cent to 4.75 per cent. ...

... The Reserve Bank had previously lifted rates seven times from October 2009 to November 2010 – a total of 1.75 percentage points, from 3.00 per cent to 4.75 per cent. ...

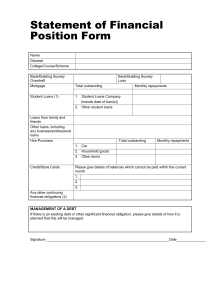

Statement of Financial Position Form

... In the case of married candidates who are applying or who have applied for a diocesan family maintenance grant, the candidate’s spouse is asked to jointly complete and sign the form or, if preferred, to complete a separate form. (1) STUDENT LOANS It should be noted that grants from Central Church Fu ...

... In the case of married candidates who are applying or who have applied for a diocesan family maintenance grant, the candidate’s spouse is asked to jointly complete and sign the form or, if preferred, to complete a separate form. (1) STUDENT LOANS It should be noted that grants from Central Church Fu ...

April 2016 Investment Letter - "MARCH MARKET

... In particular, Draghi said the ECB would now be buying 80 billion euros of bonds every month. That's an increase of 20 billion euros a month, topping expectations of an increase of 10 billion to 15 billion euros. The program is also expanding to allow the central bank to purchase investment-grade Eu ...

... In particular, Draghi said the ECB would now be buying 80 billion euros of bonds every month. That's an increase of 20 billion euros a month, topping expectations of an increase of 10 billion to 15 billion euros. The program is also expanding to allow the central bank to purchase investment-grade Eu ...

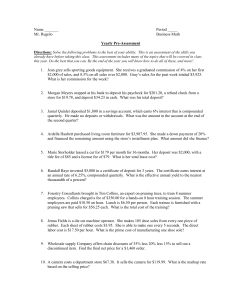

Business Math Yearly Pre

... Directions: Solve the following problems to the best of your ability. This is an assessment of the skills you already have before taking this class. This assessment includes many of the topics that will be covered in class this year. Do the best that you can. By the end of the year you will know how ...

... Directions: Solve the following problems to the best of your ability. This is an assessment of the skills you already have before taking this class. This assessment includes many of the topics that will be covered in class this year. Do the best that you can. By the end of the year you will know how ...

October 31, 2015 — Market Comment

... environment. Modest growth and subdued inflation suppressing interest rates also foster a premium on top-line revenue gains, benefitting “growth” stocks, takeover targets and other restructuring plays. Heightened asset-price volatility could make “risk on/ risk-off” trading a more common feature of ...

... environment. Modest growth and subdued inflation suppressing interest rates also foster a premium on top-line revenue gains, benefitting “growth” stocks, takeover targets and other restructuring plays. Heightened asset-price volatility could make “risk on/ risk-off” trading a more common feature of ...

File

... more demand/more sales/more profits. Lower corporation tax rates – companies will make more profit/more money for expansion/investment. Lower PRSI rates/cost of employing staff is reduced. ...

... more demand/more sales/more profits. Lower corporation tax rates – companies will make more profit/more money for expansion/investment. Lower PRSI rates/cost of employing staff is reduced. ...

PowerPoint Templates Color Set

... The belief that house prices would never decline, Low interest rates, An “agency” problem, wherein ownership at key steps in the mortgage process was avoided (mortgage banking, brokers), Lax underwriting, Pressure to lend into the sub-prime market from various sources, Weak regulation, ...

... The belief that house prices would never decline, Low interest rates, An “agency” problem, wherein ownership at key steps in the mortgage process was avoided (mortgage banking, brokers), Lax underwriting, Pressure to lend into the sub-prime market from various sources, Weak regulation, ...

OVERVIEW

... mentioned risks materialize, a new credit squeeze might emerge in the financial system and exit from the recession could be slower than expected worldwide. In 2009, the Turkish economy contracted by a significant margin, mainly because of the serious decrease in external demand due to the global cri ...

... mentioned risks materialize, a new credit squeeze might emerge in the financial system and exit from the recession could be slower than expected worldwide. In 2009, the Turkish economy contracted by a significant margin, mainly because of the serious decrease in external demand due to the global cri ...

Saving

... per year at the end of the year on the average balance in the savings account Compound Interest – interest paid on the principal and also on previously earned interest, assuming that the interest is left on deposit in the account ...

... per year at the end of the year on the average balance in the savings account Compound Interest – interest paid on the principal and also on previously earned interest, assuming that the interest is left on deposit in the account ...

Fergal McCann SMEs in Ireland

... Countries in Europe with weaker demand or higher leverage have higher probability that SMEs are rejected for credit. ...

... Countries in Europe with weaker demand or higher leverage have higher probability that SMEs are rejected for credit. ...

Campus SBB

... OFFER NOT AVAILABLE ON EXISTING CAMPUS LOANS. OFFER IS FOR NEW LOANS DURING THE SALE DATES ONLY. 1. Credit approval required. Your rate may be higher based on credit worthiness, vehicle and term of loan. Promotional rate applies only when you finance with a CAMPUS Pre-Approved Loan draft at the sale ...

... OFFER NOT AVAILABLE ON EXISTING CAMPUS LOANS. OFFER IS FOR NEW LOANS DURING THE SALE DATES ONLY. 1. Credit approval required. Your rate may be higher based on credit worthiness, vehicle and term of loan. Promotional rate applies only when you finance with a CAMPUS Pre-Approved Loan draft at the sale ...

Slides from the press conference

... even more cautious in provision of credit This in turn may further weaken prospects Negative spiral of declining economic activity and reduced credit supply ...

... even more cautious in provision of credit This in turn may further weaken prospects Negative spiral of declining economic activity and reduced credit supply ...

Speech to Town Hall – Los Angeles Los Angeles, California

... ensuing flight to safety was the decline in the three-month Treasury bill rate, which dipped by almost 2 percentage points between mid-July and August 20th. Dramatically wider yield spreads on credit default swaps, which provide insurance against default on the underlying securities, are further ev ...

... ensuing flight to safety was the decline in the three-month Treasury bill rate, which dipped by almost 2 percentage points between mid-July and August 20th. Dramatically wider yield spreads on credit default swaps, which provide insurance against default on the underlying securities, are further ev ...

Risk Based Capital for Mortgage Securitization Firms

... Cheap, robust, simple, secure system to mobilize private bonds and to insure liquidity access to more mortgage lenders with economies of scale. ...

... Cheap, robust, simple, secure system to mobilize private bonds and to insure liquidity access to more mortgage lenders with economies of scale. ...

Document

... Which of the following rankings of sources of funds for businesses from the least important to the most important is correct? (a) Stock issues, bond issues, loans from financial institutions (b) Bond issues, stock issues, loans from financial institutions (c) Loans from financial institutions, stock ...

... Which of the following rankings of sources of funds for businesses from the least important to the most important is correct? (a) Stock issues, bond issues, loans from financial institutions (b) Bond issues, stock issues, loans from financial institutions (c) Loans from financial institutions, stock ...

The Non-Income Determinants of Consumption and Saving

... and savings. • If taxes increase, we save and consume less. • Conversely, tax reductions by the government encourage us to buy and save more. • Thinking & Inquiry: Why might the government be afraid to raise taxes to pay off the debt during a slow economy? ...

... and savings. • If taxes increase, we save and consume less. • Conversely, tax reductions by the government encourage us to buy and save more. • Thinking & Inquiry: Why might the government be afraid to raise taxes to pay off the debt during a slow economy? ...

Honduras_en.pdf

... domestic demand. While domestic political uncertainty dampened demand for consumer credit, the steep drop in external demand had the same effect on business borrowing. One of the main measures taken by the central bank in 2010 was its review of the financial conditions of the BANHPROVI trust fund wi ...

... domestic demand. While domestic political uncertainty dampened demand for consumer credit, the steep drop in external demand had the same effect on business borrowing. One of the main measures taken by the central bank in 2010 was its review of the financial conditions of the BANHPROVI trust fund wi ...

Lecture Notes - School of Cooperative Individualism

... this portion of their business. The other major innovation was a group of mortgage products that allowed for periodic adjustment in the rate of interest, tied to U.S. Treasury debt and other indices. For consumers, the benefits depended on how and when rates could adjust and whether they had the inc ...

... this portion of their business. The other major innovation was a group of mortgage products that allowed for periodic adjustment in the rate of interest, tied to U.S. Treasury debt and other indices. For consumers, the benefits depended on how and when rates could adjust and whether they had the inc ...

Debt crisis hits Europe`s retail credit markets

... 3. Household deleveraging is driven by pre-crisis credit expansion rather than current household debt levels The extent of deleveraging in separate countries is significantly correlated with the country’s credit expansion prior to the financial crisis, but is only weakly linked to current household ...

... 3. Household deleveraging is driven by pre-crisis credit expansion rather than current household debt levels The extent of deleveraging in separate countries is significantly correlated with the country’s credit expansion prior to the financial crisis, but is only weakly linked to current household ...

Speech to the National Association for Business Economics’ Annual Meeting

... instead actually fell slightly in August, in part due to a drop in construction jobs. However, recent data on manufacturing output and on orders and shipments for core capital goods have been upbeat, and business investment in equipment and software promises to be a bright spot. Despite the hike in ...

... instead actually fell slightly in August, in part due to a drop in construction jobs. However, recent data on manufacturing output and on orders and shipments for core capital goods have been upbeat, and business investment in equipment and software promises to be a bright spot. Despite the hike in ...

Lecture 17: The IMF & Financial Crises

... • Foreign reserves depleted by maintaining overvalued exchange rate and making loan payments in dollars ...

... • Foreign reserves depleted by maintaining overvalued exchange rate and making loan payments in dollars ...