Corporate Leverage and Currency Crises - S-WoPEc

... pegged to the foreign one. The government can make investments feasible by not defending the currency and thus letting it ‡oat. The resulting equilibrium currency depreciation increases the pro…tability of new investments when revenues from the new investments are in a foreign currency and costs den ...

... pegged to the foreign one. The government can make investments feasible by not defending the currency and thus letting it ‡oat. The resulting equilibrium currency depreciation increases the pro…tability of new investments when revenues from the new investments are in a foreign currency and costs den ...

Macroeconomic Risk and Debt Overhang PRELIMINARY AND INCOMPLETE ∗ Hui Chen

... Myers (1977) argues that, in the presence of risky debt, equityholders of a levered firm underinvest, because a fraction of the value generated by their new investment will accrue to the existing debtholders. Thus, investment decisions not only depend on the cash flows from investment, but also the ...

... Myers (1977) argues that, in the presence of risky debt, equityholders of a levered firm underinvest, because a fraction of the value generated by their new investment will accrue to the existing debtholders. Thus, investment decisions not only depend on the cash flows from investment, but also the ...

NBER WORKING PAPER SERIES INTERNATIONAL RESERVES AND ROLLOVER RISK Javier Bianchi

... do not allow the government to accumulate assets for insurance purposes. Alfaro and Kanczuk (2009) study a model with one-period debt where assets are only useful for transferring resources to default states. In contrast, we study the role of reserves in hedging against rollover risk. Telyukova (20 ...

... do not allow the government to accumulate assets for insurance purposes. Alfaro and Kanczuk (2009) study a model with one-period debt where assets are only useful for transferring resources to default states. In contrast, we study the role of reserves in hedging against rollover risk. Telyukova (20 ...

Debt committee report March 2001

... creation is that borrowers can earn a higher economic return than the cost of invested funds and that these economic returns can then be translated into financial returns. Debt problems for governments arise if debt-servicing capacity does not keep pace with growth of debt. This may also be expresse ...

... creation is that borrowers can earn a higher economic return than the cost of invested funds and that these economic returns can then be translated into financial returns. Debt problems for governments arise if debt-servicing capacity does not keep pace with growth of debt. This may also be expresse ...

FM11 Ch 14 Instructors Manual

... Betty Simmons, the new financial manager of Southeast Chemicals (SEC), a Georgia producer of specialized chemicals for use in fruit orchards, must prepare a financial forecast for 2005. SEC’s 2004 sales were $2 billion, and the marketing department is forecasting a 25 percent increase for 2005. Simm ...

... Betty Simmons, the new financial manager of Southeast Chemicals (SEC), a Georgia producer of specialized chemicals for use in fruit orchards, must prepare a financial forecast for 2005. SEC’s 2004 sales were $2 billion, and the marketing department is forecasting a 25 percent increase for 2005. Simm ...

This PDF is a selection from an out-of-print volume from... of Economic Research Volume Title: Consumer Instalment Credit and Economic Fluctuations

... however, are relatively small users of instalment credit facilities; a regular repayment schedule is not well suited to the discontinuous flow of farmers' income.. This does not mean that farmers do not buy consumer goods on credit, but rather that their credit needs, both as consumers and as produc ...

... however, are relatively small users of instalment credit facilities; a regular repayment schedule is not well suited to the discontinuous flow of farmers' income.. This does not mean that farmers do not buy consumer goods on credit, but rather that their credit needs, both as consumers and as produc ...

Types and Institutions of Instalment Credit

... however, are relatively small users of instalment credit facilities; a regular repayment schedule is not well suited to the discontinuous flow of farmers' income.. This does not mean that farmers do not buy consumer goods on credit, but rather that their credit needs, both as consumers and as produc ...

... however, are relatively small users of instalment credit facilities; a regular repayment schedule is not well suited to the discontinuous flow of farmers' income.. This does not mean that farmers do not buy consumer goods on credit, but rather that their credit needs, both as consumers and as produc ...

foreword - Port Phillip Publishing

... created to finance our ‘cake and eat it too’ world. The financial sector has grown obscenely rich on the ability to lend more and more dollars under a fractional banking system. And yes, the more they give out, the more interest income they receive, and the bigger the bankers’ bonuses. The remunerat ...

... created to finance our ‘cake and eat it too’ world. The financial sector has grown obscenely rich on the ability to lend more and more dollars under a fractional banking system. And yes, the more they give out, the more interest income they receive, and the bigger the bankers’ bonuses. The remunerat ...

DOC - Europa.eu

... No threshold for a significant fall in the value of derivatives which have an underlying which is not a financial instrument, including commodity derivatives, is specified in this Regulation. Given the diversity of these other derivatives, the difficulty of calculating consistent and stable threshol ...

... No threshold for a significant fall in the value of derivatives which have an underlying which is not a financial instrument, including commodity derivatives, is specified in this Regulation. Given the diversity of these other derivatives, the difficulty of calculating consistent and stable threshol ...

Financial Ratio Medians-2015.indd

... Of the 97 borrowers in our analysis, 38 had investment grade rated bonds at the time of this publication (“BBB-” or greater rating from S&P or Fitch). We did not match ratings in effect during FY 2014. As expected, the ratio medians generated from the audited financial results of borrowers who have ...

... Of the 97 borrowers in our analysis, 38 had investment grade rated bonds at the time of this publication (“BBB-” or greater rating from S&P or Fitch). We did not match ratings in effect during FY 2014. As expected, the ratio medians generated from the audited financial results of borrowers who have ...

Sovereign Risk, Currency Risk, and Corporate Balance Sheets.

... dramatically changing the way they finance themselves, the private sector continued to borrow from foreigners almost entirely in FC. Despite their shift toward LC debt, emerging market (EM) sovereigns continue to be charged a positive credit spread when they borrow in their own currency. The outrigh ...

... dramatically changing the way they finance themselves, the private sector continued to borrow from foreigners almost entirely in FC. Despite their shift toward LC debt, emerging market (EM) sovereigns continue to be charged a positive credit spread when they borrow in their own currency. The outrigh ...

sovereign debt, domestic banks and the provision of public liquidity

... of credit it can obtain from other banks to finance its projects. This lowers the amount of labor demanded for these projects, thereby reducing the aggregate demand for labor and equilibrium wages. The fall in wages increases the expected return on projects and induces banks with lower-productivity- ...

... of credit it can obtain from other banks to finance its projects. This lowers the amount of labor demanded for these projects, thereby reducing the aggregate demand for labor and equilibrium wages. The fall in wages increases the expected return on projects and induces banks with lower-productivity- ...

Inflation, Debt, and Default

... the overall reduction in risk perceived by domestic lenders. However, for a domestic government, debt becomes less attractive in bad times: deflation makes real government obligations larger in recessions, when the government values consumption more. In contrast, the government in the countercyclica ...

... the overall reduction in risk perceived by domestic lenders. However, for a domestic government, debt becomes less attractive in bad times: deflation makes real government obligations larger in recessions, when the government values consumption more. In contrast, the government in the countercyclica ...

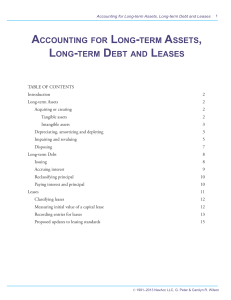

accounting for long-term assets, long

... Aside from these differences in terms, the entries for using up PP&E, intangible assets, or natural resources are structurally the same. For example, to record depreciation expense, we increase the expense and increase accumulated depreciation. To record amortization expense, we increase the expense ...

... Aside from these differences in terms, the entries for using up PP&E, intangible assets, or natural resources are structurally the same. For example, to record depreciation expense, we increase the expense and increase accumulated depreciation. To record amortization expense, we increase the expense ...

How Excessive Is Banks` Maturity Transformation?∗

... We combine information about banks’ liability structure and the average maturities of the various debt categories to estimate the refinancing needs of a representative Eurozone bank in a crisis. The calibrated model matches the average maturity of banks’ wholesale debt, which is of 2.8 months.3 Rea ...

... We combine information about banks’ liability structure and the average maturities of the various debt categories to estimate the refinancing needs of a representative Eurozone bank in a crisis. The calibrated model matches the average maturity of banks’ wholesale debt, which is of 2.8 months.3 Rea ...

The pari passu clause in sovereign debt instruments

... For several decades, lenders and borrowers in the international capital markets have, by their behavior, demonstrated a collective understanding of the import of the clause. But it is difficult to corroborate that understanding based solely on the text of the provision. Inevitably, there was a risk ...

... For several decades, lenders and borrowers in the international capital markets have, by their behavior, demonstrated a collective understanding of the import of the clause. But it is difficult to corroborate that understanding based solely on the text of the provision. Inevitably, there was a risk ...

Transactions Costs and Capital Structure Choice: Evidence from

... large enough to plausibly explain leverage choices by most firms (Myers (1984), Shyam-Sunder and Myers (1995)). Transactions costs are potentially very important to financially distressed firms. The debt adjustments contemplated by these firms are quite large, and financial distress may have pushed ...

... large enough to plausibly explain leverage choices by most firms (Myers (1984), Shyam-Sunder and Myers (1995)). Transactions costs are potentially very important to financially distressed firms. The debt adjustments contemplated by these firms are quite large, and financial distress may have pushed ...

Mauro Alessandro

... usually follow governments' defaults. Among other results, we find that countries either reaccess the markets in the first years after a default or have to wait much longer to do it, and that political stability significantly increases the chances of reaccessing the market. We present a political ec ...

... usually follow governments' defaults. Among other results, we find that countries either reaccess the markets in the first years after a default or have to wait much longer to do it, and that political stability significantly increases the chances of reaccessing the market. We present a political ec ...

Corporate Finance

... Bottom line: Large cash balances would not be tolerated in this company. Expect to face relentless pressure to pay out more dividends. ...

... Bottom line: Large cash balances would not be tolerated in this company. Expect to face relentless pressure to pay out more dividends. ...

The Financial Structure of Startup Firms: The Role of

... 1A) show that for the average startup, 64 percent 7 of financing at inception is internal equity (primarily the entrepreneur’s own resources), 30 percent is external loans, and the rest is made up of loans from friends and family and external equity financing. Compared with previous work on small fi ...

... 1A) show that for the average startup, 64 percent 7 of financing at inception is internal equity (primarily the entrepreneur’s own resources), 30 percent is external loans, and the rest is made up of loans from friends and family and external equity financing. Compared with previous work on small fi ...

Lazard Emerging Markets Debt

... local yields more than offset a slight spot depreciation in emerging markets currencies. For the quarter, the index returned 3.63%, benefiting from both spot currency appreciation and falling yields. Local yields diverged from core yields in June and ended the period at 6.15%, the lowest level since ...

... local yields more than offset a slight spot depreciation in emerging markets currencies. For the quarter, the index returned 3.63%, benefiting from both spot currency appreciation and falling yields. Local yields diverged from core yields in June and ended the period at 6.15%, the lowest level since ...

The Role of Bond Covenants in Municipal Finance Credit

... force officials to take steps for the protection of the bondholders even to the detriment of other constituencies. The 1986 Tax Reform Act reduced the maximum funding of a debt service reserve fund to 10% of the issue size, but debt service reserve fund provisions continue to be important credit con ...

... force officials to take steps for the protection of the bondholders even to the detriment of other constituencies. The 1986 Tax Reform Act reduced the maximum funding of a debt service reserve fund to 10% of the issue size, but debt service reserve fund provisions continue to be important credit con ...

Default, Debt Maturity and Investment Dynamics

... toward explaining why firms tend to operate with lower leverage, pay higher credit spreads, and default less often in the data than these models would otherwise predict (Hackbarth et al. 2006, Kuehn and Schmid 2014).2 Long-term debt also affects the business-cycle properties of investment: with long ...

... toward explaining why firms tend to operate with lower leverage, pay higher credit spreads, and default less often in the data than these models would otherwise predict (Hackbarth et al. 2006, Kuehn and Schmid 2014).2 Long-term debt also affects the business-cycle properties of investment: with long ...

Accrued Interest on Debt Securities with a Fixed Rate of

... or when it is paid for. The same applies to income: “Under investment income, interest is recorded on an accrual basis, which is the continuous method of recording that matches the cost of capital with the provision of capital. If the interest is not actually paid, an entry is required, together wit ...

... or when it is paid for. The same applies to income: “Under investment income, interest is recorded on an accrual basis, which is the continuous method of recording that matches the cost of capital with the provision of capital. If the interest is not actually paid, an entry is required, together wit ...

The size and composition of government debt in - ECB

... in government debt varies across the euro area countries: Belgium, Estonia, Cyprus, Malta and Austria on the one hand are experiencing relatively minor increases in their government debt-to-GDP ratios, but increases over the period 2007-12 are expected to be huge in Ireland (roughly 93 p.p. of GDP), ...

... in government debt varies across the euro area countries: Belgium, Estonia, Cyprus, Malta and Austria on the one hand are experiencing relatively minor increases in their government debt-to-GDP ratios, but increases over the period 2007-12 are expected to be huge in Ireland (roughly 93 p.p. of GDP), ...