capital structure and dividend policy

... declines, primarily because the tax benefit offered by the debt more than offsets the increased cost of equity, rs; (3) at some point the tax benefit associated with debt is more than offset by increases in the before-tax cost of debt and the cost of equity that result from increases in the risk ass ...

... declines, primarily because the tax benefit offered by the debt more than offsets the increased cost of equity, rs; (3) at some point the tax benefit associated with debt is more than offset by increases in the before-tax cost of debt and the cost of equity that result from increases in the risk ass ...

Wealth Inequality and the Optimal Level of Government Debt

... Our result suggests that the negative impact government debt has on welfare via efficiency losses and the income composition channel overrides the positive effect of additional insurance. Our conclusion that the government should optimally provide additional capital as a means of production instead ...

... Our result suggests that the negative impact government debt has on welfare via efficiency losses and the income composition channel overrides the positive effect of additional insurance. Our conclusion that the government should optimally provide additional capital as a means of production instead ...

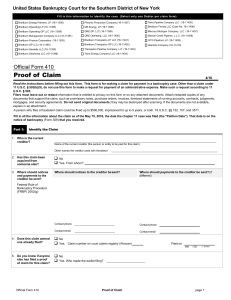

Bankruptcy Court Proof of Claim form

... These instructions and definitions generally explain the law. In certain circumstances, such as bankruptcy cases that debtors do not file voluntarily, exceptions to these general rules may apply. You should consider obtaining the advice of an attorney, especially if you are unfamiliar with the bankr ...

... These instructions and definitions generally explain the law. In certain circumstances, such as bankruptcy cases that debtors do not file voluntarily, exceptions to these general rules may apply. You should consider obtaining the advice of an attorney, especially if you are unfamiliar with the bankr ...

Government Debt

... The Eurozone includes the member states that have the euro as currency, meaning they have a common monetary policy with the same interest-and exchange rate. The rationale behind the euro was to simplify trade and communication between the member states, and preventing individual countries to use mon ...

... The Eurozone includes the member states that have the euro as currency, meaning they have a common monetary policy with the same interest-and exchange rate. The rationale behind the euro was to simplify trade and communication between the member states, and preventing individual countries to use mon ...

FINALHill Rebuttal

... increased the distribution utility’s leverage. In that instance the utility equity ratio had ...

... increased the distribution utility’s leverage. In that instance the utility equity ratio had ...

From Debt Collection to Relief Provision: 60 Years of Official Debt

... understanding official sector debt relief and its effects on countries’ economic performance. Easterly (2002) focuses on heavily indebted poor countries (HIPCs) and finds that, paradoxically, the debt relief efforts of the 1980s and 1990s resulted in increased indebtedness for these countries. His p ...

... understanding official sector debt relief and its effects on countries’ economic performance. Easterly (2002) focuses on heavily indebted poor countries (HIPCs) and finds that, paradoxically, the debt relief efforts of the 1980s and 1990s resulted in increased indebtedness for these countries. His p ...

Optimal Federal Public Debt Composition

... Unit II: The Analytical Framework of the Federal Public Debt Benchmark With regard to defining an optimal long-term public debt composition (benchmark), it represents the desired profile for the debt structure and constitutes a guide for delineating the government's short and medium-term financing s ...

... Unit II: The Analytical Framework of the Federal Public Debt Benchmark With regard to defining an optimal long-term public debt composition (benchmark), it represents the desired profile for the debt structure and constitutes a guide for delineating the government's short and medium-term financing s ...

Choice of comparable firms for multiple valuation

... Industry classes are subjectively defined and subjectively chosen Companies within the same industry class can be very different from each other ...

... Industry classes are subjectively defined and subjectively chosen Companies within the same industry class can be very different from each other ...

selection from a published volume from the of Economic Research

... Our paper also relates more broadly to the literature on financial imperfections in open economies. A growing body of research finds that credit market imperfections help explain some of the features of the international transmission of business cycles that cannot be explained by RBC models. Backus, ...

... Our paper also relates more broadly to the literature on financial imperfections in open economies. A growing body of research finds that credit market imperfections help explain some of the features of the international transmission of business cycles that cannot be explained by RBC models. Backus, ...

Proof of Claim - Cases

... United States Bankruptcy Court for the Southern District of New York Fill in this information to identify the case (Select only one Debtor per claim form): ...

... United States Bankruptcy Court for the Southern District of New York Fill in this information to identify the case (Select only one Debtor per claim form): ...

- Munich Personal RePEc Archive

... good, like a car for instance, or to purchase items on a credit card for which payments will have to be made in future. In, for instance, the United States the total household liabilities as per the end of 2012 stood at $13.453 trillion and 90.8% of these liabilities were used for the three purposes ...

... good, like a car for instance, or to purchase items on a credit card for which payments will have to be made in future. In, for instance, the United States the total household liabilities as per the end of 2012 stood at $13.453 trillion and 90.8% of these liabilities were used for the three purposes ...

docx - ICEBUSS

... An enterprise must be want profitability high.To companies must keep profitabilitasnya remain stable. So the purpose company to achieved profitability optimal can be achieved. Profitability can provide guidance useful in judging keefektivan of the operation of a company, raising the profitability go ...

... An enterprise must be want profitability high.To companies must keep profitabilitasnya remain stable. So the purpose company to achieved profitability optimal can be achieved. Profitability can provide guidance useful in judging keefektivan of the operation of a company, raising the profitability go ...

OPTIMAL TAXATION WITH ENDOGENOUS DEFAULT UNDER INCOMPLETE MARKETS

... becomes an option, rather than a non state-contingent bond. This option, however, does not come for free: infinitely lived households accurately predict the possibility of default, and the equilibrium incorporates it in the pricing of the bond. This mechanism hinders the ability of the government to ...

... becomes an option, rather than a non state-contingent bond. This option, however, does not come for free: infinitely lived households accurately predict the possibility of default, and the equilibrium incorporates it in the pricing of the bond. This mechanism hinders the ability of the government to ...

No.305 / November 2009 Emerging Markets Capital Structure and Financial Integration

... are outstanding international bond issues and outstanding loans from non-resident banks (both as a percentage of GDP). The data come from the Financial Development and Structure Database produced by World Bank. Quantity-based de facto measures try to underline how much a country is integrated with i ...

... are outstanding international bond issues and outstanding loans from non-resident banks (both as a percentage of GDP). The data come from the Financial Development and Structure Database produced by World Bank. Quantity-based de facto measures try to underline how much a country is integrated with i ...

The Changing Face of the Payments System

... to encourage marketplace innovations that promote consumer convenience, transaction efficiency, competition and overall benefits to the U.S. economy, free of overly inhibiting government regulation. On the other hand, it is also important that adequate protections be built into any regulatory framew ...

... to encourage marketplace innovations that promote consumer convenience, transaction efficiency, competition and overall benefits to the U.S. economy, free of overly inhibiting government regulation. On the other hand, it is also important that adequate protections be built into any regulatory framew ...

Firm Life Cycle and Corporate Financing Choices

... we exclude financial firms and regulated utilities and consider only firms that have securities with CRSP share codes 10 or 11. Table I provides descriptive statistics for firms in each life cycle stage. (Variable definitions are described in detail in the appendix.) On average, firms in the mature ...

... we exclude financial firms and regulated utilities and consider only firms that have securities with CRSP share codes 10 or 11. Table I provides descriptive statistics for firms in each life cycle stage. (Variable definitions are described in detail in the appendix.) On average, firms in the mature ...

Classes of Ratios

... industry, then the company may be experiencing cash shortages, disputing invoices with suppliers, enjoying extended terms, or deliberately expanding its trade credit. The ratio comparison of company to industry suggests the existence of these possible causes or others. If a firm buys on 30-day terms ...

... industry, then the company may be experiencing cash shortages, disputing invoices with suppliers, enjoying extended terms, or deliberately expanding its trade credit. The ratio comparison of company to industry suggests the existence of these possible causes or others. If a firm buys on 30-day terms ...

Long-duration Bonds and Sovereign Defaults

... accompanied by a large decline in foreign credit to domestic private firms. This may be the case because a sovereign default may indicate to investors a higher risk of expropriation or bad economic conditions, and therefore, it may reduce firms’ net worth and their ability to borrow (see Sandleris ( ...

... accompanied by a large decline in foreign credit to domestic private firms. This may be the case because a sovereign default may indicate to investors a higher risk of expropriation or bad economic conditions, and therefore, it may reduce firms’ net worth and their ability to borrow (see Sandleris ( ...

WHICH FACTORS DETERMINE SOVEREIGN CREDIT RATINGS

... difficulties, ranging from debt rescheduling to outright defaults, that a country may face. A country may be illiquid, while being solvent if creditors decide not to reschedule/restructure short-term debts. On the other hand, excessive long-term debt may be associated with an insolvency situation. I ...

... difficulties, ranging from debt rescheduling to outright defaults, that a country may face. A country may be illiquid, while being solvent if creditors decide not to reschedule/restructure short-term debts. On the other hand, excessive long-term debt may be associated with an insolvency situation. I ...

Cash Available Segment

... Income tax payments Intermediate term loan payments: Interest payments Principal payments Long term loan payments: Interest payments Principal payments Capital expenditures: Machinery and motor vehicles Breeding livestock Buildings and improvements Land Family living expenses Other cash required Tot ...

... Income tax payments Intermediate term loan payments: Interest payments Principal payments Long term loan payments: Interest payments Principal payments Capital expenditures: Machinery and motor vehicles Breeding livestock Buildings and improvements Land Family living expenses Other cash required Tot ...

NBER WORKING PAPER SERIES HOUSEHOLD LEVERAGING AND DELEVERAGING Alejandro Justiniano Giorgio E. Primiceri

... the link between these two variables, figure 1.2 displays the historical evolution of house prices and of the ratio between mortgages and the value of real estate. The massive boom in home values that started in the late 1990s was matched by an increase in debt of similar magnitude, so that the mort ...

... the link between these two variables, figure 1.2 displays the historical evolution of house prices and of the ratio between mortgages and the value of real estate. The massive boom in home values that started in the late 1990s was matched by an increase in debt of similar magnitude, so that the mort ...

The Role of the IMF in Debt Restructurings: L I A , Moral Hazard and

... a concern with the possible moral hazard consequences of its interventions. This framework, however, which includes an emphasis on greater private sector involvement, the encouragement of the use of collective action clauses and a more effective enforcement of access limits to IMF lending has not ge ...

... a concern with the possible moral hazard consequences of its interventions. This framework, however, which includes an emphasis on greater private sector involvement, the encouragement of the use of collective action clauses and a more effective enforcement of access limits to IMF lending has not ge ...

NBER WORKING PAPER SERIES Paul Beaudry Amartya Lahiri

... examine how an economy may adjust to good profit/productivity shocks in the absence of abundant investment opportunities. However before using the model to interpret recent observations, we use it to better understand what macro-risk allocation implies. For example, we show how and why the efficien ...

... examine how an economy may adjust to good profit/productivity shocks in the absence of abundant investment opportunities. However before using the model to interpret recent observations, we use it to better understand what macro-risk allocation implies. For example, we show how and why the efficien ...

2017-2018 Budget - Generations Fund

... The Act to reduce the debt and establish the Generations Fund. The Act to reduce the debt and establish the Generations Fund (CQLR, chapter R2.2.0.1) was passed on June 15, 2006. This Act set debt reduction targets and established the Generations Fund, a fund dedicated exclusively to repaying the g ...

... The Act to reduce the debt and establish the Generations Fund. The Act to reduce the debt and establish the Generations Fund (CQLR, chapter R2.2.0.1) was passed on June 15, 2006. This Act set debt reduction targets and established the Generations Fund, a fund dedicated exclusively to repaying the g ...

The new debt trap - Jubilee Debt Campaign

... For currently impoverished countries to become more resilient to global economic changes, they need to be less dependent on primary commodity exports. Gaining other sources of income will require a whole range of government interventions depending on the situation of the country concerned. The freed ...

... For currently impoverished countries to become more resilient to global economic changes, they need to be less dependent on primary commodity exports. Gaining other sources of income will require a whole range of government interventions depending on the situation of the country concerned. The freed ...