National Foreclosure Settlement

... monthly payments. Typically, refinancing programs have disqualified bankruptcy debtors. This description does not say that. Ally will try to force the borrower into this option. Make sure to state that the payments are not sustainable for the borrower if that is true, in which case the borrower will ...

... monthly payments. Typically, refinancing programs have disqualified bankruptcy debtors. This description does not say that. Ally will try to force the borrower into this option. Make sure to state that the payments are not sustainable for the borrower if that is true, in which case the borrower will ...

Do Tests of Capital Structure Theory Mean What They Say? ∗

... seem less regrettable. To this end, therefore, I take a standard state-contingent model of dynamic capital structure rooted in a trade-off argument. While several features differentiate the model from others in the field, the basic setup is widely used in the literature. In the model, firms are alwa ...

... seem less regrettable. To this end, therefore, I take a standard state-contingent model of dynamic capital structure rooted in a trade-off argument. While several features differentiate the model from others in the field, the basic setup is widely used in the literature. In the model, firms are alwa ...

Venture Debt Financing for Start

... Importantly, these early stage investors are characterised by a strong willingness to put their own capital at risk. Nevertheless, after raising several equity rounds start-up’s shareholders, especially founders, become reluctant to give up more equity and prefer to preserve their ownership shares s ...

... Importantly, these early stage investors are characterised by a strong willingness to put their own capital at risk. Nevertheless, after raising several equity rounds start-up’s shareholders, especially founders, become reluctant to give up more equity and prefer to preserve their ownership shares s ...

Inflation vs Deflation

... the costs of higher inflation as central banks, which typically have restrictive inflation targets of around 2%. Here’s Joseph Stiglitz: “Moderate inflation, under 8% to 10%, does not have any significant effect on growth.” Meanwhile, IMF Chief Economist Blanchard suggested that inflation targets sh ...

... the costs of higher inflation as central banks, which typically have restrictive inflation targets of around 2%. Here’s Joseph Stiglitz: “Moderate inflation, under 8% to 10%, does not have any significant effect on growth.” Meanwhile, IMF Chief Economist Blanchard suggested that inflation targets sh ...

HAMISH FRASER MT CECIL, HUNTER 1RD KELLOGG'S RURAL LEADERSHIP PROGRAMME 2013

... New Zealand's low on farm profitability has meant that the majority of growth in the industries capital has come from debt funding. Therefore in relation to the diagram above people borrow to purchase assets that return more than the interest on the debt, or in finance terms debt is a means of using ...

... New Zealand's low on farm profitability has meant that the majority of growth in the industries capital has come from debt funding. Therefore in relation to the diagram above people borrow to purchase assets that return more than the interest on the debt, or in finance terms debt is a means of using ...

Liberal Mercantilism: Exchange Rate Regimes, Foreign Currency

... trade disputes is therefore a natural response to increased reserve needs. As we describe in more detail below, trade disputes are very plausibly capable of expanding exporting opportunities and, importantly, they operate on a timescale that allows them to serve foreign exchange needs. Declines in r ...

... trade disputes is therefore a natural response to increased reserve needs. As we describe in more detail below, trade disputes are very plausibly capable of expanding exporting opportunities and, importantly, they operate on a timescale that allows them to serve foreign exchange needs. Declines in r ...

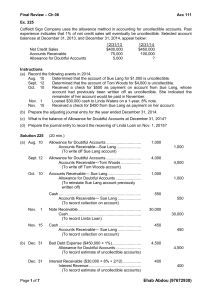

Final Review – Ch 08 Acc 111 Ex. 225 Coffeldt Sign Company uses

... Instructions (a) Prepare the adjusting entry on December 31, 2014, to recognize bad debts expense. (b) Assume the same facts as above except that the Allowance for Doubtful Accounts account had a $500 debit balance before the current year's provision for uncollectible accounts. Prepare the adjusting ...

... Instructions (a) Prepare the adjusting entry on December 31, 2014, to recognize bad debts expense. (b) Assume the same facts as above except that the Allowance for Doubtful Accounts account had a $500 debit balance before the current year's provision for uncollectible accounts. Prepare the adjusting ...

Tilburg University The Life Cycle of the Firm with

... establishes how the capital income tax system affects the cost of capital throughout the entire life cycle of a firm. In particular, the cost of newly issued equity may exceed the cost of new equity as derived by King and Fullerton (1984). Intuitively, the more new equity the firm issues initially, ...

... establishes how the capital income tax system affects the cost of capital throughout the entire life cycle of a firm. In particular, the cost of newly issued equity may exceed the cost of new equity as derived by King and Fullerton (1984). Intuitively, the more new equity the firm issues initially, ...

and Accounts Receivable Methods Percent of

... Credit Card Sales On July 16, 2011, Barton, Co. has a bank credit card sale of $500 to a customer. The bank charges a processing fee of 2%. Barton remits the credit card sale to the credit card company and waits for the payment that is received on July 28. Jul. 16 Accounts Receivable - Credit Card C ...

... Credit Card Sales On July 16, 2011, Barton, Co. has a bank credit card sale of $500 to a customer. The bank charges a processing fee of 2%. Barton remits the credit card sale to the credit card company and waits for the payment that is received on July 28. Jul. 16 Accounts Receivable - Credit Card C ...

0538479736_265849

... analysis of both the bank’s records and the depositor’s books may be necessary to determine whether errors or irregularities exist on the records of ...

... analysis of both the bank’s records and the depositor’s books may be necessary to determine whether errors or irregularities exist on the records of ...

Utility Cost of Capital

... especially given that the growth rate will change over time. • This model has been very popular in the U.S. especially at the Federal level ...

... especially given that the growth rate will change over time. • This model has been very popular in the U.S. especially at the Federal level ...

Consumer Law and Credit / Debt Law

... Use other individuals or agencies: There are many people other than advocates or lawyers who may be able to help resolve the problem. These include MPs, MLAs, government agencies (such as Consumer Protection BC, also known as the Business Practices and Consumer Protection Authority), the Better Busi ...

... Use other individuals or agencies: There are many people other than advocates or lawyers who may be able to help resolve the problem. These include MPs, MLAs, government agencies (such as Consumer Protection BC, also known as the Business Practices and Consumer Protection Authority), the Better Busi ...

Kampala Capital City Authority

... ceased to be a Local Government entity and under Section 3(2) of the Act, it became a Central Government entity administered by the Central Government. In practicality, this meant that Central Government would have direct authority over Kampala, with the Minister in charge of the Presidency, also be ...

... ceased to be a Local Government entity and under Section 3(2) of the Act, it became a Central Government entity administered by the Central Government. In practicality, this meant that Central Government would have direct authority over Kampala, with the Minister in charge of the Presidency, also be ...

What is the Risk of European Sovereign Debt Defaults? Fiscal

... sovereign debt crisis in Europe surfaced. Systematically large prediction errors may due to mispricing of risk or may be attributable to expectations of a future decline in fundamentals. Our analysis may help address a number of questions. Was risk in many markets (e.g. PIIGS) “underpriced” during ...

... sovereign debt crisis in Europe surfaced. Systematically large prediction errors may due to mispricing of risk or may be attributable to expectations of a future decline in fundamentals. Our analysis may help address a number of questions. Was risk in many markets (e.g. PIIGS) “underpriced” during ...

Understanding Credit Reports

... have the right to submit a 100 word explanation which stays in the consumer’s file ◊ Negative information is usually removed from credit file after seven years, except bankruptcy which is removed after 10 years © Family Economics & Financial Education – Revised October 2004 – Credit Unit –Understand ...

... have the right to submit a 100 word explanation which stays in the consumer’s file ◊ Negative information is usually removed from credit file after seven years, except bankruptcy which is removed after 10 years © Family Economics & Financial Education – Revised October 2004 – Credit Unit –Understand ...

DebT anD (noT mucH) DeLeveraGInG

... economic fundamentals. For the most highly indebted countries, implausibly large increases in real GDP growth or extremely deep reductions in fiscal deficits would be required to start deleveraging. A broader range of solutions for reducing government debt will need to be considered, including large ...

... economic fundamentals. For the most highly indebted countries, implausibly large increases in real GDP growth or extremely deep reductions in fiscal deficits would be required to start deleveraging. A broader range of solutions for reducing government debt will need to be considered, including large ...

DebT anD (noT mucH) DeLeveraGInG

... economic fundamentals. For the most highly indebted countries, implausibly large increases in real GDP growth or extremely deep reductions in fiscal deficits would be required to start deleveraging. A broader range of solutions for reducing government debt will need to be considered, including large ...

... economic fundamentals. For the most highly indebted countries, implausibly large increases in real GDP growth or extremely deep reductions in fiscal deficits would be required to start deleveraging. A broader range of solutions for reducing government debt will need to be considered, including large ...

standards for the use of eu securities settlement systems in escb

... The EMI and the NCBs will assess existing systems and their links against these standards. This will enable the EMI to compile a list of SSSs to be used for central bank credit operations, which will be published by the ECB. If an SSS does not meet the requirements of the standards the former may be ...

... The EMI and the NCBs will assess existing systems and their links against these standards. This will enable the EMI to compile a list of SSSs to be used for central bank credit operations, which will be published by the ECB. If an SSS does not meet the requirements of the standards the former may be ...

open-end credit under -truth-in- lending

... aformentioned NOTICE was not furnished that customer; then such NOTICE must be mailed or delivered to said customer either before or with the next billing on said account. It follows that creditors must decide whether it would be more economical to mail out the notices to all customers- listed on th ...

... aformentioned NOTICE was not furnished that customer; then such NOTICE must be mailed or delivered to said customer either before or with the next billing on said account. It follows that creditors must decide whether it would be more economical to mail out the notices to all customers- listed on th ...

Chapter 2 & 9

... Contributions & Distributions • Contribution of Encumbered Property – The contribution of encumbered property to a partnership should be analyzed as two separate transactions: The contribution of property by the partner to the partnership, followed by ...

... Contributions & Distributions • Contribution of Encumbered Property – The contribution of encumbered property to a partnership should be analyzed as two separate transactions: The contribution of property by the partner to the partnership, followed by ...

Linkages across Sovereign Debt Markets

... together and received an unusually good deal. These countries were able to exchange their defaulted debt for new Brady bonds with principal collateralized by the U.S. government. ...

... together and received an unusually good deal. These countries were able to exchange their defaulted debt for new Brady bonds with principal collateralized by the U.S. government. ...

Chapter 16 -- Operating and Financial Leverage

... Make an examination of the coverage ratios for Basket Wonders when EBIT=$500,000. Compare the equity and the debt financing alternatives. ...

... Make an examination of the coverage ratios for Basket Wonders when EBIT=$500,000. Compare the equity and the debt financing alternatives. ...

Trying To Understand All-Equity Firms

... investments was larger than total debt. Between 1987 and 2009, on average 14,1% of firms show no debt, 16.8% show zero long-term debt and 41% zero net debt. Looking to the evolution in Table 1, we see a stable rising trend with a maximum in 2005. This extreme debt aversion exists in all firm sizes b ...

... investments was larger than total debt. Between 1987 and 2009, on average 14,1% of firms show no debt, 16.8% show zero long-term debt and 41% zero net debt. Looking to the evolution in Table 1, we see a stable rising trend with a maximum in 2005. This extreme debt aversion exists in all firm sizes b ...