Centene Corporation - corporate

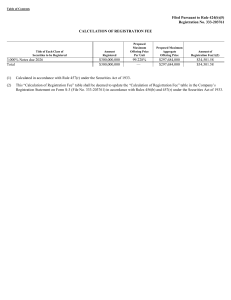

... This prospectus is part of an automatic “shelf” registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or SEC, as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”). Under this shelf registr ...

... This prospectus is part of an automatic “shelf” registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or SEC, as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”). Under this shelf registr ...

PINNACLE WEST CAPITAL CORP (Form: 8-K

... The ACC Staff is conducting workshops on the Track B issues with various parties to determine and define the appropriate process to be used for competitive power procurement. On September 13, 2002, the ACC Staff issued a "proposal and request for comments" describing a process by which APS would pro ...

... The ACC Staff is conducting workshops on the Track B issues with various parties to determine and define the appropriate process to be used for competitive power procurement. On September 13, 2002, the ACC Staff issued a "proposal and request for comments" describing a process by which APS would pro ...

Financing Provisions in Acquisition Agreements

... after giving effect to the sale transaction and related debt financing. Solvency is usually defined in a way consistent with applicable state and federal fraudulent transfer laws and in light of case holdings that certain aspects of leveraged buyout transactions may be challenged as fraudulent trans ...

... after giving effect to the sale transaction and related debt financing. Solvency is usually defined in a way consistent with applicable state and federal fraudulent transfer laws and in light of case holdings that certain aspects of leveraged buyout transactions may be challenged as fraudulent trans ...

Small Firm Use of Debt: An Examination of the Smallest Small Firms

... applied for a loan within the last 3 years, however, compared to half of the larger firms. Although the two groups had comparable credit histories, the smaller firms were less likely to provide collateral or personal guarantees for a loan. This could be because their firms lacked assets that could b ...

... applied for a loan within the last 3 years, however, compared to half of the larger firms. Although the two groups had comparable credit histories, the smaller firms were less likely to provide collateral or personal guarantees for a loan. This could be because their firms lacked assets that could b ...

Caesars Acquisition Co (Form: 425, Received: 05/27/2016 12:46:21)

... The Projections are, and the Disclosure Statement contains or may contain, “forward-looking statements” intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. You can identify these statements by the fact that they do not relate st ...

... The Projections are, and the Disclosure Statement contains or may contain, “forward-looking statements” intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. You can identify these statements by the fact that they do not relate st ...

Debt Refinancing and Equity Returns

... with leverage within each refinancing tertile. Furthermore, the difference in returns of highand low-leverage firms increases as the refinancing intensity increases (i.e. debt maturities become shorter). These findings are consistent with the notion that shareholders demand a premium for holding hi ...

... with leverage within each refinancing tertile. Furthermore, the difference in returns of highand low-leverage firms increases as the refinancing intensity increases (i.e. debt maturities become shorter). These findings are consistent with the notion that shareholders demand a premium for holding hi ...

The Gains from Resolving Debt Overhang: Evidence from a

... Each period, the firm enters with a productivity level, investment opportunities, and a coupon level. It has some probability of exiting exogenously. If it survives, equity holders alone decide whether or not to go bankrupt and then make the investment decision. Firm productivity follows a binomial ...

... Each period, the firm enters with a productivity level, investment opportunities, and a coupon level. It has some probability of exiting exogenously. If it survives, equity holders alone decide whether or not to go bankrupt and then make the investment decision. Firm productivity follows a binomial ...

Why do Spanish firms rarely use the bankruptcy

... The econometric test of our hypothesis is carried out by using data on more than 1 million Spanish, French and British firms from the OECD-Orbis database. The main conclusion is that holding mortgage debt is a “bankruptcyavoidance activity” with a much greater impact in Spain than in the other two co ...

... The econometric test of our hypothesis is carried out by using data on more than 1 million Spanish, French and British firms from the OECD-Orbis database. The main conclusion is that holding mortgage debt is a “bankruptcyavoidance activity” with a much greater impact in Spain than in the other two co ...

13 Fiscal Monitor Fiscal Adjustment in an Uncertain World

... taining these surpluses over time may be difficult. Altogether, about one-third of advanced economies—representing some 40 percent of global GDP—still face major fiscal challenges. Most of these countries have never experienced debt levels similar to the current ones, and certainly not for decades. ...

... taining these surpluses over time may be difficult. Altogether, about one-third of advanced economies—representing some 40 percent of global GDP—still face major fiscal challenges. Most of these countries have never experienced debt levels similar to the current ones, and certainly not for decades. ...

Saving Your Home in Bankruptcy

... bankruptcy under Chapter 13. First, they can reinstate the original mortgage payment schedule by repaying arrears during the five years of the repayment plan, rather than being forced to repay the entire mortgage debt immediately. Second, part or all of their unsecured debt is discharged. Third, deb ...

... bankruptcy under Chapter 13. First, they can reinstate the original mortgage payment schedule by repaying arrears during the five years of the repayment plan, rather than being forced to repay the entire mortgage debt immediately. Second, part or all of their unsecured debt is discharged. Third, deb ...

MERCURY GENERAL CORP (Form: 424B5

... Revolving Facility will have terms substantially similar to the Revolving Facility. However, we have not obtained any financing commitments for the New Revolving Facility, and it is subject to the execution of definitive documentation and other uncertainties, many of which are not within our control ...

... Revolving Facility will have terms substantially similar to the Revolving Facility. However, we have not obtained any financing commitments for the New Revolving Facility, and it is subject to the execution of definitive documentation and other uncertainties, many of which are not within our control ...

Government Debt and Risk Premia - Penn Economics

... risk premia, low risk-free rates, low expected returns on government debt, and high fiscal policy uncertainty. I rationalize these facts in a general equilibrium model featuring a fiscal uncertainty channel that links government debt and asset prices. The importance of government debt is manifested ...

... risk premia, low risk-free rates, low expected returns on government debt, and high fiscal policy uncertainty. I rationalize these facts in a general equilibrium model featuring a fiscal uncertainty channel that links government debt and asset prices. The importance of government debt is manifested ...

2 0 0 6 / 0 7 A... O F C L E A R I... A N D S E T T L... F A C I L I T I E S

... Bank quarterly, while the two central counterparties also report risk management information. The Bank also holds regular discussions with the licensees on issues relevant to compliance at both an operational and a policy level. The information gathered from these sources is supplemented with a deta ...

... Bank quarterly, while the two central counterparties also report risk management information. The Bank also holds regular discussions with the licensees on issues relevant to compliance at both an operational and a policy level. The information gathered from these sources is supplemented with a deta ...

words

... contain and/or incorporate by reference information that you should consider when making an investment decision. Neither we nor any underwriter has authorized anyone to provide any information or to make any representations other than those contained or incorporated by reference in this prospectus s ...

... contain and/or incorporate by reference information that you should consider when making an investment decision. Neither we nor any underwriter has authorized anyone to provide any information or to make any representations other than those contained or incorporated by reference in this prospectus s ...

MAKING SURE THE BAD GUYS PAY

... embodied in a piece of paper (in some cases there may be evidence of the obligation in written form but the paper form is not the agreement obligation itself) 1. Accounts. Such as keeping an account with the supplier, which holds a continuing duty to pay the supplier for goods dispersed over time. a ...

... embodied in a piece of paper (in some cases there may be evidence of the obligation in written form but the paper form is not the agreement obligation itself) 1. Accounts. Such as keeping an account with the supplier, which holds a continuing duty to pay the supplier for goods dispersed over time. a ...

Capital Structure Decision

... capital structure it should not loose site of the future impact of its present financial plan. For example if the firm has exhausted its firms capital it may be force to issue equity shares for future financing on unfavorable term due to heavy debt. Hence the firm should all ways return some unused ...

... capital structure it should not loose site of the future impact of its present financial plan. For example if the firm has exhausted its firms capital it may be force to issue equity shares for future financing on unfavorable term due to heavy debt. Hence the firm should all ways return some unused ...

KELLOGG CO (Form: 424B5, Received: 02/26/2016 17:06:57)

... Tender Offer for 7.45% debentures due 2031 On February 25, 2016, we commenced an offer to purchase for cash (the “tender offer”) up to $440 million aggregate principal amount (the “Maximum Tender Amount”) of our 7.45% debentures due 2031 (the “2031 Debentures”). As of such date, $1,100,000,000 aggre ...

... Tender Offer for 7.45% debentures due 2031 On February 25, 2016, we commenced an offer to purchase for cash (the “tender offer”) up to $440 million aggregate principal amount (the “Maximum Tender Amount”) of our 7.45% debentures due 2031 (the “2031 Debentures”). As of such date, $1,100,000,000 aggre ...

SPIRE INC (Form: 424B2, Received: 02/23/2017 15:27:05)

... Gas Utilities in 2017 reflects the continued ramp-up of infrastructure upgrades across both Missouri and Alabama, and the addition of capital expenditures to support EnergySouth. Acquiring and Integrating Gas Utilities We utilize a well-defined, disciplined process based on appropriate returns on in ...

... Gas Utilities in 2017 reflects the continued ramp-up of infrastructure upgrades across both Missouri and Alabama, and the addition of capital expenditures to support EnergySouth. Acquiring and Integrating Gas Utilities We utilize a well-defined, disciplined process based on appropriate returns on in ...

The Urban Infrastructure Challenge in Canada: Making Greater Use

... slowed considerably in most communities across the country during the recession, and governments directed considerable stimulus funds toward infrastructure during this same period. Moreover, a heavy reliance on development charges and other “pay-as-yougo” schemes to finance infrastructure have downl ...

... slowed considerably in most communities across the country during the recession, and governments directed considerable stimulus funds toward infrastructure during this same period. Moreover, a heavy reliance on development charges and other “pay-as-yougo” schemes to finance infrastructure have downl ...

MICROSOFT CORP (Form: 424B2, Received: 01/31/2017 16:20:44)

... Microsoft is a technology company whose mission is to empower every person and every organization on the planet to achieve more . Our strategy is to build best-in-class platforms and productivity services for a mobile- first, cloud-first world. The mobile-first, cloud-first world is transforming the ...

... Microsoft is a technology company whose mission is to empower every person and every organization on the planet to achieve more . Our strategy is to build best-in-class platforms and productivity services for a mobile- first, cloud-first world. The mobile-first, cloud-first world is transforming the ...

The Market for Corporate Control and the Cost of Debt

... …rms with imperfectly correlated cash ‡ows combine, bondholders may bene…t from a reduction in total risk. In support of this hypothesis, Billett, King, and Mauer (2004) …nd that target bondholders earn an average excess return of 1.09 percent around takeover announcements; they also …nd a much bigg ...

... …rms with imperfectly correlated cash ‡ows combine, bondholders may bene…t from a reduction in total risk. In support of this hypothesis, Billett, King, and Mauer (2004) …nd that target bondholders earn an average excess return of 1.09 percent around takeover announcements; they also …nd a much bigg ...

SOUTHWEST AIRLINES CO

... This prospectus supplement, the accompanying prospectus, and the documents we incorporate by reference may contain statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, or Exchan ...

... This prospectus supplement, the accompanying prospectus, and the documents we incorporate by reference may contain statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, or Exchan ...

Some Indicators of a Firm`s Risk and Debt Capacity

... than ICT'.FOR). For each firm, and in different economic environments, the relative importance of the various factors will differ. However, the manager should ensure that all the important factors have been analyzed. The first factor, flexibility, refers to the future financing options for managemen ...

... than ICT'.FOR). For each firm, and in different economic environments, the relative importance of the various factors will differ. However, the manager should ensure that all the important factors have been analyzed. The first factor, flexibility, refers to the future financing options for managemen ...

The Aggregate Demand for Treasury Debt

... securities such as corporate bonds, causing the yield on Treasuries to fall further below corporate bond rates, and the bond spread to widen. The opposite applies when the stock of debt is high. Variation in the supply of Treasury securities traces out a downward sloping demand curve for Treasuries ...

... securities such as corporate bonds, causing the yield on Treasuries to fall further below corporate bond rates, and the bond spread to widen. The opposite applies when the stock of debt is high. Variation in the supply of Treasury securities traces out a downward sloping demand curve for Treasuries ...

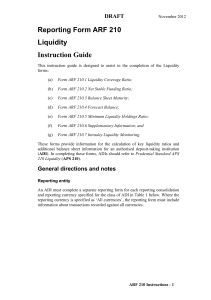

Reporting Form ARF 210 Liquidity Instruction Guide

... All assets accounted for in this section must be available for the ADI to convert into cash at any time to fill funding gaps between cash inflows and outflows during a stressed period. The assets must be unencumbered and should not be comingled with or used as hedges on trading positions, be designa ...

... All assets accounted for in this section must be available for the ADI to convert into cash at any time to fill funding gaps between cash inflows and outflows during a stressed period. The assets must be unencumbered and should not be comingled with or used as hedges on trading positions, be designa ...