FIN 331 in a Nutshell

... The discount rate used to value a bond Return earned if bond held to maturity Usually = coupon rate at issue Quoted as an APR The IRR of a bond ...

... The discount rate used to value a bond Return earned if bond held to maturity Usually = coupon rate at issue Quoted as an APR The IRR of a bond ...

Corporate Governance and Risk Management at Unprotected Banks

... find that, in 1935 and 1995, higher managerial ownership is associated with lower risk. Following the recent financial crisis, a number of studies have examined the extent to which corporate governance and manager incentive schemes influenced how banks fared during the crisis (Acharya et al. 2009 ...

... find that, in 1935 and 1995, higher managerial ownership is associated with lower risk. Following the recent financial crisis, a number of studies have examined the extent to which corporate governance and manager incentive schemes influenced how banks fared during the crisis (Acharya et al. 2009 ...

Batelco`s Cost of Capital

... The TRA determines that a single cost of capital shall apply to all of Batelco’s business units, since Batelco has retained a single integrated business structure, thus making it difficult for an outside observer to distinguish between the risks inherent in each of its business units, and for the fu ...

... The TRA determines that a single cost of capital shall apply to all of Batelco’s business units, since Batelco has retained a single integrated business structure, thus making it difficult for an outside observer to distinguish between the risks inherent in each of its business units, and for the fu ...

The Balance Sheet

... How would you use the profitability and liquidity ratios to determine whether the business is moving in a positive direction? A ratio is most useful when it is compared to the same ratio prepared at several different times for the same company or compared to the same ratio prepared for the industry ...

... How would you use the profitability and liquidity ratios to determine whether the business is moving in a positive direction? A ratio is most useful when it is compared to the same ratio prepared at several different times for the same company or compared to the same ratio prepared for the industry ...

ISS research paper template

... for a need to formulate and implement prudent debt management strategies to mitigate undesirable effects associated with domestic borrowings. The effect of domestic debts on private investment and economic growth is of main concern. Credit to the private sector is important in financing short term a ...

... for a need to formulate and implement prudent debt management strategies to mitigate undesirable effects associated with domestic borrowings. The effect of domestic debts on private investment and economic growth is of main concern. Credit to the private sector is important in financing short term a ...

Fiscal Risks and Contingent Liabilities

... Sources: IMF staff calculations. 1/ Number of episodes includes all episodes, average fiscal cost is calculated using only those episodes for 8 which a fiscal cost number is available. ...

... Sources: IMF staff calculations. 1/ Number of episodes includes all episodes, average fiscal cost is calculated using only those episodes for 8 which a fiscal cost number is available. ...

Home credit remedies evaluation

... When the last repayments on a loan have been made, the agent generally takes the payment book/card into the branch office for checking and returns it to the customer. Where the customer settles the loan early (for whatever reason) a rebate may be payable. Some customers settle new loans early by ren ...

... When the last repayments on a loan have been made, the agent generally takes the payment book/card into the branch office for checking and returns it to the customer. Where the customer settles the loan early (for whatever reason) a rebate may be payable. Some customers settle new loans early by ren ...

Enhanced-Supervision-for-U.S.-Operations-of-Foreign

... SEC Rule 15c3-1(a)(1)(i) sets forth the “basic” standard for computing net capital and is often used by smaller broker-dealers. A brokerdealer operating under this requirement must maintain minimum net capital equal to the greater of some specified amount (which varies depending on the type of busin ...

... SEC Rule 15c3-1(a)(1)(i) sets forth the “basic” standard for computing net capital and is often used by smaller broker-dealers. A brokerdealer operating under this requirement must maintain minimum net capital equal to the greater of some specified amount (which varies depending on the type of busin ...

Article III, Section 49-k of the Texas Constitution created the Texas

... Overview of the Financial Statements The annual financial report consists of three parts: Management’s Discussion and Analysis (this section), the basic financial statements with the notes to the financial statements, and supplementary information. The Mobility Fund’s financial statements combine tw ...

... Overview of the Financial Statements The annual financial report consists of three parts: Management’s Discussion and Analysis (this section), the basic financial statements with the notes to the financial statements, and supplementary information. The Mobility Fund’s financial statements combine tw ...

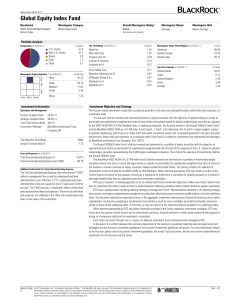

Global Equity Index Fund

... investment objective. An investment in the Fund is not a bank deposit, is not guaranteed by BlackRock, Inc. or any of its affiliates, and is not insured by the Federal Deposit Insurance Corporation or any other agency of the U.S. government. Equity Investment Risk: The price of an equity security fl ...

... investment objective. An investment in the Fund is not a bank deposit, is not guaranteed by BlackRock, Inc. or any of its affiliates, and is not insured by the Federal Deposit Insurance Corporation or any other agency of the U.S. government. Equity Investment Risk: The price of an equity security fl ...

Unlocking funding for European investment and growth

... This report has been commissioned by the Association of Financial Markets in Europe (AFME), which represents the voice of Europe’s wholesale financial markets. The findings of the report can stand alone, but are also designed to offer constructive recommendations to the debate prompted by the Europe ...

... This report has been commissioned by the Association of Financial Markets in Europe (AFME), which represents the voice of Europe’s wholesale financial markets. The findings of the report can stand alone, but are also designed to offer constructive recommendations to the debate prompted by the Europe ...