TVN plc – the meaning behind the IPO

... with the graph showing not even one more in the period from April to September 2004. Boasting about successful placement of the issue may be a bit off the point here. One would rather suspect that the bonds were bought by parties linked to ITI, such as the BRE Bank. The bond issue had an effect of h ...

... with the graph showing not even one more in the period from April to September 2004. Boasting about successful placement of the issue may be a bit off the point here. One would rather suspect that the bonds were bought by parties linked to ITI, such as the BRE Bank. The bond issue had an effect of h ...

Medium Term Debt Strategy

... essential requirement for our policies and priorities to be successful. The opportunities for new prudent borrowing, resulting from recent progress in lowering our level of debt distress from high risk to moderate risk, are being taken with care. They focus on saving costs, driving growth, and addre ...

... essential requirement for our policies and priorities to be successful. The opportunities for new prudent borrowing, resulting from recent progress in lowering our level of debt distress from high risk to moderate risk, are being taken with care. They focus on saving costs, driving growth, and addre ...

FY16 Preliminary Results 766KB

... Against this backdrop, we have remained firmly committed to creating sustained and shared value for all our stakeholders, focusing on efficient, competitive operations, and high potential silver and gold projects that can be developed into low cost mines able to withstand unpredictable metal prices. ...

... Against this backdrop, we have remained firmly committed to creating sustained and shared value for all our stakeholders, focusing on efficient, competitive operations, and high potential silver and gold projects that can be developed into low cost mines able to withstand unpredictable metal prices. ...

Global Fixed Income Portfolio

... Exchange rate risk is the risk that the exchange rate between the currency in which a bond is denominated and the currency of the investor’s home country might change Volatility risk describes the risk that changes in volatility of interest rates will affect the value of options embedded in a bond I ...

... Exchange rate risk is the risk that the exchange rate between the currency in which a bond is denominated and the currency of the investor’s home country might change Volatility risk describes the risk that changes in volatility of interest rates will affect the value of options embedded in a bond I ...

interest rates - EESC European Economic and Social Committee

... .. ECB: “key” interest rates. (Or government bonds rates in APP Programme) .. So, could it be an opportunity to provide real economy not only with more funds but also with lower rates? ...

... .. ECB: “key” interest rates. (Or government bonds rates in APP Programme) .. So, could it be an opportunity to provide real economy not only with more funds but also with lower rates? ...

Corporate Finance, 3e (Berk/DeMarzo) Chapter 2 Introduction to

... 1) In addition to the balance sheet, income statement, and the statement of cash flows, a firm's complete financial statements will include all of the following EXCEPT: A) Management discussion and analysis B) Notes to the financial statements C) Securities and Exchange Commission's (SEC) commentary ...

... 1) In addition to the balance sheet, income statement, and the statement of cash flows, a firm's complete financial statements will include all of the following EXCEPT: A) Management discussion and analysis B) Notes to the financial statements C) Securities and Exchange Commission's (SEC) commentary ...

FL BlackRock Long Term (Aquila C) IE/XE

... E - Fixed Interest: Where a fund invests in fixed interest securities, such as corporate or government bonds, changes in interest rates can contribute to the value of the investment going up or down. If interest rates rise, the value is likely to fall. Bonds with a lower credit rating are known as s ...

... E - Fixed Interest: Where a fund invests in fixed interest securities, such as corporate or government bonds, changes in interest rates can contribute to the value of the investment going up or down. If interest rates rise, the value is likely to fall. Bonds with a lower credit rating are known as s ...

evolving to a specialty care biopharma company - Bristol

... Changes were also announced to better align and focus the Global Finance, Strategic Planning, and Business Development groups, along with Enterprise Services and Global Manufacturing and Supply. These changes are creating a more focused company, concentrated on a smaller number of core assets and pr ...

... Changes were also announced to better align and focus the Global Finance, Strategic Planning, and Business Development groups, along with Enterprise Services and Global Manufacturing and Supply. These changes are creating a more focused company, concentrated on a smaller number of core assets and pr ...

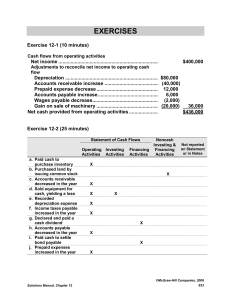

Cash flows from operating activities

... Cash flows from financing activities Cash received from issuing stock.............................. Cash received from borrowing ................................... Cash paid for note payable ......................................... Cash paid for dividends .......................................... ...

... Cash flows from financing activities Cash received from issuing stock.............................. Cash received from borrowing ................................... Cash paid for note payable ......................................... Cash paid for dividends .......................................... ...

NBER WORKING PAPER SERIES LEVERAGE CONSTRAINTS AND THE INTERNATIONAL TRANSMISSION OF SHOCKS

... The paper’s main contribution is to compare how macro shocks are transmitted under different financial market structures. We do not attempt to provide an integrated explanation of the recent crisis, or a full quantitative calibration, but instead highlight how the joint process of balance sheet con ...

... The paper’s main contribution is to compare how macro shocks are transmitted under different financial market structures. We do not attempt to provide an integrated explanation of the recent crisis, or a full quantitative calibration, but instead highlight how the joint process of balance sheet con ...

2005 Survey - Freddie Mac Home

... – Do not feel entirely comfortable talking – Do not find banks intimidating to their banks about personal finances – Strongly agree that their banks treat – Find prioritizing their bills difficult (and ...

... – Do not feel entirely comfortable talking – Do not find banks intimidating to their banks about personal finances – Strongly agree that their banks treat – Find prioritizing their bills difficult (and ...

cordros money market fund - Cordros Asset Management

... administration of the Fund, extracts of which are set out from page 36 of this Prospectus. ...

... administration of the Fund, extracts of which are set out from page 36 of this Prospectus. ...

Joint Stock Company “NORVIK BANKA” Consolidated and Separate

... 2016 has undeniably been important for the development of AS “Norvik Banka” (the Bank). The Bank has shown strong progress in moving towards its established goals. The management considered 2016 to be a successful though challenging period on the way to ensuring the Bank’s long-term and effective pr ...

... 2016 has undeniably been important for the development of AS “Norvik Banka” (the Bank). The Bank has shown strong progress in moving towards its established goals. The management considered 2016 to be a successful though challenging period on the way to ensuring the Bank’s long-term and effective pr ...

the fragile capital structure of hedge funds and the

... have the right to redeem their investment at an intermediate date, T1 . We assume that the total amount of assets under management of the fund at T0 is 1, that there is a continuum of investors with measure 1, and each investor contributes 1 unit of capital. We model the liquidity risk of the hedge ...

... have the right to redeem their investment at an intermediate date, T1 . We assume that the total amount of assets under management of the fund at T0 is 1, that there is a continuum of investors with measure 1, and each investor contributes 1 unit of capital. We model the liquidity risk of the hedge ...

0000897101-15-000290 - Investor Relations

... purchase a hearing aid, consolidation at the retail level and inconveniences in the distribution channel. These factors have created the opportunity for alternative care models, such as the value hearing aid (VHA) channel and personal sound amplifier (PSAP) channel. The VHA channel is outcome based ...

... purchase a hearing aid, consolidation at the retail level and inconveniences in the distribution channel. These factors have created the opportunity for alternative care models, such as the value hearing aid (VHA) channel and personal sound amplifier (PSAP) channel. The VHA channel is outcome based ...

Capital market imperfections and trade liberalization in

... trade related xed or variable costs), (ii) the theoretical motivation of nancial constraints (e.g. moral hazard, imperfect contractibility, information asymmetry), and (iii) the underlying preference structure (e.g. CES vs. linear demand). To the best of our knowledge, this paper is the rst to intr ...

... trade related xed or variable costs), (ii) the theoretical motivation of nancial constraints (e.g. moral hazard, imperfect contractibility, information asymmetry), and (iii) the underlying preference structure (e.g. CES vs. linear demand). To the best of our knowledge, this paper is the rst to intr ...

Inflation, Debt, and Default

... and finally becomes positive in the most recent sample (1994–2015). If inflation co-varies positively with domestic consumption growth, then returns on domestic nominal debt are high (low) when consumption growth is low (high). This feature makes domestic nominal bonds less risky from a domestic inv ...

... and finally becomes positive in the most recent sample (1994–2015). If inflation co-varies positively with domestic consumption growth, then returns on domestic nominal debt are high (low) when consumption growth is low (high). This feature makes domestic nominal bonds less risky from a domestic inv ...

Analysing and Decomposing the Sources of Added

... corporate bonds are particularly wellsuited to improve the PSP/LHP interaction, given that they have a well-controlled interest rate risk exposure while providing an access to an equity-like risk premium. In other words, they have on the one hand attractive interest rate hedging benefits which shoul ...

... corporate bonds are particularly wellsuited to improve the PSP/LHP interaction, given that they have a well-controlled interest rate risk exposure while providing an access to an equity-like risk premium. In other words, they have on the one hand attractive interest rate hedging benefits which shoul ...

Default Risk, the Real Exchange Rate and Income

... because even though foreign debt cannot be used to smooth consumption of nontradable goods, nontradable output fluctuations affect repayment incentives and equilibrium interest rates through changes in the real exchange rate. In the first part of the paper, a simpler version of the model with i.i.d. ...

... because even though foreign debt cannot be used to smooth consumption of nontradable goods, nontradable output fluctuations affect repayment incentives and equilibrium interest rates through changes in the real exchange rate. In the first part of the paper, a simpler version of the model with i.i.d. ...

BLOUNT INTERNATIONAL INC (Form: 10-K

... administration of various health and welfare plans, risk management and insurance services, supervision of the Company’s capital structure, and oversight of the regulatory, compliance, and legal functions. Operating expenses of this central administrative function are included in selling, general, a ...

... administration of various health and welfare plans, risk management and insurance services, supervision of the Company’s capital structure, and oversight of the regulatory, compliance, and legal functions. Operating expenses of this central administrative function are included in selling, general, a ...