Tactical Asset Allocation with Macroeconomic Factors

... concerned about volatility, again multiple-asset-class strategies are dominant. … Again, we find multipleasset-class strategies delivering much higher rates of risk-adjusted returns than single-asset-class strategies.” In other words, each additional asset class provides additional return-risk benef ...

... concerned about volatility, again multiple-asset-class strategies are dominant. … Again, we find multipleasset-class strategies delivering much higher rates of risk-adjusted returns than single-asset-class strategies.” In other words, each additional asset class provides additional return-risk benef ...

Default Risk and Aggregate Fluctuations in Emerging Economies

... prediction because it assumes an incomplete set of assets where default occurs with a positive probability. In this regard the paper is specially related to the analysis on unsecured consumer credit with the risk of default by Chaterrjee, Corbae, Nakajima and Rios Rull (2002) where they model equili ...

... prediction because it assumes an incomplete set of assets where default occurs with a positive probability. In this regard the paper is specially related to the analysis on unsecured consumer credit with the risk of default by Chaterrjee, Corbae, Nakajima and Rios Rull (2002) where they model equili ...

Basics and Problems - Ace MBAe Finance Specialization

... These results indicate that Walgreens currently collects its accounts receivable in about 10 days on average, and this collection period has increased slightly over the recent five years. To determine whether these receivable collection numbers are good or bad, it is essential that they be related ...

... These results indicate that Walgreens currently collects its accounts receivable in about 10 days on average, and this collection period has increased slightly over the recent five years. To determine whether these receivable collection numbers are good or bad, it is essential that they be related ...

KITE REALTY GROUP TRUST

... portion of the Company's disclosure applies to both the Parent Company and the Operating Partnership; and creating time and cost efficiencies through the preparation of one combined report instead of two separate reports. ...

... portion of the Company's disclosure applies to both the Parent Company and the Operating Partnership; and creating time and cost efficiencies through the preparation of one combined report instead of two separate reports. ...

NBER WORKING PAPER SERIES BORROWING CONSTRAINTS AND CONSUMPTION BEHAVIOR IN JAPAN Midori Wakabayashi

... indicators, some of which are unique to our data source, and find that the characteristics of households that are likely to be borrowing-constrained differ depending on which of the three indicators we use. We also find that changes in current income have a positive and significant impact on changes ...

... indicators, some of which are unique to our data source, and find that the characteristics of households that are likely to be borrowing-constrained differ depending on which of the three indicators we use. We also find that changes in current income have a positive and significant impact on changes ...

interest rate and inflation risks in PFI contracts

... debt has a term of 20-30 years; the Unitary Charge would then be subject to variation in line with prevailing interest rates after 10 years. In this case, the Authority will need to consider whether it is content for interest-rate risk to revert to it in this way (after 10 years), or whether it woul ...

... debt has a term of 20-30 years; the Unitary Charge would then be subject to variation in line with prevailing interest rates after 10 years. In this case, the Authority will need to consider whether it is content for interest-rate risk to revert to it in this way (after 10 years), or whether it woul ...

Financial Supply Chain Dynamics Risk Operational

... having a sufficient amount of assets in the bank. ...

... having a sufficient amount of assets in the bank. ...

Risk and Capital Management

... the Group by adopting a number of risk policies and instructions. Together with the Group Executive Board, the Group Supervisory Board is responsible for ensuring that the Group has an organisational structure that will secure a distinct allocation of responsibility and include an appropriate separa ...

... the Group by adopting a number of risk policies and instructions. Together with the Group Executive Board, the Group Supervisory Board is responsible for ensuring that the Group has an organisational structure that will secure a distinct allocation of responsibility and include an appropriate separa ...

Guidelines on Risk Based Capital Adequacy

... Capital and Disclosure requirement as stated in the guidelines had to be followed by all scheduled banks for the purpose of statutory compliance. Basel III reforms are the response of Basel Committee on Banking Supervision (BCBS) to improve the banking sector’s ability to absorb shocks arising from ...

... Capital and Disclosure requirement as stated in the guidelines had to be followed by all scheduled banks for the purpose of statutory compliance. Basel III reforms are the response of Basel Committee on Banking Supervision (BCBS) to improve the banking sector’s ability to absorb shocks arising from ...

IPSAS 26 Impairment of Cash-Generating Assets

... place during the period, or will take place in the near future, in the technological, market, economic, or legal environment in which the entity operates, or in the market to which an asset is dedicated; (c) Market interest rates or other market rates of return on investments have increased during t ...

... place during the period, or will take place in the near future, in the technological, market, economic, or legal environment in which the entity operates, or in the market to which an asset is dedicated; (c) Market interest rates or other market rates of return on investments have increased during t ...

Document

... There are many ways of negotiating a price. Counsel for the Taxpayer argued at length that the price had been calculated in a reverse manner. He pointed out that the price to be paid for the bad and doubtful loans was an amount which reduced the book value of C Institution so that the third party pu ...

... There are many ways of negotiating a price. Counsel for the Taxpayer argued at length that the price had been calculated in a reverse manner. He pointed out that the price to be paid for the bad and doubtful loans was an amount which reduced the book value of C Institution so that the third party pu ...

WPX ENERGY, INC. (Form: 424B2, Received: 01/17

... • cash flow from operations or results of operations; • acquisitions or divestitures, including the consummation of the Acquisition and its effects on us; and • seasonality of our business. Forward-looking statements are based on numerous assumptions, uncertainties and risks that could cause future ...

... • cash flow from operations or results of operations; • acquisitions or divestitures, including the consummation of the Acquisition and its effects on us; and • seasonality of our business. Forward-looking statements are based on numerous assumptions, uncertainties and risks that could cause future ...

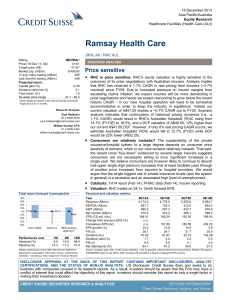

Ramsay Health Care 2013 12 18 - Price sensitive

... estimate Australian hospitals' ROIC would fall to 12.7% (FY20) while DCF would be 22% lower (A$32.20). ■ Consumers are relatively inelastic? The sustainability of the private insurance/hospital system to a large degree depends on consumer price elasticity of demand, which in our view remains relativ ...

... estimate Australian hospitals' ROIC would fall to 12.7% (FY20) while DCF would be 22% lower (A$32.20). ■ Consumers are relatively inelastic? The sustainability of the private insurance/hospital system to a large degree depends on consumer price elasticity of demand, which in our view remains relativ ...

- Free Documents

... primarily because these assets typically are owned by individual investors in the form of money market mutual funds. Chapter concentrates on the major capital market assets, bonds and stocks, while providing a very brief coverage of derivative securities. The idea of indirect investingthe ownership ...

... primarily because these assets typically are owned by individual investors in the form of money market mutual funds. Chapter concentrates on the major capital market assets, bonds and stocks, while providing a very brief coverage of derivative securities. The idea of indirect investingthe ownership ...

Perpetual subordinated bond of 400 million euros

... or after the date on which adequate public disclosure of the final terms of the offer of the Notes is made and, if begun, may be ended at any time, but it must end no later than the earlier of 30 days after the issue date of the Notes and 60 days after the date of the allotment of the Notes. Any sta ...

... or after the date on which adequate public disclosure of the final terms of the offer of the Notes is made and, if begun, may be ended at any time, but it must end no later than the earlier of 30 days after the issue date of the Notes and 60 days after the date of the allotment of the Notes. Any sta ...

The Credit Spread Puzzle - Myth or Reality?

... This implies that the conclusions in Leland (2006) and McQuade (2013) that standard structural models underpredict spreads are misleading. A similar bias occurs when calculating default probabilities based on average firm variables. As we show this bias is also most severe at short maturities for h ...

... This implies that the conclusions in Leland (2006) and McQuade (2013) that standard structural models underpredict spreads are misleading. A similar bias occurs when calculating default probabilities based on average firm variables. As we show this bias is also most severe at short maturities for h ...

Inflation-Indexed Bonds and the Expectations

... are not exposed to inflation risk, since their coupons and principal adjust automatically with inflation.3 The starting point of our empirical investigation of bond risk premia is the expectations hypothesis of interest rates (EH for short). The EH postulates that the risk premium on long-term bonds ...

... are not exposed to inflation risk, since their coupons and principal adjust automatically with inflation.3 The starting point of our empirical investigation of bond risk premia is the expectations hypothesis of interest rates (EH for short). The EH postulates that the risk premium on long-term bonds ...

Can Local Long-term Institutional Ownership

... also suggest that informed ownership can serve as a signal (Leland and Pyle, 1977) and that an informative signal is a valuable indicator of due diligence and monitoring (Holmstrom, 1979; Holmstrom and Tirole, 1997). As informed ownership of the borrower is associated with improved due diligence and ...

... also suggest that informed ownership can serve as a signal (Leland and Pyle, 1977) and that an informative signal is a valuable indicator of due diligence and monitoring (Holmstrom, 1979; Holmstrom and Tirole, 1997). As informed ownership of the borrower is associated with improved due diligence and ...