Short selling around the world with applications to the S…

... creates “phantom”stock and improperly increases the number of shares in circulation. ...

... creates “phantom”stock and improperly increases the number of shares in circulation. ...

GENERAL ELECTRIC CO (Form: 10-K405, Received: 03

... commercial broadcast television networks. It also competes with two newly launched commercial broadcast networks, syndicated broadcast television programming and cable and satellite television programming activities. The businesses in which GE Capital Services engages are subject to competition from ...

... commercial broadcast television networks. It also competes with two newly launched commercial broadcast networks, syndicated broadcast television programming and cable and satellite television programming activities. The businesses in which GE Capital Services engages are subject to competition from ...

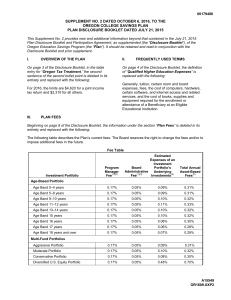

Disclosure Booklet - Oregon College Savings Plan

... with positive duration will generally decline if interest rates increase. Certain other investments, such as inverse floaters and certain derivative instruments, may have a negative duration. The value of instruments with a negative duration will generally decline if interest rates decrease. Inverse ...

... with positive duration will generally decline if interest rates increase. Certain other investments, such as inverse floaters and certain derivative instruments, may have a negative duration. The value of instruments with a negative duration will generally decline if interest rates decrease. Inverse ...

Sample Chapter - McGraw Hill Higher Education

... single period. But often you will be interested in average returns over longer periods of time. For example, you might want to measure how well a mutual fund has performed over the preceding five-year period. In this case, return measurement is more ambiguous. Consider a fund that starts with $1 mil ...

... single period. But often you will be interested in average returns over longer periods of time. For example, you might want to measure how well a mutual fund has performed over the preceding five-year period. In this case, return measurement is more ambiguous. Consider a fund that starts with $1 mil ...

Form 10-K - corporate

... Table of Contents materials, precision photonic solutions used in life sciences, research and defense markets, and precision gear and peristaltic pump technologies that meet exacting original equipment manufacturer specifications. The segment accounted for 34% of IDEX’s sales and 31% of operating i ...

... Table of Contents materials, precision photonic solutions used in life sciences, research and defense markets, and precision gear and peristaltic pump technologies that meet exacting original equipment manufacturer specifications. The segment accounted for 34% of IDEX’s sales and 31% of operating i ...

Banks credit assessment to small businesses

... society and the economic growth. In the way that it is a valuable source of creating new job opportunities and introducing innovative products to the market among other factors (OECD, 2006). Small businesses represent 99 percent of all companies in Sweden and they are a provider of one third of the ...

... society and the economic growth. In the way that it is a valuable source of creating new job opportunities and introducing innovative products to the market among other factors (OECD, 2006). Small businesses represent 99 percent of all companies in Sweden and they are a provider of one third of the ...

Structural Features of Australian Residential Mortgage

... denominated in a foreign currency. Swaps with third parties are used to reduce asset-liability mismatches by modifying some of the funds in the collection account (see ‘Transforming Cash Flows’ section). ...

... denominated in a foreign currency. Swaps with third parties are used to reduce asset-liability mismatches by modifying some of the funds in the collection account (see ‘Transforming Cash Flows’ section). ...

CreditMetrics™ — Technical Document

... default risk as the available data quality would allow. Although we never mandated during this development that CreditMetrics must resemble RiskMetrics, the outcome has yielded philosophically similar models. One major difference in the models was driven by the difference in the available data. In R ...

... default risk as the available data quality would allow. Although we never mandated during this development that CreditMetrics must resemble RiskMetrics, the outcome has yielded philosophically similar models. One major difference in the models was driven by the difference in the available data. In R ...

Current Trends in the Global Reinsurance Market

... simulations and projections are for illustrative purposes only and are based on certain assumptions. Therefore the recipient should not place undue reliance on these results. Past performance does not guarantee future results. Neither MMCSC nor GC is a legal, tax or accounting adviser and makes no r ...

... simulations and projections are for illustrative purposes only and are based on certain assumptions. Therefore the recipient should not place undue reliance on these results. Past performance does not guarantee future results. Neither MMCSC nor GC is a legal, tax or accounting adviser and makes no r ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to s ...

... Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to s ...

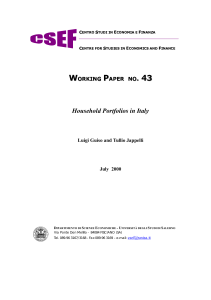

Household Portfolios in Italy

... different from that of subsequent surveys. Accordingly, we choose to start our analysis with 1989.4 Portfolio data are particularly rich in the 1995 and in the newly released 1998 SHIW: special sections of the questionnaire address crucial issues in the analysis of household portfolios, such as know ...

... different from that of subsequent surveys. Accordingly, we choose to start our analysis with 1989.4 Portfolio data are particularly rich in the 1995 and in the newly released 1998 SHIW: special sections of the questionnaire address crucial issues in the analysis of household portfolios, such as know ...

FREE Sample Here

... http://testbank360.eu/test-bank-essentials-of-corporate-finance-6th-edition-ross 32. Which two of the following determine when revenue is recorded on the financial statements based on the recognition principle? I. when payment is collected for the sale of a good or service II. when the earnings proc ...

... http://testbank360.eu/test-bank-essentials-of-corporate-finance-6th-edition-ross 32. Which two of the following determine when revenue is recorded on the financial statements based on the recognition principle? I. when payment is collected for the sale of a good or service II. when the earnings proc ...

Essay - Shadow Banking

... repurchase agreement) have been used by the traditional sector too12. Therefore, one cannot label an activity as a shadow banking one since it does not depend on the activity 8 Firstly mentioned in April 2011 in [13] FSB, April 2011. 9 Maturity transformation refers to using short-term liabilities t ...

... repurchase agreement) have been used by the traditional sector too12. Therefore, one cannot label an activity as a shadow banking one since it does not depend on the activity 8 Firstly mentioned in April 2011 in [13] FSB, April 2011. 9 Maturity transformation refers to using short-term liabilities t ...

sterling advisors, inc firm brochure

... After an initial meeting with the client and when deemed appropriate, we may recommend the services of an independent investment adviser (“Third Party Adviser”). The recommendation will depend on the client’s circumstances, goals and objectives, strategy desired, account size, risk tolerance, or oth ...

... After an initial meeting with the client and when deemed appropriate, we may recommend the services of an independent investment adviser (“Third Party Adviser”). The recommendation will depend on the client’s circumstances, goals and objectives, strategy desired, account size, risk tolerance, or oth ...

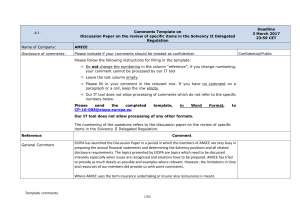

Title of presentation

... backtest the performance of P2P based on historical bank loan performance data ...

... backtest the performance of P2P based on historical bank loan performance data ...