Microcredit vs. Microsaving

... MF helps build small businesses by offering credit to households otherwise denied formal credit. Yet, survey data indicates that MF loans are also used for household needs. ...

... MF helps build small businesses by offering credit to households otherwise denied formal credit. Yet, survey data indicates that MF loans are also used for household needs. ...

Document

... cost saving innovations and the proliferation of new financial instruments. Explain why asset-backed securities are an example of direct finance. If a bank issues asset-backed securities, how does it get new funds to lend? The asset-backed securities market is one where lenders (SSUs) lend their fun ...

... cost saving innovations and the proliferation of new financial instruments. Explain why asset-backed securities are an example of direct finance. If a bank issues asset-backed securities, how does it get new funds to lend? The asset-backed securities market is one where lenders (SSUs) lend their fun ...

The role of fixed income in a multi-asset portfolio

... The role of fixed income in a multi-asset portfolio In a world where yields are paper thin, the natural question to ask is, does fixed income still have a role to play in a multi-asset portfolio? Our latest research paper answers that very question. The paper works from the premise that bonds are ex ...

... The role of fixed income in a multi-asset portfolio In a world where yields are paper thin, the natural question to ask is, does fixed income still have a role to play in a multi-asset portfolio? Our latest research paper answers that very question. The paper works from the premise that bonds are ex ...

Adaptation of Fishing Communities in the Philippines

... credit arm of the Department of Agriculture. The financing scheme has been quite successful with repayment rate at 95%. However, climate change has brought about more frequent typhoons as well as pests and diseases which have affected the productivity of fisheries, thus, hindering fishers from payin ...

... credit arm of the Department of Agriculture. The financing scheme has been quite successful with repayment rate at 95%. However, climate change has brought about more frequent typhoons as well as pests and diseases which have affected the productivity of fisheries, thus, hindering fishers from payin ...

How Stocks Promote Growth

... • Even when a company finds all the money to pay for these, it has no guarantee of success; the expansion may not be profitable after all. ...

... • Even when a company finds all the money to pay for these, it has no guarantee of success; the expansion may not be profitable after all. ...

Convertibles During High Inflation

... of shares. The hybrid nature of the securities offers investors the principal protection and income characteristics of bonds with the opportunity for higher returns if the issuer’s stock price rises. This discussion also includes convertible preferred shares, which have similar characteristics. Ther ...

... of shares. The hybrid nature of the securities offers investors the principal protection and income characteristics of bonds with the opportunity for higher returns if the issuer’s stock price rises. This discussion also includes convertible preferred shares, which have similar characteristics. Ther ...

Realize Higher Returns from Income-Producing Credit

... Corserv management includes veteran credit card portfolio managers to guide clients. We design, develop, implement and manage a comprehensive suite of consumer, business and corporate credit card products, overcoming the obstacles that have prevented you from building a profitable relationship-based ...

... Corserv management includes veteran credit card portfolio managers to guide clients. We design, develop, implement and manage a comprehensive suite of consumer, business and corporate credit card products, overcoming the obstacles that have prevented you from building a profitable relationship-based ...

Bank of Ireland Mortgage Bank

... are issued by a credit institution authorised by the Central Bank for the purpose of the ACS Act. The Firm is designated as a mortgage credit institution under the ACS Act and is obliged to comply with its provisions. Asset Covered Securities are backed by a defined pool of assets, in this case mort ...

... are issued by a credit institution authorised by the Central Bank for the purpose of the ACS Act. The Firm is designated as a mortgage credit institution under the ACS Act and is obliged to comply with its provisions. Asset Covered Securities are backed by a defined pool of assets, in this case mort ...

Directors` Guide to Credit - Federal Reserve Bank of Atlanta

... on the overall financial performance of the institution. Troubled debt restructure (TDR): Directors should understand the definition of TDR and its potential impact on asset quality. Allowance for loan and lease losses (ALLL): Directors should have a working knowledge of the ALLL and the financial i ...

... on the overall financial performance of the institution. Troubled debt restructure (TDR): Directors should understand the definition of TDR and its potential impact on asset quality. Allowance for loan and lease losses (ALLL): Directors should have a working knowledge of the ALLL and the financial i ...

Money

... -- mitigates default risk through ongoing payments. -- gives the bank a highly predictable stream of income. -- has features that make it a “superliquidating” loan. ...

... -- mitigates default risk through ongoing payments. -- gives the bank a highly predictable stream of income. -- has features that make it a “superliquidating” loan. ...

US Fed finally raises rates and sends bond prices down

... US Fed finally raises rates and sends bond prices down Frito Lay Potato Chips used to have a slogan: “Betcha Can’t Eat Just One!” Today, that catch phrase could easily apply to the actions of the US Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in n ...

... US Fed finally raises rates and sends bond prices down Frito Lay Potato Chips used to have a slogan: “Betcha Can’t Eat Just One!” Today, that catch phrase could easily apply to the actions of the US Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in n ...

[Int`lFinance]FinalPaper_KWAKJeeEun5

... originally guaranteed state securities which were very safe, their credit rate was high and guaranteed by these companies imposed same credit to the products. As derivatives developed, such as collateralized debt obligations which were assigned with different level of risks and priorities “tranche,” ...

... originally guaranteed state securities which were very safe, their credit rate was high and guaranteed by these companies imposed same credit to the products. As derivatives developed, such as collateralized debt obligations which were assigned with different level of risks and priorities “tranche,” ...

Statement of Capital Adequacy (Form PDR III) Quarter ended

... Note: Cash margins/ deposits should be deducted before applying the credit ...

... Note: Cash margins/ deposits should be deducted before applying the credit ...

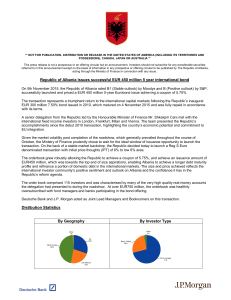

Form of Press Releases to be issued via the primary

... Global Excess Liquidity Sources increased $65B to record $504B; time to required funding at 39 months ...

... Global Excess Liquidity Sources increased $65B to record $504B; time to required funding at 39 months ...

Topic Foreign investors investing in Brazilian mortgage

... not domiciled in countries where the income is not taxed or where the maximum income tax rate is less than 20%, in securities issued by entities in Brazil to raise funds for long time investments. In order to be entitled to such exemption, certain requirements must be met: (i) the issuer must be a p ...

... not domiciled in countries where the income is not taxed or where the maximum income tax rate is less than 20%, in securities issued by entities in Brazil to raise funds for long time investments. In order to be entitled to such exemption, certain requirements must be met: (i) the issuer must be a p ...

Valuation Hierarchy Determination of Fair Value Assets

... When available, the fair value of securities is based on quoted prices in active markets. If quoted prices are not available, fair values are obtained from nationally-recognized pricing services, broker quotes, or other model-based valuation techniques such as the present value of cash flows. Level ...

... When available, the fair value of securities is based on quoted prices in active markets. If quoted prices are not available, fair values are obtained from nationally-recognized pricing services, broker quotes, or other model-based valuation techniques such as the present value of cash flows. Level ...

![[Int`lFinance]FinalPaper_KWAKJeeEun5](http://s1.studyres.com/store/data/020902525_1-8b3bd67b6fcbe05022cd6ab5ab1a1f0a-300x300.png)