1 - BrainMass

... same required returns on debt c. For any given firm, the required return on debt is always greater than the required return on equity 13. which of the following items is not considered a receipt in a cash budget? a. b. c. d. ...

... same required returns on debt c. For any given firm, the required return on debt is always greater than the required return on equity 13. which of the following items is not considered a receipt in a cash budget? a. b. c. d. ...

Factsheet Floating Rate Income Trust USD

... instruments, including derivatives, which may be used to gain or reduce market exposure and/or risk management. Certain transactions the funds may utilize may give rise to a form of leverage through either (a) additional market exposure or (b) borrowing capital in an attempt to increase investment r ...

... instruments, including derivatives, which may be used to gain or reduce market exposure and/or risk management. Certain transactions the funds may utilize may give rise to a form of leverage through either (a) additional market exposure or (b) borrowing capital in an attempt to increase investment r ...

RBI IFRS Session - Impairment

... group (eg increased number of credit card borrowers who have reached their credit limit and are paying the minimum monthly amount); or (ii) national or local economic conditions that correlate with defaults (eg decrease in property prices for mortgages in the relevant area, decrease in oil prices fo ...

... group (eg increased number of credit card borrowers who have reached their credit limit and are paying the minimum monthly amount); or (ii) national or local economic conditions that correlate with defaults (eg decrease in property prices for mortgages in the relevant area, decrease in oil prices fo ...

20170504 CACEIS partner in the initiative to develop apost

... infrastructure for the SME segment in Europe. Launched in June 2016, the objective of this partnership is to improve the access of such companies to capital markets, while facilitating and enhancing the security of post-market operations. It brings together eight major financial institutions: CACEIS ...

... infrastructure for the SME segment in Europe. Launched in June 2016, the objective of this partnership is to improve the access of such companies to capital markets, while facilitating and enhancing the security of post-market operations. It brings together eight major financial institutions: CACEIS ...

total alternative debt holdings at 31 december 2016

... TOTAL ALTERNATIVE DEBT HOLDINGS AT 31 DECEMBER 2016 The table below lists the Alternative Debt Funds that Cbus invests in, and their % of the total Alternative Debt asset class. Alternative debt investments are a type of fixed interest investment. Cbus’ alternative debt investments are generally mad ...

... TOTAL ALTERNATIVE DEBT HOLDINGS AT 31 DECEMBER 2016 The table below lists the Alternative Debt Funds that Cbus invests in, and their % of the total Alternative Debt asset class. Alternative debt investments are a type of fixed interest investment. Cbus’ alternative debt investments are generally mad ...

Debt position of the Government of India

... value of dated securities plus discounted value of treasury bills) has been kept at ` 50,000 crore. However, net issuance for the year has been estimated at ` 20,000 crore in BE 2016-17. The estimated outstanding liabilities under MSS in respect of market loans, 91/182/364 days Treasury Bills are se ...

... value of dated securities plus discounted value of treasury bills) has been kept at ` 50,000 crore. However, net issuance for the year has been estimated at ` 20,000 crore in BE 2016-17. The estimated outstanding liabilities under MSS in respect of market loans, 91/182/364 days Treasury Bills are se ...

Lester Coyle - We look at where the bonds will be in a year

... might be 5% or 6%. But because of rolldown, the first year real yield could be 8% or 9%. In European CMBS we are buying paper with a two-year average life that has as much as 10% yield. Why does roll-down provide such a big pick-up? Many double Bs should get upgraded as the senior notes pay down, an ...

... might be 5% or 6%. But because of rolldown, the first year real yield could be 8% or 9%. In European CMBS we are buying paper with a two-year average life that has as much as 10% yield. Why does roll-down provide such a big pick-up? Many double Bs should get upgraded as the senior notes pay down, an ...

Lecture4

... These are related to long life assets like land, farm buildings construction of permanent drainages or irrigation system etc. which require large sum of money as initial investment. Benefits generated through such assets are spread over the entire life span of the asset. ...

... These are related to long life assets like land, farm buildings construction of permanent drainages or irrigation system etc. which require large sum of money as initial investment. Benefits generated through such assets are spread over the entire life span of the asset. ...

Answers to Chapter 12 Questions

... the accumulation of assets, liabilities, and equity as of a specific point in time. The Report of Income refers to the bank's income statement which presents information about the flow of revenues and expenses between two points in time. 2. a-3; b-1; c-2. 3. a-5,6,12; b-2,10; c-3, 13; d-1,8,15; e-9, ...

... the accumulation of assets, liabilities, and equity as of a specific point in time. The Report of Income refers to the bank's income statement which presents information about the flow of revenues and expenses between two points in time. 2. a-3; b-1; c-2. 3. a-5,6,12; b-2,10; c-3, 13; d-1,8,15; e-9, ...

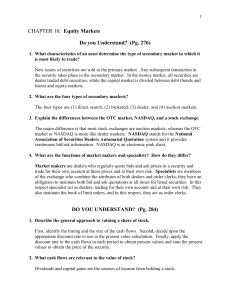

CHAPTER 10: Equity Markets

... 1. What characteristics of an asset determine the type of secondary market in which it is most likely to trade? New issues of securities are sold in the primary market. Any subsequent transaction in the security takes place in the secondary market. In the money market, all securities are dealer trad ...

... 1. What characteristics of an asset determine the type of secondary market in which it is most likely to trade? New issues of securities are sold in the primary market. Any subsequent transaction in the security takes place in the secondary market. In the money market, all securities are dealer trad ...

here - The Lab Haverfordwest

... 2. Local Cooperative Share offers options 3. Community – Peer to Peer loans 4. Income Generation and Sustainability ...

... 2. Local Cooperative Share offers options 3. Community – Peer to Peer loans 4. Income Generation and Sustainability ...

Downlaod File

... diversified portfolio of high-yield, in a scale of moderate to high risk securities. Investment horizon: 20 years Risk tolerance: Average Mr. Collingwood should immediately begin to invest his current balance as he has no essential need to leave his money idle. By taking time value of money into con ...

... diversified portfolio of high-yield, in a scale of moderate to high risk securities. Investment horizon: 20 years Risk tolerance: Average Mr. Collingwood should immediately begin to invest his current balance as he has no essential need to leave his money idle. By taking time value of money into con ...

Charity Finance Directors’ Group

... Formed from a merger of DTA and bassac in 2011 DTA – 20 years old, bassac 80 Co-owned office building in London (funded by grants and bank loans) History of collaborative working Turnover around £5m Cash £1m, post merger & Community Organisers now £4m ...

... Formed from a merger of DTA and bassac in 2011 DTA – 20 years old, bassac 80 Co-owned office building in London (funded by grants and bank loans) History of collaborative working Turnover around £5m Cash £1m, post merger & Community Organisers now £4m ...