An Asian Investment Fund - Global Clearinghouse for Development

... ▪ Lending ▪ Equity investment ▫ pooling SME assets for securitization ▫ creating a fund of private equity funds ...

... ▪ Lending ▪ Equity investment ▫ pooling SME assets for securitization ▫ creating a fund of private equity funds ...

Ch.1 - 13ed Overview of Fin Mgmt

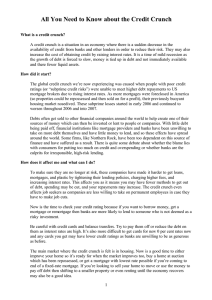

... Many originators and securitizers still owned subprime securities, which led to many bankruptcies, government takeovers, and fire sales, including: ...

... Many originators and securitizers still owned subprime securities, which led to many bankruptcies, government takeovers, and fire sales, including: ...

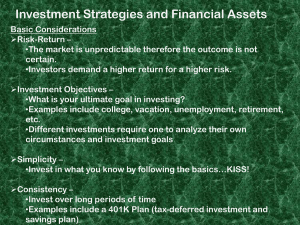

Investment Strategies and Financial Assets

... •The market is unpredictable therefore the outcome is not certain. •Investors demand a higher return for a higher risk. Investment Objectives – •What is your ultimate goal in investing? •Examples include college, vacation, unemployment, retirement, etc. •Different investments require one to analyze ...

... •The market is unpredictable therefore the outcome is not certain. •Investors demand a higher return for a higher risk. Investment Objectives – •What is your ultimate goal in investing? •Examples include college, vacation, unemployment, retirement, etc. •Different investments require one to analyze ...

A Depositor Run in Securities Markets: The Korean Experience

... compiled lists of events which could “never happen,” at least according to common wisdom. But some of them did happen, and the others can not be ruled out scientifically. The EVM subgroup is currently sponsoring a contest to encourage actuaries to write discussions of approaches which could be taken ...

... compiled lists of events which could “never happen,” at least according to common wisdom. But some of them did happen, and the others can not be ruled out scientifically. The EVM subgroup is currently sponsoring a contest to encourage actuaries to write discussions of approaches which could be taken ...

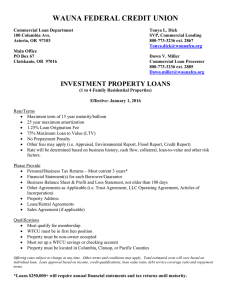

Mortgage Loans

... • Comprehensive view of borrower’s creditworthiness; help with lower credit scores & financial assets • Potential portfolio mortgages for special situations • Home loans in Washington (new and existing members), Oregon and Alaska (existing members only) Per the Safe and Fair Enforcement (SAFE) Act, ...

... • Comprehensive view of borrower’s creditworthiness; help with lower credit scores & financial assets • Potential portfolio mortgages for special situations • Home loans in Washington (new and existing members), Oregon and Alaska (existing members only) Per the Safe and Fair Enforcement (SAFE) Act, ...

Annotation Improving the management of credit risk in banking

... To successfully lending and increase profitability of credit operations, banks should implement a clear and flexible credit risk management operations. Formation of quality loan portfolio with indication credit risk is one of the priorities of Ukrainian banks. No bank can not completely prevent the ...

... To successfully lending and increase profitability of credit operations, banks should implement a clear and flexible credit risk management operations. Formation of quality loan portfolio with indication credit risk is one of the priorities of Ukrainian banks. No bank can not completely prevent the ...

ITEM

... List of main types of investments in the investment funds hold by the insurance undertaking. In this template the report is made by asset category, according to splits defined by cells A1 to A6 (example: EEA equity in local currency held in Life portfolio, for unit-linked fund) Distinction between l ...

... List of main types of investments in the investment funds hold by the insurance undertaking. In this template the report is made by asset category, according to splits defined by cells A1 to A6 (example: EEA equity in local currency held in Life portfolio, for unit-linked fund) Distinction between l ...

Title Use sentence case

... Results & Profits •Purchased 20 different $25 “notes” ranging from grades BE •Currently have 21 note portfolio through reinvestment •One note paid in full, zero defaults •Garnered 16.50% return •$13.83 earned as interest •Account valued at $513.44 •Weighted average of return on current portfolio: 16 ...

... Results & Profits •Purchased 20 different $25 “notes” ranging from grades BE •Currently have 21 note portfolio through reinvestment •One note paid in full, zero defaults •Garnered 16.50% return •$13.83 earned as interest •Account valued at $513.44 •Weighted average of return on current portfolio: 16 ...

Non ERISA Collateral Schedule

... Unstripped British Government debt DBV (Class UBG) as defined in the CREST Reference Manual. ...

... Unstripped British Government debt DBV (Class UBG) as defined in the CREST Reference Manual. ...

Diapositive 1 - University of Ottawa

... Flow-of-funds – stylized facts • The net accumulation of financial assets of corporations is positive, meaning that they lend their surpluses to households, with about half of these funds coming from financial corporations. • The net accumulation of financial assets of households is negative, meani ...

... Flow-of-funds – stylized facts • The net accumulation of financial assets of corporations is positive, meaning that they lend their surpluses to households, with about half of these funds coming from financial corporations. • The net accumulation of financial assets of households is negative, meani ...

Introduction to Investments

... Bonds that provide some sort of security to investors. Example: A mortgage debenture ...

... Bonds that provide some sort of security to investors. Example: A mortgage debenture ...