asset liability management

... • Economic Value Perspective involves analysing the impact of interest on expected cash flows from assets minus expected cash flows from liabilities in long term and its impact on equity or net worth of the bank. ...

... • Economic Value Perspective involves analysing the impact of interest on expected cash flows from assets minus expected cash flows from liabilities in long term and its impact on equity or net worth of the bank. ...

Risk Based Capital for Mortgage Securitization Firms

... Successful expansion of demand-driven products after 1992 (fixed/variable rate, maturities, recourse /nonrecourse, Islamic debt, leasing/commercial property, etc.) ...

... Successful expansion of demand-driven products after 1992 (fixed/variable rate, maturities, recourse /nonrecourse, Islamic debt, leasing/commercial property, etc.) ...

HKMA column 251

... risks. And it is not just credit risks that are of concern to banks. When they choose to invest money in financial assets denominated in foreign currencies, they incur exchange risk as well. When investing in debt securities that pay a fixed rate of interest, they additionally incur interest rate r ...

... risks. And it is not just credit risks that are of concern to banks. When they choose to invest money in financial assets denominated in foreign currencies, they incur exchange risk as well. When investing in debt securities that pay a fixed rate of interest, they additionally incur interest rate r ...

Repurchase Agreements (Repo) - International Islamic Financial

... • If the financial asset is sold under a repurchase agreement, it cannot be derecognised from the books as the transferor retains substantially all the risks and rewards of ownership. • On-balance sheet: An accounting entry appears as secured loan and not as a “sell” transaction. Bonds given as coll ...

... • If the financial asset is sold under a repurchase agreement, it cannot be derecognised from the books as the transferor retains substantially all the risks and rewards of ownership. • On-balance sheet: An accounting entry appears as secured loan and not as a “sell” transaction. Bonds given as coll ...

The Financial Crisis

... Modern runs in repo market (which killed Lehmann Brothers), money market funds ...

... Modern runs in repo market (which killed Lehmann Brothers), money market funds ...

Manitoba Securities Commission

... The Securities Act states that the Commission be composed of not more than seven (7) members including the Chair. Length of Terms: Three years and then at pleasure. Desirable Expertise: Law degree and experience in commercial or administrative law. Accounting degree with securities practice experien ...

... The Securities Act states that the Commission be composed of not more than seven (7) members including the Chair. Length of Terms: Three years and then at pleasure. Desirable Expertise: Law degree and experience in commercial or administrative law. Accounting degree with securities practice experien ...

xxxxxxxx File Notes

... would have been reduced proportionately and the balance due from the borrowers would have been correspondingly reduced, subject to potential claims for contributions from subservicers who continued to make payments even after the loan was declared in default, insurance and hedge products. 1.10.3.1. ...

... would have been reduced proportionately and the balance due from the borrowers would have been correspondingly reduced, subject to potential claims for contributions from subservicers who continued to make payments even after the loan was declared in default, insurance and hedge products. 1.10.3.1. ...

Invesco Core Plus Bond Fund investment philosophy and process

... more than those of high quality bonds and can decline significantly over short time periods. Mortgage- and asset-backed securities are subject to prepayment or call risk, which is the risk that the borrower’s payments may be received earlier or later than expected due to changes in prepayment rate ...

... more than those of high quality bonds and can decline significantly over short time periods. Mortgage- and asset-backed securities are subject to prepayment or call risk, which is the risk that the borrower’s payments may be received earlier or later than expected due to changes in prepayment rate ...

Short-Term Income Fund - Investor Fact Sheet

... The value of some mortgage-backed securities may be particularly sensitive to changes in prevailing interest rates, and although the securities are generally supported by some form of government or private insurance, there is no assurance that private guarantors or insurers will meet their obligatio ...

... The value of some mortgage-backed securities may be particularly sensitive to changes in prevailing interest rates, and although the securities are generally supported by some form of government or private insurance, there is no assurance that private guarantors or insurers will meet their obligatio ...

Answers to Chapter 1 Questions

... underwriters allocate “hot” IPO issues to directors and/or executives of potential investment banking clients in exchange for investment banking business) and “biased” recommendations by research analysts (due to their compensation being tied to the success of their firms’ investment banking busines ...

... underwriters allocate “hot” IPO issues to directors and/or executives of potential investment banking clients in exchange for investment banking business) and “biased” recommendations by research analysts (due to their compensation being tied to the success of their firms’ investment banking busines ...

SEC Form NELET-AF - Securities and Exchange Commission

... (Name of Capital Market Institution), through the undersigned President, hereby applies for the payment of annual fee as (Type of Registration/License), including the annual fees for the following Branches: (Enumerate Branches) and, of the (State Number of Professionals Included in the List) Capital ...

... (Name of Capital Market Institution), through the undersigned President, hereby applies for the payment of annual fee as (Type of Registration/License), including the annual fees for the following Branches: (Enumerate Branches) and, of the (State Number of Professionals Included in the List) Capital ...

Credit Risk: Individual Loan Risk Chapter 11

... loans. More recently, credit card loans and auto loans. • In mid-90s, improvements in NPLs for large banks. • New types of credit risk related to loan guarantees and off-balance-sheet activities. • Increased emphasis on credit risk evaluation. ...

... loans. More recently, credit card loans and auto loans. • In mid-90s, improvements in NPLs for large banks. • New types of credit risk related to loan guarantees and off-balance-sheet activities. • Increased emphasis on credit risk evaluation. ...

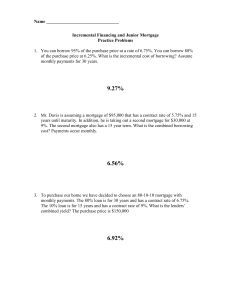

Adjustable Rate Mortgage

... 2. Mrs. Sellers is selling her home with an assumable mortgage. The balance on the assumable loan is $130,000. The contract rate is 4.5% and there are 180 remaining monthly payments. The current market rate on a 15-year loan is 9%. How much should she increase the asking price in order to capitalize ...

... 2. Mrs. Sellers is selling her home with an assumable mortgage. The balance on the assumable loan is $130,000. The contract rate is 4.5% and there are 180 remaining monthly payments. The current market rate on a 15-year loan is 9%. How much should she increase the asking price in order to capitalize ...

Opalesque Exclusive: Coherence Capital sees central bank actions

... Our favored sectors include autos/auto parts and auto retailers. We like healthcare, home improvement, high yield (HY) media and investment grade (IG) technology. In addition, we believe that financial AT1s offer significant opportunity for returns based on two factors. First, the ECB has softened i ...

... Our favored sectors include autos/auto parts and auto retailers. We like healthcare, home improvement, high yield (HY) media and investment grade (IG) technology. In addition, we believe that financial AT1s offer significant opportunity for returns based on two factors. First, the ECB has softened i ...

Commercial paper Davenport

... participants are referred. This material is based on public information as of the specified date, and may be stale thereafter. We have no obligation to tell you when information herein may change. We make no representation or warranty with respect to the completeness of this material. Davenport has ...

... participants are referred. This material is based on public information as of the specified date, and may be stale thereafter. We have no obligation to tell you when information herein may change. We make no representation or warranty with respect to the completeness of this material. Davenport has ...

Credit Analysis for Bank Qualified Municipal Bonds

... lowered by an amount greater than the fees paid to the insurers. This was true as long as the credit rating of the insurer itself was AAA. Sadly, this arrangement deteriorated as the insurers, seeking greater profits, began to guarantee high risk assets such as CDOs created from subprime mortgage lo ...

... lowered by an amount greater than the fees paid to the insurers. This was true as long as the credit rating of the insurer itself was AAA. Sadly, this arrangement deteriorated as the insurers, seeking greater profits, began to guarantee high risk assets such as CDOs created from subprime mortgage lo ...

Comment on a National Securities Regulator

... persons. Both are national self-regulatory organizations (“SROs”) which obtain their regulatory jurisdiction in each province by that province’s securities commission. What that means is that each provincial securities commission enters into a recognition Order or similar instrument, setting out the ...

... persons. Both are national self-regulatory organizations (“SROs”) which obtain their regulatory jurisdiction in each province by that province’s securities commission. What that means is that each provincial securities commission enters into a recognition Order or similar instrument, setting out the ...

Chapter 4

... Interest Drives the Price of Securities A lower price => a higher return given a stream of cash flows Security prices (both stocks and bonds) adjust to changing interest rates by changing their prices in the opposite direction Hence: Interest (among other things) ...

... Interest Drives the Price of Securities A lower price => a higher return given a stream of cash flows Security prices (both stocks and bonds) adjust to changing interest rates by changing their prices in the opposite direction Hence: Interest (among other things) ...