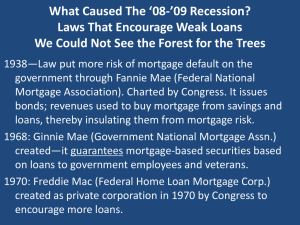

What Caused This Mess? Bad Laws Built Up Over Time

... • Lurking in the background since the ’30s is the FHA (Federal Housing Admin.) Part of HUD. • It provides insurance for mortgages. Pretends to be real insurance company, but taxpayers are on the hook when it goes under. • When Fannie and Freddie crashed in ’08, FHA began to provide mortgage money—on ...

... • Lurking in the background since the ’30s is the FHA (Federal Housing Admin.) Part of HUD. • It provides insurance for mortgages. Pretends to be real insurance company, but taxpayers are on the hook when it goes under. • When Fannie and Freddie crashed in ’08, FHA began to provide mortgage money—on ...

NCSHA_Comments S7_24_10

... established by federal tax laws and strict credit criteria established by each HFA. In addition, the bonds are generally issued under an open parity bond resolution, under which HFAs have substantial flexibility, subject to certain covenants, to sell loans or withdraw loans or other assets to protec ...

... established by federal tax laws and strict credit criteria established by each HFA. In addition, the bonds are generally issued under an open parity bond resolution, under which HFAs have substantial flexibility, subject to certain covenants, to sell loans or withdraw loans or other assets to protec ...

Week5.1 Money Markets - B-K

... Cash Investments • Text calls all these “money market” investments ...

... Cash Investments • Text calls all these “money market” investments ...

im08

... least not in the common sense of the term. The debt is denominated in dollars, which the U.S. government can print. In real terms, however, such inflationary finance leads to repaying with lower-valued dollars, which, in an economic sense, is a default. ...

... least not in the common sense of the term. The debt is denominated in dollars, which the U.S. government can print. In real terms, however, such inflationary finance leads to repaying with lower-valued dollars, which, in an economic sense, is a default. ...

Risk transfer mechanisms

... financial instruments: – Credit linked securities (credit derivatives) transfer risks embedded in credit lending, i.e. borrowers are not repaying debt. – Insurance linked securities such as some ART products and Cat bonds are designed to shed risks from underlying insurance risks. ...

... financial instruments: – Credit linked securities (credit derivatives) transfer risks embedded in credit lending, i.e. borrowers are not repaying debt. – Insurance linked securities such as some ART products and Cat bonds are designed to shed risks from underlying insurance risks. ...

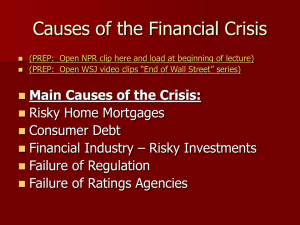

Causes of the Financial Crisis

... and concerns grew over the complexity and sustainability of financial assets. •Liquidity freeze, unpricable assets, crisis in insurance policies ...

... and concerns grew over the complexity and sustainability of financial assets. •Liquidity freeze, unpricable assets, crisis in insurance policies ...

Allianz US Short Duration High Income Bond

... which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency. This is for infor ...

... which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency. This is for infor ...

Liquidity Coverage Ratio ( LCR )

... Securities issued or Guaranteed by : State of Qatar Qatar Central Bank PSEs in Qatar -Not functioning on commercial basis Marketable Securities with a 0% RW - Outside Qatar- issued or guaranteed by: Sovereigns Central Banks The Bank of international Settlments , IMF ,Eur Commission & Multilateral De ...

... Securities issued or Guaranteed by : State of Qatar Qatar Central Bank PSEs in Qatar -Not functioning on commercial basis Marketable Securities with a 0% RW - Outside Qatar- issued or guaranteed by: Sovereigns Central Banks The Bank of international Settlments , IMF ,Eur Commission & Multilateral De ...

Active Management

... • This pool works as backed for pass through security • Investors get share in principal ale payments related with backed securities • Securitization of mortgages means that mortgages can be traded as securities • Other pass-through arrangements • Car, student, home equity, credit card loans • Offer ...

... • This pool works as backed for pass through security • Investors get share in principal ale payments related with backed securities • Securitization of mortgages means that mortgages can be traded as securities • Other pass-through arrangements • Car, student, home equity, credit card loans • Offer ...

Securitisation in Ireland

... Most commonly in Ireland, loans are purchased by a bankruptcy-remote vehicle created for this purpose (so-called SPV / SPE / FVC) ...

... Most commonly in Ireland, loans are purchased by a bankruptcy-remote vehicle created for this purpose (so-called SPV / SPE / FVC) ...

Week2.1 Balance Sheet - B-K

... – You buy a house for $500k, putting $100k down and getting a mortgage for $400k – You owe $300 on your credit card and pay it off by writing a check from your bank – The housing market goes up and your house is worth $50,000 more – Your landlord gives you a bill for $2,000 in rent that you haven’t ...

... – You buy a house for $500k, putting $100k down and getting a mortgage for $400k – You owe $300 on your credit card and pay it off by writing a check from your bank – The housing market goes up and your house is worth $50,000 more – Your landlord gives you a bill for $2,000 in rent that you haven’t ...

1 of 35

... including zero-coupon rate bonds, floating rate bonds and real return bonds. (LO4) 5. Outline the characteristics of long-term ...

... including zero-coupon rate bonds, floating rate bonds and real return bonds. (LO4) 5. Outline the characteristics of long-term ...

Alfred M. Pollard, General Counsel Attention: Comments/RIN 2590

... assets from the 10 percent test to join FHLBanks in 1998. In 2008, I was glad to see the Congress increase the eligibility for this exemption to institutions with $1 billion in assets. That number is now inflation-indexed to bring it to $1.1 billion. This proposed regulation would circumvent the int ...

... assets from the 10 percent test to join FHLBanks in 1998. In 2008, I was glad to see the Congress increase the eligibility for this exemption to institutions with $1 billion in assets. That number is now inflation-indexed to bring it to $1.1 billion. This proposed regulation would circumvent the int ...

Dhaka Stock Exchange

... a placement holder (s) since .................., the full particulars of which are given below: ...

... a placement holder (s) since .................., the full particulars of which are given below: ...