The Investment Environment

... Some investment banks are also involved in private equity, where the bank invests its own capital. In contrast to commercial banks that deal with individuals, investment banks tend to work with corporations and governments. P.V. Viswanath ...

... Some investment banks are also involved in private equity, where the bank invests its own capital. In contrast to commercial banks that deal with individuals, investment banks tend to work with corporations and governments. P.V. Viswanath ...

BLOOMBERG Slovenian Market Regulator Plans to Fight `Shell

... commentator and editor at Dnevnik newspaper, said in a telephone interview. The issue is going to be one of the main election themes along with high inflation and continued sales of state assets, Zerdin said. The ``parking of shares'' or having ``mailbox'' or ``shell'' companies that are incorporate ...

... commentator and editor at Dnevnik newspaper, said in a telephone interview. The issue is going to be one of the main election themes along with high inflation and continued sales of state assets, Zerdin said. The ``parking of shares'' or having ``mailbox'' or ``shell'' companies that are incorporate ...

Mortgage backed securities

... different classes of CMO interests, known as tranches, according to a complicated deal structure. Each tranche may have different principal balances, coupon rates, prepayment risks, and maturity dates (ranging from a few months to twenty years). CMOs are often highly sensitive to changes in interest ...

... different classes of CMO interests, known as tranches, according to a complicated deal structure. Each tranche may have different principal balances, coupon rates, prepayment risks, and maturity dates (ranging from a few months to twenty years). CMOs are often highly sensitive to changes in interest ...

Credit Unions and Caisses Populaires SECTOR OUTLOOK 4Q16

... Higher eligibility standards may cause a major constraint to mortgage lending and restrain the ability to sell these loans into securitization vehicles. Credit unions may experience a decline in residential mortgage loans being issued because home buyers will qualify for less than their desired amou ...

... Higher eligibility standards may cause a major constraint to mortgage lending and restrain the ability to sell these loans into securitization vehicles. Credit unions may experience a decline in residential mortgage loans being issued because home buyers will qualify for less than their desired amou ...

Eurizon EasyFund Azioni Strategia Flessibile R

... Exposure to stocks denominated in currencies other than the euro was consistently hedged against exchange rate fluctuations, in respect of the sub-fund’s management policy, which is aimed at preventing exposure to this source of risk. The product’s investment philosophy awards a preference to Europe ...

... Exposure to stocks denominated in currencies other than the euro was consistently hedged against exchange rate fluctuations, in respect of the sub-fund’s management policy, which is aimed at preventing exposure to this source of risk. The product’s investment philosophy awards a preference to Europe ...

Microsoft Word - TempDoc1.doc

... amount payable to the Bank under the contract but not yet paid may be indicated) VI. Repayment terms (for demand loans, term loans, corporate loans, project- wise finance). VII. Security offered (complete details of security, both primary and collateral including1 specific cash flows assigned to pro ...

... amount payable to the Bank under the contract but not yet paid may be indicated) VI. Repayment terms (for demand loans, term loans, corporate loans, project- wise finance). VII. Security offered (complete details of security, both primary and collateral including1 specific cash flows assigned to pro ...

Title in Arial bold Subhead in Arial

... – SF arranges security on a portfolio basis on behalf of all eligible companies – all eligible companies (based on minimum credit rating) must participate ...

... – SF arranges security on a portfolio basis on behalf of all eligible companies – all eligible companies (based on minimum credit rating) must participate ...

The Case for Middle Market Lending

... joked, “I remember interest rates. We used to have them.” No kidding. Seven years after the Great Recession, interest rates in the United States remain remarkably low. Investors in traditional fixed income have three basic options: Wait out the low rates and accept lower returns in the meantime; tak ...

... joked, “I remember interest rates. We used to have them.” No kidding. Seven years after the Great Recession, interest rates in the United States remain remarkably low. Investors in traditional fixed income have three basic options: Wait out the low rates and accept lower returns in the meantime; tak ...

Monetizing Your Parking Assets

... Transaction or (iii) execution of a definitive agreement (with or without conditions) to enter into such Transaction; provided, however, that if such Transaction is not consummated for any reason, the provisions of this sentence shall cease to apply. These Materials are for discussion purposes only. ...

... Transaction or (iii) execution of a definitive agreement (with or without conditions) to enter into such Transaction; provided, however, that if such Transaction is not consummated for any reason, the provisions of this sentence shall cease to apply. These Materials are for discussion purposes only. ...

Final Exam

... a. Column A assets are liquid but have low returns b. Column B assets are partially liquid, protected and have medium returns c. Column C assets are usually liquid, and have the potential for higher returns as well as greater losses d. All of the above e. None of the above 8. Which of the following ...

... a. Column A assets are liquid but have low returns b. Column B assets are partially liquid, protected and have medium returns c. Column C assets are usually liquid, and have the potential for higher returns as well as greater losses d. All of the above e. None of the above 8. Which of the following ...

Innovation in the Asset Management Industry: Risk

... day=0 for the same asset. Non-trading thus artificially creates a smaller beta. Gompers-Lerner attempt to rectify with time series of returns as surrogate to actual trading using best estimate of change in price from observable data. More advanced approach would be a Brownian Bridge estimation model ...

... day=0 for the same asset. Non-trading thus artificially creates a smaller beta. Gompers-Lerner attempt to rectify with time series of returns as surrogate to actual trading using best estimate of change in price from observable data. More advanced approach would be a Brownian Bridge estimation model ...

Warren Buffett: Why stocks beat gold and bonds

... 2008, just when cash should have been deployed rather than held. Similarly, we heard “cash is trash” in the early 1980s just when fixed-dollar investments were at their most attractive level in memory. On those occasions, investors who required a supportive crowd paid dearly for that comfort. My own ...

... 2008, just when cash should have been deployed rather than held. Similarly, we heard “cash is trash” in the early 1980s just when fixed-dollar investments were at their most attractive level in memory. On those occasions, investors who required a supportive crowd paid dearly for that comfort. My own ...

Practice Exam 3

... 1) Which of the following will tend to cause domestic currency to appreciate? A) an increase in foreign interest rates. B) a decrease in the expected future exchange rate C) an increase in the domestic interest rate. D) an equal change in domestic and foreign interest rates. 2) A borrower engages in ...

... 1) Which of the following will tend to cause domestic currency to appreciate? A) an increase in foreign interest rates. B) a decrease in the expected future exchange rate C) an increase in the domestic interest rate. D) an equal change in domestic and foreign interest rates. 2) A borrower engages in ...

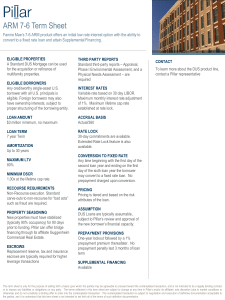

ARM 7-6 Term Sheet

... the new borrower’s financial capacity. PREPAYMENT PROVISIONS One-year lockout followed by a 1% prepayment premium thereafater. No prepayment penalty last 3 months of loan term ...

... the new borrower’s financial capacity. PREPAYMENT PROVISIONS One-year lockout followed by a 1% prepayment premium thereafater. No prepayment penalty last 3 months of loan term ...

**** 1

... profits shall be reserved in full. ② In case where any losses are incurred in the closing, they shall be covered by the reserve under Paragragh ①, and if the reserves are insufficient, the Government may cover them. ...

... profits shall be reserved in full. ② In case where any losses are incurred in the closing, they shall be covered by the reserve under Paragragh ①, and if the reserves are insufficient, the Government may cover them. ...

Sample Exercises Chapter 11

... 1) Carter Co. is considering two alternatives to finance its construction of a new $2 million plant. Compare bond versus stock financing for: a) Issuance of 200,000 shares of common stock at the market price of $10 per share. b) Issuance of $2 million, 8% bonds at par ...

... 1) Carter Co. is considering two alternatives to finance its construction of a new $2 million plant. Compare bond versus stock financing for: a) Issuance of 200,000 shares of common stock at the market price of $10 per share. b) Issuance of $2 million, 8% bonds at par ...

Financing Non-P3 Infrastructure Projects

... Revenue stream can be in the form of user fees ( tolls, fees, fares, etc). or payments from a governmental entity based on the asset performance (“Availability ...

... Revenue stream can be in the form of user fees ( tolls, fees, fares, etc). or payments from a governmental entity based on the asset performance (“Availability ...