securities investment services

... The price of securities may go up or down, investors may lose all his funds under certain circumstances. The risk of loss in leveraged trading can be substantial. Investors may sustain losses in excess of your initial margin funds. Placing contingent orders, such as “stop order” or “limit order”, wi ...

... The price of securities may go up or down, investors may lose all his funds under certain circumstances. The risk of loss in leveraged trading can be substantial. Investors may sustain losses in excess of your initial margin funds. Placing contingent orders, such as “stop order” or “limit order”, wi ...

Chapter 12.1: Bankruptcy

... Legal process by which a debtor can make a fresh start through the sale of assets to pay off creditors. ...

... Legal process by which a debtor can make a fresh start through the sale of assets to pay off creditors. ...

MBS Total Return Fund

... RISKS AND DISCLOSURES This material must be preceded or accompanied by a prospectus. Please refer to the prospectus for further details. Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is ...

... RISKS AND DISCLOSURES This material must be preceded or accompanied by a prospectus. Please refer to the prospectus for further details. Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is ...

EBCC - Arrangements for gas and electricity supply and gas

... for the provision of LoCs, particularly after the impact of the Enron losses on the banking community and would welcome further analysis on this. ...

... for the provision of LoCs, particularly after the impact of the Enron losses on the banking community and would welcome further analysis on this. ...

FREE Sample Here

... Finally, all shareholders in a corporation have limited liability, although owner/ shareholders of small businesses often have to give banks their personal guarantees. 1-11. The corporate form is best suited to large organizations because of the easy divisibility of ownership through issuance of sha ...

... Finally, all shareholders in a corporation have limited liability, although owner/ shareholders of small businesses often have to give banks their personal guarantees. 1-11. The corporate form is best suited to large organizations because of the easy divisibility of ownership through issuance of sha ...

handbill on eligibility to bid for government securities in the primary

... UNIMPAIRED CAPITAL AND SURPLUS means the combined capital accounts of a financial institution. CAPITAL means the paid-in capital and surplus account. SURPLUS means the excess of the assets over the liabilities and paid-in capital of the financial institutions but excluding the reserves set aside fo ...

... UNIMPAIRED CAPITAL AND SURPLUS means the combined capital accounts of a financial institution. CAPITAL means the paid-in capital and surplus account. SURPLUS means the excess of the assets over the liabilities and paid-in capital of the financial institutions but excluding the reserves set aside fo ...

Total Risk-Weighted Assets, Which Are the Denominator The

... not be subject to withdrawal by check, and they may or may not bear interest. Examples include overnight accounts, corporate credit union daily ...

... not be subject to withdrawal by check, and they may or may not bear interest. Examples include overnight accounts, corporate credit union daily ...

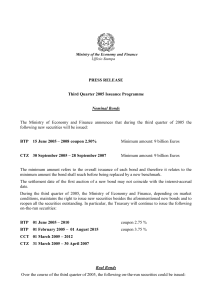

Third Quarter 2005 Issuance Programme

... The Treasury will offer the BTP€i at auction – usually on a monthly basis - according to market conditions. The auctions will take place in the second half of the month, one business day prior to the medium-long-term auction. The Treasury will announce the bonds to be issued, and the relative maximu ...

... The Treasury will offer the BTP€i at auction – usually on a monthly basis - according to market conditions. The auctions will take place in the second half of the month, one business day prior to the medium-long-term auction. The Treasury will announce the bonds to be issued, and the relative maximu ...

accounting review quiz

... •Minimizing bad debt loss with UCCs • Reducing bankruptcy losses • Bulk sales/transfers losses • Loss payee provision ...

... •Minimizing bad debt loss with UCCs • Reducing bankruptcy losses • Bulk sales/transfers losses • Loss payee provision ...

Roger Coffin, a lead Partner in our Regulatory Advisory

... Advisory Practice and a member of the PwC Global Regulatory Leadership team. Mr. Coffin has twenty years experience working with financial institutions on regulatory, compliance and control issues. Mr. Coffin is responsible for managing the firm’s investment management and securities industry practi ...

... Advisory Practice and a member of the PwC Global Regulatory Leadership team. Mr. Coffin has twenty years experience working with financial institutions on regulatory, compliance and control issues. Mr. Coffin is responsible for managing the firm’s investment management and securities industry practi ...

Lecture / Chapter 3

... - Truth-In-Lending disclosure statement, demonstrating costs of mortgage financing considering all financing costs - U.S. HUD booklet explaining RESPA protections to the borrower ...

... - Truth-In-Lending disclosure statement, demonstrating costs of mortgage financing considering all financing costs - U.S. HUD booklet explaining RESPA protections to the borrower ...

What is Systemic Risk?

... Morgan become banks again; US govt $700bn purchase of bad debt; G3 central banks support world banking. • Expansionary monetary policy (to avoid recession like 1930s) and scale of US Govt (and G3) bailouts will have large repercussions, yet to be evaluated [lessons of ...

... Morgan become banks again; US govt $700bn purchase of bad debt; G3 central banks support world banking. • Expansionary monetary policy (to avoid recession like 1930s) and scale of US Govt (and G3) bailouts will have large repercussions, yet to be evaluated [lessons of ...

Homework Quiz 11

... its control over the size of Federal budget deficits b. the quickness with which it can be used c. the opportunity for broad political influence d. its domination of major sectors of the economy e. all of the above 6. Which monetary policy would most likely increase aggregate demand? A) increasing r ...

... its control over the size of Federal budget deficits b. the quickness with which it can be used c. the opportunity for broad political influence d. its domination of major sectors of the economy e. all of the above 6. Which monetary policy would most likely increase aggregate demand? A) increasing r ...

A BRIEF EXPLANATION OF ACCOUNTING

... theory as a basis for recording business transactions. Since all business events are an exchange of one thing for another, every event results in at least two entries in an accounting system. These entries are classified as either debits or credits. The total amount of the debits and credits involve ...

... theory as a basis for recording business transactions. Since all business events are an exchange of one thing for another, every event results in at least two entries in an accounting system. These entries are classified as either debits or credits. The total amount of the debits and credits involve ...

What Might Investors Expect from US High Yield?

... response to market movements. Generally, when interest rates rise, the prices of debt securities f all, and when interest rates f all, prices generally rise. Bonds may also be subject to other types of risk, such as call, credit, liquidity, interest-rate, and general market risks. High-yield secur ...

... response to market movements. Generally, when interest rates rise, the prices of debt securities f all, and when interest rates f all, prices generally rise. Bonds may also be subject to other types of risk, such as call, credit, liquidity, interest-rate, and general market risks. High-yield secur ...