Real options Primer

... Look to the financial markets for relevant information. Even if the key focus is private risk, financial markets may provide valuable information. Don’t aim for too much precision. Strategic investment decisions should be dynamically updated and revised over time. It is not realistic to pin dow ...

... Look to the financial markets for relevant information. Even if the key focus is private risk, financial markets may provide valuable information. Don’t aim for too much precision. Strategic investment decisions should be dynamically updated and revised over time. It is not realistic to pin dow ...

The safe asset meme - Université Paris

... ‘(1) low credit and market risks, (2) high market liquidity, (3) limited inflation risks, (4) low exchange rate risks, and (5) limited idiosyncratic risks.’ (GFSR 2012) ‘…assets that are … used in an information-insensitive fashion… bank deposits, money market mutual fund shares, commercial paper, f ...

... ‘(1) low credit and market risks, (2) high market liquidity, (3) limited inflation risks, (4) low exchange rate risks, and (5) limited idiosyncratic risks.’ (GFSR 2012) ‘…assets that are … used in an information-insensitive fashion… bank deposits, money market mutual fund shares, commercial paper, f ...

Chapter 3 Lecture

... There are two approaches to creating the pro forma income statement: the percentage of sales method and what I will call the judgmental approach. The percentage of sales approach is simplistic and prone to error (estimating financial statements is tricky enough without compounding the error using an ...

... There are two approaches to creating the pro forma income statement: the percentage of sales method and what I will call the judgmental approach. The percentage of sales approach is simplistic and prone to error (estimating financial statements is tricky enough without compounding the error using an ...

CFIN

... then the balance sheet item A/R would be down $106,846 from the current level. That $106,846 could be used 1. to reduce debt, which would lower interest charges and thus increase profits 2. to buy back stock, which would lower shares outstanding and thus raise EPS ...

... then the balance sheet item A/R would be down $106,846 from the current level. That $106,846 could be used 1. to reduce debt, which would lower interest charges and thus increase profits 2. to buy back stock, which would lower shares outstanding and thus raise EPS ...

The Economic Bailout: An Analysis of the Economic

... this type of behavior by bundling the loans into securities that were sold to pension funds and other institutional investors seeking higher returns. Securitization One of the causes of the subprime mortgage meltdown is a prominent factor in the current credit crisis: securitization. Securitization ...

... this type of behavior by bundling the loans into securities that were sold to pension funds and other institutional investors seeking higher returns. Securitization One of the causes of the subprime mortgage meltdown is a prominent factor in the current credit crisis: securitization. Securitization ...

CDS Spread Determinants

... We find that, in general, the results for the sub-sample periods are very similar to each other and to the whole sample period results. In general, our results in Table 4 suggest that the theoretical explanatory variables remain robust to explain the CDS spread for different time periods in Japan. ...

... We find that, in general, the results for the sub-sample periods are very similar to each other and to the whole sample period results. In general, our results in Table 4 suggest that the theoretical explanatory variables remain robust to explain the CDS spread for different time periods in Japan. ...

B.A 5th Semester, Sub: Economics (M). Paper: 5.04 By : Surabi

... transactions in different securities. Such securities include shares and debentures issued by public companies which are duly listed at the stock exchange, and bonds and debentures issued by government, public corporations and municipal and port trust bodies. Stock exchanges are indispensable for th ...

... transactions in different securities. Such securities include shares and debentures issued by public companies which are duly listed at the stock exchange, and bonds and debentures issued by government, public corporations and municipal and port trust bodies. Stock exchanges are indispensable for th ...

Alberta Tax and Revenue Administration

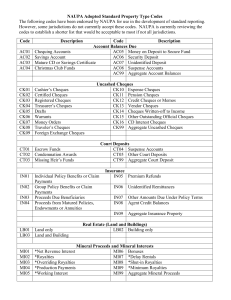

... NAUPA Adopted Standard Property Type Codes The following codes have been endorsed by NAUPA for use in the development of standard reporting. However, some jurisdictions do not currently accept these codes. NAUPA is currently reviewing the codes to establish a shorter list that would be acceptable to ...

... NAUPA Adopted Standard Property Type Codes The following codes have been endorsed by NAUPA for use in the development of standard reporting. However, some jurisdictions do not currently accept these codes. NAUPA is currently reviewing the codes to establish a shorter list that would be acceptable to ...

executive summary - Adelante Capital Management

... Manufactured Housing bounced back in performance. The one constant in relative performance by property type, recently, has been the woes of retail REITs; while the calendar may have turned, investor sentiment on malls and shopping centers has not. Holiday sales were anemic; J.C. Penney said that it ...

... Manufactured Housing bounced back in performance. The one constant in relative performance by property type, recently, has been the woes of retail REITs; while the calendar may have turned, investor sentiment on malls and shopping centers has not. Holiday sales were anemic; J.C. Penney said that it ...

Chap014

... Presents aggregate view of the financial position of the NPO as a whole, rather than a disaggregated view focused on funds Can also be called a balance sheet Net assets (the difference between assets and liabilities) must be classified into three classes: ...

... Presents aggregate view of the financial position of the NPO as a whole, rather than a disaggregated view focused on funds Can also be called a balance sheet Net assets (the difference between assets and liabilities) must be classified into three classes: ...

CHAPTER 13 Capital Structure and Leverage

... interest is stock price, not E(EPS). The example shows that we can push up E(EPS) by using more debt, but the risk resulting from increased leverage more than offsets the benefit of higher E(EPS). ...

... interest is stock price, not E(EPS). The example shows that we can push up E(EPS) by using more debt, but the risk resulting from increased leverage more than offsets the benefit of higher E(EPS). ...

Shadow banks and macroeconomic instability CAMA Working Paper

... Between the early 1990s and the onset of the 2007-2009 subprime crisis, the financial system in the United States and elsewhere underwent a remarkable period of growth and evolution. Banking underwent a shift, away from the traditional ‘commercial’ activities of loan origination and deposit issuing ...

... Between the early 1990s and the onset of the 2007-2009 subprime crisis, the financial system in the United States and elsewhere underwent a remarkable period of growth and evolution. Banking underwent a shift, away from the traditional ‘commercial’ activities of loan origination and deposit issuing ...

INTERCARDIA INC

... marketing costs prior to product launch is estimated to be up to $4,000,000. Upon product launch, the Company will be responsible for 40% of any net loss incurred in the Territory as defined. The Company is also responsible for approximately 40% of the once-daily development costs which relate to de ...

... marketing costs prior to product launch is estimated to be up to $4,000,000. Upon product launch, the Company will be responsible for 40% of any net loss incurred in the Territory as defined. The Company is also responsible for approximately 40% of the once-daily development costs which relate to de ...

Mercer Low Volatility Equity Fund M3 GBP

... shares and equity interests, either directly, or it can invest up to 100% of its assets in other funds ('Underlying Funds') which are consistent with the Fund's investment objectives and restrictions, but no more than 20% may be invested in any one Underlying Fund. Underlying Funds can include other ...

... shares and equity interests, either directly, or it can invest up to 100% of its assets in other funds ('Underlying Funds') which are consistent with the Fund's investment objectives and restrictions, but no more than 20% may be invested in any one Underlying Fund. Underlying Funds can include other ...

Portfolio Diversification and Asset Allocation

... the beginning of 1926. Assumes reinvestment of income and no transaction costs or taxes. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in an index. ...

... the beginning of 1926. Assumes reinvestment of income and no transaction costs or taxes. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in an index. ...

The Changing Nature of Financial Intermediation and the Financial

... sell individual mortgages into a mortgage pool such as a conduit. The mortgage pool is a passive firm (sometimes called a warehouse) whose only role is to hold mortgage assets. The mortgage is then packaged into another pool of mortgages to form MBSs, which are liabilities issued against the mortgag ...

... sell individual mortgages into a mortgage pool such as a conduit. The mortgage pool is a passive firm (sometimes called a warehouse) whose only role is to hold mortgage assets. The mortgage is then packaged into another pool of mortgages to form MBSs, which are liabilities issued against the mortgag ...

Taiwan 2015 - 2016.docx

... talent and skills, increase asset management scale and develop in the direction of internationalization, announcing the Advanced Excellence Program for SITEs on June 1st 2015. With regards to SITEs that meet the basic necessary requirements, they have committed no major regulations breaches, have so ...

... talent and skills, increase asset management scale and develop in the direction of internationalization, announcing the Advanced Excellence Program for SITEs on June 1st 2015. With regards to SITEs that meet the basic necessary requirements, they have committed no major regulations breaches, have so ...