M02_MADURA_4e_IM_C02

... 10. You could try to identify components of the budget that you can change to provide more cash for savings. For example, you could either attempt to increase your income or to reduce one or more expenses. 11. People who do not establish a budget may just deal with cash deficiencies when they occur. ...

... 10. You could try to identify components of the budget that you can change to provide more cash for savings. For example, you could either attempt to increase your income or to reduce one or more expenses. 11. People who do not establish a budget may just deal with cash deficiencies when they occur. ...

Calvert High Yield Bond Fund

... to make principal and interest payments. The value of a municipal obligation also may decline because of real or perceived concerns about the issuer’s ability to make principal and interest payments. Liquidity Risk. Liquidity risk exists when particular investments are difficult to sell. The Fund ma ...

... to make principal and interest payments. The value of a municipal obligation also may decline because of real or perceived concerns about the issuer’s ability to make principal and interest payments. Liquidity Risk. Liquidity risk exists when particular investments are difficult to sell. The Fund ma ...

Chapter 15

... Global depository receipts (GDRs) are issued in the Euromarket and are backed by the Euromarket depositories rather than by a specific bank. ...

... Global depository receipts (GDRs) are issued in the Euromarket and are backed by the Euromarket depositories rather than by a specific bank. ...

quantitative finance after the recent financial crisis

... Spatial interaction has been well studied in the spatial econometrics literature. Instead of studying prices of houses and apartments that are illiquid and difficult to be sold short, we study the risk and return of real estate securities that are liquid and can be easily shorted, such as futures co ...

... Spatial interaction has been well studied in the spatial econometrics literature. Instead of studying prices of houses and apartments that are illiquid and difficult to be sold short, we study the risk and return of real estate securities that are liquid and can be easily shorted, such as futures co ...

Northrop Grumman Financial Security and Savings - corporate

... the reported amounts of assets, liabilities and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates. ...

... the reported amounts of assets, liabilities and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates. ...

risk - Development Studies

... • Mobilisation is concerned with moving funds from savers to users of funds. • In developing countries savers have little inclination to place funds in financial assets even if they have access to them. • The thrust of the mobilisation effort is to encourage savers to invest in productive assets and ...

... • Mobilisation is concerned with moving funds from savers to users of funds. • In developing countries savers have little inclination to place funds in financial assets even if they have access to them. • The thrust of the mobilisation effort is to encourage savers to invest in productive assets and ...

Working capital

... gross working capital, simply refers to the firm's total current assets. Working capital management includes mgmt of current assets and current liabilities, including accounts payable (trade credit), notes payable (bank loans), and accrued ...

... gross working capital, simply refers to the firm's total current assets. Working capital management includes mgmt of current assets and current liabilities, including accounts payable (trade credit), notes payable (bank loans), and accrued ...

Global Institutional Consulting An Investor

... way that minimizes the pain of short-term loss from market movements. Accordingly, the assets are generally invested in low-risk, but also low-return, financial instruments such as cash equivalents and short-duration bonds collectively referred to as protective assets. This bucket of assets helps to ...

... way that minimizes the pain of short-term loss from market movements. Accordingly, the assets are generally invested in low-risk, but also low-return, financial instruments such as cash equivalents and short-duration bonds collectively referred to as protective assets. This bucket of assets helps to ...

Finance 332

... 3. All else equal, if the correlation between the two assets became slightly negative, A. the standard deviation of the portfolio would be zero. B. the standard deviation of the portfolio would be unaffected. C. the standard deviation of the portfolio would rise. D. the standard deviation of the por ...

... 3. All else equal, if the correlation between the two assets became slightly negative, A. the standard deviation of the portfolio would be zero. B. the standard deviation of the portfolio would be unaffected. C. the standard deviation of the portfolio would rise. D. the standard deviation of the por ...

Fiscal Consequences of Paying Interest on Reserves

... two agencies: “Treasury” and the “central bank” (CB). For each one of these two agencies, we keep the model as simple as possible by only including their functions and the budget items that are relevant for our discussion. Treasury issues government bonds of different maturities. We assume that ther ...

... two agencies: “Treasury” and the “central bank” (CB). For each one of these two agencies, we keep the model as simple as possible by only including their functions and the budget items that are relevant for our discussion. Treasury issues government bonds of different maturities. We assume that ther ...

University of Provence - University of North Florida

... accumulated investment cash flows (nondiscounted) equal the original investment, i.e., how long to get your money back • Payback Period Rule – accept an investment if it pays back original investment within acceptable length of time • Shortcomings – timing of cash flows is ignored; cash flows after ...

... accumulated investment cash flows (nondiscounted) equal the original investment, i.e., how long to get your money back • Payback Period Rule – accept an investment if it pays back original investment within acceptable length of time • Shortcomings – timing of cash flows is ignored; cash flows after ...

securities 101: handbook for law enforcement officials

... Shares of stock represent a fraction of ownership in a corporation. If the company does well, the value of your stock should go up over time. If the company does not do well, the value of your investment will decrease. Companies distribute a portion of their profits to shareholders as dividends. A s ...

... Shares of stock represent a fraction of ownership in a corporation. If the company does well, the value of your stock should go up over time. If the company does not do well, the value of your investment will decrease. Companies distribute a portion of their profits to shareholders as dividends. A s ...

FA1

... • Depreciation Cost of assets other than land that will benefit a business enterprise for more than a year is allocated over the asset’s service life. ...

... • Depreciation Cost of assets other than land that will benefit a business enterprise for more than a year is allocated over the asset’s service life. ...

the nigerian bond market

... Debt Management Office (DMO) is currently in the market with series of bond in trenches aimed at financing the Nation’s budget deficit. Some Terminologies in the Bond Market Par or Face Value: This is the stated principal amount of a bond. It is usually printed on the face of the selling document. ...

... Debt Management Office (DMO) is currently in the market with series of bond in trenches aimed at financing the Nation’s budget deficit. Some Terminologies in the Bond Market Par or Face Value: This is the stated principal amount of a bond. It is usually printed on the face of the selling document. ...

Lazard Emerging Markets Equity Portfolio

... Beta is a relative measure of the sensitivity of a fund’s return to changes in the benchmark’s return. The beta of the fund versus its benchmark is the amount (and direction) the fund has historically moved when the benchmark moved by one unit. Standard deviation measures the dispersion or “spread” ...

... Beta is a relative measure of the sensitivity of a fund’s return to changes in the benchmark’s return. The beta of the fund versus its benchmark is the amount (and direction) the fund has historically moved when the benchmark moved by one unit. Standard deviation measures the dispersion or “spread” ...

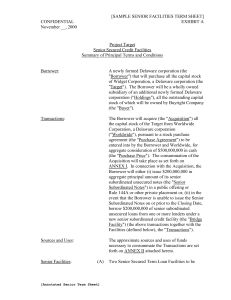

Senior Loan Term Sheet

... In the case of unpaid principal, the applicable interest rate plus 2% per annum and, in the case of any other amount, the rate of interest applicable to ABR loans plus 2% per annum. ...

... In the case of unpaid principal, the applicable interest rate plus 2% per annum and, in the case of any other amount, the rate of interest applicable to ABR loans plus 2% per annum. ...