2010 FOURTH QUARTER AND FULL YEAR EARNINGS REVIEW AND 2011 OUTLOOK

... • Further strengthened balance sheet with $7.3 billion in Automotive debt reductions, including $2.5 billion of newly announced reductions, bringing the Full Year to $14.5 billion • Announced new investments to grow our business, including: – $850 million in future investments for Michigan-based eng ...

... • Further strengthened balance sheet with $7.3 billion in Automotive debt reductions, including $2.5 billion of newly announced reductions, bringing the Full Year to $14.5 billion • Announced new investments to grow our business, including: – $850 million in future investments for Michigan-based eng ...

FMA Minimum Standards for the Risk Management

... a. The threshold value shall be defined as that precise value of the outstanding liability on a local currency basis, which, if exceeded, requires the credit institution to take expedient measures. b. Acting as an early warning indicator, the threshold value shall be below that maximum outstanding l ...

... a. The threshold value shall be defined as that precise value of the outstanding liability on a local currency basis, which, if exceeded, requires the credit institution to take expedient measures. b. Acting as an early warning indicator, the threshold value shall be below that maximum outstanding l ...

Lower Middle Market Direct Lending

... the J-curve affect that confronts private equity investors. In private equity, it can take years before cash on cash returns are available given the contractual relationship that exists between senior secured debt and equity. More importantly, direct lending portfolios, with their ability to recaptu ...

... the J-curve affect that confronts private equity investors. In private equity, it can take years before cash on cash returns are available given the contractual relationship that exists between senior secured debt and equity. More importantly, direct lending portfolios, with their ability to recaptu ...

EPIC RECESSION - Kyklos Productions

... -The Greenspan Legacy in Monetary Policy -Bernanke the Protégé -The Perils of Paulson -Bernanke’s B-52 -The Limits of Liquidity Solutions to Epic Recessions -Obama’s $787 Billion Fiscal Stimulus -PIPP: Son of TARP -TALF: Resurrecting Securitization -Housing: Bailing Out Builders and Lenders -A Strat ...

... -The Greenspan Legacy in Monetary Policy -Bernanke the Protégé -The Perils of Paulson -Bernanke’s B-52 -The Limits of Liquidity Solutions to Epic Recessions -Obama’s $787 Billion Fiscal Stimulus -PIPP: Son of TARP -TALF: Resurrecting Securitization -Housing: Bailing Out Builders and Lenders -A Strat ...

Risk Assessment Report - Fondo de Valores Inmobiliarios

... the weakness of the labor market could affect the potential of this growth negatively. On the other hand, the prices of office spaces have undergone an important increase during the last five years, due to the increased demand that took place with the increase of the economic activity and the low in ...

... the weakness of the labor market could affect the potential of this growth negatively. On the other hand, the prices of office spaces have undergone an important increase during the last five years, due to the increased demand that took place with the increase of the economic activity and the low in ...

Temi di Discussione

... of loans produced by commercial banks, and transform it into ABS. Although increased securitization activity expands the supply of real economy credit by broadening the available base of pledgeable assets, it also creates a vulnerability as the supply of ABS is itself governed by the strength of sha ...

... of loans produced by commercial banks, and transform it into ABS. Although increased securitization activity expands the supply of real economy credit by broadening the available base of pledgeable assets, it also creates a vulnerability as the supply of ABS is itself governed by the strength of sha ...

Beyond Libor: The Evolution of `Risk-Free` Benchmarks

... values of derivative transactions in the portfolio, market conditions, interest rates and credit risk, among others. Investments in foreign currency denominated assets will be affected by foreign exchange rates. There is no guarantee that the principal amount of the investment will be preserved, or ...

... values of derivative transactions in the portfolio, market conditions, interest rates and credit risk, among others. Investments in foreign currency denominated assets will be affected by foreign exchange rates. There is no guarantee that the principal amount of the investment will be preserved, or ...

Investment Grade Debt Offerings

... underwriters’ counsel will prepare the first drafts of the description of notes to be included in the offering document, as well as the underwriting agreement and the indenture. Board Approvals: An issuer of investment grade debt will generally obtain approval from its Board of Directors, either ...

... underwriters’ counsel will prepare the first drafts of the description of notes to be included in the offering document, as well as the underwriting agreement and the indenture. Board Approvals: An issuer of investment grade debt will generally obtain approval from its Board of Directors, either ...

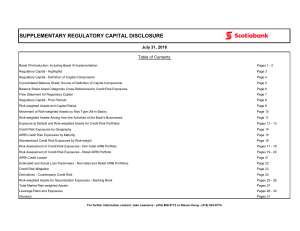

supplementary regulatory capital disclosure

... Canadian banks are subject to the revised capital adequacy requirements as published by the Basel Committee on Banking Supervision (BCBS) - commonly referred to as Basel III - effective November 1, 2012. Basel lII builds on the “International Convergence of Capital Measurement and Capital Standards: ...

... Canadian banks are subject to the revised capital adequacy requirements as published by the Basel Committee on Banking Supervision (BCBS) - commonly referred to as Basel III - effective November 1, 2012. Basel lII builds on the “International Convergence of Capital Measurement and Capital Standards: ...

Lecture 12

... between risk and return so we can determine appropriate risk-adjusted discount rates for our NPV analysis. At least as important, the relation between risk and return is useful for investors (who buy securities), corporations (that sell securities to finance themselves), and for financial intermed ...

... between risk and return so we can determine appropriate risk-adjusted discount rates for our NPV analysis. At least as important, the relation between risk and return is useful for investors (who buy securities), corporations (that sell securities to finance themselves), and for financial intermed ...

North Americans go bargain hunting in UK listed sector

... share prices and the weakness of the pound,” said Iain Daly, a partner at Radnor. The UK Real Estate Index fell dramatically in the days after the Brexit vote, losing 22% of its value in just two days (Datastream). The value of the pound against the dollar also plummeted, making UK assets cheaper fo ...

... share prices and the weakness of the pound,” said Iain Daly, a partner at Radnor. The UK Real Estate Index fell dramatically in the days after the Brexit vote, losing 22% of its value in just two days (Datastream). The value of the pound against the dollar also plummeted, making UK assets cheaper fo ...

answers to "do you understand" text questions

... 1. Describe the likely consequences for GDP growth when the FOMC directs the trading desk at the New York Fed to sell Treasury securities. Solution: Selling securities reduces bank reserves, money market liquidity, the bank's availability of funds, and might increase interest rates, serving the slow ...

... 1. Describe the likely consequences for GDP growth when the FOMC directs the trading desk at the New York Fed to sell Treasury securities. Solution: Selling securities reduces bank reserves, money market liquidity, the bank's availability of funds, and might increase interest rates, serving the slow ...

MONETARY POLICY IN THE US BEFORE AND AFTER THE CRISIS

... account but do not change the total amount of balances that the banking system holds at the Federal Reserve Banks. The Federal Reserve can change the total amount of balances available to the banking system through its lending programs or through open market operations. As discussed below, transacti ...

... account but do not change the total amount of balances that the banking system holds at the Federal Reserve Banks. The Federal Reserve can change the total amount of balances available to the banking system through its lending programs or through open market operations. As discussed below, transacti ...

Loans Classified by Special Provision

... eligible veterans - those who have served a minimum of 181 days of active service since September 16, 1940 (some specifically designated wartime periods require as few as 90 days. Two full years are required for those enlisting for the first time after September 7, 1980). GI loans assist veterans in ...

... eligible veterans - those who have served a minimum of 181 days of active service since September 16, 1940 (some specifically designated wartime periods require as few as 90 days. Two full years are required for those enlisting for the first time after September 7, 1980). GI loans assist veterans in ...

Landscaping carbon risk - 2° Investing Initiative

... 1. Society/taxpayers. The first and most prominent ‘risk’ correlated with GHG-‐emissions relate to their external cost. Based on IPCC report, the existence of a cost is almost certain. The main uncertainties ...

... 1. Society/taxpayers. The first and most prominent ‘risk’ correlated with GHG-‐emissions relate to their external cost. Based on IPCC report, the existence of a cost is almost certain. The main uncertainties ...

Securities Trading Policy

... Trade Derivatives relating to Company Securities (other than exercises of stock options for Best Buy stock granted to you by the Company). (h) Hedge Company Securities (that is, make an investment in another security in order to reduce the risk of a loss or gain on any Company Security), whether via ...

... Trade Derivatives relating to Company Securities (other than exercises of stock options for Best Buy stock granted to you by the Company). (h) Hedge Company Securities (that is, make an investment in another security in order to reduce the risk of a loss or gain on any Company Security), whether via ...

Introducing the Emerging Market Bond Index Plus

... or are awaiting a restructuring into Brady bonds. These loans were either previously restructured loan agreements or unstructured loans, pools of which were formed for the purpose of trading. Trading of these loan pools among their original commercial bank creditors began to pick up around 1987. In ...

... or are awaiting a restructuring into Brady bonds. These loans were either previously restructured loan agreements or unstructured loans, pools of which were formed for the purpose of trading. Trading of these loan pools among their original commercial bank creditors began to pick up around 1987. In ...

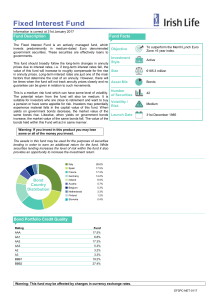

Fixed Interest Fund - Irish Life Corporate Business

... in annuity prices. Long-term interest rates are just one of the main factors that determine the cost of an annuity. However, there will be times when the fund will not track annuity prices closely and no Asset Mix guarantee can be given in relation to such movements. This is a medium risk fund which ...

... in annuity prices. Long-term interest rates are just one of the main factors that determine the cost of an annuity. However, there will be times when the fund will not track annuity prices closely and no Asset Mix guarantee can be given in relation to such movements. This is a medium risk fund which ...

Bear Stearns Takeover - Congregation for Reconciliation CfR Dayton

... the Fed’s $28.82 billion loan, if there are losses on the $30 billion assets, the first $1 billion of losses will be borne, in effect, by JPMorgan Chase, however. The interest on the loan will be repaid out of the asset sales, not by JPMorgan Chase. Table 1. Use of Funds Raised by Liquidation of Be ...

... the Fed’s $28.82 billion loan, if there are losses on the $30 billion assets, the first $1 billion of losses will be borne, in effect, by JPMorgan Chase, however. The interest on the loan will be repaid out of the asset sales, not by JPMorgan Chase. Table 1. Use of Funds Raised by Liquidation of Be ...