the discussion note

... by markets, studies show that expected returns vary more over time and across assets than can be accounted for by traditional models where the variation of discount rates is constant. In these models, changes in future expected payoffs are calibrated to match the statistical properties of observed t ...

... by markets, studies show that expected returns vary more over time and across assets than can be accounted for by traditional models where the variation of discount rates is constant. In these models, changes in future expected payoffs are calibrated to match the statistical properties of observed t ...

Cash Flow IN Sources of Cash Flow in

... Equity What a company owns minus what a company owes OR What your business is worth at book value (not market value) ...

... Equity What a company owns minus what a company owes OR What your business is worth at book value (not market value) ...

Seeing Value in Alternative Minimum Tax (AMT) Bonds

... money issuance to fund capital projects, which increased a solid 21% over last year and 27% versus the prior five-year average. The increase in new money financing, led by local government issuers, is a welcome improvement to the lackluster borrowing in recent years. As municipalities struggle to ba ...

... money issuance to fund capital projects, which increased a solid 21% over last year and 27% versus the prior five-year average. The increase in new money financing, led by local government issuers, is a welcome improvement to the lackluster borrowing in recent years. As municipalities struggle to ba ...

Bond Basics - RBC Wealth Management

... also affect the price of its bonds. This factor is most common with non-U.S. government issuers such as corporate and municipal issuers. An issuer’s credit quality is evaluated according to its ability to make timely principal and interest payments to bondholders. Bonds are evaluated for credit risk ...

... also affect the price of its bonds. This factor is most common with non-U.S. government issuers such as corporate and municipal issuers. An issuer’s credit quality is evaluated according to its ability to make timely principal and interest payments to bondholders. Bonds are evaluated for credit risk ...

www.catleylakeman.co.uk

... Backtested, hypothetical or simulated performance results have inherent limitations. Simulated results are achieved by the retroactive application of a backtested model itself designed with the benefit of hindsight. The backtesting of performance differs from the actual performance because the inves ...

... Backtested, hypothetical or simulated performance results have inherent limitations. Simulated results are achieved by the retroactive application of a backtested model itself designed with the benefit of hindsight. The backtesting of performance differs from the actual performance because the inves ...

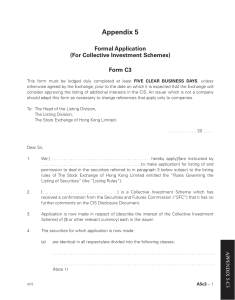

Appendix 5

... Formal Application (For Collective Investment Schemes) Form C3 This form must be lodged duly completed at least FIVE CLEAR BUSINESS DAYS, unless otherwise agreed by the Exchange, prior to the date on which it is expected that the Exchange will consider approving the listing of additional interests i ...

... Formal Application (For Collective Investment Schemes) Form C3 This form must be lodged duly completed at least FIVE CLEAR BUSINESS DAYS, unless otherwise agreed by the Exchange, prior to the date on which it is expected that the Exchange will consider approving the listing of additional interests i ...

- TestbankU

... 10. You could try to identify components of the budget that you can change to provide more cash for savings. For example, you could either attempt to increase your income or to reduce one or more expenses. 11. People who do not establish a budget may just deal with cash deficiencies when they occur. ...

... 10. You could try to identify components of the budget that you can change to provide more cash for savings. For example, you could either attempt to increase your income or to reduce one or more expenses. 11. People who do not establish a budget may just deal with cash deficiencies when they occur. ...

Risk and Return: The Portfolio Theory The crux of portfolio theory

... broken down into two sources: - Firm specific risk (only faced by that firm), - Market wide risk (affects all investments). • Firm-specific risk can be reduced, if not eliminated, by increasing the number of investments in your portfolio (i.e. by being diversified). Market wide risk cannot. • On eco ...

... broken down into two sources: - Firm specific risk (only faced by that firm), - Market wide risk (affects all investments). • Firm-specific risk can be reduced, if not eliminated, by increasing the number of investments in your portfolio (i.e. by being diversified). Market wide risk cannot. • On eco ...

Chapter 2

... • CCA is depreciation for tax purposes • CCA is deducted before taxes and acts as a tax shield • Every capital assets is assigned to a specific asset class by the government • Every asset class is given a depreciation method and rate • Half-year Rule – In the first year, only half of the asset’s cos ...

... • CCA is depreciation for tax purposes • CCA is deducted before taxes and acts as a tax shield • Every capital assets is assigned to a specific asset class by the government • Every asset class is given a depreciation method and rate • Half-year Rule – In the first year, only half of the asset’s cos ...

Credit Risk Transfer

... CIRT program, transferring credit risk on approximately $66.2 billion in loans across nine transactions. Description: Credit insurance risk sharing deals shift credit risk on a pool of loans to an insurance provider which may then transfer that risk to one or more domestic or international reinsurer ...

... CIRT program, transferring credit risk on approximately $66.2 billion in loans across nine transactions. Description: Credit insurance risk sharing deals shift credit risk on a pool of loans to an insurance provider which may then transfer that risk to one or more domestic or international reinsurer ...

15 March 2017 ThinkSmart Limited (“ThinkSmart” or “the Company

... ThinkSmart Limited is a leading provider in the UK of retail point-of-sale lease finance for high-volume small-ticket electronic and commercial equipment. The Group provides both B2B and B2C point-of-sale lease finance, primarily through its longstanding relationship with Dixons Retail and its new r ...

... ThinkSmart Limited is a leading provider in the UK of retail point-of-sale lease finance for high-volume small-ticket electronic and commercial equipment. The Group provides both B2B and B2C point-of-sale lease finance, primarily through its longstanding relationship with Dixons Retail and its new r ...

Publication in doc format - Irish Congress of Trade Unions

... Ordinary working families who have lost their jobs or seen their incomes cut must be protected from threats of repossession and they must be provided with realistic ways to deal with their over indebtedness. It is unfair that working people who have had their wages forced down in lieu of devaluation ...

... Ordinary working families who have lost their jobs or seen their incomes cut must be protected from threats of repossession and they must be provided with realistic ways to deal with their over indebtedness. It is unfair that working people who have had their wages forced down in lieu of devaluation ...

tactallocbrochure - Railroad Street Weaith Management LLC

... rebalanced on a daily basis and measured by pricing all currencies against the US Dollar. S&P 500 Index: S&P 500 index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index with each stock’s weight in the Index proportionate ...

... rebalanced on a daily basis and measured by pricing all currencies against the US Dollar. S&P 500 Index: S&P 500 index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index with each stock’s weight in the Index proportionate ...

Chapter 19 | You Will Learn... 1. To detail recent changes in

... To detail recent changes in accounting standards relating to earnings per share, and know why the changes were made and how these changes will affect computations relating to earnings per share. In 1997, the FASB issued Statement No. 128, which provides new requirements associated with earnings pe ...

... To detail recent changes in accounting standards relating to earnings per share, and know why the changes were made and how these changes will affect computations relating to earnings per share. In 1997, the FASB issued Statement No. 128, which provides new requirements associated with earnings pe ...

Presentation

... and holdings) with the BIS, ECB, and the WB (Working Group on Securities Databases) Promotion of high-frequency (quarterly) general government sector data on a harmonized basis Development of Public Sector Debt Guide for the collection and dissemination of public sector debt statistics. Coordi ...

... and holdings) with the BIS, ECB, and the WB (Working Group on Securities Databases) Promotion of high-frequency (quarterly) general government sector data on a harmonized basis Development of Public Sector Debt Guide for the collection and dissemination of public sector debt statistics. Coordi ...