Slides on regionalism

... have genuinely increased trade flows between members) – Agreements are not always effectively implemented – The coverage and real preferences might be low – Recent agreements are more likely to be effective. ...

... have genuinely increased trade flows between members) – Agreements are not always effectively implemented – The coverage and real preferences might be low – Recent agreements are more likely to be effective. ...

CH06 - Class Index

... for an investment will be different from the expected return • Investors are concerned that the realized return will be less than the expected return • The greater the variability between the expected and realized return, the greater the risk • Although, investors may receive on average their expect ...

... for an investment will be different from the expected return • Investors are concerned that the realized return will be less than the expected return • The greater the variability between the expected and realized return, the greater the risk • Although, investors may receive on average their expect ...

Franklin High Yield Fund

... The information is not a complete analysis of every aspect of any market, country, industry, security or portfolio. Statements of fact are from sources considered to be reliable, but no representation or warranty is made as to their completeness or accuracy. Because market and economic conditions ar ...

... The information is not a complete analysis of every aspect of any market, country, industry, security or portfolio. Statements of fact are from sources considered to be reliable, but no representation or warranty is made as to their completeness or accuracy. Because market and economic conditions ar ...

SLR Holdings under Held to Maturity Category

... the mandatory SLR, it is advised that banks are permitted to exceed the limit of 25 per cent of total investments under HTM category provided: a. the excess comprises only of SLR securities, and b. the total SLR securities held under the HTM category are not more than • 21.50 per cent from January 9 ...

... the mandatory SLR, it is advised that banks are permitted to exceed the limit of 25 per cent of total investments under HTM category provided: a. the excess comprises only of SLR securities, and b. the total SLR securities held under the HTM category are not more than • 21.50 per cent from January 9 ...

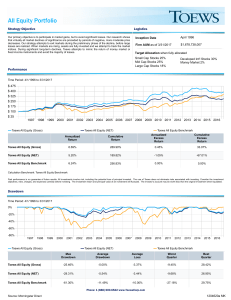

All Equity Portfolio

... Past performance is no guarantee of future results. All investments involve risk, including the potential loss of principal invested. The use of Toews does not eliminate risks associated with investing. Consider the investment objectives, risks, charges, and expenses carefully before investing. The ...

... Past performance is no guarantee of future results. All investments involve risk, including the potential loss of principal invested. The use of Toews does not eliminate risks associated with investing. Consider the investment objectives, risks, charges, and expenses carefully before investing. The ...

investing for the future

... banks; regional inequalities in growth; encouraging the transition to a low-carbon economy; backing innovative start-ups; and improving the country’s infrastructure. In the past, commentators and lobbyists have argued for some form of national bank in the UK to tackle each of these. There is a risk, ...

... banks; regional inequalities in growth; encouraging the transition to a low-carbon economy; backing innovative start-ups; and improving the country’s infrastructure. In the past, commentators and lobbyists have argued for some form of national bank in the UK to tackle each of these. There is a risk, ...

For What IT`s Worth: Insights into the True Business Value of IT

... all the strategy and goals of the business have to be considered. After all, it is this strategy IT should align with. In modern business strategy literature, three dominant strategies are identified: Product Leadership, Customer Intimacy and Price Leadership (Treacey en Wiersema, 1997). In a Price ...

... all the strategy and goals of the business have to be considered. After all, it is this strategy IT should align with. In modern business strategy literature, three dominant strategies are identified: Product Leadership, Customer Intimacy and Price Leadership (Treacey en Wiersema, 1997). In a Price ...

Borrowing to invest

... will change the results. This example is provided for illustrative purposes only. It is not representative of any particular investment product, investment strategy or the returns on any investment. No allowance has been made for inflation, fees or expenses. ...

... will change the results. This example is provided for illustrative purposes only. It is not representative of any particular investment product, investment strategy or the returns on any investment. No allowance has been made for inflation, fees or expenses. ...

Wisconsin`s Uniform Prudent Management of Institutional Act

... “Although the Act does not require that a specific amount be set aside as “principal,” the Act assumes that the charity will act to preserve “principal” (i.e., to maintain the purchasing power of the amounts contributed to the fund) while spending “income” (i.e. making a distribution each year that ...

... “Although the Act does not require that a specific amount be set aside as “principal,” the Act assumes that the charity will act to preserve “principal” (i.e., to maintain the purchasing power of the amounts contributed to the fund) while spending “income” (i.e. making a distribution each year that ...

Key Investor Information db x-trackers Equity Value Factor UCITS ETF

... The Index is calculated and published by Solactive AG. Solactive AG does not offer any explicit or tacit guarantee or assurance to the results of use of the Index or value of the Index. There is no obligation of Solactive AG to advise of any errors in the Index. The Index is rules based and is not c ...

... The Index is calculated and published by Solactive AG. Solactive AG does not offer any explicit or tacit guarantee or assurance to the results of use of the Index or value of the Index. There is no obligation of Solactive AG to advise of any errors in the Index. The Index is rules based and is not c ...

Equity for Rural America: From Wall Street to Main Street

... company, bank holding company, or investment bank. The affiliated companies are generally structured and managed no differently than independent partnership management companies. Limited partnerships typically have a ten-year life. During this period, investors forego virtually all control over the ...

... company, bank holding company, or investment bank. The affiliated companies are generally structured and managed no differently than independent partnership management companies. Limited partnerships typically have a ten-year life. During this period, investors forego virtually all control over the ...

Mutual Funds Investment

... the fund mangers to speculate properly in the right direction. The investors who invest their money in the Mutual fund of any Investment Management Company, receive an Equity Position in that particular mutual fund. When after certain period of time, whether long term or short term, the investors se ...

... the fund mangers to speculate properly in the right direction. The investors who invest their money in the Mutual fund of any Investment Management Company, receive an Equity Position in that particular mutual fund. When after certain period of time, whether long term or short term, the investors se ...

Individual Acquisition of Earning Power

... affecting individual productivity and earnings during the life cycle. Since changes in earnings are produced by net investments in human capital stock, the net concept is used in most of the analysis. In this section, zero depreciation is, in effect, assumed during the school years and zero net inve ...

... affecting individual productivity and earnings during the life cycle. Since changes in earnings are produced by net investments in human capital stock, the net concept is used in most of the analysis. In this section, zero depreciation is, in effect, assumed during the school years and zero net inve ...

Information Statement MNTRUST

... possible investment yield while maintaining liquidity and preserving capital by investing only in instruments authorized by Minnesota laws which govern the investment of funds by Government Units. The Fund seeks to attain its investment objectives by pursuing a professionally managed investment prog ...

... possible investment yield while maintaining liquidity and preserving capital by investing only in instruments authorized by Minnesota laws which govern the investment of funds by Government Units. The Fund seeks to attain its investment objectives by pursuing a professionally managed investment prog ...

BCAS 21: Capital Budgeting

... 21.5.1 Capital budgeting: Capital budgeting, or investment appraisal, is the planning process used to determine whether an organization's long term investments such as investment in new machinery, replacement of existing machinery, installing new plants, launching new products, and research developm ...

... 21.5.1 Capital budgeting: Capital budgeting, or investment appraisal, is the planning process used to determine whether an organization's long term investments such as investment in new machinery, replacement of existing machinery, installing new plants, launching new products, and research developm ...

The Role of ,,Business Angels“ in the Financial Market

... meeting point of capital and good ideas in one place, and effective exchange of all information related to the promotion and development of innovative entrepreneurship. The methods used in the paper are quantitative and qualitative methods as well as methods of comparison of spatial and temporal fe ...

... meeting point of capital and good ideas in one place, and effective exchange of all information related to the promotion and development of innovative entrepreneurship. The methods used in the paper are quantitative and qualitative methods as well as methods of comparison of spatial and temporal fe ...

How FSCS protects your money

... the type of policy you have: Motor insurance, Employers Liability insurance and Professional Indemnity insurance: the entire claim relating to the third-party element of your insurance, and 90% of any remaining elements of the claim. Death or incapacity of the policyholder due to injury, sickness or ...

... the type of policy you have: Motor insurance, Employers Liability insurance and Professional Indemnity insurance: the entire claim relating to the third-party element of your insurance, and 90% of any remaining elements of the claim. Death or incapacity of the policyholder due to injury, sickness or ...

Reliance Capital Completes Transfer Of Its Commercial Finance

... Reliance Capital, a part of the Reliance Group, is one of India’s leading private sector financial services companies. It ranks amongst the top private sector financial services and banking groups, in terms of net worth. The Company is a constituent of CNX Midcap 50 and MSCI Global Small Cap Index. ...

... Reliance Capital, a part of the Reliance Group, is one of India’s leading private sector financial services companies. It ranks amongst the top private sector financial services and banking groups, in terms of net worth. The Company is a constituent of CNX Midcap 50 and MSCI Global Small Cap Index. ...

Who Owns the Assets?

... Recently, academics and policy makers have focused on the potentially destabilizing impact of pro-cyclical “asset flows”.1 The concern is that the actions of various financial institutions may, on occasion, materially increase systemic risk. A proposed solution is to increase the scope and intensity ...

... Recently, academics and policy makers have focused on the potentially destabilizing impact of pro-cyclical “asset flows”.1 The concern is that the actions of various financial institutions may, on occasion, materially increase systemic risk. A proposed solution is to increase the scope and intensity ...

Paulson Confronts Goldman Fallout

... John Paulson hasn't been accused of any wrongdoing. But the hedge-fund billionaire has gone on the offensive to reassure investors that his huge firm will emerge unscathed from a case that has drawn him into a political and legal vortex. The steps, including a conference call with about 100 investor ...

... John Paulson hasn't been accused of any wrongdoing. But the hedge-fund billionaire has gone on the offensive to reassure investors that his huge firm will emerge unscathed from a case that has drawn him into a political and legal vortex. The steps, including a conference call with about 100 investor ...

Offering and Investor Fees - Handout

... Administration fees are non-contingent fees generally used by the issuer to pass some of the cost of the capital raise to the investor. In offerings that might allow for small investor commitments, such as Reg A and Reg CF, this can be particularly important. In a Reg D, covering the cost of a wire ...

... Administration fees are non-contingent fees generally used by the issuer to pass some of the cost of the capital raise to the investor. In offerings that might allow for small investor commitments, such as Reg A and Reg CF, this can be particularly important. In a Reg D, covering the cost of a wire ...

Merritt 7 Corporate Park in Norwalk Leases 31,217 Square Feet to

... “Merritt 7 management is committed to maintaining and consistently reinvesting in the property to meet and exceed the needs of current and prospective tenants,” said David Fiore of Marcus Partners. “The extensive renovations we’ve made have resulted in an enhanced office environment with a contempo ...

... “Merritt 7 management is committed to maintaining and consistently reinvesting in the property to meet and exceed the needs of current and prospective tenants,” said David Fiore of Marcus Partners. “The extensive renovations we’ve made have resulted in an enhanced office environment with a contempo ...

Investments and mortgages supplement

... Share premium account: This is a reserve of money set up in the applicant firm's accounts to account for the issue of new shares above their par value. i.e. if you issue some shares at £1 each, and you keep some back which you then sell at £1.50 each, you put the extra 50p into the share premium acc ...

... Share premium account: This is a reserve of money set up in the applicant firm's accounts to account for the issue of new shares above their par value. i.e. if you issue some shares at £1 each, and you keep some back which you then sell at £1.50 each, you put the extra 50p into the share premium acc ...

Corporate Finance Sample Exam 2A Dr. A. Frank Thompson

... 4. Your grandmother wants to give you 100 shares of stock, but it is in either company A or company B. Company A’s coefficient of variation in its expected stock return of 1.5 and a Beta of .8, while company B has a coefficient of variation in its expected stock return of 1.50 and a Beta of 1.75 . A ...

... 4. Your grandmother wants to give you 100 shares of stock, but it is in either company A or company B. Company A’s coefficient of variation in its expected stock return of 1.5 and a Beta of .8, while company B has a coefficient of variation in its expected stock return of 1.50 and a Beta of 1.75 . A ...

Angel Broking-Restricted Scrips Policy Dealing in Restricted Scrips

... Option contracts (+,-) 20 % in accordance with the closing price of that particular scrip in cash market. ...

... Option contracts (+,-) 20 % in accordance with the closing price of that particular scrip in cash market. ...