Investment Policy

... district, village, town or school district of this state. Financing of City projects, including short-term financing, for not more than five years unless approved by the City Council for a longer period. Interest will be charged at .5% over the rate obtained by the most recent City general obligatio ...

... district, village, town or school district of this state. Financing of City projects, including short-term financing, for not more than five years unless approved by the City Council for a longer period. Interest will be charged at .5% over the rate obtained by the most recent City general obligatio ...

Contribution of Savings Banks to Small and Medium Enterprise

... trends in the economy and society. So it can be said that the mission of the financial sector is to provide support for such strategy and reorganization. From this perspective the following points in the report were of particular interest. German savings banks provide consulting services on financia ...

... trends in the economy and society. So it can be said that the mission of the financial sector is to provide support for such strategy and reorganization. From this perspective the following points in the report were of particular interest. German savings banks provide consulting services on financia ...

signed a statement

... of global sustainability challenges, such as poverty and climate change. The Food and Beverage Sector faces a particularly difficult set of sustainability challenges. Given its dependence on land, water, proximity to local communities and exposure to volatile commodity prices, we recognize that seve ...

... of global sustainability challenges, such as poverty and climate change. The Food and Beverage Sector faces a particularly difficult set of sustainability challenges. Given its dependence on land, water, proximity to local communities and exposure to volatile commodity prices, we recognize that seve ...

Quiz 4

... 1. What is are the fundamental differences between a broker and a dealer? Which has a higher risk of capital losses and why? Brokers match buyers and sellers without using their own accounts, while dealers take positions. Dealers risk capital losses, while brokers do not. 2. You deposit $100 that yo ...

... 1. What is are the fundamental differences between a broker and a dealer? Which has a higher risk of capital losses and why? Brokers match buyers and sellers without using their own accounts, while dealers take positions. Dealers risk capital losses, while brokers do not. 2. You deposit $100 that yo ...

International financial risk, investment and growth in Nigeria:

... This study analyzes the impact of international finance risk and domestic investment on the levels of growth in the Nigerian economy. Essentially, the researchers adopted the ARDL approach of the co-integration method taking into consideration macroeconomic variables such as exchange rate volatility ...

... This study analyzes the impact of international finance risk and domestic investment on the levels of growth in the Nigerian economy. Essentially, the researchers adopted the ARDL approach of the co-integration method taking into consideration macroeconomic variables such as exchange rate volatility ...

Governance of EIRIS

... expertise in methodology development, reporting standards and social & environmental best practice • We can build customized teams according to the specific needs of the client – ensuring a high level of competency and project specific solutions • EIRIS works with partner organisations to gain local ...

... expertise in methodology development, reporting standards and social & environmental best practice • We can build customized teams according to the specific needs of the client – ensuring a high level of competency and project specific solutions • EIRIS works with partner organisations to gain local ...

Download pdf | 5989 KB |

... now explicit quotas allocated to different regions • Firms must also show profits in 3 consecutive years, among other financial requirements • Initial purpose of setting up stock market was to help privatization of SOEs • Firms with connections to regulators are more likely to be listed ...

... now explicit quotas allocated to different regions • Firms must also show profits in 3 consecutive years, among other financial requirements • Initial purpose of setting up stock market was to help privatization of SOEs • Firms with connections to regulators are more likely to be listed ...

Golden rules of investing in stock market

... A well thought out plan and discipline in implementing it can safeguard your portfolio from impulsive mistakes. Good financial investment advice is to have an investment plan for investment in stock. This is an important means of controlling the potential emotional roller coaster that can be associa ...

... A well thought out plan and discipline in implementing it can safeguard your portfolio from impulsive mistakes. Good financial investment advice is to have an investment plan for investment in stock. This is an important means of controlling the potential emotional roller coaster that can be associa ...

Review Your Strategy

... created by applying your recommended asset mix (which considers the forecasts and assumptions about the growth of your wealth) to your investment options. Your recommended asset mix is derived from various factors such as your years to retirement, your projected salary growth, and results from an "a ...

... created by applying your recommended asset mix (which considers the forecasts and assumptions about the growth of your wealth) to your investment options. Your recommended asset mix is derived from various factors such as your years to retirement, your projected salary growth, and results from an "a ...

Investment

... • Financial capital consists of IOUs like stocks, bonds, and money. • Financial capital may facilitate production of final goods and services, but does not directly produce output. • In contrast, physical/human capital serves as an input in the production process. • Think of physical capital as an i ...

... • Financial capital consists of IOUs like stocks, bonds, and money. • Financial capital may facilitate production of final goods and services, but does not directly produce output. • In contrast, physical/human capital serves as an input in the production process. • Think of physical capital as an i ...

Document

... After a shift from PPR to QAR, on average, Sharpe ratio drops by 20% for EMEs PF, while by 3% for OECD PF. As regards optimal portfolio part, there is evidence that higher return required, more allocated to equities In addition, foreign assets in OECD PF’s optimal portfolio always do not account for ...

... After a shift from PPR to QAR, on average, Sharpe ratio drops by 20% for EMEs PF, while by 3% for OECD PF. As regards optimal portfolio part, there is evidence that higher return required, more allocated to equities In addition, foreign assets in OECD PF’s optimal portfolio always do not account for ...

Investments

... Gain familiarity with the institutions and language of Wall Street so as to facilitate the development of an effective personal investment strategy. To help you make investment decisions that will enhance your economic welfare To create realistic expectations about the outcome of investment decision ...

... Gain familiarity with the institutions and language of Wall Street so as to facilitate the development of an effective personal investment strategy. To help you make investment decisions that will enhance your economic welfare To create realistic expectations about the outcome of investment decision ...

01-03-2017 Weekly Market Review

... Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed by Private Capital Grou ...

... Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed by Private Capital Grou ...

Investment Update December 2011 Quarter

... Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time ...

... Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time ...

Factors That Affect the Rate of Return on an Investment

... 2. Managing the parents’ estate for the children until they reach a certain age ...

... 2. Managing the parents’ estate for the children until they reach a certain age ...

Mariner Investment Group Adds Fourth Portfolio Team to Mariner

... "Mariner provides a proven institutional infrastructure for derivatives portfolio management, as well as a substantial and reputable strategic partner for building and growing our business together,” said Mr. Loflin. “Investment banks have long been the dominant players in exploiting relative-value ...

... "Mariner provides a proven institutional infrastructure for derivatives portfolio management, as well as a substantial and reputable strategic partner for building and growing our business together,” said Mr. Loflin. “Investment banks have long been the dominant players in exploiting relative-value ...

PPT

... Bridge loans are used in venture capital and other corporate finance for several purposes: To inject small amounts of cash to carry a company so that it does not run out of cash between successive major private equity financings To carry distressed companies while searching for an acquirer or larger ...

... Bridge loans are used in venture capital and other corporate finance for several purposes: To inject small amounts of cash to carry a company so that it does not run out of cash between successive major private equity financings To carry distressed companies while searching for an acquirer or larger ...

Investment Policy - United States Power Squadrons

... markets, rather than on maximizing performances during rising markets. This should result in more consistent results and reduce the potential impact of investment losses. ...

... markets, rather than on maximizing performances during rising markets. This should result in more consistent results and reduce the potential impact of investment losses. ...

Keeping Up with the (Paul Tudor) Joneses: a Hedge

... FIRST OF (W)ALL (OF TEXT) Hedge funds are private partnerships in which the manager or general partner (GP) has a significant personal stake in the fund and is free to operate in a variety of markets and to utilize investments and strategies with variable long/short exposures and degrees of leverag ...

... FIRST OF (W)ALL (OF TEXT) Hedge funds are private partnerships in which the manager or general partner (GP) has a significant personal stake in the fund and is free to operate in a variety of markets and to utilize investments and strategies with variable long/short exposures and degrees of leverag ...

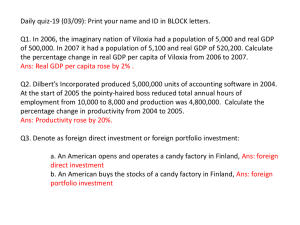

03/09

... Q1. In 2006, the imaginary nation of Viloxia had a population of 5,000 and real GDP of 500,000. In 2007 it had a population of 5,100 and real GDP of 520,200. Calculate the percentage change in real GDP per capita of Viloxia from 2006 to 2007. Ans: Real GDP per capita rose by 2% . Q2. Dilbert’s Incor ...

... Q1. In 2006, the imaginary nation of Viloxia had a population of 5,000 and real GDP of 500,000. In 2007 it had a population of 5,100 and real GDP of 520,200. Calculate the percentage change in real GDP per capita of Viloxia from 2006 to 2007. Ans: Real GDP per capita rose by 2% . Q2. Dilbert’s Incor ...

How do you assess multi-asset funds?

... particular market or other asset class, as well as leverage and may subject a portfolio to potentially dramatic changes (including losses) in a portfolio’s value. Alternative investments commonly include the use of derivatives, or investments where the investor does not own the underlying asset, but ...

... particular market or other asset class, as well as leverage and may subject a portfolio to potentially dramatic changes (including losses) in a portfolio’s value. Alternative investments commonly include the use of derivatives, or investments where the investor does not own the underlying asset, but ...

DailyNewsTSIK

... News from the field of education. Briarwood eighth in investment contest A team of four Briarwood Elementary School students took eighth place in the fall 2006 statewide Take Stock in Kentucky investment competition. More than 300 teams from across the state competed in the fall Take Stock in Kentuc ...

... News from the field of education. Briarwood eighth in investment contest A team of four Briarwood Elementary School students took eighth place in the fall 2006 statewide Take Stock in Kentucky investment competition. More than 300 teams from across the state competed in the fall Take Stock in Kentuc ...

October 2016 - Reynders, McVeigh Capital Management

... research report or as a recommendation to invest in a particular sector or security or in a particular manner. This material does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security in any particula ...

... research report or as a recommendation to invest in a particular sector or security or in a particular manner. This material does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security in any particula ...

Code of Ethics

... Through managing assets of pension funds and such like, investment advisers provide professional and high-quality services to their clients that meet their needs. Investment advisers have a special relationship of trust and confidence with their clients and also are expected to contribute to society ...

... Through managing assets of pension funds and such like, investment advisers provide professional and high-quality services to their clients that meet their needs. Investment advisers have a special relationship of trust and confidence with their clients and also are expected to contribute to society ...