Segmentation in the US Financial Services Industry

... A section 20 affiliate agrees to underwrite a debt issue for one of its clients. It has suggested a firm commitment offering for issuing 100,000 shares of stock. The bank quotes a bid-ask spread of $97-$97.50 to its customers on the issue date. a. What are the total underwriting fees generated if al ...

... A section 20 affiliate agrees to underwrite a debt issue for one of its clients. It has suggested a firm commitment offering for issuing 100,000 shares of stock. The bank quotes a bid-ask spread of $97-$97.50 to its customers on the issue date. a. What are the total underwriting fees generated if al ...

Thornton Matheson

... The thesis comprises two studies of regional investment in transitional Russia: one on private domestic and foreign investment and the other on local public investment. The first study constructs a general equilibrium model of a regional economy with non-traded goods, industrial specialization and p ...

... The thesis comprises two studies of regional investment in transitional Russia: one on private domestic and foreign investment and the other on local public investment. The first study constructs a general equilibrium model of a regional economy with non-traded goods, industrial specialization and p ...

oil, gas and mineral rights

... generations. Other times though, people can acquire this property and not realize they’re acquiring the mineral rights as well. Until an oil company shows up at their door wanting to lease. ...

... generations. Other times though, people can acquire this property and not realize they’re acquiring the mineral rights as well. Until an oil company shows up at their door wanting to lease. ...

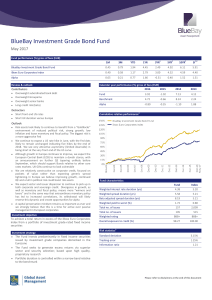

BlueBay Investment Grade Bond Fund

... 4. The Fund AUM is stated on a T+1 basis and includes non-fee earning assets. 5. CDS long exposure means sold protection and CDS short exposure means brought protection. This document is issued in the United Kingdom (UK) by BlueBay Asset Management LLP (BlueBay), which is authorised and regulated by ...

... 4. The Fund AUM is stated on a T+1 basis and includes non-fee earning assets. 5. CDS long exposure means sold protection and CDS short exposure means brought protection. This document is issued in the United Kingdom (UK) by BlueBay Asset Management LLP (BlueBay), which is authorised and regulated by ...

Portfolio Advisory Council, LLC presents:

... Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the "NYSE") and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. ...

... Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the "NYSE") and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. ...

Investment demand

... Stock Markets • Stock (Equity): A certificate of ownership and claim to the profits of a corporation. • Stock Market: An institution that facilitates the transfer of stocks among wealth holders. Examples: NYSE, NASDAQ, London Stock Exchange, Paris Bourse, Tokyo Stock Exchange, Toronto Stock Excha ...

... Stock Markets • Stock (Equity): A certificate of ownership and claim to the profits of a corporation. • Stock Market: An institution that facilitates the transfer of stocks among wealth holders. Examples: NYSE, NASDAQ, London Stock Exchange, Paris Bourse, Tokyo Stock Exchange, Toronto Stock Excha ...

Investment and saving

... the profits of a corporation. • Stock Market: An institution that facilitates the transfer of stocks among wealth holders. Examples: NYSE, NASDAQ, London Stock Exchange, Paris Bourse, Tokyo Stock Exchange, Toronto Stock Exchange ...

... the profits of a corporation. • Stock Market: An institution that facilitates the transfer of stocks among wealth holders. Examples: NYSE, NASDAQ, London Stock Exchange, Paris Bourse, Tokyo Stock Exchange, Toronto Stock Exchange ...

Second Quarter 2013 - CCB Financial Services

... market as new home sales hit a 5 year high and, since last June, single family home sales were up over 38%. The Vanguard 500 stock index was up 2.9% in the quarter and 13.8% for the year to date. Over the last two months of the quarter, foreign stocks ...

... market as new home sales hit a 5 year high and, since last June, single family home sales were up over 38%. The Vanguard 500 stock index was up 2.9% in the quarter and 13.8% for the year to date. Over the last two months of the quarter, foreign stocks ...

Systematic and Unsystematic Risks

... rate of return (for example return on U.S. treasury bonds), adjusted for inflation rate expectation, and with the specific risk premium. The risk premium is peculiar to each investment and includes, country risk, exchange rate risk and other international investment associated risks, in addition to ...

... rate of return (for example return on U.S. treasury bonds), adjusted for inflation rate expectation, and with the specific risk premium. The risk premium is peculiar to each investment and includes, country risk, exchange rate risk and other international investment associated risks, in addition to ...

The Weekly Letter CIO REPORTS

... led by Haruhiko Kuroda, is buying domestic government bonds. One goal is lowering interest rates to motivate individuals to invest their savings in riskier assets. The hope is that this increased investment would spur economic activity, lifting Japan out of its dormancy. By expanding its balance she ...

... led by Haruhiko Kuroda, is buying domestic government bonds. One goal is lowering interest rates to motivate individuals to invest their savings in riskier assets. The hope is that this increased investment would spur economic activity, lifting Japan out of its dormancy. By expanding its balance she ...

Investment Grade Corporate Strategy

... fee-based “institutional” accounts and “commission-based” Bloomberg Barclays Intermediate U.S. Corporate Index. accounts) or through broker-dealer programs as an advisor The index is defined as publicly issued U.S. corporate and or sub-advisor (fee-based ”advisor-sponsored” accounts). For specified ...

... fee-based “institutional” accounts and “commission-based” Bloomberg Barclays Intermediate U.S. Corporate Index. accounts) or through broker-dealer programs as an advisor The index is defined as publicly issued U.S. corporate and or sub-advisor (fee-based ”advisor-sponsored” accounts). For specified ...

Panasonic Manufacturing Malaysia Berhad Maintain NEUTRAL

... (+0.1%yoy) which is a significant 60% of total assets. In addition, all of its subsidiaries are in net cash positions, hence intercompany lending is unnecessary at this juncture. Approximately 80% or RM500m of the cash is placed in fixed deposit instruments at local financial institutions (FIs) yiel ...

... (+0.1%yoy) which is a significant 60% of total assets. In addition, all of its subsidiaries are in net cash positions, hence intercompany lending is unnecessary at this juncture. Approximately 80% or RM500m of the cash is placed in fixed deposit instruments at local financial institutions (FIs) yiel ...

Lydia Prieg

... longer partially underwrite such business. Risky investment strategies should only be pursued by small, non-depository institutions, where investors fully understand that their money is not guaranteed. The existence of retail and investment banking under one roof also is facilitating the funnelling ...

... longer partially underwrite such business. Risky investment strategies should only be pursued by small, non-depository institutions, where investors fully understand that their money is not guaranteed. The existence of retail and investment banking under one roof also is facilitating the funnelling ...

Chp 1 notes - the School of Economics and Finance

... A firm that has operating subsidiaries, branches or affiliates located in foreign countries. There are about 60,000 MNCs around the world. • The ownership of some MNCs is so dispersed internationally that they are known as transnational corporations. • The transnationals are usually managed from a g ...

... A firm that has operating subsidiaries, branches or affiliates located in foreign countries. There are about 60,000 MNCs around the world. • The ownership of some MNCs is so dispersed internationally that they are known as transnational corporations. • The transnationals are usually managed from a g ...

Plan Summary - Meteor Asset Management

... ten Shares are equal to or greater than their Opening Levels, at which point the Plan will make a growth payment of 15% for each year it has been in force. ...

... ten Shares are equal to or greater than their Opening Levels, at which point the Plan will make a growth payment of 15% for each year it has been in force. ...

Hiding in Plain Sight

... done so in an era when a significant majority of managers fail to meet their respective benchmarks each year. With such remarkable performance and an easily understood strategy, you might expect that by now the assets managed by Mr. Raub’s firm would have swelled well into the billions and that they ...

... done so in an era when a significant majority of managers fail to meet their respective benchmarks each year. With such remarkable performance and an easily understood strategy, you might expect that by now the assets managed by Mr. Raub’s firm would have swelled well into the billions and that they ...

how does a pooled vehicle deliver better risk

... on how to actively manage the allocations based on traditional fundamental or valuation measures. By pooling assets with others, investors could not only gain better diversification than on their own, but they can access other strategies as well. In addition, actively managing the allocation to spec ...

... on how to actively manage the allocations based on traditional fundamental or valuation measures. By pooling assets with others, investors could not only gain better diversification than on their own, but they can access other strategies as well. In addition, actively managing the allocation to spec ...

Diversification – Too Much of a Good Thing is a Bad Thing

... often mimic an index fund. This is galling as the investment manager is charging a fee ostensibly to construct a unique portfolio and then ends up creating an index fund – at a cost far in excess of what a standard index fund fee is! Another related issue in the portfolio management sphere was broug ...

... often mimic an index fund. This is galling as the investment manager is charging a fee ostensibly to construct a unique portfolio and then ends up creating an index fund – at a cost far in excess of what a standard index fund fee is! Another related issue in the portfolio management sphere was broug ...

Lesson 16 - Mr. Wilson

... Act was seen as a way to modernize the industry and was created to allow commercial banks, investment banks, and insurance companies to offer some of the same services. ...

... Act was seen as a way to modernize the industry and was created to allow commercial banks, investment banks, and insurance companies to offer some of the same services. ...

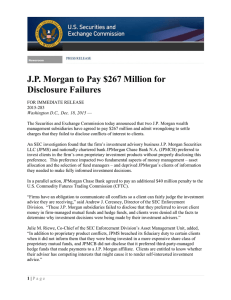

J.P. Morgan to Pay $267 Million for Disclosure Failures

... determine why investment decisions were being made by their investment advisers.” Julie M. Riewe, Co-Chief of the SEC Enforcement Division’s Asset Management Unit, added, “In addition to proprietary product conflicts, JPMS breached its fiduciary duty to certain clients when it did not inform them th ...

... determine why investment decisions were being made by their investment advisers.” Julie M. Riewe, Co-Chief of the SEC Enforcement Division’s Asset Management Unit, added, “In addition to proprietary product conflicts, JPMS breached its fiduciary duty to certain clients when it did not inform them th ...

January 25, 2013 Greetings All: I once again find it hard to believe

... your needs and block out these often incorrect assessments of the future. As we enter the New Year, we enter a new earnings quarter. Alcoa was the first company to release earnings. On Jan 8th it did so and exceeded expectations, but in their press release, their words were more interesting than the ...

... your needs and block out these often incorrect assessments of the future. As we enter the New Year, we enter a new earnings quarter. Alcoa was the first company to release earnings. On Jan 8th it did so and exceeded expectations, but in their press release, their words were more interesting than the ...

Summer Doldrums - RBC Wealth Management

... improving. The bank stress test, believe it a farce or not, went “OK”. Business confidence in Germany is running at a 3-year high in July. The UK GDP numbers beat expectations, as did their retail sales. The BP oil spill news is better. At some point, the huge $15 trillion US economy can reverse cou ...

... improving. The bank stress test, believe it a farce or not, went “OK”. Business confidence in Germany is running at a 3-year high in July. The UK GDP numbers beat expectations, as did their retail sales. The BP oil spill news is better. At some point, the huge $15 trillion US economy can reverse cou ...

India`s Capital Market - Learning Financial Management

... with the goal of earning some expected return. Diversification is essential…reduce the variability of returns A single asset or portfolio of assets is considered to be efficient if no other offers higher expected return with the ...

... with the goal of earning some expected return. Diversification is essential…reduce the variability of returns A single asset or portfolio of assets is considered to be efficient if no other offers higher expected return with the ...

7_Boie, B. - NCCR Trade Regulation

... Third Dimension of Fragmentation: Investment Law v. other Law, such as Human Rights or Environmental Law ...

... Third Dimension of Fragmentation: Investment Law v. other Law, such as Human Rights or Environmental Law ...

US Based Silicon Valley - Department of Information Technology

... US Based Silicon Valley to invest USD 300 million in IT and ESDM sector in Odisha. A team of global IT (information technology) investors led by Ajit Monancha with other member as Prakash Aggarwal, Arif Maskatia and Sanjeev Shriya from Silicon Valley visited the state 10th July 2014 to explore the i ...

... US Based Silicon Valley to invest USD 300 million in IT and ESDM sector in Odisha. A team of global IT (information technology) investors led by Ajit Monancha with other member as Prakash Aggarwal, Arif Maskatia and Sanjeev Shriya from Silicon Valley visited the state 10th July 2014 to explore the i ...