Arbitrage

... “When the threat of litigation represents an inhibiting factor in the policy-makers’ decisions to adopt regulatory measures in the public interest” vs. A tribunal may take into account whether a party made “a specific representation to an investor to induce a covered investment, that created a l ...

... “When the threat of litigation represents an inhibiting factor in the policy-makers’ decisions to adopt regulatory measures in the public interest” vs. A tribunal may take into account whether a party made “a specific representation to an investor to induce a covered investment, that created a l ...

Slides - WordPress.com

... Ability to protect and defend the intellectual property Barriers to entry Growing, large, definable market Awareness of the competitive landscape Rapid growth and ability to scale Clear strategy to execute the route to market Global opportunities & international marketing Identifiable sales ...

... Ability to protect and defend the intellectual property Barriers to entry Growing, large, definable market Awareness of the competitive landscape Rapid growth and ability to scale Clear strategy to execute the route to market Global opportunities & international marketing Identifiable sales ...

Investment Club General Meeting September 7

... decisions such as buy/sell stocks Meet new interesting people who have the same passion for finance and investing as you do Educate you on financial statements such as the balance sheet, income statement, and cash flow statement. Learn different types of securities and ways you can minimize the risk ...

... decisions such as buy/sell stocks Meet new interesting people who have the same passion for finance and investing as you do Educate you on financial statements such as the balance sheet, income statement, and cash flow statement. Learn different types of securities and ways you can minimize the risk ...

I. “Active” Small/Mid Cap US Equity (SMID) Should Play Second

... Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker‐dealer in the United States. This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or ot ...

... Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker‐dealer in the United States. This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or ot ...

Bob Geldof`s private equity firm 8 Miles to make first investment

... vibrant exchanges across frontier economies, going beyond Africa and beyond agriculture, to transform not only commodity markets but also the livelihoods of millions of producers.” 8 Miles reached a $200m first close for its maiden fund in February last year. The fund, which is looking to raise abou ...

... vibrant exchanges across frontier economies, going beyond Africa and beyond agriculture, to transform not only commodity markets but also the livelihoods of millions of producers.” 8 Miles reached a $200m first close for its maiden fund in February last year. The fund, which is looking to raise abou ...

Your global investment challenges answered

... Investment management products and services are offered to a broad range of clients around the world including: corporate and public pension plans; supranationals; endowments, municipalities and charities; insurance companies; wholesale intermediaries; financial institutions; and private clients. We ...

... Investment management products and services are offered to a broad range of clients around the world including: corporate and public pension plans; supranationals; endowments, municipalities and charities; insurance companies; wholesale intermediaries; financial institutions; and private clients. We ...

located in Boston, is seeking an Execut

... The Commonwealth of Massachusetts Pension Reserves Investment Management Board (PRIM), located in Boston, is seeking a Chief Operating Officer/Chief Financial Officer. The position is responsible for managing PRIM’s general operating activities including: financial accounting and reporting, investme ...

... The Commonwealth of Massachusetts Pension Reserves Investment Management Board (PRIM), located in Boston, is seeking a Chief Operating Officer/Chief Financial Officer. The position is responsible for managing PRIM’s general operating activities including: financial accounting and reporting, investme ...

Finance - Aberdeenshire Council

... while but it was not sufficiently weak to force the Bank of England to cut interest rates until 8 October 2008. It was the strength of the banking crisis, pre-empted by the collapse of Lehmans Bank in New York that eventually drove the interest cut of 0.5% on October 8 in conjunction with the Federa ...

... while but it was not sufficiently weak to force the Bank of England to cut interest rates until 8 October 2008. It was the strength of the banking crisis, pre-empted by the collapse of Lehmans Bank in New York that eventually drove the interest cut of 0.5% on October 8 in conjunction with the Federa ...

global fixed income core plus bond

... securities (MBS) and asset-backed securities (ABS). By leveraging the expertise of Principal Real Estate Investors, we are also able to offer expertise managing commercial mortgage-backed securities (CMBS). ...

... securities (MBS) and asset-backed securities (ABS). By leveraging the expertise of Principal Real Estate Investors, we are also able to offer expertise managing commercial mortgage-backed securities (CMBS). ...

is buying a home in today`s economy a good idea

... Here are a few examples of why, dollar for dollar, homeownership is a solid stepping stone to a future of financial security and the single largest creator of wealth for many Americans. Over the long-term real estate has consistently appreciated, even through periodic adjustments in local markets in ...

... Here are a few examples of why, dollar for dollar, homeownership is a solid stepping stone to a future of financial security and the single largest creator of wealth for many Americans. Over the long-term real estate has consistently appreciated, even through periodic adjustments in local markets in ...

Europe under Threat: The Political Dynamics of Brexit

... The efficient functioning of equity markets is especially important given the decline in the number of companies going public (IPOs) and the increase in de-listings, resulting in fewer companies being listed in Europe. Moreover, liquidity in capital markets has been declining and systemic risk incre ...

... The efficient functioning of equity markets is especially important given the decline in the number of companies going public (IPOs) and the increase in de-listings, resulting in fewer companies being listed in Europe. Moreover, liquidity in capital markets has been declining and systemic risk incre ...

Pre-Appointment Forms - GCSB Investment Center

... 2. Current balances of any Retirement Accounts which are specifically earmarked for retirement including IRAs, 401Ks, brokerage statements, mutual funds, stocks, variable annuities, fixed annuity contracts, etc. Also make sure to include cash on hand and/or emergency fund balances. 3. Most recent co ...

... 2. Current balances of any Retirement Accounts which are specifically earmarked for retirement including IRAs, 401Ks, brokerage statements, mutual funds, stocks, variable annuities, fixed annuity contracts, etc. Also make sure to include cash on hand and/or emergency fund balances. 3. Most recent co ...

SECONDARY MARKET FIRMS The following companies buy and

... SECONDARY MARKET FIRMS The following companies buy and sell ownership interests in non-listed REITs, limited partnerships, LLCs and other direct investment programs in the informal Secondary Market. Certain of these firms deal only with licensed securities brokers and therefore do not transact busin ...

... SECONDARY MARKET FIRMS The following companies buy and sell ownership interests in non-listed REITs, limited partnerships, LLCs and other direct investment programs in the informal Secondary Market. Certain of these firms deal only with licensed securities brokers and therefore do not transact busin ...

Unauthorized/Illegal Foreign Exchange Trading Activities

... foreign exchange, depositing an initial investment in Sri Lanka rupees with a company, proprietorship concern or individual in Sri Lanka to be transferred later into an online account or, payment through credit, debit or any other electronic funds transfer card direct to an online account opened in ...

... foreign exchange, depositing an initial investment in Sri Lanka rupees with a company, proprietorship concern or individual in Sri Lanka to be transferred later into an online account or, payment through credit, debit or any other electronic funds transfer card direct to an online account opened in ...

relative return strategies classic portfolio

... The Classic Portfolio offers you three different investment profiles; Conservative, Balanced and Dynamic. Your investment profile will be dependent upon your individual risk tolerance. The Classic Portfolio diversifies your portfolio across asset classes according to the investment strategy of Lloyd ...

... The Classic Portfolio offers you three different investment profiles; Conservative, Balanced and Dynamic. Your investment profile will be dependent upon your individual risk tolerance. The Classic Portfolio diversifies your portfolio across asset classes according to the investment strategy of Lloyd ...

PDF - 50 South Capital

... Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Comparisons to indices are for illustrative purposes only as they are widely used performance benchmarks. Returns of indices assume the ...

... Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Comparisons to indices are for illustrative purposes only as they are widely used performance benchmarks. Returns of indices assume the ...

Comment on

... for raising the return on equity, regardless of risk. In the beginning, the tax regime had no effect on the structure of finance. At the end, it strongly rewarded increases in leverage. In the beginning creditors knew they could lose their money. At the end, creditors had good reason to expect they ...

... for raising the return on equity, regardless of risk. In the beginning, the tax regime had no effect on the structure of finance. At the end, it strongly rewarded increases in leverage. In the beginning creditors knew they could lose their money. At the end, creditors had good reason to expect they ...

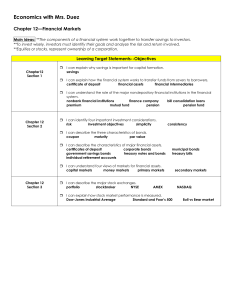

government - Humble ISD

... Main Ideas: **The components of a financial system work together to transfer savings to investors. **To invest wisely, investors must identify their goals and analyze the risk and return involved. **Equities or stocks, represent ownership of a corporation. ...

... Main Ideas: **The components of a financial system work together to transfer savings to investors. **To invest wisely, investors must identify their goals and analyze the risk and return involved. **Equities or stocks, represent ownership of a corporation. ...

UNCLE Credit Union Launches New Wealth Management Center

... May 12, 2014, Livermore, CA—UNCLE Credit Union announced today that its investment services unit launched last summer—UNCLE Investment Services—in partnership with CUSO Financial Services, L.P. (CFS), has introduced a new online integrated financial planning tool, UNCLE’s Wealth Management Center ...

... May 12, 2014, Livermore, CA—UNCLE Credit Union announced today that its investment services unit launched last summer—UNCLE Investment Services—in partnership with CUSO Financial Services, L.P. (CFS), has introduced a new online integrated financial planning tool, UNCLE’s Wealth Management Center ...

Raaj Rohan Reddy Pasunoor

... to extract their investment holdings in various structured products along with tenor and counterparty. The tool identified 140 new custom indices ($3.4B notional) offered in the market, and provided a view of competitive landscape and the right time to target firms based on the tenor. The analysis w ...

... to extract their investment holdings in various structured products along with tenor and counterparty. The tool identified 140 new custom indices ($3.4B notional) offered in the market, and provided a view of competitive landscape and the right time to target firms based on the tenor. The analysis w ...

Mutual Funds - McDonaldMath

... Mutual Funds (cont.) -generally require a minimum of $1000 investment -your return is a share of the dividends and/or capital gains/losses -Purchase through brokerage such as Merrill Lynch, TD Waterhouse ...

... Mutual Funds (cont.) -generally require a minimum of $1000 investment -your return is a share of the dividends and/or capital gains/losses -Purchase through brokerage such as Merrill Lynch, TD Waterhouse ...

[agency] identifies top investor traps

... [DATELINE] – The [AGENCY] today released its annual list of traps that cautious investors should avoid when seeking to jump-start their investment portfolios as the impact of the financial crisis and increased market volatility continue to reverberate along Main Street. [ADMINISTRATOR] said investor ...

... [DATELINE] – The [AGENCY] today released its annual list of traps that cautious investors should avoid when seeking to jump-start their investment portfolios as the impact of the financial crisis and increased market volatility continue to reverberate along Main Street. [ADMINISTRATOR] said investor ...

Russia: The Impact -- and Lack Thereof -

... that $28 billion -- roughly $6 billion -- is what can be considered true investment originating at foreign firms. Nearly all of this is European money. More than a third -- nearly $10 billion -- is flat out from haven states such as the British Virgin Islands, Luxembourg or Cyprus and represents Rus ...

... that $28 billion -- roughly $6 billion -- is what can be considered true investment originating at foreign firms. Nearly all of this is European money. More than a third -- nearly $10 billion -- is flat out from haven states such as the British Virgin Islands, Luxembourg or Cyprus and represents Rus ...

On Profiling the Superior IT Portfolio Characteristics

... How is it possible to derive the superior IT investment portfolio? One main identified research objective in IT portfolio management (ITPM) is to manage a set of IT assets, similar to manage a financial portfolio to attain the superior return and risk. Among various IT assets, the investment in IT p ...

... How is it possible to derive the superior IT investment portfolio? One main identified research objective in IT portfolio management (ITPM) is to manage a set of IT assets, similar to manage a financial portfolio to attain the superior return and risk. Among various IT assets, the investment in IT p ...

![[agency] identifies top investor traps](http://s1.studyres.com/store/data/009232037_1-ce9ec19a7a045cfd66fc60aafc639f57-300x300.png)