NAV | USD 10.0716 (As of 29-Sep-15)

... Fund Objective & Strategy : The objective of the fund is to generate competitive shari’a compliant returns by increasing its Net Asset Value, while maintaining a high level of liquidity. The fund will pursue its investment objective by investing in short and medium term Islamic money market instrume ...

... Fund Objective & Strategy : The objective of the fund is to generate competitive shari’a compliant returns by increasing its Net Asset Value, while maintaining a high level of liquidity. The fund will pursue its investment objective by investing in short and medium term Islamic money market instrume ...

InfrasoftTech featured in Gartner`s Market Guide for Islamic Core

... delivering projects according to three different types: ■ Conversion. In some countries, banks have been converted from conventional operations to full-fledged Islamic operations. ■ Greenfield. Greenfield projects involve new banks setting up operations in this specific environment. An iCBS provider ...

... delivering projects according to three different types: ■ Conversion. In some countries, banks have been converted from conventional operations to full-fledged Islamic operations. ■ Greenfield. Greenfield projects involve new banks setting up operations in this specific environment. An iCBS provider ...

Qualified Default Investment Alternatives

... charge or a liquidation, exchange or redemption fee. After the 90-day period, the normal restrictions, fees and expenses of the plan will also apply to a QDIA. For those plan sponsors who chose stable value products as the plan’s default investment prior to December 24, 2007, these arrangements are ...

... charge or a liquidation, exchange or redemption fee. After the 90-day period, the normal restrictions, fees and expenses of the plan will also apply to a QDIA. For those plan sponsors who chose stable value products as the plan’s default investment prior to December 24, 2007, these arrangements are ...

Econ-Growth-for-Development

... • Gov’ts or firms may borrow from other countries or aid agencies – pay back interest from future growth Investment must be balanced between human, physical, and technological resources ...

... • Gov’ts or firms may borrow from other countries or aid agencies – pay back interest from future growth Investment must be balanced between human, physical, and technological resources ...

Investment Incentives

... machinery and equipment necessary for their investment projects through their supplier’s credit. ...

... machinery and equipment necessary for their investment projects through their supplier’s credit. ...

investment report - Brenthurst Wealth Management

... Newspapers are full of adverts offering substantially higher interest rates. One hotelbuilding scheme in the Cape, which I have personally investigated, is offering rates up to 18% per annum, more than double the going rate elsewhere in the market place. This alone should serve as a warning to poten ...

... Newspapers are full of adverts offering substantially higher interest rates. One hotelbuilding scheme in the Cape, which I have personally investigated, is offering rates up to 18% per annum, more than double the going rate elsewhere in the market place. This alone should serve as a warning to poten ...

Exari`s Investment Banking Solution

... In the wake of recent turmoil in the financial markets, the Dodd- Frank Wall Street Reform and Consumer Protection Act and re- cent FSA regulations, institutions that trade in complex financial products are looking for ways to document and manage the high risks inherent in the business. The 2008 glo ...

... In the wake of recent turmoil in the financial markets, the Dodd- Frank Wall Street Reform and Consumer Protection Act and re- cent FSA regulations, institutions that trade in complex financial products are looking for ways to document and manage the high risks inherent in the business. The 2008 glo ...

Approved Instruments, Methods and Techniques

... Approved Methods and Techniques The range of approved methods to be used in the process of treasury management shall include trained internal staff resources and advice from authorised consultants, brokers and bankers. Internal staff resources will maintain relevant skills through appropriate traini ...

... Approved Methods and Techniques The range of approved methods to be used in the process of treasury management shall include trained internal staff resources and advice from authorised consultants, brokers and bankers. Internal staff resources will maintain relevant skills through appropriate traini ...

Norma Nisbet - Vista Properties and Investment

... investment products to clients. Services include, buyer-seller representation, landlord-tenant representation with specialization in land, and development, site acquisition. The spectrum of brokerage services may include retail, industrial, mixed use development projects. and commercial investments, ...

... investment products to clients. Services include, buyer-seller representation, landlord-tenant representation with specialization in land, and development, site acquisition. The spectrum of brokerage services may include retail, industrial, mixed use development projects. and commercial investments, ...

BridgeValley Community and Technical College Financial Aid Office

... you live in), trust funds, UMGA and UTMA accounts, money market funds, mutual funds, certificates of deposit, stocks, stock options, bonds and other securities. Coverdell savings accounts, 529 college savings plans, the refund value of 529 state prepaid tuition plans, installment and land sale contr ...

... you live in), trust funds, UMGA and UTMA accounts, money market funds, mutual funds, certificates of deposit, stocks, stock options, bonds and other securities. Coverdell savings accounts, 529 college savings plans, the refund value of 529 state prepaid tuition plans, installment and land sale contr ...

'Clear and Present Challenges to the Chinese Economy' (pdf)

... now explicit quotas allocated to different regions • Firms must also show profits in 3 consecutive years, among other financial requirements • Initial purpose of setting up stock market was to help privatization of SOEs • Firms with connections to regulators are more likely to be listed ...

... now explicit quotas allocated to different regions • Firms must also show profits in 3 consecutive years, among other financial requirements • Initial purpose of setting up stock market was to help privatization of SOEs • Firms with connections to regulators are more likely to be listed ...

The City of Neenah Municipal Museum Fund

... Foreign equities are allowable to the extent they are in a well-diversified foreign equity fund and represent a range of 5% to 15% of total equities. Should the equity exposure exceed the maximum limitation at the end of any quarter, the equity exposure will be reviewed and reduced where appropriat ...

... Foreign equities are allowable to the extent they are in a well-diversified foreign equity fund and represent a range of 5% to 15% of total equities. Should the equity exposure exceed the maximum limitation at the end of any quarter, the equity exposure will be reviewed and reduced where appropriat ...

deep value fund

... that losses may exceed the original amount invested. The fund may invest in derivatives which can be volatile and involve various types and degrees of risks, and, depending upon the characteristics of a particular derivative, suddenly can become illiquid. Options may be more volatile than investment ...

... that losses may exceed the original amount invested. The fund may invest in derivatives which can be volatile and involve various types and degrees of risks, and, depending upon the characteristics of a particular derivative, suddenly can become illiquid. Options may be more volatile than investment ...

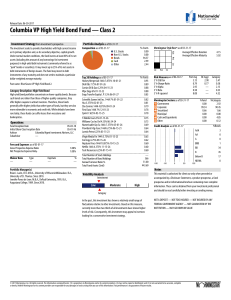

Columbia VP High Yield Bond Fund — Class 2

... Columbia VP High Yield Bond Fund — Class 2 Investment Strategy from investment’s prospectus The investment seeks to provide shareholders with high current income as its primary objective and, as its secondary objective, capital growth. Under normal market conditions, the fund invests at least 80% of ...

... Columbia VP High Yield Bond Fund — Class 2 Investment Strategy from investment’s prospectus The investment seeks to provide shareholders with high current income as its primary objective and, as its secondary objective, capital growth. Under normal market conditions, the fund invests at least 80% of ...

Investment climate and opportunities for investment in the

... – 100% FI to be allowed for large capital investments – Automatic approval for FI – Streamlining the royalty regime to remove current inconsistencies – Tax holiday for investments based outside greater Male region to foster regional development – Tax holidays and import duty exemptions for investmen ...

... – 100% FI to be allowed for large capital investments – Automatic approval for FI – Streamlining the royalty regime to remove current inconsistencies – Tax holiday for investments based outside greater Male region to foster regional development – Tax holidays and import duty exemptions for investmen ...

non-discretionary portfolio - Alternative Capital Partners

... This portfolio provides an investment strategy that emphasizes capital growth over the medium and long term. The portfolio takes advantage of investment opportunities in alternative asset classes as well as more volatile traditional asset classes. These assets classes provide opportunities for reali ...

... This portfolio provides an investment strategy that emphasizes capital growth over the medium and long term. The portfolio takes advantage of investment opportunities in alternative asset classes as well as more volatile traditional asset classes. These assets classes provide opportunities for reali ...

Somendra Sarwal

... & business strategies Experienced finance professional in Corporate and Institutional Banking domain in various capacities in India. Initial years were focused on ground level exposure to banking operations, products and mid & large corporate clients. This was followed by exposure to credit risk & ...

... & business strategies Experienced finance professional in Corporate and Institutional Banking domain in various capacities in India. Initial years were focused on ground level exposure to banking operations, products and mid & large corporate clients. This was followed by exposure to credit risk & ...

UK current account

... (a) The UK NIIP measures the difference between the United Kingdom’s external assets and external liabilities. Data are non seasonally adjusted. (b) Estimates of the United Kingdom’s NIIP are uncertain. The estimate published by the ONS does not incorporate revaluation effects on the foreign direct ...

... (a) The UK NIIP measures the difference between the United Kingdom’s external assets and external liabilities. Data are non seasonally adjusted. (b) Estimates of the United Kingdom’s NIIP are uncertain. The estimate published by the ONS does not incorporate revaluation effects on the foreign direct ...

Be Careful of What You Think You Know

... or distributed to any person other than to professional investors (as permitted by local regulations) and should not be relied upon or distributed to persons where such reliance or distribution would be contrary to local regulation. Issued in Hong Kong by MFS International (Hong Kong) Limited (“MIL ...

... or distributed to any person other than to professional investors (as permitted by local regulations) and should not be relied upon or distributed to persons where such reliance or distribution would be contrary to local regulation. Issued in Hong Kong by MFS International (Hong Kong) Limited (“MIL ...

Download attachment

... But countries with no exchange controls showed “huge” home bias in the allocation of their assets, with only 25%-35% of their portfolios invested offshore, so the question was whether exchange controls played any role at all in the decision to invest offshore, said Totaram. Much of the evidence, tak ...

... But countries with no exchange controls showed “huge” home bias in the allocation of their assets, with only 25%-35% of their portfolios invested offshore, so the question was whether exchange controls played any role at all in the decision to invest offshore, said Totaram. Much of the evidence, tak ...

DTZ investment market update

... Magali Marton continued: “Looking forward, uncertainty surrounding the European sovereign debt crisis and weak economic growth is likely to impact investor sentiment. Furthermore, the impact of banks deleveraging is yet to be seen in the CEE countries. For the time being, local banks have proven to ...

... Magali Marton continued: “Looking forward, uncertainty surrounding the European sovereign debt crisis and weak economic growth is likely to impact investor sentiment. Furthermore, the impact of banks deleveraging is yet to be seen in the CEE countries. For the time being, local banks have proven to ...

In the years after the Second World War global FDI was dominated

... In the US, in the late 1960s and early 1970s, outward investment became increasingly politicized. Organized labor, convinced that investment abroad exported jobs, undertook a major campaign to reform the tax provisions which affected foreign direct investment. The Foreign Trade and Investment Act of ...

... In the US, in the late 1960s and early 1970s, outward investment became increasingly politicized. Organized labor, convinced that investment abroad exported jobs, undertook a major campaign to reform the tax provisions which affected foreign direct investment. The Foreign Trade and Investment Act of ...

Compensation Structure Response

... Brandes views compensation differently than many others asset managers do. Since our goal is to incentivize Analysts to produce consistent high-quality company research that is unbiased and objective, compensation is not tied directly to asset levels or the number of covered companies in the portfol ...

... Brandes views compensation differently than many others asset managers do. Since our goal is to incentivize Analysts to produce consistent high-quality company research that is unbiased and objective, compensation is not tied directly to asset levels or the number of covered companies in the portfol ...

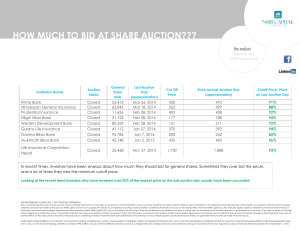

How Much to Bid in Share Auctions

... without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect ...

... without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect ...