Information and Registration

... The World Investment Report 2010 presents the latest data on foreign direct investment (FDI) around the world. It also traces global and regional trends in investment and international production by transnational corporations (TNCs). This year’s World Investment Report puts a special focus on climat ...

... The World Investment Report 2010 presents the latest data on foreign direct investment (FDI) around the world. It also traces global and regional trends in investment and international production by transnational corporations (TNCs). This year’s World Investment Report puts a special focus on climat ...

Investment Management Policy

... Month-wise disbursement plan for partner organizations (PO) has to be prepared at the beginning of each year. The plan has to be checked each month to find out the variation. The monthly variations of the actual to be the plan to be adjusted in the flexible manner. Month-wise repayment schedule ...

... Month-wise disbursement plan for partner organizations (PO) has to be prepared at the beginning of each year. The plan has to be checked each month to find out the variation. The monthly variations of the actual to be the plan to be adjusted in the flexible manner. Month-wise repayment schedule ...

eFront for Alternative Investments

... serve more than 300 customers in 38 countries, including companies in the private equity, real estate investment, banking and insurance sectors. eFront’s primary product suites, FrontInvest™, FrontAnalytics™, Pevara, FrontCRM™ and FrontERM™, offer tightly integrated solutions for streamlining the ma ...

... serve more than 300 customers in 38 countries, including companies in the private equity, real estate investment, banking and insurance sectors. eFront’s primary product suites, FrontInvest™, FrontAnalytics™, Pevara, FrontCRM™ and FrontERM™, offer tightly integrated solutions for streamlining the ma ...

Ending Too-Big-To Fail - The Independent Community Bankers of

... deserve to be jailed – are effectively immune from prosecution. As if we did not have incentive enough already to end the dominance of too-big-to-fail institutions. The Attorney General’s statement reveals a new, appalling aspect of the problem. As a result of the financial crisis of 2008, our natio ...

... deserve to be jailed – are effectively immune from prosecution. As if we did not have incentive enough already to end the dominance of too-big-to-fail institutions. The Attorney General’s statement reveals a new, appalling aspect of the problem. As a result of the financial crisis of 2008, our natio ...

FCF New York Life Anchor IV

... the figures shown. Investment return and principal value will fluctuate so that upon redemption, shares may be worth more or less than their original cost. Performance data does not reflect deduction of redemption fee, which, if such fee exists, would lower performance. For current to the most recen ...

... the figures shown. Investment return and principal value will fluctuate so that upon redemption, shares may be worth more or less than their original cost. Performance data does not reflect deduction of redemption fee, which, if such fee exists, would lower performance. For current to the most recen ...

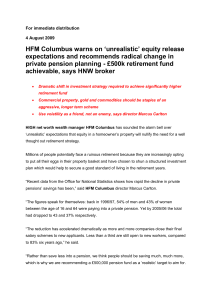

For immediate distribution 4 August 2009 HFM Columbus warns on

... “Investing regularly each month – in other words, adopting a pound cost averaging strategy means that some months the investor will buy cheaper shares, and other months more expensive shares. Overall, however, the cost of the investment is averaged, and timing – which has caught out so many shorter ...

... “Investing regularly each month – in other words, adopting a pound cost averaging strategy means that some months the investor will buy cheaper shares, and other months more expensive shares. Overall, however, the cost of the investment is averaged, and timing – which has caught out so many shorter ...

Increasing EU industries, challenges and opportunities

... Complete banking union Right balance on prudential regulation Attractive tax environment – no FTT Use public funds to leverage private – EIB Alternative financing routes ...

... Complete banking union Right balance on prudential regulation Attractive tax environment – no FTT Use public funds to leverage private – EIB Alternative financing routes ...

Title Use sentence case

... Following the 2007-2008 financial crisis large banks were imposed with capital regulations that forced them have stricter loan requirements. Many of the “regular” citizens of the world were squeezed out of receiving once traditional loans. With the gap between banks and borrowers closing, LendingClu ...

... Following the 2007-2008 financial crisis large banks were imposed with capital regulations that forced them have stricter loan requirements. Many of the “regular” citizens of the world were squeezed out of receiving once traditional loans. With the gap between banks and borrowers closing, LendingClu ...

Test Presentation Line 2

... Epworth range of funds • Common Investment and Common Deposit Funds ◦ Affirmative Equity Fund ◦ Affirmative Fixed Interest Fund ◦ Affirmative Corporate Bond Fund ◦ Affirmative Deposit Fund • UCITS Umbrella Unit Trust Scheme ◦ Epworth UK Equity Fund ◦ Epworth European Fund ...

... Epworth range of funds • Common Investment and Common Deposit Funds ◦ Affirmative Equity Fund ◦ Affirmative Fixed Interest Fund ◦ Affirmative Corporate Bond Fund ◦ Affirmative Deposit Fund • UCITS Umbrella Unit Trust Scheme ◦ Epworth UK Equity Fund ◦ Epworth European Fund ...

MFIN5600 Practice questions Chapter 1 1. Characterize each of the

... U.S technology company with a traditional defined-benefit pension plan. Because of LSC’s young workforce, Donovan believes the pension plan has no liquidity needs and can thus invest aggressively to maximize returns. He also believes that U.S. Treasury bills and bonds, yielding 5.4% and 6.1%, respec ...

... U.S technology company with a traditional defined-benefit pension plan. Because of LSC’s young workforce, Donovan believes the pension plan has no liquidity needs and can thus invest aggressively to maximize returns. He also believes that U.S. Treasury bills and bonds, yielding 5.4% and 6.1%, respec ...

Cash Flow Capital Preservation Moderate Growth Wealth Building

... Through a balancing process of the potential risk return trade-off, the portfolio objectives can be achieved. All investment strategies used to achieve the objectives must focus on these two important portfolio elements. “Risk & Return.” ...

... Through a balancing process of the potential risk return trade-off, the portfolio objectives can be achieved. All investment strategies used to achieve the objectives must focus on these two important portfolio elements. “Risk & Return.” ...

Title: INVESTMENTS Policy No. 102

... Obligations of foreign governments, including their respective agencies, which have an “Investment Grade” credit rating as rated by any major bond rating agency; ...

... Obligations of foreign governments, including their respective agencies, which have an “Investment Grade” credit rating as rated by any major bond rating agency; ...

08-01-Cotula-271_ppt

... Aggregate scale of agribusiness plantation deals smaller than originally thought – but significant increase, often geographically concentrated Concomitant pressures from investments in other sectors, including petroleum, mining and forestry Eg investment in metals exploration increased ten-fold in 2 ...

... Aggregate scale of agribusiness plantation deals smaller than originally thought – but significant increase, often geographically concentrated Concomitant pressures from investments in other sectors, including petroleum, mining and forestry Eg investment in metals exploration increased ten-fold in 2 ...

• Always deal with the market intermediaries registered with SEBI

... Before placing an order with the market intermediaries, please check about the credentials of the companies, its management, fundamentals and recent announcements made by them and various other disclosures made under various regulations. The sources of information are the websites of Exchanges and c ...

... Before placing an order with the market intermediaries, please check about the credentials of the companies, its management, fundamentals and recent announcements made by them and various other disclosures made under various regulations. The sources of information are the websites of Exchanges and c ...

Infrastructure holds Europe`s untapped potential

... It’s only in the very recent past that economic growth has come back into focus. That largely explains the public side, but private investment has also dropped sharply since the recession. German companies, for instance, have doubled their retained cash in the past decade, and others have followed s ...

... It’s only in the very recent past that economic growth has come back into focus. That largely explains the public side, but private investment has also dropped sharply since the recession. German companies, for instance, have doubled their retained cash in the past decade, and others have followed s ...

The Importance of Risk Adjusted Returns

... Important notes - please read: The past is not an indication to future performance. The value of investments and any income they produce can go down as well as up and you may not get back the full amount invested. The stockmarket should not be considered as a suitable place for short-term investment ...

... Important notes - please read: The past is not an indication to future performance. The value of investments and any income they produce can go down as well as up and you may not get back the full amount invested. The stockmarket should not be considered as a suitable place for short-term investment ...

International Financial Risk, Investment and Growth in Nigeria:

... researchers adopted the vector autoregression (VAR) approach method taking into consideration macroeconomic variables such as exchange rate volatility which was used to represent international financial risk. Investment is captured by gross capital formation and real GDP growth in order to determine ...

... researchers adopted the vector autoregression (VAR) approach method taking into consideration macroeconomic variables such as exchange rate volatility which was used to represent international financial risk. Investment is captured by gross capital formation and real GDP growth in order to determine ...

Investment Climate for Financial Sector Investment

... • Not a seasoned economist like most you but matters of the economy should interest all… • Need to focus not merely on difficulties but also on opportunities • Financial Domain – Short & Long-term Markets. ...

... • Not a seasoned economist like most you but matters of the economy should interest all… • Need to focus not merely on difficulties but also on opportunities • Financial Domain – Short & Long-term Markets. ...

FSI Statement on Introduction of Senate Regulatory Reform

... stakeholders in this debate, but most importantly the interests of small investors, are carefully considered before final rules are implemented,” said Dale E. Brown, President & CEO of FSI. “As the delivery of financial advice, products and services has evolved in the seven decades since Congress fi ...

... stakeholders in this debate, but most importantly the interests of small investors, are carefully considered before final rules are implemented,” said Dale E. Brown, President & CEO of FSI. “As the delivery of financial advice, products and services has evolved in the seven decades since Congress fi ...

Financial Assets

... If the price of a share increases by 60% in year 1 and decreases by 50% the following year I am flat/losing/gaining? Show calc ...

... If the price of a share increases by 60% in year 1 and decreases by 50% the following year I am flat/losing/gaining? Show calc ...

Now - Wellington Consulting Group

... While 42% of Wealth Managers believe that a mix of digital and offline communicating is ideal, only 17% of high net worth clients (HNW) say technology is essential, but 48% rate cyber risk and hacking as a top concern. At the same time, a significant number (42%) of wealth managers surveyed believe ...

... While 42% of Wealth Managers believe that a mix of digital and offline communicating is ideal, only 17% of high net worth clients (HNW) say technology is essential, but 48% rate cyber risk and hacking as a top concern. At the same time, a significant number (42%) of wealth managers surveyed believe ...

Steward Balanced Strategy

... $2 billion) and larger company stocks (large cap). Small cap investments are subject to considerable price fluctuations and are more volatile than large cap stocks. Investors should consider the additional risks involved in small cap investments. Large capitalization (large cap) investments involve ...

... $2 billion) and larger company stocks (large cap). Small cap investments are subject to considerable price fluctuations and are more volatile than large cap stocks. Investors should consider the additional risks involved in small cap investments. Large capitalization (large cap) investments involve ...

Western Balkans Investment Framework (WBIF) – Call for Projects

... WBIF was established with the aim of coordination, preparation and financing of investment projects by the European Commission through funding from the Multi-IPA and the International Financial Institutions (IFIs) within the candidate countries and potential candidates. It was founded by the Europea ...

... WBIF was established with the aim of coordination, preparation and financing of investment projects by the European Commission through funding from the Multi-IPA and the International Financial Institutions (IFIs) within the candidate countries and potential candidates. It was founded by the Europea ...

Dear All, The Commissione Nazionale per le Società e la Borsa

... Dear All, The Commissione Nazionale per le Società e la Borsa (CONSOB) reports that the companies: ...

... Dear All, The Commissione Nazionale per le Società e la Borsa (CONSOB) reports that the companies: ...