Asset Valuation Policy

... change an asset’s or group of assets’ value. The resulting valuation(s) will be used to adjust the carrying value of the asset(s) if STC’s Board, Investment Committee, Risk, Audit and Compliance Committee or management determines the revised amount is an appropriate estimate of arm’s length value. A ...

... change an asset’s or group of assets’ value. The resulting valuation(s) will be used to adjust the carrying value of the asset(s) if STC’s Board, Investment Committee, Risk, Audit and Compliance Committee or management determines the revised amount is an appropriate estimate of arm’s length value. A ...

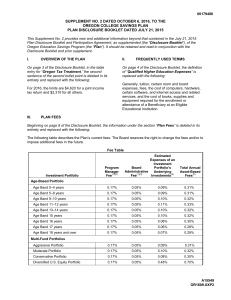

Disclosure Booklet - Oregon College Savings Plan

... Environmental, Social, Governance Criteria Risk: The risk that because a mutual fund’s environmental, social, or governance criteria exclude securities of certain issuers for nonfinancial reasons, the fund may forgo some market opportunities available to funds that don’t use such criteria. On page 2 ...

... Environmental, Social, Governance Criteria Risk: The risk that because a mutual fund’s environmental, social, or governance criteria exclude securities of certain issuers for nonfinancial reasons, the fund may forgo some market opportunities available to funds that don’t use such criteria. On page 2 ...

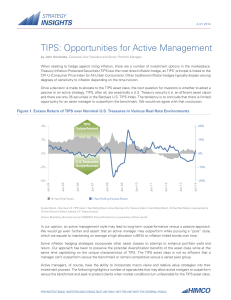

TIPS: Opportunities for Active Management

... When seeking to hedge against rising inflation, there are a number of investment options in the marketplace. Treasury Inflation-Protected Securities (TIPS) are the most direct inflation hedge, as TIPS’ principal is linked to the CPI-U (Consumer Price Index for All Urban Consumers). Other traditional ...

... When seeking to hedge against rising inflation, there are a number of investment options in the marketplace. Treasury Inflation-Protected Securities (TIPS) are the most direct inflation hedge, as TIPS’ principal is linked to the CPI-U (Consumer Price Index for All Urban Consumers). Other traditional ...

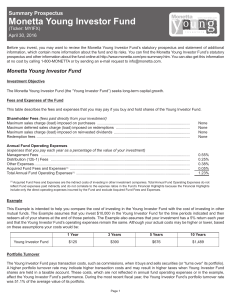

Monetta Young Investor Fund

... broad-based market indices that primarily include stocks of large capitalization U.S. companies. The balance of the Fund is directly invested in common stocks of companies of all market capitalization ranges and is diversified among industries and market sectors. However, the Adviser will primarily ...

... broad-based market indices that primarily include stocks of large capitalization U.S. companies. The balance of the Fund is directly invested in common stocks of companies of all market capitalization ranges and is diversified among industries and market sectors. However, the Adviser will primarily ...

Proxy Advisory Business: Apotheosis or Apogee?

... The proxy advisory firms are a critical part of the process of establishing corporate governance best practices and standards within the corporate governance community. Their adoption of new “best” practices as part of their voting policies validates the practice as being truly “best,” and gives the ...

... The proxy advisory firms are a critical part of the process of establishing corporate governance best practices and standards within the corporate governance community. Their adoption of new “best” practices as part of their voting policies validates the practice as being truly “best,” and gives the ...

Lida furniture factory

... Reception +375 154 534003 Economy department +375 154 534010 e-mail: office@mail.lida.by ...

... Reception +375 154 534003 Economy department +375 154 534010 e-mail: office@mail.lida.by ...

SAST - VCP Value Portfolio Summary Prospectus

... earlier than expected. This may happen when there is a decline in interest rates. Under these circumstances, the Portfolio may be unable to recoup all of its initial investment and will also suffer from having to reinvest in lower-yielding securities. Convertible Securities Risk. The value of conver ...

... earlier than expected. This may happen when there is a decline in interest rates. Under these circumstances, the Portfolio may be unable to recoup all of its initial investment and will also suffer from having to reinvest in lower-yielding securities. Convertible Securities Risk. The value of conver ...

Private Sector Investment Survey (PSIS) 2010

... Investment Authority. The survey also incorporated the requirements for the International Monetary Fund’s (IMF) Coordinated Direct Investment Survey (CDIS) whose main aim was to generate a comprehensive and harmonized investment position statement by country to assist with improving the quality of d ...

... Investment Authority. The survey also incorporated the requirements for the International Monetary Fund’s (IMF) Coordinated Direct Investment Survey (CDIS) whose main aim was to generate a comprehensive and harmonized investment position statement by country to assist with improving the quality of d ...

International Accounting Standard 28 Investments in Associates and

... The following terms are used in this Standard with the meanings specified: An associate is an entity over which the investor has significant influence. Consolidated financial statements are the financial statements of a group in which assets, liabilities, equity, income, expenses and cash flows of t ...

... The following terms are used in this Standard with the meanings specified: An associate is an entity over which the investor has significant influence. Consolidated financial statements are the financial statements of a group in which assets, liabilities, equity, income, expenses and cash flows of t ...

NATIONAL ASSEMBLY SOCIALIST REPUBLIC OF VIETNAM

... 2. Take initiative in To advertiseing and marketing their products and services and directly enter into advertising contracts with those organizations permitted to provide advertising services on a non-discriminatory basis. Article 16. Right to buy foreign currencies 1. Investors may purchase foreig ...

... 2. Take initiative in To advertiseing and marketing their products and services and directly enter into advertising contracts with those organizations permitted to provide advertising services on a non-discriminatory basis. Article 16. Right to buy foreign currencies 1. Investors may purchase foreig ...

Consumer finance companies

... Types of finance companies Sources of finance company funds Uses of finance company funds Regulation of finance companies Risks faced by finance companies Captive finance subsidiaries Valuation of a finance company Interaction with other financial institutions Participation in financial markets Mult ...

... Types of finance companies Sources of finance company funds Uses of finance company funds Regulation of finance companies Risks faced by finance companies Captive finance subsidiaries Valuation of a finance company Interaction with other financial institutions Participation in financial markets Mult ...

SunAmerica Dynamic Allocation Portfolio Summary

... 80% of its assets to Underlying Portfolios investing primarily in equity securities and 20% to 50% of its assets to Underlying Portfolios investing primarily in fixed income securities and short-term investments, which may include mortgage- and asset-backed securities, to seek capital appreciation a ...

... 80% of its assets to Underlying Portfolios investing primarily in equity securities and 20% to 50% of its assets to Underlying Portfolios investing primarily in fixed income securities and short-term investments, which may include mortgage- and asset-backed securities, to seek capital appreciation a ...

Beaumont Financial Partners, LLC

... occur with providers with whom BCM already has a business relationship, and the contribution would not be additional incentive to market products, including their ETFs. There would be no impact to our clients’ fees or the investment strategies made available to them or other advisors. (Item 5 -E: Fe ...

... occur with providers with whom BCM already has a business relationship, and the contribution would not be additional incentive to market products, including their ETFs. There would be no impact to our clients’ fees or the investment strategies made available to them or other advisors. (Item 5 -E: Fe ...

cash balance plans for the small employer

... services over 21,000 plans, with $91 billion of assets under management and more than three million participants.4 This singular focus enables us to continually develop innovative strategies to help our clients more efficiently manage their retirement plans—including services for defined benefit, de ...

... services over 21,000 plans, with $91 billion of assets under management and more than three million participants.4 This singular focus enables us to continually develop innovative strategies to help our clients more efficiently manage their retirement plans—including services for defined benefit, de ...

EDHEC Working Paper Comparing Regulatory Measures Stock Market Volatility

... One of the main objectives of a regulator is to maintain stable financial markets. Major instruments for attaining such stability include fiscal and monetary policy measures, as well as direct restrictions on trading in financial markets. In this paper, we compare the effects of different regulatory ...

... One of the main objectives of a regulator is to maintain stable financial markets. Major instruments for attaining such stability include fiscal and monetary policy measures, as well as direct restrictions on trading in financial markets. In this paper, we compare the effects of different regulatory ...

cross-reference table on the basis of Art. 32 of the AIFM Directive

... latest market price of the unit or share of the AIF, in accordance with Article 19; where available, the historical performance of the AIF; the identity of the prime broker; a description of any material arrangements of the AIF with its prime brokers and the way the conflicts of interest are managed ...

... latest market price of the unit or share of the AIF, in accordance with Article 19; where available, the historical performance of the AIF; the identity of the prime broker; a description of any material arrangements of the AIF with its prime brokers and the way the conflicts of interest are managed ...

Lender Claim Trust - Transfer Notice

... to accept for registration of transfer any Lender Claim Trust Beneficial Interests acquired by us, except upon presentation of evidence satisfactory to the Lender Claim Trust and the Trustee that the foregoing restrictions on transfer have been complied with, including without limitation those set f ...

... to accept for registration of transfer any Lender Claim Trust Beneficial Interests acquired by us, except upon presentation of evidence satisfactory to the Lender Claim Trust and the Trustee that the foregoing restrictions on transfer have been complied with, including without limitation those set f ...

ARC - Aegon

... This communication is for financial advisers only. It mustn’t be distributed to, or relied on by, customers. Here, we provide some factual information that you may find helpful when explaining why you think Aegon Retirement Choices (ARC) will meet your particular clients’ needs when drafting your su ...

... This communication is for financial advisers only. It mustn’t be distributed to, or relied on by, customers. Here, we provide some factual information that you may find helpful when explaining why you think Aegon Retirement Choices (ARC) will meet your particular clients’ needs when drafting your su ...

Iceland`s Creditworthiness Is Not Affected by British and Dutch Effort

... ranging from $1,500 to approximately $2,500,000. MCO and MIS also maintain policies and procedures to address the independence of MIS’s ratings and rating processes. Information regarding certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold r ...

... ranging from $1,500 to approximately $2,500,000. MCO and MIS also maintain policies and procedures to address the independence of MIS’s ratings and rating processes. Information regarding certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold r ...

Annual Report

... Following a review of the investment structure in 2013, the Trustee approved a change in the assets backing the Promina Division of the Fund from the Suncorp Defined Benefit Active Fund to the Suncorp Defined Benefit Cash Fund. The majority of assets were transferred on 17 December 2013 with the rem ...

... Following a review of the investment structure in 2013, the Trustee approved a change in the assets backing the Promina Division of the Fund from the Suncorp Defined Benefit Active Fund to the Suncorp Defined Benefit Cash Fund. The majority of assets were transferred on 17 December 2013 with the rem ...

Asset Acquisition for Constructed Assets

... and SAP SE or its affiliated companies shall not be liable for errors or omissions with respect to the materials. The only warranties for SAP SE or SAP affiliate company products and services are those that are set forth in the express warranty statements accompanying such products and services, if ...

... and SAP SE or its affiliated companies shall not be liable for errors or omissions with respect to the materials. The only warranties for SAP SE or SAP affiliate company products and services are those that are set forth in the express warranty statements accompanying such products and services, if ...

Regulation of CrowdFunding in Germany, the UK, Spain and Italy

... Second, two Crowdfunding platforms currently operate within the scope of regulation (both with different approaches). One simply offers securities. Therefore all companies seeking funding ("entrepreneurs") must transform to a (private) stock corporation first. This platform also offers a trade marke ...

... Second, two Crowdfunding platforms currently operate within the scope of regulation (both with different approaches). One simply offers securities. Therefore all companies seeking funding ("entrepreneurs") must transform to a (private) stock corporation first. This platform also offers a trade marke ...

INVESTMENT-CASH FLOW SENSITIVITY IN SMALL AND MEDIUM

... required there is a hierarchy in the use of funds, which is based on information asymmetry. Whenever possible, funding a firm should be covered by internally generated funds, which are not affected by adverse selection problems. If these were not enough, debt would be the next option, with stock iss ...

... required there is a hierarchy in the use of funds, which is based on information asymmetry. Whenever possible, funding a firm should be covered by internally generated funds, which are not affected by adverse selection problems. If these were not enough, debt would be the next option, with stock iss ...

Homeownership and Commercial Real Estate

... compared with 7.7 percent for homeownership. REITs have had an even higher return, averaging 14.5 percent over the same time. REITs returned more than private real estate partly because REITs use debt, and the NPI measures property-level return free of any leverage. Both the NPI and NAREIT indexes o ...

... compared with 7.7 percent for homeownership. REITs have had an even higher return, averaging 14.5 percent over the same time. REITs returned more than private real estate partly because REITs use debt, and the NPI measures property-level return free of any leverage. Both the NPI and NAREIT indexes o ...