Banks! It`s time to change your game in SME Lending Why

... Small and medium-size business enterprises (SMEs) are vital for the economic growth and competitiveness of any country; hence supporting the SMEs’ financial needs is crucial. For banks too, SMEs form a key and loyal customer segment. Unfortunately, in spite of these factors, the recent years have se ...

... Small and medium-size business enterprises (SMEs) are vital for the economic growth and competitiveness of any country; hence supporting the SMEs’ financial needs is crucial. For banks too, SMEs form a key and loyal customer segment. Unfortunately, in spite of these factors, the recent years have se ...

Market structures and systemic risks of exchange

... structured credit products were marketed to gear up investment returns for institutional investors as the value of their liabilities increased; banks were also willing buyers as they offered higher returns to comparably rated plain vanilla assets. Rising investor demand for these products subsequent ...

... structured credit products were marketed to gear up investment returns for institutional investors as the value of their liabilities increased; banks were also willing buyers as they offered higher returns to comparably rated plain vanilla assets. Rising investor demand for these products subsequent ...

Why Does Brazil`s Banking Sector Need Public Banks?

... Rather than justifying the existence of public banks, and BNDES in particular, using an argument based on market failures (Garcia 2011), an effective answer to this question requires a theory of financial instability. The 2007–2008 global financial crisis had a profound impact on the state of modern ...

... Rather than justifying the existence of public banks, and BNDES in particular, using an argument based on market failures (Garcia 2011), an effective answer to this question requires a theory of financial instability. The 2007–2008 global financial crisis had a profound impact on the state of modern ...

Al Rifai raises USD $15000000 in a private placement

... equities, fixed income, currency and commodity markets. MedSecurities has been involved in several private placements over the course of the past several years across different industries and geographies and has raised in excess of USD 300 Mln in private deals. ...

... equities, fixed income, currency and commodity markets. MedSecurities has been involved in several private placements over the course of the past several years across different industries and geographies and has raised in excess of USD 300 Mln in private deals. ...

Resocializing Capital: Putting Pension Savings in the Service of

... from a moral point of view. The more capital concentrates, the more it serves the interests of global financial players, the less it is accessible to local or otherwise dissenting agents. In other words, the question how to ensure more equal access to capital has high economic and moral, albeit hard ...

... from a moral point of view. The more capital concentrates, the more it serves the interests of global financial players, the less it is accessible to local or otherwise dissenting agents. In other words, the question how to ensure more equal access to capital has high economic and moral, albeit hard ...

Bank Lending Puzzles: Business Models and the

... What is worrying about these trends is that the fall in leverage has mostly been via the value of securities, which may be easily ‘pumped up’ again if monetary policy succeeds in reflating asset prices. This is already beginning to happen in the USA, where other assets are on an upward trend rising ...

... What is worrying about these trends is that the fall in leverage has mostly been via the value of securities, which may be easily ‘pumped up’ again if monetary policy succeeds in reflating asset prices. This is already beginning to happen in the USA, where other assets are on an upward trend rising ...

Regulatory Capital - Duisenberg school of finance

... The main purpose of equity capital is to provide a first line of defence against bankruptcy. The equity capital buffer has the capacity to absorb losses. In European industry, the average capital ratio (defined as equity capital divided by total assets) is about 70 per cent, and typically well above ...

... The main purpose of equity capital is to provide a first line of defence against bankruptcy. The equity capital buffer has the capacity to absorb losses. In European industry, the average capital ratio (defined as equity capital divided by total assets) is about 70 per cent, and typically well above ...

Financial Stress and Economic Activity in Germany and the Euro Area

... economic activityin low-stress regimes is insignificant, the impact in high stress regimes significantly dampens economic activity considerably in the months after the shock. Mallick and Sousa (2011) use two identifications in a Bayesian VAR (BVAR) and a sign-restriction VAR to examine the real eff ...

... economic activityin low-stress regimes is insignificant, the impact in high stress regimes significantly dampens economic activity considerably in the months after the shock. Mallick and Sousa (2011) use two identifications in a Bayesian VAR (BVAR) and a sign-restriction VAR to examine the real eff ...

Financial stress and economic activity in Germany and the Euro Area

... economic activityin low-stress regimes is insignificant, the impact in high stress regimes significantly dampens economic activity considerably in the months after the shock. Mallick and Sousa (2011) use two identifications in a Bayesian VAR (BVAR) and a sign-restriction VAR to examine the real eff ...

... economic activityin low-stress regimes is insignificant, the impact in high stress regimes significantly dampens economic activity considerably in the months after the shock. Mallick and Sousa (2011) use two identifications in a Bayesian VAR (BVAR) and a sign-restriction VAR to examine the real eff ...

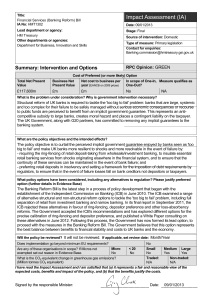

Impact Assessment

... capitalised and economically independent of their wider corporate groups, will insulate retail banking services from shocks originating elsewhere in the global financial system and will make both individual banks and the UK banking system as a whole more resilient. By requiring that retail banking s ...

... capitalised and economically independent of their wider corporate groups, will insulate retail banking services from shocks originating elsewhere in the global financial system and will make both individual banks and the UK banking system as a whole more resilient. By requiring that retail banking s ...

Major banks analysis

... an impact far beyond the US economy. The US dollar’s unique role as the world’s reserve currency means that monetary policy decisions in the US have real and direct consequences for the global economy. The expectation of higher policy rates in the US has already had an appreciating impact on the val ...

... an impact far beyond the US economy. The US dollar’s unique role as the world’s reserve currency means that monetary policy decisions in the US have real and direct consequences for the global economy. The expectation of higher policy rates in the US has already had an appreciating impact on the val ...

The ECB`s non-standard monetary policy measures

... Is this different approach on the part of the ECB mainly an issue of semantics, as some observers have argued? What is behind the different rationale for introducing non-standard measures? What are the factors framing the ECB’s response that are specific to the euro area? This paper argues that the ...

... Is this different approach on the part of the ECB mainly an issue of semantics, as some observers have argued? What is behind the different rationale for introducing non-standard measures? What are the factors framing the ECB’s response that are specific to the euro area? This paper argues that the ...

SECURITIZATION, RISK TRANSFERRING AND FINANCIAL

... rising interest has recently emerged with the financial crisis. There is an empirical literature studying the interaction of lending and housing prices both at the international (Hofmann, 2001; Tsatsaronis and Zhu, 2004) and the individual country levels (Gerlach and Peng, 2005; Gimeno and Martínez- ...

... rising interest has recently emerged with the financial crisis. There is an empirical literature studying the interaction of lending and housing prices both at the international (Hofmann, 2001; Tsatsaronis and Zhu, 2004) and the individual country levels (Gerlach and Peng, 2005; Gimeno and Martínez- ...

Appendix F 151202-lgps-investment-pooling-next

... benefits of scale. They need to indicate how much they expect to be able to allocate to infrastructure in the future. ...

... benefits of scale. They need to indicate how much they expect to be able to allocate to infrastructure in the future. ...

Islamic Syndicated Finance

... It is a contract of sale of a described asset to be manufactured or constructed with an obliga@on on the part of the manufacturer to deliver the asset to the customer upon comple@on on a future date/ Investment Agent request a manufacturer to manufacture a specific asset for the borrower in e ...

... It is a contract of sale of a described asset to be manufactured or constructed with an obliga@on on the part of the manufacturer to deliver the asset to the customer upon comple@on on a future date/ Investment Agent request a manufacturer to manufacture a specific asset for the borrower in e ...

An Analysis of Interest Rate Spread in the Banking Sector in

... to ensure the required flow of saving into productive investments that depends on the development of appropriate financial institutions capable of generating adequate quantity and quality of investment resources. In this context, an efficient financial system has two important roles: first, transfer ...

... to ensure the required flow of saving into productive investments that depends on the development of appropriate financial institutions capable of generating adequate quantity and quality of investment resources. In this context, an efficient financial system has two important roles: first, transfer ...