Venture Issuers are Reminded to Consider Recent

... number of conditions must be met, including that the issuer’s shares must be listed on a designated stock exchange, the issuer must make the offering available to all existing security holders, the offering may not increase the number of outstanding listed securities of the issuer by more than 100% ...

... number of conditions must be met, including that the issuer’s shares must be listed on a designated stock exchange, the issuer must make the offering available to all existing security holders, the offering may not increase the number of outstanding listed securities of the issuer by more than 100% ...

PowerPoint Ch. 16

... Valuing and Reporting Investments Categories of Securities Companies classify debt and stock investments into three categories: Trading securities Available-for-sale securities Held-to-maturity securities These guidelines apply to all debt securities and all stock investments in which the hol ...

... Valuing and Reporting Investments Categories of Securities Companies classify debt and stock investments into three categories: Trading securities Available-for-sale securities Held-to-maturity securities These guidelines apply to all debt securities and all stock investments in which the hol ...

Taiwan 2015 - 2016.docx

... offering and follow-on offering of securities investment trust funds submitted by securities investment trust enterprises to their board of directors and lifting restrictions for applications submitted by new securities investment trust enterprise for the public offering of its first fund product In ...

... offering and follow-on offering of securities investment trust funds submitted by securities investment trust enterprises to their board of directors and lifting restrictions for applications submitted by new securities investment trust enterprise for the public offering of its first fund product In ...

The Growing Prominence of Non-Cash Collateral

... Lending agents vary widely in the types of non-cash collateral types supported in their programs. For lenders, it is important to consider whether their lending agent supports a sufficiently wide range of non-cash collateral to both maximize lending utilization and possibly improve borrower diversif ...

... Lending agents vary widely in the types of non-cash collateral types supported in their programs. For lenders, it is important to consider whether their lending agent supports a sufficiently wide range of non-cash collateral to both maximize lending utilization and possibly improve borrower diversif ...

synta pharmaceuticals corp. - corporate

... As of September 30, 2015, the Company had $88.3 million in cash, cash equivalents and marketable securities, compared to $97.7 million in cash, cash equivalents and marketable securities as of December 31, 2014. More detailed financial information and analysis may be found in the Company’s Quarterly ...

... As of September 30, 2015, the Company had $88.3 million in cash, cash equivalents and marketable securities, compared to $97.7 million in cash, cash equivalents and marketable securities as of December 31, 2014. More detailed financial information and analysis may be found in the Company’s Quarterly ...

Form 8-K, 12/14/15

... On December 14, 2015, Lions Gate Entertainment Corp. (the “Company”) issued a press release announcing that the Company’s Board of Directors declared a quarterly cash dividend of nine cents ($0.09) per common share, payable February 5, 2016 to shareholders of record as of December 31, 2015. The pres ...

... On December 14, 2015, Lions Gate Entertainment Corp. (the “Company”) issued a press release announcing that the Company’s Board of Directors declared a quarterly cash dividend of nine cents ($0.09) per common share, payable February 5, 2016 to shareholders of record as of December 31, 2015. The pres ...

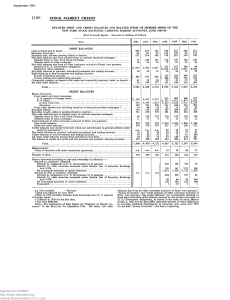

Detailed Debit and Credit Balances and Related Items of Member

... Member firms of New York Stock Exchange Member firms of other exchanges Net debit balances due from all other customers exclusive of firms' own partners: Secured by U. S. Government obligations Secured by other collateral Net debit balances in partners' individual investment and trading accounts Deb ...

... Member firms of New York Stock Exchange Member firms of other exchanges Net debit balances due from all other customers exclusive of firms' own partners: Secured by U. S. Government obligations Secured by other collateral Net debit balances in partners' individual investment and trading accounts Deb ...

Tips for Startups – Understanding Debt vs. Equity

... Preferred shares are the favoured form of equity for most sophisticated investors, whether venture capital firms, other institutional investors, or just those savvy in the modern realm of investment. Preferred shares are the most common form of security sold in a private company financing, particula ...

... Preferred shares are the favoured form of equity for most sophisticated investors, whether venture capital firms, other institutional investors, or just those savvy in the modern realm of investment. Preferred shares are the most common form of security sold in a private company financing, particula ...

Genesis and prospects of the Ukrainian stock market

... affirmed on the basis of quite high development of its components. It is characterized by features that distinguish it among others, such as: the advantage of the primary market, issue of shares, small proportion of the stock market, lack of awareness of investors about the debt securities, low guar ...

... affirmed on the basis of quite high development of its components. It is characterized by features that distinguish it among others, such as: the advantage of the primary market, issue of shares, small proportion of the stock market, lack of awareness of investors about the debt securities, low guar ...

NATIONAL FINANCIAL SERVICES LLC STATEMENT OF

... The Company is a registered broker-dealer with the Securities and Exchange Commission (“SEC”) and is a member of the Financial Industry Regulatory Authority (“FINRA”). The Company is licensed to transact on the NYSE Euronext and various national and regional stock and option exchanges. The Company p ...

... The Company is a registered broker-dealer with the Securities and Exchange Commission (“SEC”) and is a member of the Financial Industry Regulatory Authority (“FINRA”). The Company is licensed to transact on the NYSE Euronext and various national and regional stock and option exchanges. The Company p ...

united states securities and exchange commission - corporate

... If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ ...

... If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ ...

LO 3 Explain the accounting for stock investments.

... Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. ...

... Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. ...

Mexican_Financial_Market

... pesos were traded, and the exchange had a total capitalization of US$139 billion and a price-toearnings ratio of more than thirteen. The total value of stocks traded increased by US$191 billion between 1987 and 1993. Treasury bills, bank acceptances, and commercial paper were the most common instrum ...

... pesos were traded, and the exchange had a total capitalization of US$139 billion and a price-toearnings ratio of more than thirteen. The total value of stocks traded increased by US$191 billion between 1987 and 1993. Treasury bills, bank acceptances, and commercial paper were the most common instrum ...

Community Capital Management

... under the Investment Advisors Act of 1940. The performance data quoted represents past performance. Past performance does not guarantee future results.The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than ...

... under the Investment Advisors Act of 1940. The performance data quoted represents past performance. Past performance does not guarantee future results.The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than ...

Poplar Forest Cornerstone Fund Summary Prospectus

... $2.0 billion to approximately $26.3 billion as of May 27, 2016, the date of the last reconstitution of the Russell Midcap® Index) at the time of purchase. Dividend paying companies with investment grade credit ratings will be the primary focus of the Fund’s equity investments. Weightings between equ ...

... $2.0 billion to approximately $26.3 billion as of May 27, 2016, the date of the last reconstitution of the Russell Midcap® Index) at the time of purchase. Dividend paying companies with investment grade credit ratings will be the primary focus of the Fund’s equity investments. Weightings between equ ...

Extraordinary General Meeting 2004

... securities may not be sold nor offers to buy be accepted prior to the time the Registration Statement becomes effective. This communication shall not constitute an offer to buy nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale woul ...

... securities may not be sold nor offers to buy be accepted prior to the time the Registration Statement becomes effective. This communication shall not constitute an offer to buy nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale woul ...

united states securities and exchange commission - corporate

... On January 24, 2017, the Board of Directors (the “Board”) of ViewRay, Inc. (the “Company”) appointed Ted Wang, Ph.D., to serve as a Class II director of the Company until the Company’s 2017 Annual Meeting of Stockholders. To accommodate the appointment, the Board also increased the size of the Board ...

... On January 24, 2017, the Board of Directors (the “Board”) of ViewRay, Inc. (the “Company”) appointed Ted Wang, Ph.D., to serve as a Class II director of the Company until the Company’s 2017 Annual Meeting of Stockholders. To accommodate the appointment, the Board also increased the size of the Board ...

IHS buys Toronto-based Dyadem International

... specific person. You further understand that none of the information providers or their affiliates will advise you personally concerning the nature, potential, advisability, value or suitability of any particular security, portfolio of securities, transaction, investment strategy, or other matter. Y ...

... specific person. You further understand that none of the information providers or their affiliates will advise you personally concerning the nature, potential, advisability, value or suitability of any particular security, portfolio of securities, transaction, investment strategy, or other matter. Y ...

Invesco Short Term Bond Fund fact sheet

... Performance quoted is past performance and cannot guarantee comparable future results; current performance may be lower or higher. Visit invesco.com/performance for the most recent month-end performance. Performance figures reflect reinvested distributions and changes in net asset value (NAV). Inves ...

... Performance quoted is past performance and cannot guarantee comparable future results; current performance may be lower or higher. Visit invesco.com/performance for the most recent month-end performance. Performance figures reflect reinvested distributions and changes in net asset value (NAV). Inves ...

Emerging Markets Local Currency

... only. These securities are issued by emerging markets sovereigns, quasi-sovereigns, cities, regions, corporates, and supranationals. The strategy seeks competitive total return primarily through investments in debt securities issued by emerging markets issuers. The strategy is diversified both by re ...

... only. These securities are issued by emerging markets sovereigns, quasi-sovereigns, cities, regions, corporates, and supranationals. The strategy seeks competitive total return primarily through investments in debt securities issued by emerging markets issuers. The strategy is diversified both by re ...

Reporting Form SRF 536.0 Repurchase Agreements Instructions

... Report all items as at the end of the reporting period. Report the fair value, within the meaning given in AASB 13 Fair Value Measurement, in thousands of dollars for all items unless otherwise specified. Report all items in accordance with the Australian Accounting Standards unless otherwise ...

... Report all items as at the end of the reporting period. Report the fair value, within the meaning given in AASB 13 Fair Value Measurement, in thousands of dollars for all items unless otherwise specified. Report all items in accordance with the Australian Accounting Standards unless otherwise ...

Korea Securities Depository

... - cross-border custody, settlement and corporate action services over the 36 markets of 34 countries with 4 custodians for overseas investment by domestic investors ...

... - cross-border custody, settlement and corporate action services over the 36 markets of 34 countries with 4 custodians for overseas investment by domestic investors ...

“How to reduce debt costs in Southern Africa” , Johannesburg, 25/26

... Lower real yields should be matched by further sovereign credit ...

... Lower real yields should be matched by further sovereign credit ...

Ch10

... until maturity using zero-coupon Treasury strips instead of Treasury coupon securities as a basis for comparison. Treasury strips are created by investment bakers who strip off payments and sell them separately from the rest of the bond. This process creates a series of “zero coupon” securities. Zer ...

... until maturity using zero-coupon Treasury strips instead of Treasury coupon securities as a basis for comparison. Treasury strips are created by investment bakers who strip off payments and sell them separately from the rest of the bond. This process creates a series of “zero coupon” securities. Zer ...