Clarification on Government Debt Investment Limits

... This circular shall come into effect immediately. This circular is issued in exercise of powers conferred under Section 11 (1) of the Securities and Exchange Board of India Act, 1992. A copy of this circular is available at the web page “Circulars” on our website www.sebi.gov.in. Custodians are requ ...

... This circular shall come into effect immediately. This circular is issued in exercise of powers conferred under Section 11 (1) of the Securities and Exchange Board of India Act, 1992. A copy of this circular is available at the web page “Circulars” on our website www.sebi.gov.in. Custodians are requ ...

BC Securities Commission Capital Raising for Small Business

... There are several exemptions that your small business can use to raise money in the private placement market. When your business first starts raising money in this market, you will usually be able to rely on the private issuer exemption. However, when your small business is no longer a private issue ...

... There are several exemptions that your small business can use to raise money in the private placement market. When your business first starts raising money in this market, you will usually be able to rely on the private issuer exemption. However, when your small business is no longer a private issue ...

Positioning Your Portfolio for Rising Interest Rates

... impact the fund’s short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Past performance data through the most re ...

... impact the fund’s short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Past performance data through the most re ...

AIDA/ADC Investment

... arising out of the collection of such deposits upon default. It shall also provide the conditions under which the securities may be sold, presented for payment, substituted or released and the events which enable the Agency to exercise its rights against the pledged securities. In the event that the ...

... arising out of the collection of such deposits upon default. It shall also provide the conditions under which the securities may be sold, presented for payment, substituted or released and the events which enable the Agency to exercise its rights against the pledged securities. In the event that the ...

Circular 2013/8 Market conduct rules Supervisory rules on

... supervised institutions ensure that the individuals with the power of decision over trading in securities and derivatives about which the supervised institution possesses insider information have no knowledge of this insider information. They also ensure that individuals who do have knowledge of ins ...

... supervised institutions ensure that the individuals with the power of decision over trading in securities and derivatives about which the supervised institution possesses insider information have no knowledge of this insider information. They also ensure that individuals who do have knowledge of ins ...

VERISIGN INC/CA (Form: 4, Received: 08/29/2003 14:40:40)

... 3. Date of Earliest Transaction (MM/DD/YYYY) ...

... 3. Date of Earliest Transaction (MM/DD/YYYY) ...

Key Investor Information Franklin Global Aggregate Investment

... The prospectus and the financial reports refer to all sub-funds of Franklin Templeton Investment Funds. All sub-funds of Franklin Templeton Investment Funds have segregated assets and liabilities. As a result, each sub-fund is operated independently from each other. · You may switch into shares of ...

... The prospectus and the financial reports refer to all sub-funds of Franklin Templeton Investment Funds. All sub-funds of Franklin Templeton Investment Funds have segregated assets and liabilities. As a result, each sub-fund is operated independently from each other. · You may switch into shares of ...

FREE Sample Here

... 92. A difference between the primary market and the secondary market is a. Liquidity b. That primary markets allow corporations, government units, and others to raise needed funds for the expansion of their capital base C. Price competition in the secondary markets between different risk-return clas ...

... 92. A difference between the primary market and the secondary market is a. Liquidity b. That primary markets allow corporations, government units, and others to raise needed funds for the expansion of their capital base C. Price competition in the secondary markets between different risk-return clas ...

information circular: northern lights fund trust iv

... (each block of Shares called a “Creation Unit”). As a practical matter, only broker-dealers or large institutional investors with creation and redemption agreements (called Authorized Participants) can purchase or redeem these Creation Units. Except when aggregated in Creation Units, the Shares may ...

... (each block of Shares called a “Creation Unit”). As a practical matter, only broker-dealers or large institutional investors with creation and redemption agreements (called Authorized Participants) can purchase or redeem these Creation Units. Except when aggregated in Creation Units, the Shares may ...

Measuring Efficiency in Corporate Law: The Role of Shareholder

... • Is this investor protection or public law? ...

... • Is this investor protection or public law? ...

PIPEs Transaction and Regulation D

... may avoid pricing discount that PIPE can attract – Avoids going through purchase agreement / reg rights negotiation with investors & SEC registration process – Bolstered by relaxation of Form S-3 rules in 2008—SEC allowed smaller companies (float <$75m) to use primary shelf registration ...

... may avoid pricing discount that PIPE can attract – Avoids going through purchase agreement / reg rights negotiation with investors & SEC registration process – Bolstered by relaxation of Form S-3 rules in 2008—SEC allowed smaller companies (float <$75m) to use primary shelf registration ...

Material Fact - Approval of the Extraordinary General Meeting

... adhesion by the Company and admission to trading of common shares issued by the Company in the New Market, as well as a notice shall be published to the market in reference to the Offer and containing information about (ii.i) other characteristics of the Offer, (ii.ii) the places for obtaining the p ...

... adhesion by the Company and admission to trading of common shares issued by the Company in the New Market, as well as a notice shall be published to the market in reference to the Offer and containing information about (ii.i) other characteristics of the Offer, (ii.ii) the places for obtaining the p ...

Indirect Investing

... Costs and taxes should also be considered Expenses may be the best indicator of a fund’s performance ...

... Costs and taxes should also be considered Expenses may be the best indicator of a fund’s performance ...

Ph - Edelweiss Financial Services

... instruments till maturity getting a fixed rate of return. Thus FMP can manage to get a specific interest on these instruments and investors have a fair idea about it. This helps investors tailor their investments as per their future cash requirements • They primarily invest in AAA, P1+ or such kind ...

... instruments till maturity getting a fixed rate of return. Thus FMP can manage to get a specific interest on these instruments and investors have a fair idea about it. This helps investors tailor their investments as per their future cash requirements • They primarily invest in AAA, P1+ or such kind ...

Custody Policy Statement Final-1

... The instructions to Form ADV2 define the term “client” as “[a]ny of your firm’s investment advisory clients. This term includes clients from which your firm receives no compensation, such as family members of your supervised persons. If your firm also provides other services (e.g., accounting servic ...

... The instructions to Form ADV2 define the term “client” as “[a]ny of your firm’s investment advisory clients. This term includes clients from which your firm receives no compensation, such as family members of your supervised persons. If your firm also provides other services (e.g., accounting servic ...

SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... Ownership of 5 Percent or Less of a Class. If this statement is being filed to report the fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more than 5 percent of the class of securities, check the following [ ]. Item 6. Ownership of More than 5 Percent on ...

... Ownership of 5 Percent or Less of a Class. If this statement is being filed to report the fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more than 5 percent of the class of securities, check the following [ ]. Item 6. Ownership of More than 5 Percent on ...

LEARNING HOW RAYMOND JAMES PROTECTS YOUR ACCOUNT

... customer’s maximum limit of that coverage is exceeded. Like SIPC, excess SIPC covers cash and securities on deposit. It does not cover commodities, futures contracts, currencies and certain other investment contracts. ...

... customer’s maximum limit of that coverage is exceeded. Like SIPC, excess SIPC covers cash and securities on deposit. It does not cover commodities, futures contracts, currencies and certain other investment contracts. ...

Words - Investor Relations Solutions

... All statements contained in this press release, other than historical facts, may constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Words such as "anticipates," "expe ...

... All statements contained in this press release, other than historical facts, may constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Words such as "anticipates," "expe ...

Chapter 3: How Securities are Traded

... • Commission: fee paid to broker for making the transaction • Spread: cost of trading with dealer – Bid: price dealer will buy from you – Ask: price dealer will sell to you – Spread: ask - bid • Combination: on some trades both are paid ...

... • Commission: fee paid to broker for making the transaction • Spread: cost of trading with dealer – Bid: price dealer will buy from you – Ask: price dealer will sell to you – Spread: ask - bid • Combination: on some trades both are paid ...

State of Connecticut Stable Value Fund

... to provide the basis for the crediting rate available to participants in the Fund. The underlying separate accounts are managed by ING investment Management, PIMCO Investment Advisors and Prudential Fixed Income Management. The underlying assets for all of the separate accounts are “insulated” from ...

... to provide the basis for the crediting rate available to participants in the Fund. The underlying separate accounts are managed by ING investment Management, PIMCO Investment Advisors and Prudential Fixed Income Management. The underlying assets for all of the separate accounts are “insulated” from ...

DOC - Piedmont Office Realty Trust, Inc.

... Englewood Cliffs, NJ for $55 million during the fourth quarter of 2010. Transfer Agent Change - From the time that Piedmont listed on the NYSE in February 2010, we have been pleased with the reception that the company and our stock have received from the public markets. This market acceptance is ben ...

... Englewood Cliffs, NJ for $55 million during the fourth quarter of 2010. Transfer Agent Change - From the time that Piedmont listed on the NYSE in February 2010, we have been pleased with the reception that the company and our stock have received from the public markets. This market acceptance is ben ...

Comparison Between Original and Amendments to

... accordance with the TWSE or TPEx rules governing the purchase of listed securities by reverse auction or rules governing the auction of listed securities. (8)Participation in subscription to shares issued by a public company for a cash capital increase or domestic subscription to corporate bonds (in ...

... accordance with the TWSE or TPEx rules governing the purchase of listed securities by reverse auction or rules governing the auction of listed securities. (8)Participation in subscription to shares issued by a public company for a cash capital increase or domestic subscription to corporate bonds (in ...

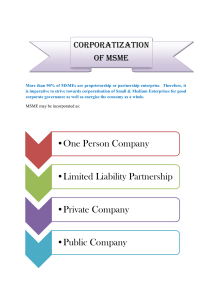

One Person Company •Limited Liability Partnership •Private

... “Public Company” A company : which is not a private company; private company which is Subsidiary of a Public Company ...

... “Public Company” A company : which is not a private company; private company which is Subsidiary of a Public Company ...

31-103F1 [F], January 11, 2015

... Investment Fund Continuous Disclosure, where the fund is a money market mutual fund as defined in National Instrument 81-102 Investment Funds; or ...

... Investment Fund Continuous Disclosure, where the fund is a money market mutual fund as defined in National Instrument 81-102 Investment Funds; or ...

form 31-103f1 calculation of excess working capital

... Investment Fund Continuous Disclosure, where the fund is a money market mutual fund as defined in National Instrument 81-102 Investment Funds; or ...

... Investment Fund Continuous Disclosure, where the fund is a money market mutual fund as defined in National Instrument 81-102 Investment Funds; or ...

![31-103F1 [F], January 11, 2015](http://s1.studyres.com/store/data/021286480_1-c986ef7bfcd613a4eda28487f5276795-300x300.png)