TIAA-CREF Global Natural Resources Fund

... The Fund seeks a favorable long-term total return, mainly through capital appreciation, from investments related to the natural resources sector. It normally invests at least 80% of its assets in securities of issuers that are primarily engaged in energy, metals, agriculture and other commodities, a ...

... The Fund seeks a favorable long-term total return, mainly through capital appreciation, from investments related to the natural resources sector. It normally invests at least 80% of its assets in securities of issuers that are primarily engaged in energy, metals, agriculture and other commodities, a ...

GLAXOSMITHKLINE PLC (Form: 6-K, Received: 02/23/2017 11:33:29)

... Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor Name GlaxoSmithKline plc LEI 5493000HZTVUYLO1D793 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and ( ...

... Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor Name GlaxoSmithKline plc LEI 5493000HZTVUYLO1D793 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and ( ...

Dealer Markets (Cont.)

... – Commit own capital in process of bringing sellers and buyers together – Expect to earn a profit by “buying low and selling high” – Take a risk on a change of price in the securities they own Copyright © 2004 Pearson Addison-Wesley. All rights reserved. ...

... – Commit own capital in process of bringing sellers and buyers together – Expect to earn a profit by “buying low and selling high” – Take a risk on a change of price in the securities they own Copyright © 2004 Pearson Addison-Wesley. All rights reserved. ...

presentation - Kinetics Mutual Funds

... The past performance data quoted is as of March 31, 2017. Performance data quoted represents past performance and does not guarantee future results. Investment return and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Current performance may ...

... The past performance data quoted is as of March 31, 2017. Performance data quoted represents past performance and does not guarantee future results. Investment return and principal value will vary, and shares may be worth more or less at redemption than at original purchase. Current performance may ...

Equity Linked Debentures

... • Equity linked debenture schemes do not allow premature exits. • All benefits are subject to investment being held till redemption date. • These products, though listed on the exchanges, are a bit illiquid and hence difficult to sell or transfer. • In certain cases, the issuer or arranger of the no ...

... • Equity linked debenture schemes do not allow premature exits. • All benefits are subject to investment being held till redemption date. • These products, though listed on the exchanges, are a bit illiquid and hence difficult to sell or transfer. • In certain cases, the issuer or arranger of the no ...

Lincoln Financial Securities Corporation (LFS) Brokerage

... The Brokerage Trading/Execution Fees listed above will apply for Mutual Funds unless otherwise specified. In lieu of charges on individual transactions, certain CWA investment programs will assess a flat or asset-based custody and execution charges that are bundled into the total program fee. The to ...

... The Brokerage Trading/Execution Fees listed above will apply for Mutual Funds unless otherwise specified. In lieu of charges on individual transactions, certain CWA investment programs will assess a flat or asset-based custody and execution charges that are bundled into the total program fee. The to ...

Nuveen High Yield Municipal Bond Fund

... Mutual fund investing involves risk; principal loss is possible. Debt or fixed income securities such as those held by the fund, are subject to market risk, credit risk, interest rate risk, call risk, tax risk, political and economic risk, and income risk. As interest rates rise, bond prices fall. C ...

... Mutual fund investing involves risk; principal loss is possible. Debt or fixed income securities such as those held by the fund, are subject to market risk, credit risk, interest rate risk, call risk, tax risk, political and economic risk, and income risk. As interest rates rise, bond prices fall. C ...

In the Matters of DELAWARE MANAGEMENT COMPANY, INC

... Management is the investment advisers to and principal underwriter for Delaware and Decatur, and its officers hold or help corresponding positions in those companies. Such officers were vested by the Funds with the executive and supervisory responsibility for conducting the affairs of the Funds, whi ...

... Management is the investment advisers to and principal underwriter for Delaware and Decatur, and its officers hold or help corresponding positions in those companies. Such officers were vested by the Funds with the executive and supervisory responsibility for conducting the affairs of the Funds, whi ...

7. Which of the following statements regarding money

... Indirect investing – buy mutual funds, contribute to pension plans, buy life insurance ...

... Indirect investing – buy mutual funds, contribute to pension plans, buy life insurance ...

Securities Trading Policy

... related to them, removing any presumption of misuse of information relating to the Act or Fact about Vale (Inside Information). Relevant Acts or Facts are those that may significantly influence the market price of securities issued or guaranteed by Vale, the decisions of investors to buy, sell or ho ...

... related to them, removing any presumption of misuse of information relating to the Act or Fact about Vale (Inside Information). Relevant Acts or Facts are those that may significantly influence the market price of securities issued or guaranteed by Vale, the decisions of investors to buy, sell or ho ...

US Securities Law Issues in Tender Offers for Foreign Companies

... precedent for the SEC issuing an exemptive or no-action relief letter when the target company was not a foreign private issuer. In a recent letter, the SEC has granted cross-border type relief with respect to a cash tender o=er for securities of a non-US company that was not a foreign private issuer ...

... precedent for the SEC issuing an exemptive or no-action relief letter when the target company was not a foreign private issuer. In a recent letter, the SEC has granted cross-border type relief with respect to a cash tender o=er for securities of a non-US company that was not a foreign private issuer ...

Mahindra Lifespace

... Under forthcoming new projects in Mumbai, for Andheri project, approvals have been applied for plot A while Plot B is awaiting approvals. For the Saki Naka project, approval process and zone conversion is being initiated. The management is looking forward to these projects in H2 FY16. ...

... Under forthcoming new projects in Mumbai, for Andheri project, approvals have been applied for plot A while Plot B is awaiting approvals. For the Saki Naka project, approval process and zone conversion is being initiated. The management is looking forward to these projects in H2 FY16. ...

Declaration of Appropriateness for Listing by a J

... (1) An initial listing applicant does not damage the reputation of the market of the Exchange and is a company that is suitable for listing on such market. (2) An initial listing applicant conducts business fairly and in good faith. (3) The corporate governance and internal management structure of a ...

... (1) An initial listing applicant does not damage the reputation of the market of the Exchange and is a company that is suitable for listing on such market. (2) An initial listing applicant conducts business fairly and in good faith. (3) The corporate governance and internal management structure of a ...

PRINCIPLES OF INVESTMENT MAY 2012

... conservative, money market securities offer significantly lower returns than most other securities. One of the main differences between the money market and the stock market is that most money market securities trade in very high denominations. This limits access for the individual investor. Further ...

... conservative, money market securities offer significantly lower returns than most other securities. One of the main differences between the money market and the stock market is that most money market securities trade in very high denominations. This limits access for the individual investor. Further ...

East African Community Common Market Protocol

... By signing the East African Community (EAC) Common Market Protocol in 2010, Tanzania and the other EAC Partner States committed to strengthen and integrate their financial markets. Deeper financial integration would help them mobilize additional capital, raise the amount and productivity of investme ...

... By signing the East African Community (EAC) Common Market Protocol in 2010, Tanzania and the other EAC Partner States committed to strengthen and integrate their financial markets. Deeper financial integration would help them mobilize additional capital, raise the amount and productivity of investme ...

Financing Growth in the WAEMU Through the Regional

... Securities’ issuance procedures depend on the type of security. Although regional regulations require that government bills and bonds be auctioned on the primary market, some T-bonds are still issued by syndication. T-bill and T-bond auctions are carried out for each member country at the national b ...

... Securities’ issuance procedures depend on the type of security. Although regional regulations require that government bills and bonds be auctioned on the primary market, some T-bonds are still issued by syndication. T-bill and T-bond auctions are carried out for each member country at the national b ...

risk management strategies

... This CTCL set up gives us client level control. Limits to all clients are set based on SPAN methodology. The customer gets limits commensurate with the credit available in his account. Every order is routed invariably through the CTCL system. Online MTM of top N losers are monitored and appropriate ...

... This CTCL set up gives us client level control. Limits to all clients are set based on SPAN methodology. The customer gets limits commensurate with the credit available in his account. Every order is routed invariably through the CTCL system. Online MTM of top N losers are monitored and appropriate ...

Chapter Twenty - Cengage Learning

... – Standard & Poor’s 500 Stock Index – New York Stock Exchange Composite Index – American Stock Exchange Index – Nasdaq Composite Index ...

... – Standard & Poor’s 500 Stock Index – New York Stock Exchange Composite Index – American Stock Exchange Index – Nasdaq Composite Index ...

Chapter 21

... Learning Goals 6 Which sources of investment information are the most helpful to investors? 7 What can investors learn from stock, bond, and mutual ...

... Learning Goals 6 Which sources of investment information are the most helpful to investors? 7 What can investors learn from stock, bond, and mutual ...

Payment of Management Fee

... IMPORTANT NOTICE The value of the Stapled Securities and the income derived from them may fall or rise. The Stapled Securities are not obligations, or deposits in, or guaranteed by the REIT Manager, the TrusteeManager (together with the REIT Manager, the “Managers”) or RBC Investor Services Trust S ...

... IMPORTANT NOTICE The value of the Stapled Securities and the income derived from them may fall or rise. The Stapled Securities are not obligations, or deposits in, or guaranteed by the REIT Manager, the TrusteeManager (together with the REIT Manager, the “Managers”) or RBC Investor Services Trust S ...

INTER PIPELINE LTD. $3,000,000,000 Common Shares Preferred

... holders thereof will become entitled to receive Common Shares or such other securities, and any other terms specific to the Subscription Receipts being offered. Where required by statute, regulation or policy, and where Securities are offered in currencies other than Canadian dollars, appropriate di ...

... holders thereof will become entitled to receive Common Shares or such other securities, and any other terms specific to the Subscription Receipts being offered. Where required by statute, regulation or policy, and where Securities are offered in currencies other than Canadian dollars, appropriate di ...

The Year Ahead in Healthcare Convertible Bonds

... (through year-end 2014), and global monetary easing and lower energy prices provide the underpinnings for outperformance by other sectors, we do not necessarily expect Healthcare’s dominant outperformance of the recent past to continue at the same trajectory. However, numerous industries within the ...

... (through year-end 2014), and global monetary easing and lower energy prices provide the underpinnings for outperformance by other sectors, we do not necessarily expect Healthcare’s dominant outperformance of the recent past to continue at the same trajectory. However, numerous industries within the ...

INSURANCE CODE TITLE 4. REGULATION OF SOLVENCY

... through which an insurer holds securities in the Federal Reserve book-entry system and the records of a custodian bank through which an insurer holds securities with a clearing corporation must show that the securities are held for the insurer and show the accounts for which the securities are held. ...

... through which an insurer holds securities in the Federal Reserve book-entry system and the records of a custodian bank through which an insurer holds securities with a clearing corporation must show that the securities are held for the insurer and show the accounts for which the securities are held. ...

NOTICE OF MATERIAL EVENT UNDER SEC RULE 15c2

... (“Issuer”) is required to file notice to satisfy the Issuer’s continuing disclosure requirements under Rule 15c2‐12 of the Securities and Exchange Commission (SEC) with respect to the Issuer’s obligations listed above. An explanation of the sigificance of the new rating may be obtained from the ra ...

... (“Issuer”) is required to file notice to satisfy the Issuer’s continuing disclosure requirements under Rule 15c2‐12 of the Securities and Exchange Commission (SEC) with respect to the Issuer’s obligations listed above. An explanation of the sigificance of the new rating may be obtained from the ra ...

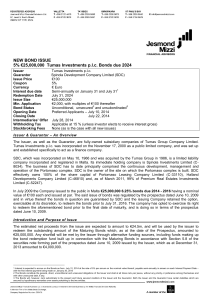

NEW BOND ISSUE 5% €25000000 Tumas Investments plc Bonds

... given in good faith at this date and may be subject to change without notice. This information is not intended to constitute an offer or agreement to buy or sell investments. The investments referred to in this document may not be suitable or appropriate for every investor. No liability is accepted ...

... given in good faith at this date and may be subject to change without notice. This information is not intended to constitute an offer or agreement to buy or sell investments. The investments referred to in this document may not be suitable or appropriate for every investor. No liability is accepted ...