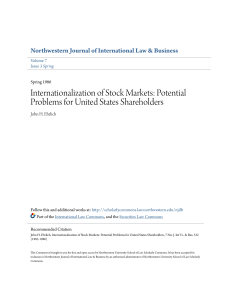

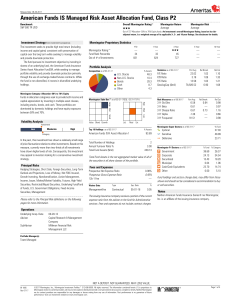

American Funds IS Managed Risk Asset Allocation Fund

... or endorsed by, any bank and is not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other U.S. governmental agency. Growth Investing Growth securities may be subject to increased volatility as the value of these securities is highly sensitive to market fluctua ...

... or endorsed by, any bank and is not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other U.S. governmental agency. Growth Investing Growth securities may be subject to increased volatility as the value of these securities is highly sensitive to market fluctua ...

() - ETF Securities

... attractive valuations. Page 8 Inflation-linked bonds improve portfolio risk-adjusted return. Page 10 ...

... attractive valuations. Page 8 Inflation-linked bonds improve portfolio risk-adjusted return. Page 10 ...

RIS-2 DOC

... instruments between unrelated persons. This could encourage some corporates to increase their overall level of borrowing, by reducing the cost of debt. It is unclear whether it would have any effect on the composition of business debt as the exemption would apply to loans, syndicated loans and priva ...

... instruments between unrelated persons. This could encourage some corporates to increase their overall level of borrowing, by reducing the cost of debt. It is unclear whether it would have any effect on the composition of business debt as the exemption would apply to loans, syndicated loans and priva ...

Intelligence in Securities Finance: Where Is It Going?

... actually getting charged (and) they might say you know what, you take the whole thing. That means that central desk will be sitting with all the requirements and all the needs, and they are going to be able to match businesses up that never talked to each other before because both parties get a bett ...

... actually getting charged (and) they might say you know what, you take the whole thing. That means that central desk will be sitting with all the requirements and all the needs, and they are going to be able to match businesses up that never talked to each other before because both parties get a bett ...

Far East Hospitality Trust - Singapore

... believe there are limited re-rating catalysts for the stock in the near term. Key Risks: Interest rate risk. Any increase in interest rates will result in higher interest payments that the REIT has to make annually to service its loans. This reduces the income available for distribution, which will ...

... believe there are limited re-rating catalysts for the stock in the near term. Key Risks: Interest rate risk. Any increase in interest rates will result in higher interest payments that the REIT has to make annually to service its loans. This reduces the income available for distribution, which will ...

FAIRPOINT COMMUNICATIONS INC (Form: 425

... The Company has filed, and the Securities and Exchange Commission (“SEC”) has declared effective, a registration statement in connection with the Merger. The Company urges investors to read this document and other materials filed and to be filed by the Company relating to the Merger because they con ...

... The Company has filed, and the Securities and Exchange Commission (“SEC”) has declared effective, a registration statement in connection with the Merger. The Company urges investors to read this document and other materials filed and to be filed by the Company relating to the Merger because they con ...

Chapter 12

... profitability of subsidiary companies Prepared in addition to financial statements for individual parent and subsidiary companies ...

... profitability of subsidiary companies Prepared in addition to financial statements for individual parent and subsidiary companies ...

FTA Morningstar 90 10 FS 3-31-17_Layout 1

... 9. The securities comprising the benchmark are not identical to those in any portfolio in the composite, but FTA believes they may be useful in evaluating performance. Unlike the composite, the benchmark is not actively managed and does not reflect the deduction of advisory fees. Differences in comp ...

... 9. The securities comprising the benchmark are not identical to those in any portfolio in the composite, but FTA believes they may be useful in evaluating performance. Unlike the composite, the benchmark is not actively managed and does not reflect the deduction of advisory fees. Differences in comp ...

NEUTRAL - Maybank Kim Eng

... We maintain our view that CPO price could trend higher in early 2016 and peak sometime in Mar-May 2016 with the possibility of hitting MYR2,700/t. But we would turn cautious towards Aug 2016, anticipating sharp CPO price correction in view of seasonally peak CPO output period. Our fundamental view f ...

... We maintain our view that CPO price could trend higher in early 2016 and peak sometime in Mar-May 2016 with the possibility of hitting MYR2,700/t. But we would turn cautious towards Aug 2016, anticipating sharp CPO price correction in view of seasonally peak CPO output period. Our fundamental view f ...

Share price performance

... SCB uses an investment horizon of 12 months for its price targets. Additional information, including disclosures, with respect to any securities referred to herein will be available upon request. Requests should be sent to scer@sc.com. Global Disclaimer: Standard Chartered Bank and/or its affiliates ...

... SCB uses an investment horizon of 12 months for its price targets. Additional information, including disclosures, with respect to any securities referred to herein will be available upon request. Requests should be sent to scer@sc.com. Global Disclaimer: Standard Chartered Bank and/or its affiliates ...

Broker-Dealer Trading Activities

... price improvement opportunities offered by markets or market-makers, these differences must be taken into account by the broker-dealer. Similarly in evaluating its procedure for handling limit orders, the broker-dealer must take into account any material differences in execution quality (e.g., the l ...

... price improvement opportunities offered by markets or market-makers, these differences must be taken into account by the broker-dealer. Similarly in evaluating its procedure for handling limit orders, the broker-dealer must take into account any material differences in execution quality (e.g., the l ...

WORD

... paragraph 2, subparagraph 4 regarding when no closing price is available on the day of the reverse auction, plus 10 to 20 percent. Article 16 When two or more securities finance enterprises simultaneously engage securities broker(s) to conduct a reverse auction for a given security, a single revers ...

... paragraph 2, subparagraph 4 regarding when no closing price is available on the day of the reverse auction, plus 10 to 20 percent. Article 16 When two or more securities finance enterprises simultaneously engage securities broker(s) to conduct a reverse auction for a given security, a single revers ...

- Franklin Templeton Investments

... All investments involve risks, including possible loss of principal. Convertible securities are subject to the risks of stocks when the underlying stock price is high relative to the conversion price (because more of the security's value resides in the conversion feature) and debt securities when th ...

... All investments involve risks, including possible loss of principal. Convertible securities are subject to the risks of stocks when the underlying stock price is high relative to the conversion price (because more of the security's value resides in the conversion feature) and debt securities when th ...

November 16, 2009

... radiosurgery at Mary Washington Hospital; and WHEREAS, Section 23-77.3 of the Code of Virginia grants authority to the Medical Center to enter into joint ventures; RESOLVED, the University, on behalf of the Medical Center, is authorized to enter into one or more joint ventures with MediCorp Health S ...

... radiosurgery at Mary Washington Hospital; and WHEREAS, Section 23-77.3 of the Code of Virginia grants authority to the Medical Center to enter into joint ventures; RESOLVED, the University, on behalf of the Medical Center, is authorized to enter into one or more joint ventures with MediCorp Health S ...

BARCLAYS BANK PLC (Form: 424B2, Received: 12/30

... You are willing to forego dividends paid on the stocks included in the Underlying Index and do not seek current income from this investment. ...

... You are willing to forego dividends paid on the stocks included in the Underlying Index and do not seek current income from this investment. ...

DOC - Europa EU

... money markets where the participants balance the overall amount of liquidity provided by central banks against transactions amongst themselves that match individual surpluses to shortages of liquidity. There are two main types of collateral arrangement: The classic way of providing collateral is by ...

... money markets where the participants balance the overall amount of liquidity provided by central banks against transactions amongst themselves that match individual surpluses to shortages of liquidity. There are two main types of collateral arrangement: The classic way of providing collateral is by ...

Form SC 13G/A WILLIAMS SONOMA INC

... PI, which is a wholly-owned subsidiary of M&MC, wholly owns two registered investment advisers: Putnam Investment Management, Inc., which is the investment adviser to the Putnam family of mutual funds and The Putnam Advisory Company, Inc., which is the investment adviser to Putnam's institutional c ...

... PI, which is a wholly-owned subsidiary of M&MC, wholly owns two registered investment advisers: Putnam Investment Management, Inc., which is the investment adviser to the Putnam family of mutual funds and The Putnam Advisory Company, Inc., which is the investment adviser to Putnam's institutional c ...

Implications of Proposed Bank Capital Regulations for Investors in

... If the rule is passed as proposed, banks would be allowed to count non-cumulative perpetual preferred stock, eligible for the inter-corporate dividends received deduction (the DRD), as Tier 1 capital. Among other requirements, Tier-1-eligible issues would have to be perpetual, subordinated, pay non- ...

... If the rule is passed as proposed, banks would be allowed to count non-cumulative perpetual preferred stock, eligible for the inter-corporate dividends received deduction (the DRD), as Tier 1 capital. Among other requirements, Tier-1-eligible issues would have to be perpetual, subordinated, pay non- ...

Havells India - ICICI Direct

... divestment) and launched premium LED lighting products in various countries. Currently, over 51% of revenue from lighting business comes from LED lighting. To strengthen its presence in the higher margin business i.e. street lights and solar solutions, Havells has acquired Bangalore based Promptec R ...

... divestment) and launched premium LED lighting products in various countries. Currently, over 51% of revenue from lighting business comes from LED lighting. To strengthen its presence in the higher margin business i.e. street lights and solar solutions, Havells has acquired Bangalore based Promptec R ...

under Fixed Price Method

... The capital market can encourage broader ownership of productive assets by small savers to enable them benefit from Bangladesh's economic growth. The capital market can provide avenues for investment opportunities that encourage a thrift culture critical to increase domestic savings and investment r ...

... The capital market can encourage broader ownership of productive assets by small savers to enable them benefit from Bangladesh's economic growth. The capital market can provide avenues for investment opportunities that encourage a thrift culture critical to increase domestic savings and investment r ...

Stock Exchange Ordinance SESTO unofficial translation

... The information contained in this document is given without warranty, implies no obligation of any kind upon SIX Swiss Exchange and may be altered by SIX Swiss Exchange at any time without further notice. SIX Swiss Exchange is not liable for any errors contained in this document. SIX Swiss Exchange ...

... The information contained in this document is given without warranty, implies no obligation of any kind upon SIX Swiss Exchange and may be altered by SIX Swiss Exchange at any time without further notice. SIX Swiss Exchange is not liable for any errors contained in this document. SIX Swiss Exchange ...

Stock Exchange Ordinance

... The information contained in this document is given without warranty, implies no obligation of any kind upon SIX Swiss Exchange and may be altered by SIX Swiss Exchange at any time without further notice. SIX Swiss Exchange is not liable for any errors contained in this document. SIX Swiss Exchange ...

... The information contained in this document is given without warranty, implies no obligation of any kind upon SIX Swiss Exchange and may be altered by SIX Swiss Exchange at any time without further notice. SIX Swiss Exchange is not liable for any errors contained in this document. SIX Swiss Exchange ...

To: Clients and Friends June 30, 2004 The articles below contain

... survey defined a hedge fund adviser as an advisory firm in which hedge funds represent 75% or more of the firm’s advisory clients. According to the survey, the number of registered hedge fund advisers rose from 508 a year ago to 601 this year, an increase of 18%. The registered hedge fund advisers m ...

... survey defined a hedge fund adviser as an advisory firm in which hedge funds represent 75% or more of the firm’s advisory clients. According to the survey, the number of registered hedge fund advisers rose from 508 a year ago to 601 this year, an increase of 18%. The registered hedge fund advisers m ...

Internationalization of Stock Markets: Potential Problems for United

... the Commission seeks to protect U.S. residents from fraud and also to prevent fraudulent activities from occurring in the U.S." 8 The implicit assumption in this statement is that a regulated market protects the investor. In practice, the regulatory activity of the SEC may actually supersede the goa ...

... the Commission seeks to protect U.S. residents from fraud and also to prevent fraudulent activities from occurring in the U.S." 8 The implicit assumption in this statement is that a regulated market protects the investor. In practice, the regulatory activity of the SEC may actually supersede the goa ...

CHAPTER 11: INVESTING IN STOCKS AND BONDS

... are available for the very first time. The issuing company gets the proceeds. Secondary market—for trading previously issued securities. Trading is done between investors; issuing company gets nothing. ...

... are available for the very first time. The issuing company gets the proceeds. Secondary market—for trading previously issued securities. Trading is done between investors; issuing company gets nothing. ...