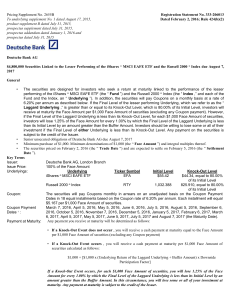

DEUTSCHE BANK AKTIENGESELLSCHAFT (Form

... Issuer’s Estimated Value of the Securities The Issuer’s estimated value of the securities is equal to the sum of our valuations of the following two components of the securities: (i) a bond and (ii) an embedded derivative(s). The value of the bond component of the securities is calculated based on ...

... Issuer’s Estimated Value of the Securities The Issuer’s estimated value of the securities is equal to the sum of our valuations of the following two components of the securities: (i) a bond and (ii) an embedded derivative(s). The value of the bond component of the securities is calculated based on ...

Download paper (PDF)

... trades make prices more efficient. For example, when liquidity increases in Kyle’s (1985) model, informed traders bet more aggressively based on their existing information because their trades have a smaller impact on prices. In addition, informed traders have greater incentives to acquire more prec ...

... trades make prices more efficient. For example, when liquidity increases in Kyle’s (1985) model, informed traders bet more aggressively based on their existing information because their trades have a smaller impact on prices. In addition, informed traders have greater incentives to acquire more prec ...

ZKB Warrant Put on Troy Ounce of Silver

... relation to the Underlying / a component of the Underlying or if any other extraordinary event occurs, which makes it impossible or particularly cumbersome for the Issuer, to fulfil its obligations under the Warrants or to calculate the value of the Warrants, the Issuer shall at its free discretion ...

... relation to the Underlying / a component of the Underlying or if any other extraordinary event occurs, which makes it impossible or particularly cumbersome for the Issuer, to fulfil its obligations under the Warrants or to calculate the value of the Warrants, the Issuer shall at its free discretion ...

Long-Term Investment Policy - American Speech

... Interest-bearing checking accounts at insured commercial banking institutions Interest-bearing savings accounts at insured commercial banking institutions Certificates of deposit at insured commercial banking institutions Money market funds ...

... Interest-bearing checking accounts at insured commercial banking institutions Interest-bearing savings accounts at insured commercial banking institutions Certificates of deposit at insured commercial banking institutions Money market funds ...

REGENERON PHARMACEUTICALS INC (Form: 8

... ”), and Teva Pharmaceuticals International GmbH (“ Teva ”), a wholly owned subsidiary of Teva Pharmaceutical Industries Ltd., entered into a collaboration agreement to develop and commercialize fasinumab (also known as REGN475), Regeneron’s investigational nerve-growth-factor antibody in Phase 3 cli ...

... ”), and Teva Pharmaceuticals International GmbH (“ Teva ”), a wholly owned subsidiary of Teva Pharmaceutical Industries Ltd., entered into a collaboration agreement to develop and commercialize fasinumab (also known as REGN475), Regeneron’s investigational nerve-growth-factor antibody in Phase 3 cli ...

united states securities and exchange commission

... The Thomas O’Brien Daly Trust, under instrument of trust dated March 22, 2000, of which George W. LeMaitre is the sole trustee, holds 100 shares of common stock. The trust is for the benefit of one minor child, who is George W. LeMaitre’s nephew. George W. LeMaitre, as trustee, has sole voting and i ...

... The Thomas O’Brien Daly Trust, under instrument of trust dated March 22, 2000, of which George W. LeMaitre is the sole trustee, holds 100 shares of common stock. The trust is for the benefit of one minor child, who is George W. LeMaitre’s nephew. George W. LeMaitre, as trustee, has sole voting and i ...

III.1 Guidelines on Debt Securities

... be considered in determining whether a particular debt security is an appropriate investment for a fund. Approved trustees and their delegates are also subject to duties to act with skill, diligence and prudence and in accordance with the investment policies and objectives of the funds concerned. ...

... be considered in determining whether a particular debt security is an appropriate investment for a fund. Approved trustees and their delegates are also subject to duties to act with skill, diligence and prudence and in accordance with the investment policies and objectives of the funds concerned. ...

Securities Trading Floor Monthly Reports (April

... only marginally. The value of share transactions amounted to Rf 149,775 during the period of 14th April 2002 to 31st July 2002. Total (1)market capitalization as at 31st July 2002 was Rufiyaa 655,534,000 (eq. US$ 51 million). To assist the development work, an international capital markets practitio ...

... only marginally. The value of share transactions amounted to Rf 149,775 during the period of 14th April 2002 to 31st July 2002. Total (1)market capitalization as at 31st July 2002 was Rufiyaa 655,534,000 (eq. US$ 51 million). To assist the development work, an international capital markets practitio ...

Core High Yield Fund - John Hancock Investments

... factors, including the fund’s duration and prevailing and anticipated market conditions. There is no limit on the fund’s average maturity. The corporate debt that the fund invests in includes traditional corporate bonds as well as bank loans (including loan participations). Some bank loans may be il ...

... factors, including the fund’s duration and prevailing and anticipated market conditions. There is no limit on the fund’s average maturity. The corporate debt that the fund invests in includes traditional corporate bonds as well as bank loans (including loan participations). Some bank loans may be il ...

Fidelity Convertible Securities Investment Trust

... pace. He believes there is enough supply at attractive valuations in the market, and that the U.S. Federal Reserve’s interest rate hikes should bode well for the asset class as investors begin to seek higher-yielding assets. In the long run, the manager believes the convertible securities market may ...

... pace. He believes there is enough supply at attractive valuations in the market, and that the U.S. Federal Reserve’s interest rate hikes should bode well for the asset class as investors begin to seek higher-yielding assets. In the long run, the manager believes the convertible securities market may ...

F2015L01378 F2015L01378 - Federal Register of Legislation

... paragraph (b) of the definition of foreign scrip bid. securities in the bid class means the securities or interests in a managed investment scheme (as applicable) forming all or a part of the class or classes of securities or interests being bid for. ...

... paragraph (b) of the definition of foreign scrip bid. securities in the bid class means the securities or interests in a managed investment scheme (as applicable) forming all or a part of the class or classes of securities or interests being bid for. ...

As filed with the Securities and Exchange Commission on January

... Stock, $.01 par value per share ("Shares"), of United Natural Foods, Inc., a Delaware corporation (the "Company"), issuable under the Company's 1996 Stock Option Plan (the "Plan"). We have examined the Amended and Restated Certificate of Incorporation and the Amended and Restated By-laws of the Comp ...

... Stock, $.01 par value per share ("Shares"), of United Natural Foods, Inc., a Delaware corporation (the "Company"), issuable under the Company's 1996 Stock Option Plan (the "Plan"). We have examined the Amended and Restated Certificate of Incorporation and the Amended and Restated By-laws of the Comp ...

MEDICINES CO /DE (Form: SC 13G, Received: 11

... Check box if the aggregate amount in row (9) excludes certain shares (see instructions). ...

... Check box if the aggregate amount in row (9) excludes certain shares (see instructions). ...

Notice Concerning Issuance of Investment Corporation Bonds

... debt maturity date and diversify the financing methods. At the same time, the Investment Corporation aims to recover the shortage of operating capital due to asset acquisition. 3. Amount of funds to be raised, use of proceeds and scheduled timing of expenditure (1) Amount of funds to be raised (esti ...

... debt maturity date and diversify the financing methods. At the same time, the Investment Corporation aims to recover the shortage of operating capital due to asset acquisition. 3. Amount of funds to be raised, use of proceeds and scheduled timing of expenditure (1) Amount of funds to be raised (esti ...

5N Plus Completes the Acquisition of MCP Group SA and a $125

... of MCP is approximately €235.2 million or CDN$317.3 million. In addition, 5N Plus assumed the net debt of MCP, which represented €65.6 million as at December 31, 2010, most of which is comprised of short‐term debt used to fund MCP’s working‐capital requirements. The promissory notes in the amoun ...

... of MCP is approximately €235.2 million or CDN$317.3 million. In addition, 5N Plus assumed the net debt of MCP, which represented €65.6 million as at December 31, 2010, most of which is comprised of short‐term debt used to fund MCP’s working‐capital requirements. The promissory notes in the amoun ...

this announcement and the information contained herein is

... Neither this announcement nor any copy of it may be taken or transmitted, published or distributed, directly or indirectly, in whole or in part, in, into or from the United States of America (including its territories and possessions, any state of the United States of America (the "United States" or ...

... Neither this announcement nor any copy of it may be taken or transmitted, published or distributed, directly or indirectly, in whole or in part, in, into or from the United States of America (including its territories and possessions, any state of the United States of America (the "United States" or ...

Lecture 1

... Markets may be differentiated by when a security is sold. The initial financing of the DSU is the primary market; subsequent resale of the financial claims of the DSU are traded in the secondary markets. Primary markets are important from a real saving/investment perspective; secondary markets provi ...

... Markets may be differentiated by when a security is sold. The initial financing of the DSU is the primary market; subsequent resale of the financial claims of the DSU are traded in the secondary markets. Primary markets are important from a real saving/investment perspective; secondary markets provi ...

Market Linked Securities

... Which investments are right for you? It is important to consider several factors before making an investment decision. An investment in Market Linked Securities may help you to modify your portfolio’s risk-return profile to more closely reflect your market views. However, at maturity you may incur ...

... Which investments are right for you? It is important to consider several factors before making an investment decision. An investment in Market Linked Securities may help you to modify your portfolio’s risk-return profile to more closely reflect your market views. However, at maturity you may incur ...

securities and exchange commission

... Not Applicable. Item 4. Ownership Provide the following information regarding the aggregate number and percentage of the class of securities of the issuer identified in Item 1. (a) Amount Beneficially Owned as of December 31, 2002: 1,200,439 (includes 374,000 shares purchasable under options exercis ...

... Not Applicable. Item 4. Ownership Provide the following information regarding the aggregate number and percentage of the class of securities of the issuer identified in Item 1. (a) Amount Beneficially Owned as of December 31, 2002: 1,200,439 (includes 374,000 shares purchasable under options exercis ...

Market Makers and Vampire Squid

... This Article unpacks the various activities of the key intermediaries in securities markets and market makers in particular. The goal is a better understanding of the distinction between those intermediary behaviors that can be left to market incentives and constraints and those for which government ...

... This Article unpacks the various activities of the key intermediaries in securities markets and market makers in particular. The goal is a better understanding of the distinction between those intermediary behaviors that can be left to market incentives and constraints and those for which government ...

Review of the Market Events of May 6, 2010

... marketplaces occurring as the result of the freezes on the listed markets or rejections by the ATSs. However, it is clear that some orders did migrate to other marketplaces once rejected by markets with volatility controls. Unlike the US “top of book” trade through obligation, the trade through rule ...

... marketplaces occurring as the result of the freezes on the listed markets or rejections by the ATSs. However, it is clear that some orders did migrate to other marketplaces once rejected by markets with volatility controls. Unlike the US “top of book” trade through obligation, the trade through rule ...

Document

... 75. Which of the following is not a reason why depository financial institutions are popular? a. They offer deposit accounts that can accommodate the amount and liquidity characteristics desired by most surplus units. b. They repackage funds received from deposits to provide loans of the size and ma ...

... 75. Which of the following is not a reason why depository financial institutions are popular? a. They offer deposit accounts that can accommodate the amount and liquidity characteristics desired by most surplus units. b. They repackage funds received from deposits to provide loans of the size and ma ...

ROYAL BANK OF CANADA

... Trigger Return Optimization Securities are unconditional, unsecured and unsubordinated debt securities issued by Royal Bank of Canada with returns linked to the performance of the Russell 2000 ® Index (the “Index”) (each, a “Security” and collectively, the “Securities”). If the Index Return is posit ...

... Trigger Return Optimization Securities are unconditional, unsecured and unsubordinated debt securities issued by Royal Bank of Canada with returns linked to the performance of the Russell 2000 ® Index (the “Index”) (each, a “Security” and collectively, the “Securities”). If the Index Return is posit ...

Portfolio1 - people.bath.ac.uk

... • Other issue: fund managers are careerist. When the payoffperformance relationship is convex, there are incentives to take high risks. This might hurts investors’ return. • It has been found that net flows into funds are highly sensitive to performance. This can generate incentive to be excessivel ...

... • Other issue: fund managers are careerist. When the payoffperformance relationship is convex, there are incentives to take high risks. This might hurts investors’ return. • It has been found that net flows into funds are highly sensitive to performance. This can generate incentive to be excessivel ...

Capital Structure

... quality as managers face a cost in bankruptcy which is less likely (for a given level of debt) the higher is the quality of the firm. • Leland and Pyle use managerial risk aversion as the cost of the signal. Increased leverage allows managers to retain a larger fraction of the equity which via the r ...

... quality as managers face a cost in bankruptcy which is less likely (for a given level of debt) the higher is the quality of the firm. • Leland and Pyle use managerial risk aversion as the cost of the signal. Increased leverage allows managers to retain a larger fraction of the equity which via the r ...